Stock Market Highlights: SENSEX plunges 1,547 pts as STT hike in Budget 2026 dents sentiment; NIFTY50 settles 2% lower at 24,825; IT stocks gain

5 min read | Updated on February 02, 2026, 07:33 IST

SUMMARY

Stock Market Highlights: The domestic equity benchmark indices settled sharply lower on Sunday, February 1, in a special Budget trading session after Finance Minister Nirmala Sitharaman announced a hike in STT for futures and options (F&O) trades.

For AI and digital companies, the Budget’s impact is structural rather than tactical, say experts. | Image: Shutterstock

Thank you.

Thank you for following our live market coverage on Budget Day. Stay tuned for more updates, insights, and analysis from the markets!

February 01, 2026, 16:27 PM

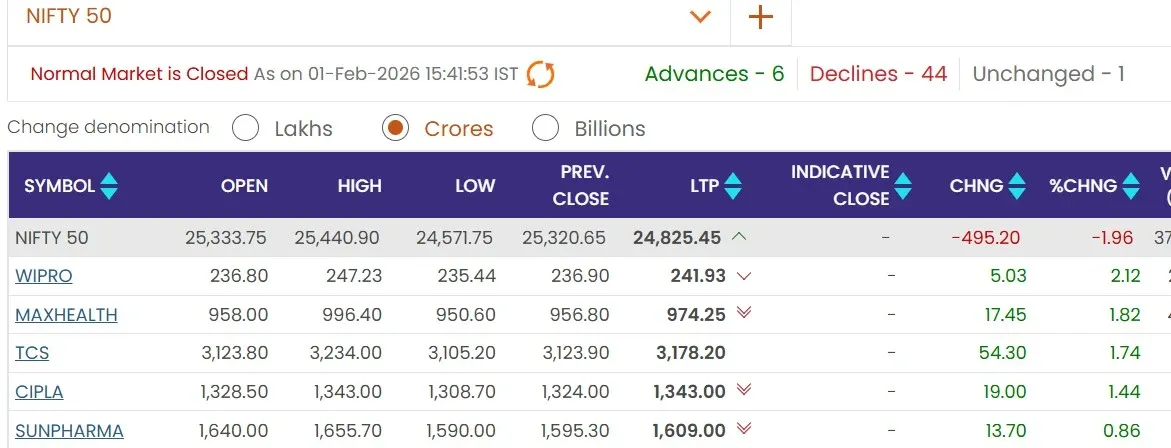

Top gainers and losers, February 1

Bharat Electronics dragged the NIFTY50 index, closing 6.02% lower, as the 2026-27 Budget failed to enthuse investors and dashed their hopes of higher spending on the defence sector, with an outlay of ₹7.85 lakh crore in FY27 (up 15%).

It was followed by Hindalco Industries (-5.78%), Oil & Natural Gas Corporation (-5.50%), State Bank of India (-5.31%) and Adani Ports and Special Economic Zone (-5.06%), which were among the top losers on Sunday. READ MOREFebruary 01, 2026, 16:25 PM

New Sovereign Gold Bond rule proposed: Capital Gains tax exemption only on original issue held till maturity

Union Budget 2026 has proposed to revise the Sovereign Gold Bond (SGB) taxation rules for investors who are not subscribed to the original issue. According to the proposal, capital gains tax exemption will only be available to taxpayers who subscribed to the SGB at the time of original issue and held continuously until maturity till redemption. READ MOREFebruary 01, 2026, 16:16 PM

EXPERT TAKE | Vibhor Kaushik, Promoter & Managing Director, Vibhor Steel Tubes Limited

“The 10.9% growth in capital expenditure for FY27 reflects the Government’s sustained commitment to the vision of Viksit Bharat 2047. With capital outlay increased to ₹12.2 lakh crore and continued investments across transport, railways, energy and manufacturing, the Union Budget provides strong demand visibility for steel-intensive segments."

"The added focus on strengthening Tier II and Tier III cities through modern infrastructure, water supply and essential amenities is clearly positive for companies like ours, given our presence in steel pipes, power transmission poles and crash barrier manufacturing—key enablers of India’s expanding infrastructure network.”

February 01, 2026, 16:12 PM

EXPERT TAKE | Rishi Anand, MD & CEO, Aadhar Housing Finance Limited

“The Budget reinforces confidence in India’s financial ecosystem and signals continued support for inclusive and sustainable growth. With clear targets for credit expansion, technology adoption, and reforms in banking and NBFCs, there is a clear direction to scale responsibly."

"The emphasis on infrastructure development in Tier II and III towns will act as a catalyst towards creating opportunities for the underserved and unserved communities in these markets, meet the growing urbanisation needs, and create meaningful impact for communities across India. This will further strengthen the housing for all missions and spur demand for affordable housing.”

February 01, 2026, 15:58 PM

Stock market on Budget Day | 210 stocks hit 52-week low

NIFTY50 and SENSEX saw a substantial fall on Sunday’s special trading session held on account of Budget 2026. Benchmark indices snap their 3-day winning streak as investors revert to profit booking following the conclusion of Budget 2026. READ MOREFebruary 01, 2026, 15:54 PM

EXPERT TAKE | Rahul Singh, CIO - Equities, Tata Asset Management

“The Union Budget seeks to simultaneously address the medium- and long-term challenges and opportunities presented by the evolving global geopolitical and economic landscape – expanding the manufacturing focus along with heavy engineering, semiconductors, electronic components, rare earths, chemicals, and data centres. Infrastructure focus is sharper with a focus on urban infra and healthcare.

The fiscal math is backed by reasonable assumptions, even though the overall investment outlay and fiscal deficit seem marginally worse than was expected. In the wake of higher STT on futures & options and no relief on capital gains, corporate earnings growth in the coming quarter and FY27 will become even more critical for the equity market outlook over the next 12-18 months.”

February 01, 2026, 15:50 PM

IT stocks settle in the green; NIFTY IT index up 0.57%

February 01, 2026, 15:47 PM

CLOSING BELL | 44 of the 50 NIFTY50 constituents end in the red

February 01, 2026, 15:48 PM

CLOSING BELL | SENSEX, NIFTY witness biggest one-day fall on Budget Day in 6 years

SENSEX tanks 1,546.84 points, or 1.88%, to settle at 80,722.94 levels. NIFTY50 index ended at 24,825.45, down 495.20 points, or 1.96%.

February 01, 2026, 15:46 PM

SENSEX HEATMAP: Index down over 1600 pts

February 01, 2026, 15:23 PM

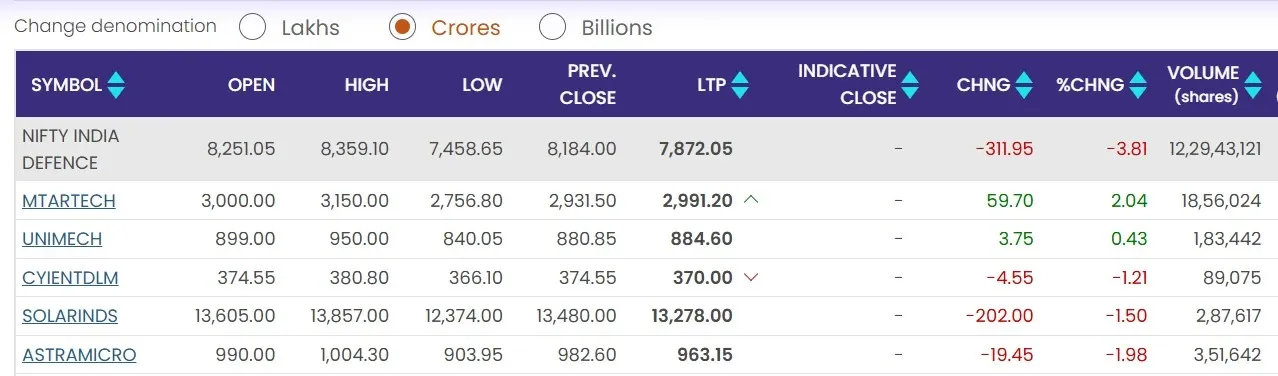

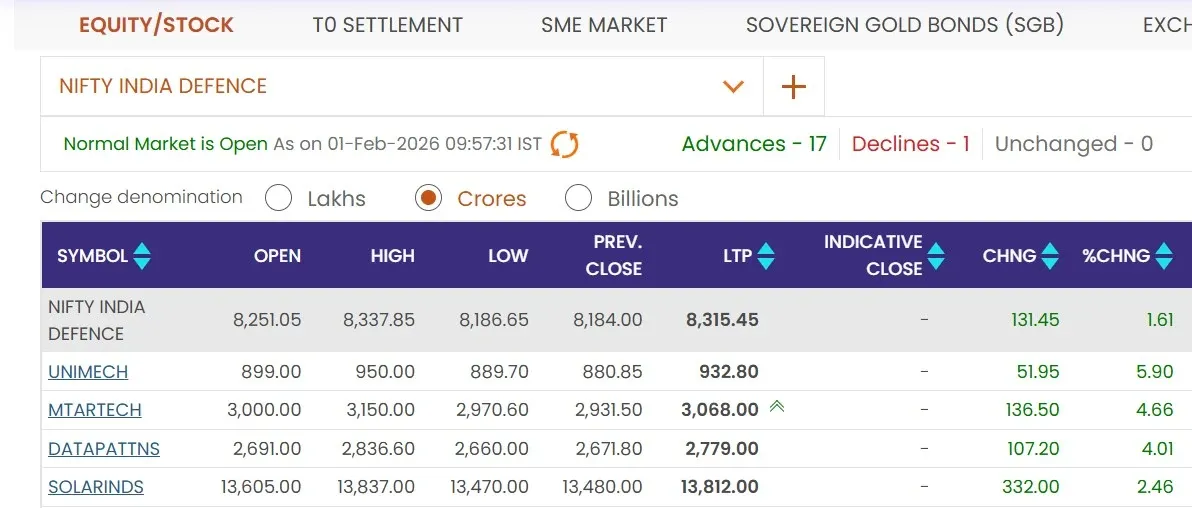

Defence stocks tank: ₹7.85 lakh crore defence outlay in budget fails to cheer markets

Shares of defence equipment makers were trading sharply lower in Sunday's special Budget trading session after the government increased its spending on defence to ₹7.85 lakh crore for financial year 2026-27 from the previous year's budget estimate of ₹6.81 lakh crore, up 15%.

The measure of defence equipment makers on the National Stock Exchange, the Nifty India Defence index, dropped as much as 8.86%, or 725 points, to hit an intraday low of 7,458.65.16 of eighteen shares in the NIFTY India Defence index were trading lower, as most analysts and industry leaders were of the view that defence spending will be the priority sector in the budget and expected up to 25% growth in the capital outlay. READ MOREFebruary 01, 2026, 15:21 PM

MARKET CHECK: NIFTY50 down nearly 2%

The stock market is trading deep in the red following the Budget 2026 presentation.

February 01, 2026, 15:16 PM

EXPERT TAKE | Ramveer Singh, Chairman, EMS Ltd

“The Union Budget 2026 is focused on infrastructure, inclusion, and industry – to support the Government’s audacious vision for a Vikasit Bharat by 2047. The focus on developing city economic regions to drive regional growth and urban development, and more importantly, expanding market-based funding options for urban local bodies, has huge potential for harnessing their fiscal independence and project investment capabilities.

Besides, the sustained thrust on the AMRUT scheme and focus on developing newer tier 2 and 3 towns will further boost the demand for water management and infrastructure services across the country.”

February 01, 2026, 14:50 PM

Defence stocks tank after Budget 2026 presentation; Nifty India Defence Index slips 4%

Defence stocks were trading deep in the red in the afternoon session.

February 01, 2026, 14:49 PM

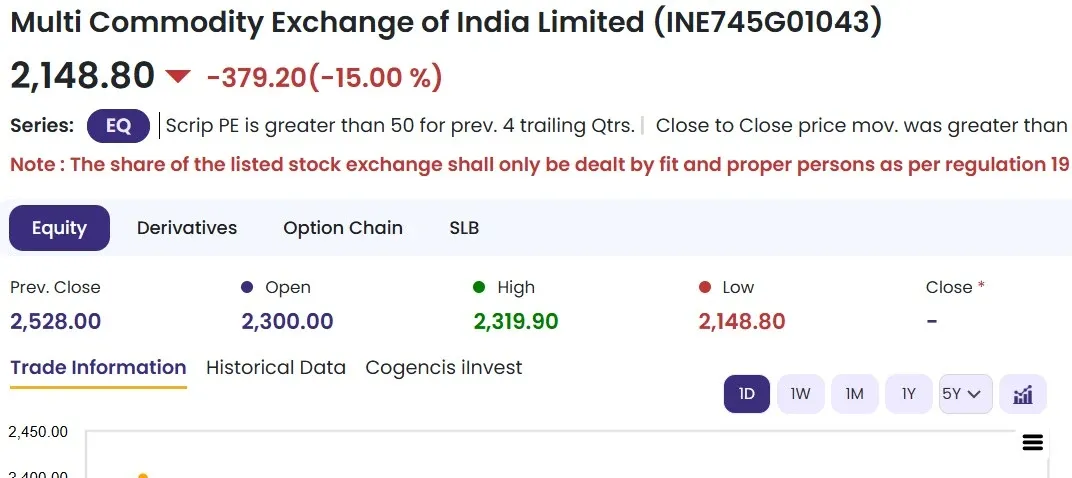

MCX shares plunge over 18% in worst single-day fall since COVID

Shares of the Multi-Commodity Exchange of India (MCX) plunged as much as 19.18% to an intraday low of ₹2,068.50 apiece on the National Stock Exchange (NSE) on the special Budget trading session on Sunday, February 1.

It registered the worst single-day decline since March 2020 in early trade on Sunday.

While it recovered from the day’s low, it was still trading in the red. The stock was at ₹2,259.40 per unit, down by 10.63% as of 12:58 pm.

The scrip has declined 3% in the past week and more than 1% over the month.

While the stock hit a 52-week high of ₹2,705 on January 29, 2026, it reached a year’s low of ₹881.63 per unit on March 11, 2025.

February 01, 2026, 14:42 PM

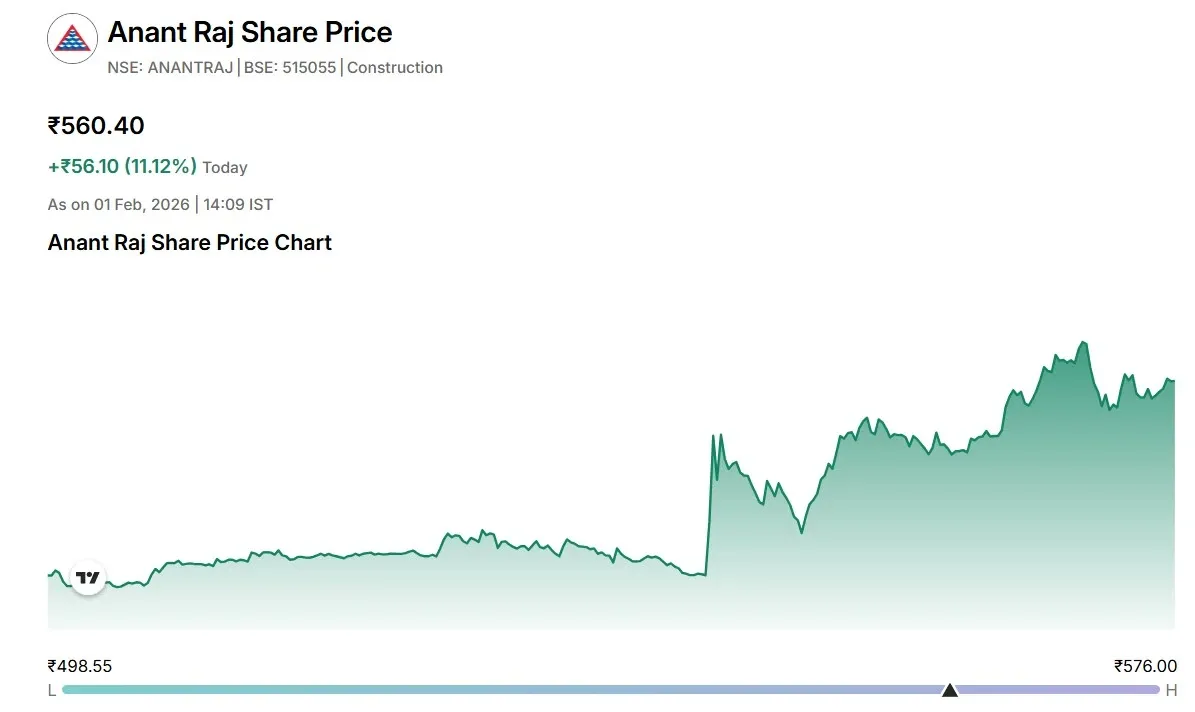

Buzzing Stock: Anant Raj shares zoom over 11%

Shares of data centre and AI companies rallied in the special session on Sunday after Finance Minister Nirmala Sitharaman announced a long-term tax initiative aimed at encouraging foreign companies to expand cloud services in India in the Union Budget 2026.

Union Finance Minister Nirmala Sitharaman on February 1 presented her ninth consecutive Union Budget. reSitharaman announced a tax holiday till 2047 for foreign companies engaged in providing cloud services by setting up a data centre in India. The proposal is being positioned as a step towards strengthening the digital services ecosystem and supporting the growth of local data storage and processing capabilities. READ MORE

February 01, 2026, 14:14 PM

STT on F&O trades hiked: Here is how it will increase your costs per trade

The announcement came in sharp contrast to the broader expectations of the abolishment of STT in the current budget. Following the development, shares of BSE Ltd plunged 10% to ₹2517 apiece, followed by Angel One down 10%, 360 One down by 10%, Groww dropped 8.7% and Nuvama plunged 8.1%. READ MOREFebruary 01, 2026, 14:05 PM

EXPERT TAKE | Chandra Kishore Thakur, Global CEO, Sterling and Wilson Renewable Energy Group

“We feel that this budget has rightly prioritised India’s energy security, especially the increasing role of renewables towards fulfilling this objective over the long term.The relief in customs duty for the import of sodium antimonate used in the manufacture of solar glass is a step in the right direction.This move will reduce input costs for solar panel manufacturers and thereby augment domestic solar equipment production, giving an impetus to the entire sector in terms of atmanirbharta.The extending of basic customs duty exemption for capital goods used for manufacturing lithium-ion cells for batteries and to those used for manufacturing lithium-ion cells for battery energy storage systems (BESS) is also a welcome decision.We must remember that BESS significantly enhances the viability of solar power by addressing its intermittency and enabling efficient energy management. BESS stores excess solar generation for use during low-production periods, thereby augmenting overall system reliability and economics in the solar industry.With these new measures, we are certain that renewable energy will play a vital role in India's sustainable development, powering economic growth while reducing dependence on imported fossil fuels.”February 01, 2026, 14:02 PM

MARKET UPDATE | IT stocks outperform; here is why

Shares of information technology were outperforming in Sunday's volatile special budget session. The NIFTY IT index touched an intraday high of 38,699 after hitting an intraday low of 37,297.55 as the government increased the threshold for availing safe harbour for IT services from ₹300 crore to ₹2,000 crore.

Shares of IT companies like Wipro, Persistent Systems, TCS, LTI Mindtree, Infosys and Coforge were trading higher in the range of 0.2%-3%. Shares in the midcap IT space, like Zensar Technologies, Tata Elxsi, Birlasoft and L&T Technology Services, advanced between 1% and 4% after the government significantly hiked safe harbour for IT services. READ MOREFebruary 01, 2026, 13:50 PM

EXPERT TAKE | Basant Bafna, Head - Fixed Income, Mirae Asset Investment Managers (India)

"The Budget provides continuity in the form of fiscal prudence while maintaining thrust on reforms. Net market borrowing at ₹11.7 lakh crores is broadly in line with market expectations, with the government scoring on its commitment to fiscal consolidation with the fiscal deficit budgeted to fall to 4.3% in FY 2027 from 4.4% in FY 2026 under the broader goal of achieving a debt-to-GDP ratio of 50 +/- 1% by FY 2030-31.

The budget also scores on continued front-loading of government capex at a time when policy transmission has been lagging. The announcement on the Market Making Framework for Corporate Bonds and the introduction of Total Return Swaps reaffirm the government’s commitment towards deepening Corporate Bond Markets."

February 01, 2026, 13:25 PM

Budget 2026: Govt plans to monetise real estate assets of CPSEs via dedicated REITs; stocks in focus

The government on Sunday proposed to accelerate "recycling" of real estate assets owned by Central Public Sector Enterprises (CPSEs) through the setting up of dedicated real estate investment trusts (REITs).

REITs are investment vehicles that own or operate income-generating real estate, enabling investors to earn a share of the income produced without directly purchasing properties.

In her Budget speech, Finance Minister Nirmala Sitharaman said, "Over the years, REITs have emerged as a successful instrument for asset monetisation. I propose to accelerate recycling of significant real estate assets of CPSEs through the setting up of dedicated REITs".

At present, there are five listed REITs in India - Brookfield India Real Estate Trust, Embassy Office Parks REIT, Mindspace Business Parks REIT, Nexus Select Trust, and Knowledge Realty Trust.

Nexus Select Trust is backed by rent-yielding retail real estate (shopping malls), while the other four are office REITs.

February 01, 2026, 13:22 PM

STT increased: What will be the impact? Deepak Shenoy, CEO, Capitalmind AMC, explains

STT has been increased:-

On selling futures, STT rises from 0.02% to 0.05%

-

On selling options, STT increases from 0.10% to 0.15%

-

On option exercise at expiry, STT goes up from 0.125% to 0.15%

This does hurt arbitrage fund returns (by roughly 0.5% annually), but even after the impact, they remain tax-efficient, the market expert says.

February 01, 2026, 13:19 PM

-

Budget 2026: What's in it for AI and tech stocks?

For AI and digital companies, the Budget’s impact is structural rather than tactical. The focus on digital public infrastructure, data platforms, skilling, and compute access expands the addressable market for AI applications across government, BFSI, healthcare, and manufacturing.

"Large IT services companies such as TCS, Infosys, and HCLTech benefit from rising enterprise AI adoption in automation, analytics, and cloud-led transformation, while mid-tier digital engineering firms gain from specialised AI deployment," says Sonam Srivastava, Founder and Fund Manager at Wright Research PMS.

The more important second-order effect is data creation.

"As capex, financial inclusion, and formalisation expand, data intensity across the economy rises, creating sustained demand for AI-driven optimisation. This positions India as an AI application and services hub rather than a frontier model developer. For markets, that means steady, compounding earnings opportunities rather than speculative spikes, which aligns well with the risk profile of listed technology companies," it added.

February 01, 2026, 12:59 PM

Budget 2026: Buyback proceeds for all types of shareholders will be taxed as capital gains

Finance Minister Nirmala Sitharaman on Sunday said buyback proceeds for all types of shareholders will be taxed as capital gains.

February 01, 2026, 12:46 PM

SENSEX, NIFTY50 nosedive after hike in STT

The equity benchmark indices slipped into the red after the Finance Minister announced a hike in the Securities Transaction Tax (STT) in the derivatives segment. STT on futures will increase from 0.02% to 0.05%, while STT on options premiums will rise from 0.10% to 0.15%.

The S&P BSE SENSEX tumbled over 2,000 points, or nearly 3% during the session before recovering a bit. NSE’s NIFTY50 was trading at 24,888.60, down 432.05 points, or 1.71%.

February 01, 2026, 12:42 PM

MARKET CHECK: SENSEX, NIFTY50 trade lower

Union Budget 2026: Finance Minister announces increase in STT on futures to 0.05%. The stock market was trading in the red following the anouncement.

February 01, 2026, 12:21 PM

IT stocks rally: Budget proposes tax holiday till 2047 to foreign companies that provide cloud services to customers

Budget proposes tax holiday till 2047 to foreign companies that provide cloud services to customers globally by using data centres in India.

February 01, 2026, 12:13 PM

Individuals residing abroad to be permitted equity investments in listed Indian firms: FM

Finance Minister Nirmala Sitharaman on Sunday said individual persons residing outside India (PROI) will be permitted equity investments in listed Indian companies through a portfolio investment scheme.

She also proposed raising the investment limit for PROIs to 10% from 5%.

The finance minister also proposed making a framework with suitable access to funds and derivatives on corporate bond indices.

The government will continue to focus on developing infrastructure in cities with over 5 lakh population, she added.

Presenting the Union Budget 2026-27, Sitharaman proposed to upgrade the WHO Global Traditional Medicine Centre at Jamnagar, Gujarat, while also stating that the country's telescope infrastructure will be upgraded to promote astrophysics and astronomy.

February 01, 2026, 12:05 PM

Avanti Feeds, Apex Frozen, Waterbase shares surge after Budget calls for integrated development of 500 reservoirs

Shares of aquaculture companies were witnessing buying interest in Sunday's special Budget session. Shares of Avanti Feeds, Apex Frozen Foods, Coastal Corp, Waterbase, Zeal Acqua, and BKV Industries rose between 1% and 6.5% after the finance minister, Sitharaman, said that the government will take initiatives for the integrated development of 500 reservoirs and Amrut Sarovars.

"We will undertake initiatives for integrated development of 500 reservoirs and Amrut Sarovars to strengthen the fisheries value chain in coastal areas and enable market linkages involving start-ups and women-led groups together with fish farmer producer organisations," Sitharaman said while presenting the Budget 2026.

February 01, 2026, 12:02 PM

MARKET UPDATE: Syrma SGS Tech, Dixon Tech: Electronic manufacturing stocks rally

Shares of electronic manufacturing companies rose up to 6% after Finance Minister Nirmala Sitharaman on Sunday proposed to increase the outlay on electronics manufacturing to ₹40,000 crore in 2026-27.

The stock of Syrma SGS Technology jumped 5.95% to ₹806.35, Dixon Technologies (India) Ltd climbed 4.21% to ₹10,885, and Kaynes Technology India rose 3.82% to ₹3,608.90 apiece on BSE.

In addition, PG Electroplast's shares increased by 2.59% to ₹561.75 per piece, DCX Systems rose 2.06% to ₹180.95, and Cyient DLM's by 1.04% to ₹379.70 apiece on the bourse.

Presenting the Union Budget for 2026-27, Finance Minister Nirmala Sitharaman said high-tech tool rooms will be established at two locations to give a push to capital goods manufacturing.

February 01, 2026, 11:52 AM

L&T, Ircon In'l, RVNL: Infra stocks rise as capex target raised to ₹12.2 lakh crore for Budget FY26

Infrastructure stocks were trading in the green as Finance Minister Nirmala Sitharaman on Sunday said the target for capex will be raised to ₹12.2 lakh crore for FY27 from ₹11.2 lakh crore earmarked for the current fiscal year and announced a slew of measures to boost infrastructure in the country.

Presenting the Union Budget for 2026-27 in the Lok Sabha, she said the government will continue to develop infrastructure in Tier-2 and Tier-3 cities.

The government also proposes to set up a risk guarantee fund for the infrastructure sector, she added.

A scheme for the enhancement of construction and infrastructure equipment will be introduced to strengthen domestic manufacturing, Sitharaman said.

February 01, 2026, 11:40 AM

MARKET UPDATE: Textile stocks jump as FM proposes setting up mega textile parks

Textile stocks such as Indo Count Industries, Trident, among others, were trading with sharp gains after the FM proposed the setting up of mega textile parks with a focus on value addition to technical textiles.

February 01, 2026, 11:27 AM

MARKET CHECK: Pharma stocks rally, Biocon up over 2% as FM announces BioPharma Sakti Scheme

Pharma stocks were trading higher as Finance Minister Nirmala Sitharaman announced the BioPharma Sakti scheme, with an outlay of ₹10,000 crore over a five-year period, in the Union Budget 2026.

Nifty Pharma was up 0.89%, led by Biocon, Sun Pharma, Piramal Pharma, Torrent Pharma, and Dr Reddy’s Laboratories.

Finance Minister Nirmala Sitharaman on Sunday proposed a ₹10,000 crore investment in the biopharma sector over the next five years, a move which would give a boost to the country's pharmaceuticals industry.

Biopharmaceuticals, or biologics, are complex medicines manufactured from living organisms, cells, or tissues rather than through chemical synthesis.

February 01, 2026, 11:31 AM

NEWS ALERT: FM rises to present Budget 2026

The Finance Minister has started her Budget 2026 Speech. SENSEX and NIFTY trade in the green.

February 01, 2026, 11:05 AM

MARKET CHECK: NIFTY50 trades in the green

The equity benchmark indices are trading in the green ahead of the Union Budget 2026-27 presentation.

February 01, 2026, 10:55 AM

Auto Sales Update: Tata Motors PV – January 2026

-

Total sales: 71,066 units, up 47% year-on-year (January 2025: 48,316 units).

-

Domestic passenger vehicle sales: 70,222 units, up 46% from 48,076 units in January 2025.

February 01, 2026, 10:48 AM

-

Gold prices jump 5% from intraday low levels

The gold prices have recouped the majority of the losses on Sunday. The MCX gold contract for March traded ₹1,40,200 per ounce, up from an intraday low of ₹1,36,185 per ounces.

Consequently, the gold ETFs have also bounced back from intraday low levels. Goldbees are trading 6.2% lower vs -11% earlier. Axisgold ETF has jumped nearly 6% from intraday lows

February 01, 2026, 10:41 AM

BUDGET WISHLIST: Apollo Hospitals’ Shobana Kamineni’s expectations from budget 2026

Apollo Hospitals Enterprise’s Promoter Director and Executive Chairperson of Apollo HealthCo, Shobana Kamineni, drew the attention of the government towards supporting preventive healthcare.

She said, ‘A Viksit Bharat will be built on a healthy youth and workforce—nearly one billion strong by 2047. A prevention-first healthcare system, powered by mandatory check-ups, digitised records, and UPI-style data portability, can unlock early risk detection, personalised care, and long-term productivity at scale’. She further said, ‘As India led the world in digital payments, preventive healthcare can be our next global export.’

February 01, 2026, 10:46 AM

Auto Sales Update: Hyundai Motor India – January 2026

-

Total sales: 73,137 units, up 11.5% year-on-year (January 2025: 65,603 units).

-

Domestic sales (dispatches to dealers): 59,107 units, up 9% from 54,003 units in January 2025.

-

Exports: 14,030 units, compared with 11,600 units in January 2025.

-

Comment from Hyundai MD & CEO Tarun Garg:

“Achieving our highest-ever monthly domestic sales of 59,107 units, alongside highest-ever total sales of 73,137 units with a strong 11.5% year-on-year growth, reflects not only Hyundai's brand leadership but also the collective strength of our people, partners and customers.”

February 01, 2026, 10:09 AM

-

EXPERT VIEW: Budget 2026 should push reforms in land, labour, and ease of doing business, says Nilesh Shah

Nilesh Shah, Managing Director of Kotak Mahindra Asset Management, in an exclusive interview with Upstox News, says that while last year’s Budget provided income tax relief and GST rationalisation helped revive consumption and sentiment, the focus now should shift to sustaining fiscal prudence, accelerating structural reforms, and crowding in private investment. Click here to read full interviewFebruary 01, 2026, 10:07 AM

Defence stocks in focus ahead of Union Budget 2026–27

Defence stocks remained in the spotlight on Sunday, February 1, ahead of the Union Budget 2026–27, amid high expectations for the sector following the India-EU deal and encouraging Q3 results from key companies.

Shares of Bharat Electronics (BEL), Mazagon Dock, Garden Reach Shipbuilders & Engineers (GRSE), Data Patterns, Cochin Shipyard, Paras Defence, Hindustan Aeronautics, and Bharat Dynamics are likely to attract investor attention. Market participants are closely watching the Budget for any allocations and policy announcements affecting the sector.

February 01, 2026, 10:01 AM

NEWS ALERT

Gold, silver prices hit lower circuit levels in futures trade ahead of Union Budget 2026-27 presentation.

February 01, 2026, 09:47 AM

MCX shares crash 15%

Shares were trading 15% lower in the early trade.

February 01, 2026, 09:42 AM

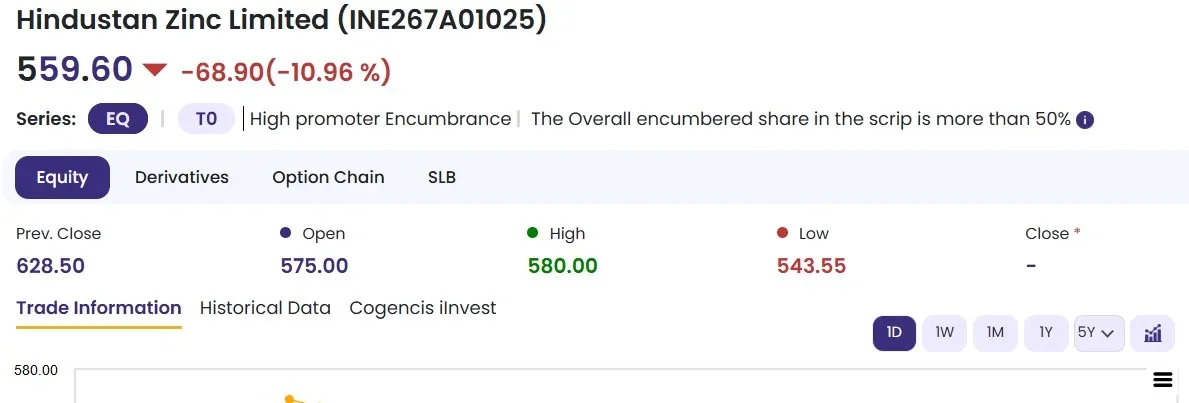

Stocks in focus: HZL, Hindustan Copper, Titan fall up to 13% as MCX Gold, Silver and Copper prices crash

MCX Gold and Silver saw a substantial fall last week amid multiple headwinds in global markets. MCX Gold February futures tumbled 11.6% on Friday and are down 6% on Monday morning to trade around ₹1,40,674 per 10 gram.

Meanwhile, MCX Silver March future declined 27% on last Friday and is down another 6% on Sunday morning to trade around ₹2,74,410 per kg ahead of Budget 2026.

The steep fall in precious metals comes amid profit booking, especially after the nomination of Kevin Warsh as the next US Federal Reserve chief, which spooked commodity markets, as investors viewed him as a hawkish policymaker likely to prioritise inflation control and maintain tighter monetary conditions. READ MOREFebruary 01, 2026, 09:40 AM

Hindustan Zinc shares extend fall on the NSE

Shares were trading with deep cuts

February 02, 2026, 07:33 AM

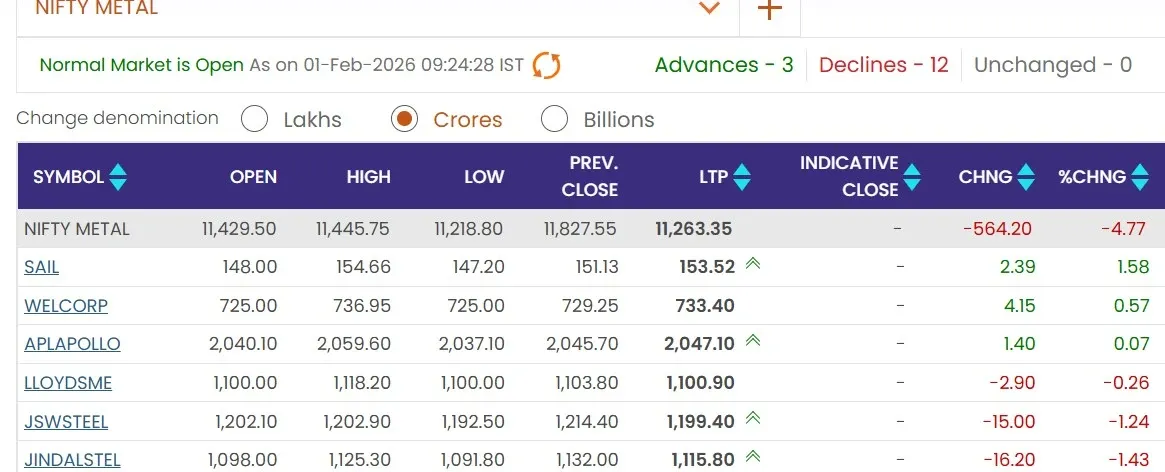

MARKET UPDATE: Metal stocks deep in the red, NIFTY METAL INDEX down nearly 5%

The metal stocks were under selling pressure following a sharp decline in commodity prices.

February 01, 2026, 09:32 AM

Opening Bell on February 1 (Budget Day)

At 9:17 am, the S&P BSE SENSEX was trading at 82,185.39, down 84.39 points, or 0.10%. The NIFTY50 was at 25,283.70, lower by 36.95 points, or 0.15%.

February 01, 2026, 09:20 AM

SENSEX, NIFTY50 pre-open session

SENSEX up over 100 pts, NIFTY hovers over 25,300

February 01, 2026, 09:14 AM

Gold, silver slide further on Budget Day

Gold futures for delivery on February 5 dropped 6% to hit an intraday low of ₹1,40,674 per 10 grams, and silver futures for delivery on March 5 tumbled 6%, or ₹17,515 to ₹2,74,410 per kilogram, data from MCX showed.

February 01, 2026, 09:12 AM