Upstox Originals

Will TCS’s $7 billion pivot towards data centres make it India’s AI backbone?

8 min read | Updated on October 17, 2025, 15:26 IST

SUMMARY

TCS plans a $6–7 billion investment to build a 1 GW AI data centre network, India’s largest. With demand expected to surge 10× by 2030, the move marks TCS’s bold shift from IT services to AI infrastructure, backed by policy tailwinds and strategic partnerships.

Stock list

India had an installed IT load capacity of approximately 1.4-1.7 GW as of Q2 2025, with an additional 1.4 GW under construction

For years, major IT firms thrived on a simple, asset-light model: hire skilled professionals from India to deliver services to global clients. It was a model with few assets that relied on people's knowledge instead of heavy infrastructure. But that old formula is starting to look out of date as AI changes the way technology works.

Tata Consultancy Services (TCS) announced a plan in its Q2 FY26 update that could change the future of the industry. The company will create a new subsidiary to build AI infrastructure (large-scale data centres and computing systems that power AI models), primarily a 1 GW data center network across India, with an investment of $6–7 billion over the next five to seven years. In 18 to 24 months, the first facilities are expected to be up and running.

In short, TCS doesn't just want to write code for the future; it wants to run it. With this, TCS is on its way to becoming the largest technology services company in the world that uses AI.

India’s Data Centre Crunch: Why TCS’s 1 GW Plan Is a Big Deal

According to S&P Global Market Intelligence, India had an installed IT load capacity of approximately 1.4-1.7 GW as of Q2 2025, with an additional 1.4 GW under construction — effectively doubling total capacity within two years.

However, this expansion still falls short of projected demand. Current estimates suggest:

- Installed capacity: ~1.4–1.7 GW

- Committed future supply: 5–6 GW

- Expected demand by 2030: 10x growth over current levels

Most existing operators are scaling cautiously, typically in 100–300 MW increments. In contrast, TCS’s planned 1 GW rollout is unprecedented in scale — positioning it as the largest single-capacity build in India’s data centre market.

In short, while the market is expanding fast, supply remains far behind future demand, and TCS is aiming to fill that gap at scale.

Largest datacenter operators in India by live and pipeline capacity (MW)

| # | Operator | Live Capacity (MW) | Pipeline Capacity (MW) | Total (MW) |

|---|---|---|---|---|

| 1 | TCS | 0 | 1000 | 1000 |

| 2 | NTT Global Data Centers | 359 | 269 | 628 |

| 3 | Others (smaller operators combined) | 343 | 276 | 619 |

| 4 | ST Telemedia Global Data Centres | 193 | 192 | 385 |

| 5 | Nxtra Data (Bharti Airtel) | 240 | 54 | 294 |

| 6 | Microsoft | 0 | 242 | 242 |

| 7 | AdaniConneX | 0 | 237 | 237 |

| 8 | Lumina CloudInfra | 0 | 240 | 240 |

| 9 | CtrlS Datacenters | 137 | 67 | 204 |

| 10 | Sify Technologies | 177 | 66 | 243 |

| 11 | Web Werks | 70 | 43 | 113 |

| 12 | Yotta Infrastructure Solutions | 19 | 74 | 93 |

Source: Anant Raj QIP Document, C&W Research

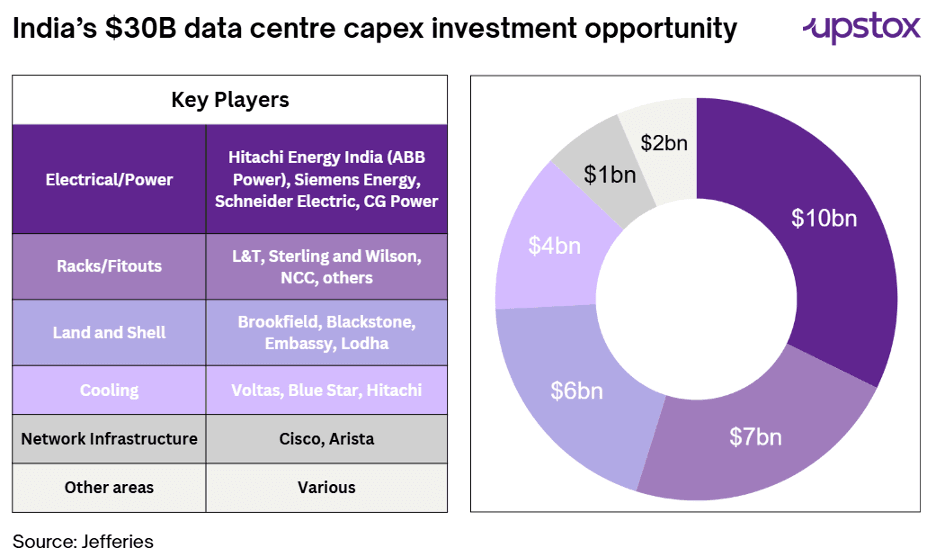

Data centre opportunity today stands at close to $30 billion

The larger data center ecosystem could bring in more than $30 billion in capital expenditures for power, construction, cooling, and networking, as seen in the chart below.

Catalysts that could fuel the move

| Governing Body | Policy | Year | Brief Description |

|---|---|---|---|

| Government of India | India AI Mission | 2024 | Aims to build an AI economy worth $1 trillion by 2035, which will increase the need for scalable cloud and data-center space. |

| MeitY | DPDP Act | 2023 | Limits the use of personal data and cross-border transfers to make sure that privacy rules are followed. |

| SEBI | Data Storage Mandate | 2023 | Requires all regulated entities, such as brokers, exchanges, and MFs, to keep and process data in India. |

| MeitY | Data Centre Policy | 2020 | Aims for investments of more than $5 billion to build digital infrastructure and boost domestic manufacturing. |

| RBI | Data Localisation Mandate for Payments | 2018 | Required all payment information to be kept in India, which increased the need for local data centers. |

Source: Government Bodies

A look at TCS’s AI and Data Centre partnerships

TCS is getting ahead of the curve by focusing on AI infrastructure and forming multiple strategic partnerships in the AI and data center space:

| Partner | Nature of Partnership |

|---|---|

| Intel | Infrastructure + AI Stack |

| HPE (Hewlett Packard Enterprise) | Edge-to-Cloud Infrastructure |

| Cisco | Next-Gen Data Centre & Networking |

| Dell Technologies | Infrastructure Integration |

| Infinidat | Data Infrastructure & Sovereign Cloud |

| Juniper Networks | AI-Driven Enterprise Networking |

| Lenovo | Edge + Compute + AI Platforms |

| Nutanix | Hyper-Converged Infrastructure |

| NetApp | Data Storage & Cloud Integration |

| VMware (Broadcom) | Cloud & Virtualisation |

| Cerebras | GenAI Supercomputing Collaboration |

| Google Cloud (GCP) | Cloud + AI Solutions Partner |

| Microsoft | Generative AI & Cloud Infrastructure |

| SAP | AI Embedded ERP Transformation |

| SymphonyAI | Predictive & Generative AI Apps |

| Vianai | Conversational AI + Decision Intelligence |

| Kore.ai | Conversational AI & Virtual Assistants |

| CEA (France) | Physical AI (Robotics + Cognition) |

Source: www.tcs.com/who-we-are/alliances-partnerships

Decoding TCS’s AI infrastructure bet

Colocation Model

The planned Data Centres (DC) will follow a colocation model (different types of DC business model will be explained later), meaning TCS will not manage or operate client workloads.

Instead, TCS will build and maintain the passive infrastructure — including land, power supply, cooling systems, and high-speed connectivity — while clients will bring in and operate their own compute and storage hardware.

Potential anchor clients include:

-

Global hyperscalers (e.g., AWS, Microsoft, Google) are seeking India-based capacity to meet data localisation norms.

-

AI-native firms developing or deploying large-scale models.

-

Indian enterprises are migrating critical workloads to dedicated AI infrastructure.

-

Government-backed projects aligned with digital sovereignty and the India AI Mission.

How will this be monetised? What are returns like?

TCS's management sees this as a steady, annuity-like source of income. It also helps build relationships with hyperscalers, AI-native companies, and government digital projects to cross-sell its wide range of IT and AI tech-related services to those clients.

The venture's return on equity (ROE) at the subsidiary level will be lower than TCS's group ROE of more than 50% because it needs a lot of capital. But management has said that the investment won't hurt margins at the consolidated level because outside partners and financial investors will fund the capex.

This move is better seen as a way to put cash to work than as a way to grow in the near future rather than paying dividends.

Risks and execution challenges

-

Capital intensity: It will take years for a $7 billion investment to pay off, and the returns depend a lot on how much it is used and how much it costs.

-

Competitive landscape: The data center market in India is already dominated by established companies like NTT GDC, ST Telemedia, Airtel Nxtra, CtrlS, AdaniConneX, and Yotta.

-

Risk of technology: Infrastructure needs to be built to handle next-gen AI workloads, which need a lot of power and advanced cooling. Both of these things are expensive and change quickly.

-

Regulatory and power limits: Regional approvals, grid reliability, and tariffs are still big problems for running large data centers.

-

Client adoption: Long-term profitability depends on steady anchor demand.

-

It is still unclear how this new infrastructure business will fit in with TCS's main IT and AI services.

Different data center business models

While most India DCs are currently focusing on building DC business on the Colocation model while managed service remains the best business model to garner higher RoE, but requires a lot of investment on the technology side.

Source: Kotak Mutual Fund

Parting thought

TCS's $7 billion bet is a brave one. It shows that the company knows where the next ten years of digital value will come from: not from cheap labor, but from owning the infrastructure that makes intelligence possible. If this works, it could change not only TCS's future but also the whole IT ecosystem in India.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story