Upstox Originals

Apple’s India bet: Made in India, built for the world

.png)

8 min read | Updated on December 16, 2024, 18:31 IST

SUMMARY

Did you know that 14% of the global iPhones are now made in India? Or that of the total smartphone exports from India (~$11 billon), iPhones account for nearly half of them. Apple has shifted a significant chunk of its manufacturing from China to India. It's not just relocating production lines—it’s fuelling India’s rise as a global tech hub while creating thousands of jobs. Dive into how Apple’s ambitious bet on India is setting the stage for unprecedented growth and innovation.

India is home to 14% of Apple’s global iPhone production

Next time you line up to buy your next iPhone, here are some very interesting facts that might make your visit even more meaningful: India is now home to 14% of Apple’s global iPhone production, making it the largest manufacturing hub for the tech giant outside China.

-

By 2027-28, this is set to rise to 25%; a step to diversify beyond China

-

Apple's iPhone production in India reached $10 billion in the first seven months of FY25, a 37% YoY increase.

-

October 2024 saw Apple hit $2 billion in production from its India

-

Apple’s Make-in-India push is expected to create about 600,000 jobs in India (200,000 direct jobs). Even more impressive is the fact that about 70% of these direct jobs will be for women

-

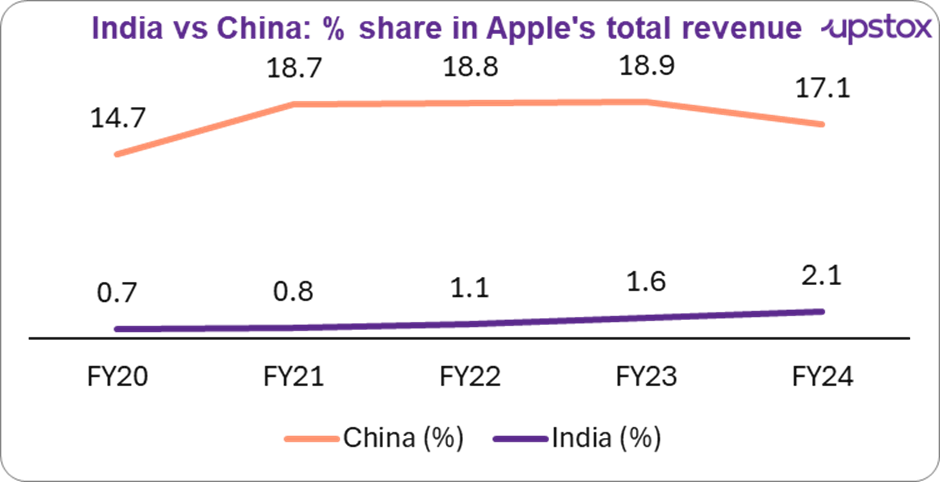

Apple posted a revenue of $8 billion in India for FY24, about 2% of its global revenue of $391 billion (see chart below)

Sources: MCA filings, Apple financial results

India still has a long way to catch up with China, for example, while iPhones are made locally, most other products like MacBooks and iPads are still imported.

However, India is rapidly rising in Apple’s supply chain and it’s clearly becoming a vital pillar of the company’s global ambitions. Apple’s India momentum is real.

International Apple suppliers now in India

-

Corning Inc. - The US-based Gorilla Glass maker is estimated to invest $0.12 billion in a new manufacturing facility in Tamil Nadu, aiming to start production by mid-2025 in partnership with Optiemus Infracom. This move supports Apple’s push to localise its supply chain and strengthen India’s electronics manufacturing ecosystem.

-

Foxconn - Foxconn is Apple's biggest iPhone supplier, with major investments to boost Apple’s iPhone production. In Karnataka, it’s setting up a massive $2.7 billion iPhone assembly plant near Bengaluru. Telangana saw a $0.6 billion facility kick off in Hyderabad, poised to start production. Meanwhile, Tamil Nadu continues to shine with Foxconn’s thriving operations, including a new residential complex for its workforce.

Including Indian suppliers into Apple's supply chain

-

Murugappa Group and Titan - Apple is in advanced discussions with Indian companies, for the assembly of iPhone camera modules. Both these companies have a strong reputation for expertise in high-precision manufacturing, making them ideal partners.

-

Other players in the Indian market - Apple is in discussions with Dixon Technologies to further expand its iPhone assembly line in India. Dixon, known for manufacturing devices for Xiaomi, Motorola, Google Pixel, and OnePlus, brings significant expertise to the table. Additionally, Apple has reportedly partnered with major tech companies like Amber Electronics, HCLTech, Wipro, and Motherson Group. However, these partnerships are expected to focus primarily on delivering locally-made components.

Financial performance of key Indian suppliers*

| Company | Industry | Revenue | EBITDA | Margin (%) | ROE (%) | EV/EBITDA** | Return in last 5 yr |

|---|---|---|---|---|---|---|---|

| HCL Technologies | IT | 1,09,913 | 24,198 | 22.0 | 23.3 | 18.5 | 28.0 |

| Wipro | IT | 89,760 | 16,752 | 18.7 | 14.3 | 15.7 | 19.8 |

| Titan | Consumer Durables | 51,084 | 5,292 | 10.4 | 32.9 | 56.7 | 24.2 |

| Motherson Group | Auto Components | 98,692 | 9,322 | 9.4 | 11.8 | 11.6 | 18.6 |

| Dixon Technologies | Consumer Durables | 17,691 | 705 | 4.0 | 24.7 | 97.6 | 90.7 |

| Amber Enterprises India | Consumer Durables | 6,729 | 491 | 7.3 | 6.7 | 32.0 | 40.8 |

Sources: Screener, Company Filling, * as of 31 March 2024; list is not exhaustive; ** as of December 06, 2024.

According to Apple’s supplier list, 14 of its 188 global suppliers are based in India. The country has emerged as Apple’s largest smartphone production hub outside of China, with plans to increase its manufacturing share to 25% by 2027-2028.

Table below shows iPhone’s supply chain for India

| Apple Products and Components | Companies | Plant Location | Head Count |

|---|---|---|---|

| iPhone Charger Cables & Connectors | Foxlink | Andhra Pradesh | 3,058 |

| Battery Cells | TDK | Haryana | 2,250 |

| PCB Mounting & Plating | Interplex | Karnataka | 120 |

| Packaging | Yuto | Karnataka | 613 |

| iPhone Assembly | Wistron | Karnataka | 10,000 |

| AirPods Components | Jabil | Maharashtra | 2,500 |

| Battery Packs | Flex | Tamil Nadu | 4,000 |

| iPhone Assembly | Foxconn | Tamil Nadu | 41,282 |

| iPhone Chargers | LY Tech | Tamil Nadu | NA |

| Logic Boards & Circuit Components | Onsemi | Tamil Nadu | 800 |

| iPhone Assembly | Pegatron | Tamil Nadu | 10,000 |

| iPhone Assembly | Tata Electronics | Tamil Nadu | 20,000 |

| PCBs | BYD Electronics | Tamil Nadu | NA |

| Battery Cells Assembly | Sunwoda | Uttar Pradesh | 5,000 |

Sources: Apple, Media reports

Increasing Indian exports

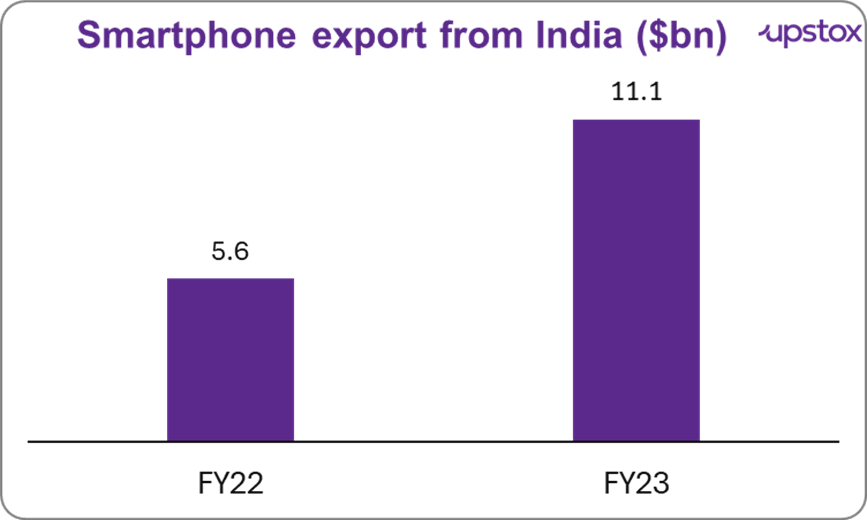

India’s Smartphone exports reached $11.1 billion, with Apple's iPhones contributing nearly half of the total.

Sources: ICEA, Inc42

Job creation

Following Apple’s footsteps, Motorola and Xiaomi have also partnered with India’s Dixon Technologies for smartphone assembly. This is just the beginning, as only smartphone contract manufacturing in India is expected to create an additional 250,000 jobs by the end of 2025.

How will Apple’s India manufacturing shift affect the bigger picture?

Provide supply chain diversification and reduce Chinese reliance Apple is rethinking its production playbook, aiming to reduce reliance on China amidst the US-China trade tensions and the need for de-risking supply chains.

The COVID-19 pandemic further highlighted the risks, with disruptions like Foxconn’s halted operations in Zhengzhou in 2022 causing global shipment delays. Diversifying to markets like India isn’t just strategy—it’s survival.

Increased demand driven by the acceptance of 5G technology and rising digital literacy

India’s rapid adoption of 5G and growing digital literacy is propelling its smartphone market. Apple is capitalising on this momentum with increasing demand for its iPads, MacBooks, and Apple Watches. Supported by initiatives like Digital India, Apple is strategically positioning itself for sustained growth in one of the world’s most dynamic economies.

Adopting sustainable manufacturing practices

With the growing global emphasis on sustainability, Apple’s suppliers in India are likely to adopt green manufacturing technologies in line with Apple’s commitment to reducing its carbon footprint. These initiatives would not only promote sustainability within India’s manufacturing sector but also establish new benchmarks for other industries to follow.

Enhancing exports and trade balance

Apple's exports from India are projected to exceed $10 billion in fiscal 2024, positioning the country as a key hub for iPhone exports to emerging markets in Asia, the Middle East, and Africa. This growth will diversify India’s export portfolio and strengthen its trade balance in the electronics sector.

What’s holding Apple back?

Strategic hurdles

India is a promising market with government incentives and affordable labor, shifting Apple’s manufacturing out of China is no easy feat. Partners like Luxshare Precision, critical to making AirPods, Apple Watches, and iPhones, maintain strong roots in China.

Geopolitical impacts

Geopolitical tensions further complicate Apple’s supply chain in India, as seen when Luxshare opted for a $330 million investment in Vietnam after struggling to expand operations in India. Southeast Asia, led by Vietnam, continues to attract attention with its skilled workforce, cost advantages, and proximity to China, posing a compelling alternative to India for electronics manufacturing.

Price battle

With a market share of less than 7% in India, Apple faces tough competition from cost-effective Chinese smartphone giants like OnePlus, Xiaomi, Oppo, and Vivo, which dominate the landscape. Breaking into this price-sensitive market remains a significant challenge.

PLI scheme targets

Achieving 35-40% value addition by the end of India’s Production Linked Incentive (PLI) scheme may require additional incentives and regulatory reforms.

Conclusion

What’s next as Apple weaves India deeper into its manufacturing tapestry? The stakes are high, and the outcome will hinge on how well the company navigates regulatory hurdles, nurtures local talent, and capitalizes on ‘Make in India’ incentives.

With each new supplier and production milestone, Apple sets a precedent that could reshape India’s tech landscape. Will these efforts forge a new industrial powerhouse or fall short of the mark? Stay tuned and watch this story unfold.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story