Market News

FMCG sector Q2FY25 earnings preview: Key insights on revenue growth and market trends

.png)

3 min read | Updated on October 14, 2024, 17:04 IST

SUMMARY

The FMCG sector's Q2FY25 earnings are expected to show modest revenue growth, with challenges from rural demand, inflation, and competition. Big players face pressure from smaller rivals, impacting margins and overall profitability.

Stock list

FMCG sector Q2FY25 earnings preview - Here are the key insights on revenue growth and market trends

The FMCG (Fast-Moving Consumer Goods) sector is facing a mixed bag of challenges and growth prospects. With a softer demand environment, especially in rural areas, and inflationary pressures affecting raw material costs, the upcoming results are expected to reflect moderate growth in key segments.

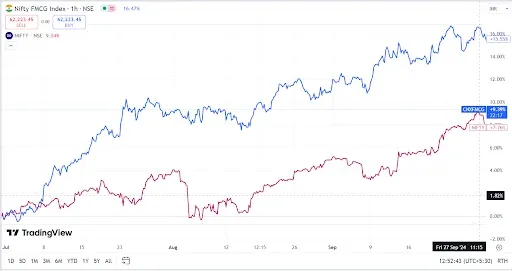

The Indian FMCG sector is set to announce its second quarter (Q2) earnings for FY2025, covering the quarter ending September 30. The Nifty FMCG index jumped 15.55% in the July to September quarter, significantly outperforming the benchmark NIFTY 50 (+7.76%).

Top FMCG companies

| Name | Market Capitalisation | Price to Earning | CMP (Rs) |

|---|---|---|---|

| HUL | 6,47,124.5 | 62.6 | 2754 |

| Nestle India | 2,42,220.4 | 74.8 | 2512 |

| Varun Beverages | 1,91,233.5 | 78.8 | 588 |

| Britannia Inds. | 1,44,531.8 | 65.6 | 6002 |

| Godrej Consumer | 1,34,657.7 | 76.7 | 1316 |

| Tata Consumer Products | 1,10,318 | 83 .2 | 1115 |

| Dabur India | 1,01,358.5 | 54.7 | 571 |

| Colgate | 99,170.10 | 70 | 3641 |

(source: screener, 10/08/2024)

What to Expect in Q2FY25?

FMCG companies are likely to report revenue growth in the range of low to mid-single digits, driven by moderate volume growth. However, EBITDA growth is expected to be modest, with profits under slight pressure.

Demand in the sector is below expectations, especially in rural regions, mainly due to heavy rainfall in certain areas. This has affected the consumption of products like ice creams, beverages, and paints. Inflationary pressures on key raw materials are likely to limit gross margins.

The consumption of categories like cigarettes and out-of-home FMCG products has also been impacted. Another factor contributing to the slowdown is competition from local and regional players in-home care and food products. Additionally, companies in the Beauty and Personal Care (BPC) segment are facing challenges from new-age D2C brands.

For the overall sector, revenue growth could be around 5%, while EBITDA may grow marginally, and PAT may see a slight decline compared to last year.

Why Are Big Players Facing Competition from Small Players?

Smaller players are more in tune with customer preferences, offering better margins and longer credit periods, giving them an edge. To remain competitive, big players are likely to invest aggressively in advertising and brand-building.

Key Insights

- ITC: The cigarette segment might see slight volume growth, though floods in southern markets like Andhra Pradesh and Telangana could affect sales.

- Colgate: Volume growth is expected to remain stable, with some improvement in the product mix, though a slight contraction in gross margins is anticipated due to higher costs.

- Dabur: A decline in revenues due to inventory adjustments and pricing pressure in the beverage segment. The company has faced challenges in its GT (General Trade) channel as well.

- Britannia: Volume growth expected due to distribution expansion, but margins faced compression due to inflation.

- Tata Consumer Products: Strong growth is expected in salt and international businesses, but the tea portfolio might underperform.

- Marico: High single-digit growth led by Saffola Foods and international markets, but competition in the mass segment might impact margins.

Review of Q1FY25

The FMCG sector saw revenue growth, largely driven by a steady recovery in rural demand. Companies managed to achieve mid to single-digit revenue growth, despite challenges such as extreme heat in the north, increased competition, and the upcoming general elections. The recovery was supported by a favourable monsoon, expansion in rural distribution, and the introduction of region-specific products.

About The Author

Next Story