Market News

Relaxo, PC Jewellers, Dabur, GCPL, HUL: Consumer names shine in listless market; top reasons behind the outperformance

5 min read | Updated on July 07, 2025, 15:12 IST

SUMMARY

Consumption stocks: The theme that was dominating Dalal Street was consumption. FMCG stocks and select consumer discretionary and consumer durable stocks were trading with notable gains in the trade. The NIFTY FMCG index was trading at 55,573.50 levels, up 1.53%.

Stock list

The top gainers on the BSE FMCG index were Hindustan Foods (up 7.05%), Godrej Consumer Products or GCPL (up 6.47%), and Bajaj Consumer Care (up 5.62%). | Image: Shutterstock

The theme that was dominating Dalal Street was consumption. FMCG stocks and select consumer discretionary and consumer durable stocks were trading with notable gains in the trade.

The NIFTY FMCG index was trading at 55,573.50 levels, up 1.53%. On the BSE too, the BSE Fast Moving Consumer Goods was ruling at 20,448.16, up 1.35%.

The top gainers on the BSE FMCG index were Hindustan Foods (up 7.05%), Godrej Consumer Products or GCPL (up 6.47%), and Bajaj Consumer Care (up 5.62%).

The top contributors to the BSE FMCG index were HUL (98 points), ITC (53 points), and GCPL (48 points).

FMCG stocks gained in the trade following encouraging Q1 business updates by leading players such as Marico, Dabur India, and Godrej Consumer Products Limited (GCPL).

Marico, last week, said the FMCG sector exhibited consistent demand patterns during the June 2025 quarter, marked by improving trends in rural markets and steady urban sentiment. The company said it expects gradual improvement in the quarters ahead, supported by easing inflation, a favourable monsoon season, and policy stimulus.

Similarly, shares of Dabur Ltd and Godrej Consumer Products gained on Monday, July 7, as investors cheered the companies' June quarter (Q1 FY26) business updates.

While Godrej Consumer Products said it expects double-digit revenue growth in rupee terms on a consolidated basis, Dabur said it expects consolidated revenue to grow in low single digits on account of a decline in beverages.

Dabur's Home and Personal Care (HPC) division is expected to perform well, driven by the oral, home and skin care categories.

Among discretionary companies, PC Jeweller shares were trading over 16% higher at ₹19.42 on the NSE, while Relaxo Footwears was trading over 9% higher at ₹507.65. Hawkins Cookers were trading nearly 7% higher at ₹9,337.95. FSN E-Commerce Ventures, the parent company of Nykaa Ltd, was trading at ₹201.32, up 1.56%.

Senco Gold was trading nearly 3% higher at ₹360.05, while Westlife Foodworld, the operator of McDonald's restaurants in West and South India, was trading 1.38% higher at ₹766.85 on the NSE.

Most of these companies were trading higher on account of good business updates from them or from their peers.

Select consumer durable companies shares were also trading with gains. For instance, Dixon Technologies was trading over 1.40% higher at ₹15,416, while Amber Enterprises India was up 0.28% at ₹7,370.

Consumption booster

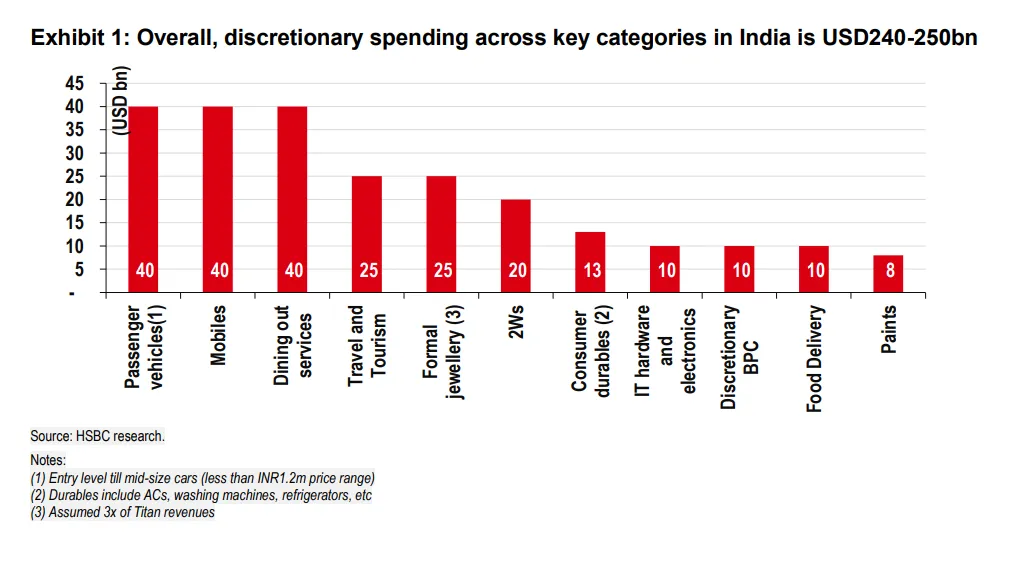

According to experts, consumption in India is likely to get a $30-40 billion annual booster shot over the next 18-24 months. This is significant as they calculate the total discretionary spending in India at around $250 billion.

This includes spending on automobiles, consumer goods, dining out, electronics, etc. Although it is difficult to determine which categories will benefit the most, on average, analysts believe consumption should improve as a result of higher disposable income.

Changes in personal tax

The biggest reason behind the increase in consumption is the higher disposable income in the hands of consumers, following the Union Budget 2025-26 presentation, wherein Finance Minister Nirmala Sitharaman, in her speech, announced that no income tax will be levied on income of up to ₹12 lakh under the new tax regime.

The 'nil tax' slab is up to ₹12.00 lakh (₹12.75 lakh for salaried taxpayers with a standard deduction of ₹75,000).

Slabs and rates are being changed across the board to benefit all taxpayers.

A new structure to substantially reduce taxes on the middle class and leave more money in their hands, boosting household consumption, savings and investment, the FM had said.

Benefits of 8th Pay Commission

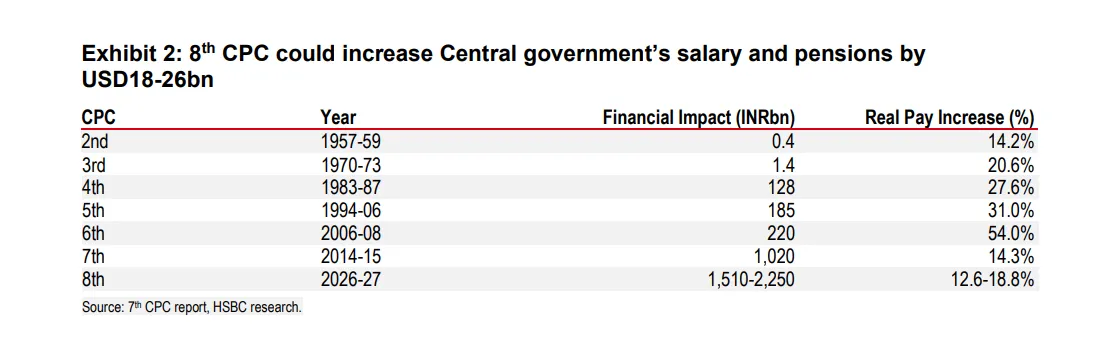

Anothe reason behind the surge in consumption is the benefits of the 8th pay commission from FY27 onwards.

In January 2025, the government of India announced the decision to set up the 8th Central Pay Commission (CPC) for its employees. The announcement has raised hopes of nearly 50 lakh central government employees and 65 lakh pensioners.

HSBC Global Research, in its report dated June 16, 2025, said that the 8th pay commission (assuming a 15% hike in salary) could mean $18-26 billion of additional incremental income for public sector and defence employees.

"Although some of the extra income could be saved or invested, we think most will go towards consumption," the report added.

Lower interest rates

HSBC notes that 75-100 bps lower interest rates would mean savings of $3-4 billion on mortgage payments alone. Lower inflation would offer further upside to these savings.

It must be noted here that the monetary policy committee (MPC) of the Reserve Bank of India (RBI), in its latest monetary policy meeting that was held from June 4 to June 6, decided to cut the repo rate by 50 basis points (bps) to 5.5%.

This was the third straight rate cut by the apex bank; after the cut, India's repo rate is the lowest in three years.

The repo rate – the rate at which banks borrow funds from the RBI – had last stood at 5.40% on August 5, 2022.

The RBI governor, while announcing the policy, said that the Indian economy presents strength, stability and opportunity amid global concerns. Governor Sanjay Malhotra added that the Indian economy is growing at a very fast pace, and "we are making all efforts to grow even faster in our vision of Viksit Bharat."

Lower interest rates, along with contained inflation, mean increased consumer spending.

Related News

About The Author

Next Story