Market News

Is Indian IT sector coming out of the woods?

4 min read | Updated on December 23, 2025, 14:10 IST

SUMMARY

Indian IT stocks regained investor attention in December as the sector outlook changed owing to multiple factors. Improved outlook by domestic IT firms in line with global guidance buoyed the outlook for IT investors altogether.

IT stocks post sharp recovery amidst Tuesday’s crash, TCS turns green

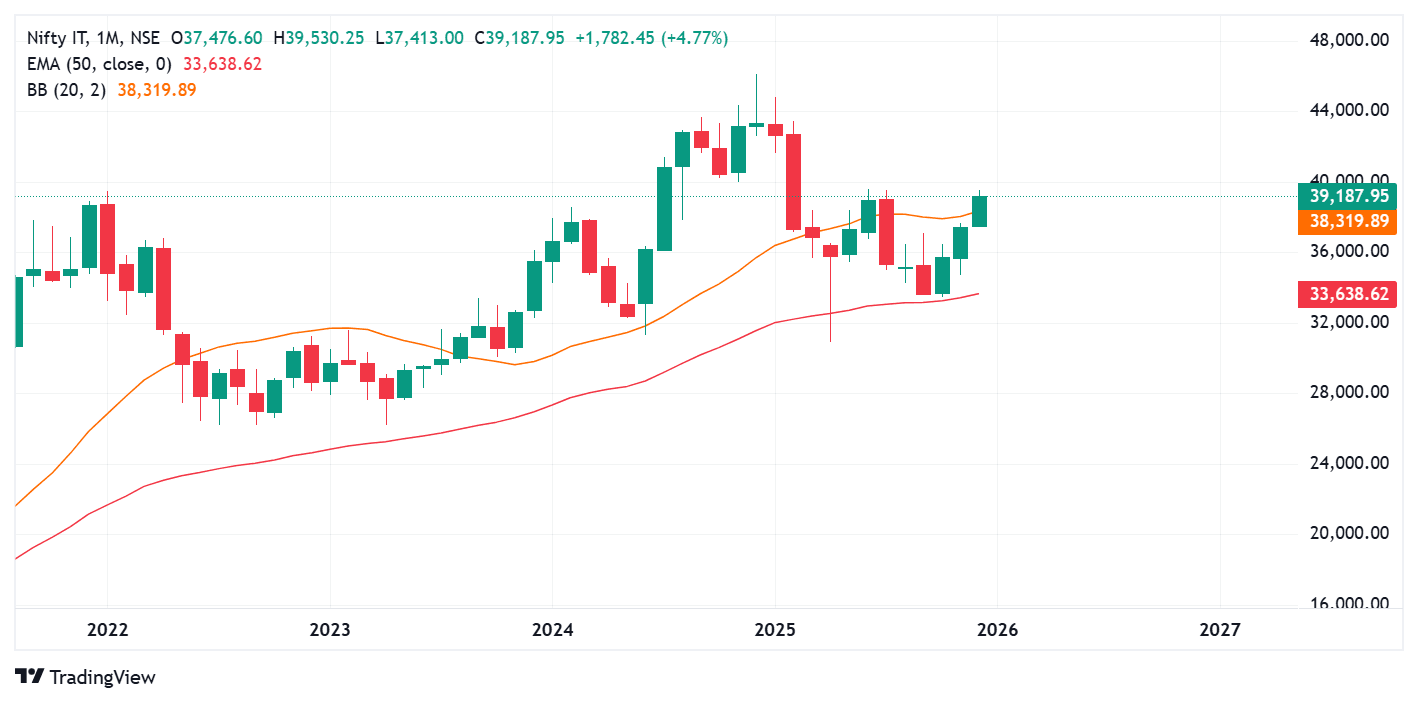

IT stocks are back in focus and among every market participant’s watchlist as the sector is showing signs of revival. The NIFTY IT index, which is one of the top losers for 2025, is now the top sectoral gainer for December, gaining over 5%. Improvement in sentiment for tech stocks across the globe has buoyed the outlook for Indian IT firms as well.

However, visa restrictions and heightened H1-B visa fees remain some of the key headwinds for the sector. Despite multiple headwinds, the IT stocks have shown strong resilience and are showing a strong comeback from the dull period. With increased adoption of AI, higher investment in GCCs (Global Capacity Centres) and improved hiring environment and a strong outlook by global IT firms, is the IT sector finally coming out of the woods? Here is why

Improved macro environment

In sharp contrast to 2024, 2025 has witnessed improved macroeconomic conditions with central banks across the globe adopting an easy money policy. The US, which is India’s largest IT export market, also saw easing in monetary tightening as the Federal Reserve cut interest rates from 5% in September 2024 to 3.7% in December 2025.

The easing of interest rates has boosted the outlook for IT companies as it leads to higher spending from the US customers. Consequently, the deal wins for the IT sector improved in high double digits in Q2FY26 as compared to muted performance in the year-ago period. Companies like Infosys, HCL Tech also improved their guidance from 1-3% to 2-5%.

Currency depreciation added benefit

The Indian rupee has depreciated by over 5% against the US dollar, proving to be a boon for IT firms as they struggled through muted topline growth in the first half of 2025. However, the currency depreciation impact was increasingly visible in the FY26 earnings to date. The Q2FY26 topline growth for the NIFTY IT index stood at 6.4%, the highest amongst the previous four quarters. It also helped in maintaining healthy operating margins for companies.

Increased AI adoption

As US tech stocks are riding the wave of artificial intelligence, the Indian tech companies were left behind and felt like they missed the bus. However, major IT players from India are now focusing on AI adoption at granular levels and redesigning their offerings blended with AI-related services. TCS, the largest IT player, announced its ambitions of becoming the largest AI-led technology services provider.

In their Q2 earnings report, the company also announced $6.5 billion worth of investment to build AI-ready data centres. Infosys unveiled an AI-first GCC model, which includes offerings with agentic AI solutions at a production-grade level for clients. Along with the large TCS and Infosys, other key players like HCLTech, Tech Mahindra, and Wipro are investing heavily in the AI space through acquisition.

Owing to increased AI participation, investors are now moving their focus towards the IT sector altogether.

Robust earnings by global IT giants

Global IT giants like Accenture Plc posted a strong set of numbers for its Q1 of 2026, beating the industry expectations. The company’s topline rose 6% higher at $18.7 billion for Q1 FY26 (November to September), led by rising adoption of AI-led transformation projects.

With robust earnings growth, the company also maintained a positive outlook for 2026. The company expects full-year revenue growth to be in the range of 1% to 5% in local currency terms. Further, it also indicated doubling down on hiring in Europe and the US throughout the year. The robust earnings growth and positive outlook buoyed the investor sentiment for Indian IT stocks as well.

Chart check

Apart from fundamental cues, the technical structure for the NIFTY IT index also looks positive. The monthly charts show that, index has bounced back from the September lows and posted a three-white soldiers candlestick chart pattern on the monthly charts. The chart pattern occurs at the reversal of the downtrend and forms a bottoming-out pattern on charts. Additionally, the NIFTY IT index is also closing above the 20 SMA level of 38,318, further underlining a reversal from the bearish trend.

In summary, the IT sector is showing signs of revival with an improved hiring trend after mass layoffs, renewed outlook better margins owing to currency depreciation and increased AI adoption at the product level. However, Indian IT's edge will depend upon strengthening in AI leadership and how well it manoeuvres through the macro and volatility turmoil.

Disclaimer: This article is purely for informational purposes and should not be considered investment advice from Upstox. Please consult with a financial advisor before making any investment decisions.

About The Author

Next Story