Market News

Waaree Energies, Adani Green, Premier Energies: How renewable energy shares performed in 2025; what to expect ahead?

.png)

5 min read | Updated on December 12, 2025, 09:45 IST

SUMMARY

Share market news: According to a recent article by India Brand Equity Foundation (IBEF), India’s energy demand is projected to rise more than any other country in the coming decades, driven by its large population and growth potential.

Stock list

India is the market with the fastest growth in renewable electricity, and by 2026, new capacity additions are expected to double. | Image: Shutterstock

One sector that holds promise and has huge potential, as highlighted by sector experts and analysts, is green energy.

According to a recent article by India Brand Equity Foundation (IBEF), India’s energy demand is projected to rise more than any other country in the coming decades, driven by its large population and growth potential.

To meet this surge sustainably, most of the additional demand must come from low-carbon, renewable sources. India’s commitment to net zero emissions by 2070 and 50% renewable electricity by 2030 marks a major global climate milestone, it adds.

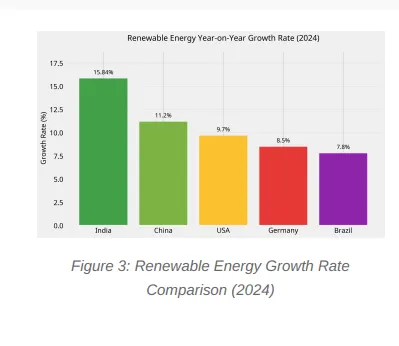

India is the market with the fastest growth in renewable electricity, and by 2026, new capacity additions are expected to double.

India has officially surpassed Japan to become the world's third-largest solar energy producer. According to data from the International Renewable Energy Agency (IRENA), India generated 1,08,494 GWh of solar power, exceeding Japan's 96,459 GWh.

"With the increased support of the Government and improved economics, the sector has become attractive from an investor’s perspective. As India looks to meet its energy demand on its own, which is expected to reach 15,820 TWh by 2040, renewable energy is set to play an important role," the article said.

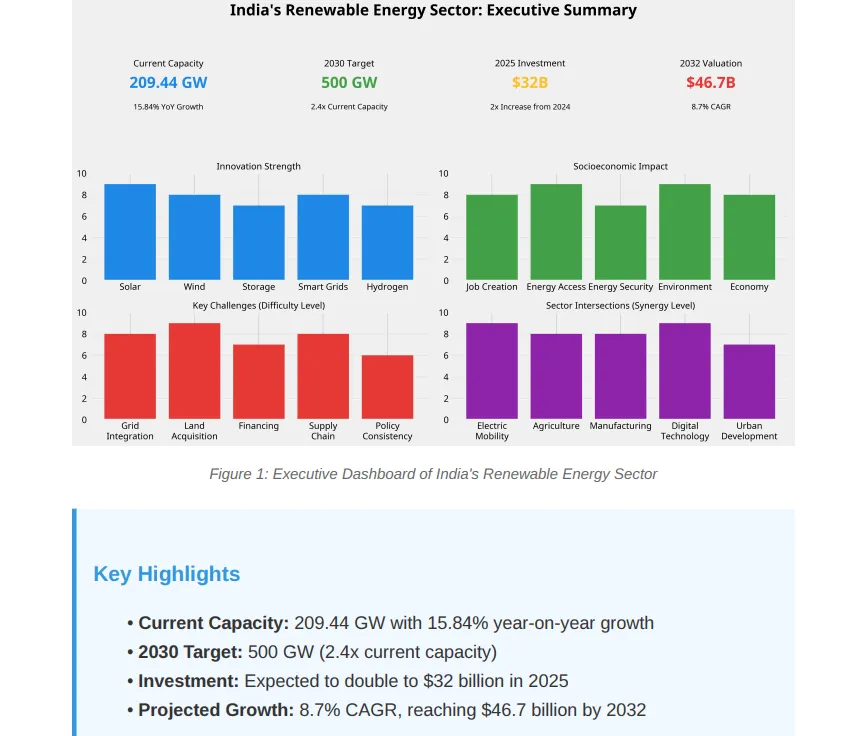

Echoing similar views, ICMAI, in its report on India's Renewable Energy Sector, published in May 2025, noted that India's renewable energy sector stands out as the most interesting and transformative industry in the country's economic landscape. Here is the visual report.

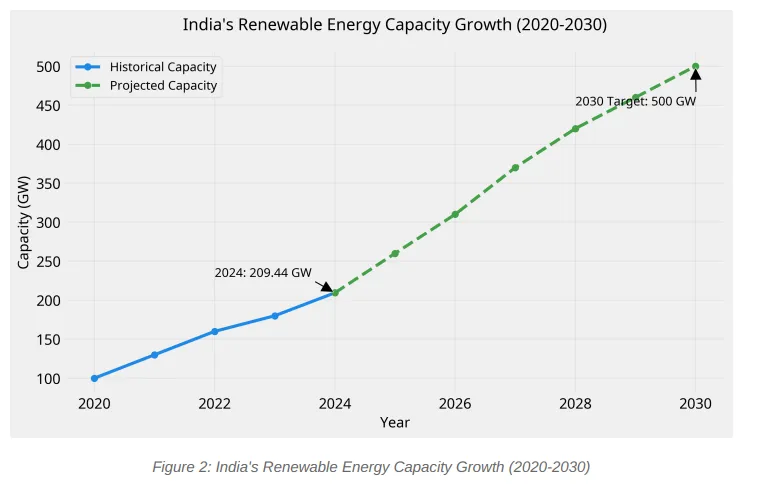

India's renewable energy sector has demonstrated remarkable growth in recent years. The country is on an ambitious path to achieve 500 GW of renewable energy capacity by 2030, positioning itself as a global leader in clean energy transition, ICMAI said.

Why This Matters

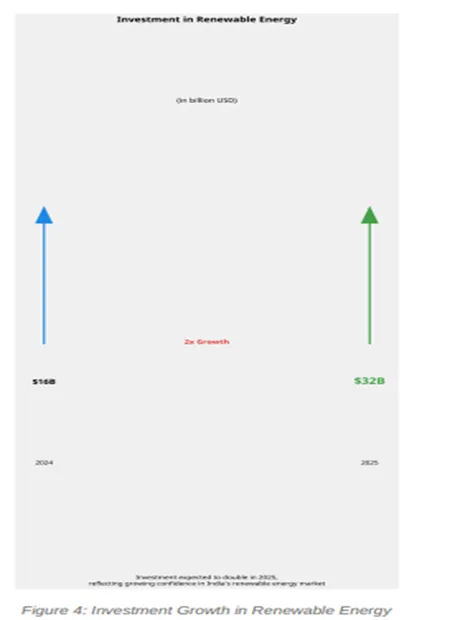

India's growth rate of 15.84% outpaces other major economies, demonstrating the country's commitment to renewable energy. The doubling of investment to $32 billion in 2025 reflects growing confidence in this market and creates significant opportunities for both domestic and international stakeholders.

The report underlined that India's renewable energy sector is characterised by rapid technological adoption and innovation across multiple domains. The country is advancing in solar technology, wind energy, energy storage solutions, smart grids, and green hydrogen production.

Solar Technology

India has become a major adopter of solar photovoltaic technology, with innovations in floating solar, agrivoltaics, and building-integrated photovoltaics.

Wind Energy

The ICMAI report said India is advancing in both onshore and offshore wind energy technologies, with increasing turbine efficiencies and capacity factors.

Hydroelectric Power

To address baseload power needs, India is investing in various hydroelectric projects, including pumped storage systems that complement intermittent renewable sources.

Smart Grid Technology

Digital technologies are being integrated into India's power infrastructure to create smart grids that can efficiently manage the variable nature of renewable energy sources.

Socioeconomic Impact

The renewable energy transition in India is creating profound socioeconomic changes that affect millions of lives. Beyond generating clean electricity, this sector is transforming job markets, improving energy access, enhancing energy security, and delivering environmental benefits.

How key listed players fared on bourses in 2025

On a year-to-date (YTD) basis, Adani Green Energy shares have slipped over 2% (as of December 11 closing level), while Premier Energies stock has slipped around 32%. Vikram Solar shares were listed in August 2025. Since that period, the stock has been trading 33% lower.

Suzlon Energy shares have slipped 20% so far in 2025, while Waaree Energies has gained 1.25% during the period. Sterling and Wilson Renewable Energy shares have declined by over 54% during the period, while KPI Green Energy shares have fallen by 27.61% so far in 2025.

Inox Green Energy Services shares have rallied 10.5% during the window.

Why did shares fall? What are the roadblocks?

According to news reports, renewable energy stocks in India have been falling this year due to various factors, such as domestic supply gluts, policy uncertainties, global economic pressures, and high valuations.

Remember, stocks from this industry gave phenomenal returns to investors last year.

The pause is intended to strengthen grid integration and enhance overall project quality.

Despite the temporary slowdown, the government remains confident in meeting India’s target of 500 GW of non-fossil fuel capacity by 2030.

To sum up

Renewable energy stocks are expected to do well in the long run, given the huge potential as cited above; however, in the short-to-medium term, the stocks may witness volatility and correction.

Related News

About The Author

Next Story