Market News

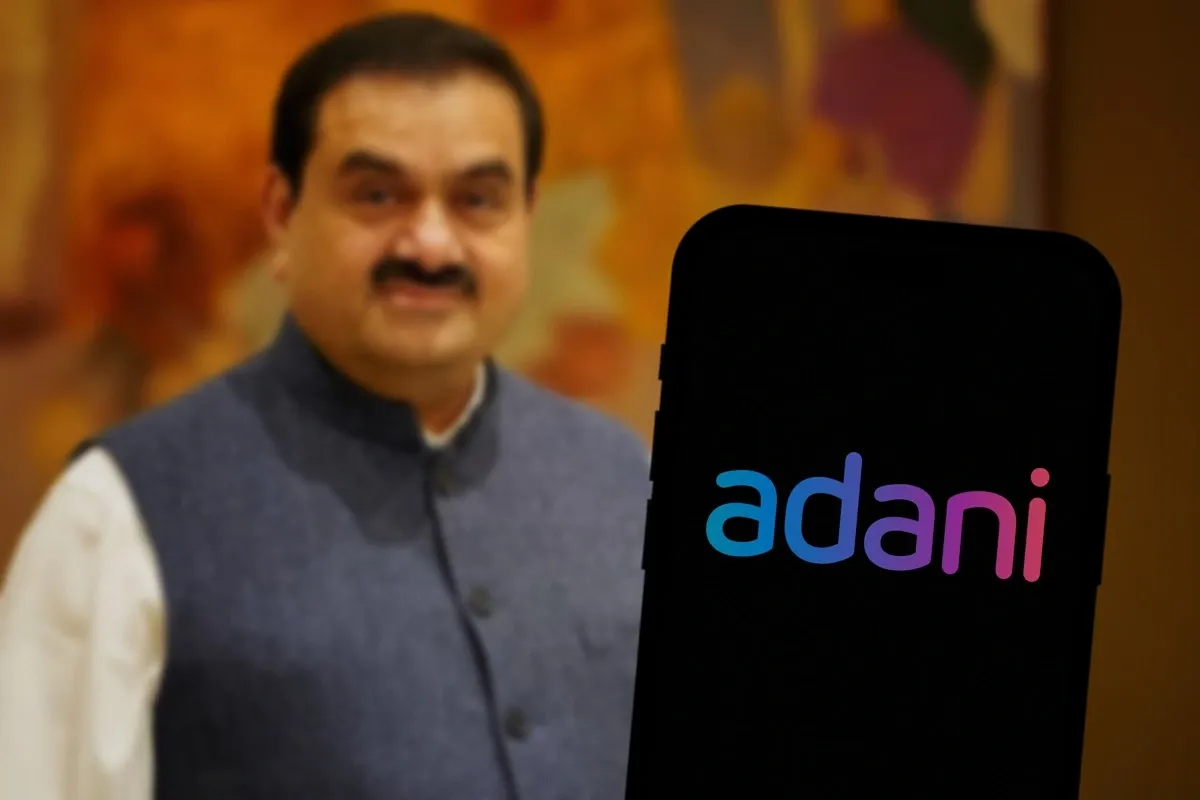

Adani Green, Adani Total Gas: Adani Group stocks tumble up to 20% as Gautam Adani indicted in US on bribery and fraud charges

.png)

3 min read | Updated on November 21, 2024, 11:08 IST

SUMMARY

Gautam Adani, the billionaire chairman of the Adani Group and one of the world's richest people, has been indicted in New York over his role in an alleged multibillion-dollar bribery and fraud scheme.

Stock list

The stocks nosedived as Gautam Adani, the billionaire chairman of the Adani Group and one of the world's richest people, has been indicted in New York over his role in an alleged multibillion-dollar bribery and fraud scheme.

The stocks nosedived as Gautam Adani, the billionaire chairman of the Adani Group and one of the world's richest people, has been indicted in New York over his role in an alleged multibillion-dollar bribery and fraud scheme.

Prosecutors also said the Adanis and another executive at Adani Green Energy, former CEO Vneet Jaain, raised more than $3 billion in loans and bonds by hiding their corruption from lenders and investors.

Among individual names, Adani Energy Solutions was locked in the 20% lower circuit at ₹697.70 on the BSE. Adani Ports was frozen at a 10% lower circuit at ₹1160.15. Shares of Adani Wilmar were down nearly 8% at ₹301.60 apiece on the BSE, while those of Adani Power were trading around 11% lower.

Adani Enterprises was also locked in the 20% lower circuit at ₹2538.20.

According to an indictment, some conspirators referred privately to Gautam Adani with the code names "Numero Uno" and "the big man," while Sagar Adani allegedly used his cellphone to track specifics about the bribes.

The report added that Gautam Adani, Sagar Adani, and Jaain were charged with securities fraud, securities fraud conspiracy, and wire fraud conspiracy, and the Adanis were also charged in a US Securities and Exchange Commission civil case.

None of the defendants is in custody, a spokesperson for US Attorney Breon Peace in Brooklyn said. Gautam Adani is believed to be in India.

This is the second serious allegation against the conglomerate after Hindenburg Research, in its report in early 2023, said that the group was involved "in a brazen stock manipulation and accounting fraud scheme" for decades.

Following this, the Adani Group stocks tumbled as investors rushed to sell the stocks left, right, and centre. However, months later, the stocks recovered.

In July this year, the Supreme Court of India rejected a plea to review its January 3, 2024, verdict upholding the Securities and Exchange Board of India (SEBI) investigation into allegations of share price manipulation and failure to disclose transactions in violation of the regulations and securities’ laws raised by US-based Hindenburg Research against the Adani Group.

In a significant win for the Adani Group, the top court, on January 3, 2024, declined to order a CBI or SIT probe. In its judgment, the apex court had said market regulator SEBI was conducting a "comprehensive investigation" into the allegations, and its conduct "inspires confidence.".

In August 2024, Sebi said it had completed all but one of the investigations into allegations against the Adani Group.

The capital markets regulator said it had completed 23 out of 24 investigations, adding that it has issued over 100 summons and 1,100 letters and emails to the Adani Group.

Refuting the allegations of inaction made by Hindenburg Research in its latest blog on August 10, Sebi said it had issued communications to domestic and foreign regulators and examined over 12,000 pages of documents.

About The Author

Next Story