Upstox Originals

Why Chinese steel oversupply won’t derail India’s steel growth

.png)

9 min read | Updated on July 08, 2025, 18:39 IST

SUMMARY

India’s steel sector remains resilient despite China’s massive oversupply. Robust domestic demand, strategic government actions, product differentiation, ESG-driven innovations, and efficient cost management shield India from global volatility.

Stock list

China’s crude steel production capacity was estimated to be ~1.25–1.3 billion tonnes per year, significantly exceeding its internal requirements

China’s steel industry is grappling with overcapacity and sluggish domestic demand, prompting a flood of exports that has raised global trade tensions. China’s crude steel production capacity was estimated to be around 1.25–1.3 billion tonnes per year by mid-2024, significantly exceeding its internal requirements.

In 2024, China produced 973 million tonnes of crude steel, while domestic consumption fell to ~877 million tonnes—a six-year low. This imbalance has driven Chinese mills to aggressively push steel abroad.

China’s steel exports surged 22.7% to a record 110 million tonnes in 2025. By March 2025, monthly exports reached 10.46 million tonnes, approaching historical highs and highlighting the extent of oversupply.

| Metric | CY23 (Actual) | CY24 (Actual) | CY25 (Estimated) |

|---|---|---|---|

| Crude Steel Production (MT) | 1,024 | 973 | 973 |

| Domestic Consumption (MT) | 961 | 877 | 877 |

| Steel Exports (MT) | 91 | 111 | 110 |

Source: S&P Global, Production and Demand – WSD Report; Exports volume and HRC Export Price – Bloomberg

China’s steel sector reported a $5 billion loss from January to September 2024. Angang Steel, the country’s second-largest steelmaker, posted a $1 billion loss, highlighting the challenges in China’s steel industry.

The world’s largest steel company from China warned of a “harsh winter,” signaling a slowdown due to oversupply, according to Bloomberg.

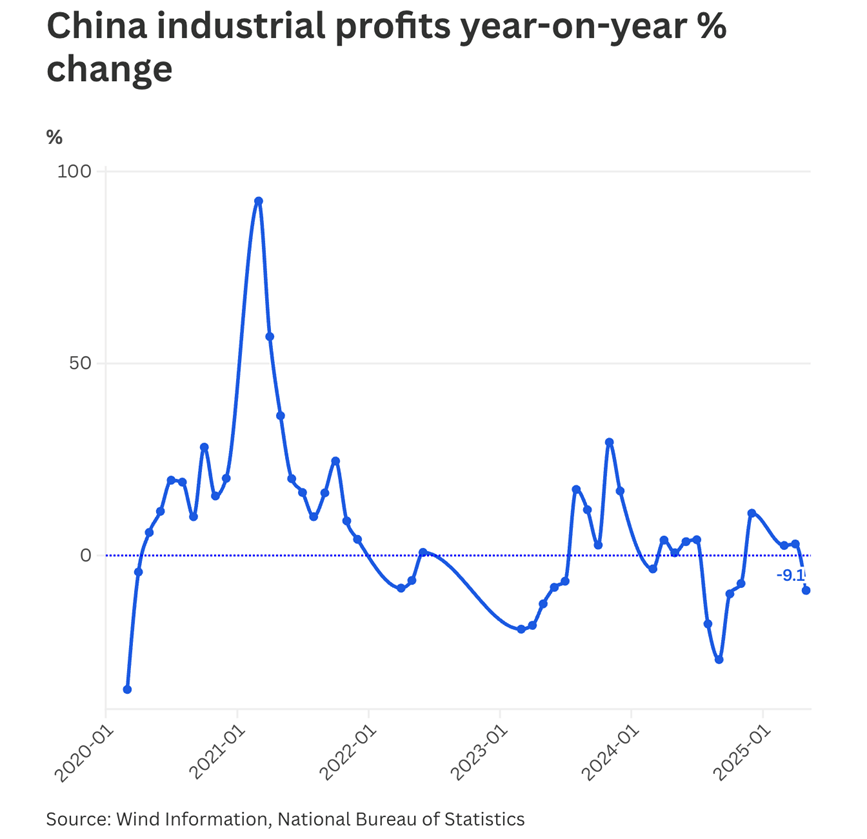

China’s industrial profit plunged by 9.1% in May-25 due to muted domestic demand and lower industrial commodity prices as per CNBC.

Global actions to curb Chinese steel supply

Between early 2024 and February 2025, around 29 major trade cases were filed against Chinese steel, nearly double the total from 2020–2023. The U.S., EU, Vietnam, South Korea, Malaysia, and others have imposed duties on various Chinese steel products in the past year.

For instance, Vietnam targeted certain Chinese hot-rolled coil imports with preliminary duties of ~19–28%, and the U.S. currently has AD/CVD orders on 34 steel products from China. Even globally, the trend is clear – WTO members initiated 67 new anti-dumping probes on Chinese steel in the first 10 months of 2024. This pushback is expected to curb China’s steel exports by late 2025 and into 2026.

A look at India’s steel industry

Amid slowing steel demand growth globally, India stands out as a key growth engine.

India’s steel sector performance (FY23–FY25E):

| Metric | FY23 | FY24 | FY25E |

|---|---|---|---|

| Installed Capacity (MT) | 154 | 180 | 205 |

| Capacity Utilisation (%) | 79% | 80% | 74% |

| Crude Steel Production (MT) | 127 | 144 | 152 |

| Finished Steel Consumption (MT) | 120 | 136 | 152 |

| Import (MT) | 6.0 | 9.6 | 10.5 |

Source: Ministry of Steel, Industry Reports, JSPL

While major economies are experiencing sluggish or declining steel demand, India continues to witness robust double-digit growth driven by substantial infrastructure spending and sustained domestic consumption.

Comparative global steel demand growth (CY23–CY25E):

| Region | CY23 Demand (MT) | CY24E Demand (MT) | CY25E Demand (MT) | CY25E Growth (YoY %) |

|---|---|---|---|---|

| World | 1,767 | 1,751 | 1,772 | 1% |

| China | 896 | 869 | 860 | -1% |

| India | 133 | 143 | 156 | 8% |

| USA | 91 | 89 | 91 | 2% |

| EU & UK | 139 | 137 | 141 | 4% |

| Japan | 53 | 52 | 53 | 2% |

Source: JSPL,World Steel Association - Short Range Outlook Oct 2024

Key demand drivers

The government’s massive infrastructure programs – Gati Shakti (National Master Plan) and record budgetary capex (roads, railways, metro projects) – are steel-intensive. Urbanisation and housing (e.g. the PM Awas Yojana affordable housing scheme) are boosting long steel demand.

The Production-Linked Incentive scheme for manufacturing (including a ₹6,322 crore PLI specifically for speciality steel) is catalysing investment in sectors like auto, white goods, and renewables.

China vs India - A comparative look

China and India represent contrasting trajectories within the global steel industry. China’s steel market is mature, with limited growth potential amid saturated domestic demand and substantial export dependence.

Conversely, India is experiencing rapid expansion driven by robust domestic demand from infrastructure, urbanisation, and renewables. India’s steel sector, characterised by private-sector dynamism, diversified technology adoption, and emerging sustainability frameworks.

According to Crisil, domestic steel prices were 5% higher than import prices (mainly from China) across various categories as of April 2025. The imposition of a 12% safeguard duty is expected to offer relief to domestic producers by curbing the influx of imports, helping to protect the local industry from price pressures.

| Parameters | China | India |

|---|---|---|

| Global position & scale | Largest producer (54% global share), high per capita consumption (~630 kg/year), export-driven | Second-largest producer (~7% global share), low per capita consumption (~80 kg/year), domestic-demand driven |

| Demand drivers | Infrastructure, real estate, and manufacturing exports | Urbanisation, infrastructure, defence, renewable energy, and affordable housing |

| Industry structure | Dominated by large, state-owned firms, aggressive export policies | Fragmented market with strong private players and declining PSUs |

| Technology & carbon profile | Dominated by blast furnaces, leading global decarbonization initiatives | Diverse technology (DRI, EAF, blast furnace), emerging ESG initiatives, high scrap use, and early green steel adoption |

| Growth outlook | Mature demand, flat production growth, slowing investment cycle | Rising demand, accelerating capacity expansion, and key global growth drivers |

Source: Shyam Metalics & Energy, Industry Reports

Key reasons Chinese steel won't hurt India

India turns inward: robust domestic demand

-

India’s core advantage is that it's still in a growth phase: demand from infrastructure, housing, railways, EVs, and defence is expected to remain strong

-

Steel producers will prioritise import substitution and push value-added domestic production to reduce dependence on global pricing volatility

-

India becomes a demand-led fortress, similar to how China was in the 2000s

Effective government safeguards

-

Tariff and trade actions: Swift response with provisional 12% safeguard duties on flat steel products (HRC/CRC) in April 2025.

-

Quality control barriers: Expanded BIS certification (QCOs) blocks sub-standard steel imports.

-

Strategic policy support: Production-linked incentives (PLI schemes) boost domestic high-grade steel manufacturing, especially in defence, rail, and EV sectors.

Product mix shift: moving up the value chain

-

Flat steel vulnerability: Chinese oversupply primarily affects commoditised, low-margin flat products.

-

Indian firms pivoting to premium: Tata Steel, JSW Steel, Jindal Steel, and Shyam Metalics focus on specialised, high-margin steels (automotive, speciality alloys, CRGO, stainless steel).

-

Value + volume strategy: Premium, specialised steel maintains pricing power and protects margins despite global price fluctuations.

Cost advantage and pricing resilience

-

Vertical integration: Indian mills (Tata, JSW, SAIL) leverage captive iron ore mines, ensuring lower input costs.

-

Stable pricing environment: Domestic steel prices remain stable and resilient, despite lower global prices, due to structural cost advantages.

Green steel and ESG differentiation

-

Sustainability as advantage: Chinese steel is perceived as carbon-intensive and subsidised; Indian producers adopt greener, cleaner methods.

-

Traceable and green steel: Aligned with global ESG frameworks, such as EU CBAM, enhancing export competitiveness.

-

Clean premium: Framing exports as green and sustainable rather than simply price competitive ensures long-term viability.

Market discipline and industry consolidation

-

Industry coordination: Proactive stance by industry and government swiftly addresses import surges and market disruptions.

-

Consolidation trend: Margin pressure accelerates M&A activity, distressed asset sales, and vertical integration (mining, logistics).

-

Market stability: India’s steel industry evolves toward fewer large-scale, efficient players, fostering resilience.

What major steel players are saying about Chinese imports?

JSW Steel

Acknowledged that near-record Chinese exports in 2024 had depressed global prices, but noted a turning point: domestic steel prices in India rose from March 2025 onward as Chinese export momentum slowed.

Notably, imports moderated from Q3 to Q4 FY25, and management stated, “We do not see any surge in import bookings as of now”.

They expressed confidence that if an import surge occurs, authorities will take appropriate safeguard action. This reflects the industry’s alignment with the government on protecting the domestic market.

SAIL

Leadership noted that India’s quality control orders help keep sub-par imports out, and SAIL itself adheres to the highest BIS standards, turning that regulation to its advantage in government tenders.

SAIL is also leveraging its downstream processing units to produce more value-added steel (like speciality rails, plates for defence), which Chinese mills cannot easily replace due to India-specific requirements and qualification processes. SAIL executives indicated they expect imports to fall going forward as the safeguard duty and BIS norms expand

Aggressive capacity expansion by Indian players reflects high confidence in domestic steel demand over the next 5–10 years. It also indicates that India will not depend on imports for additional demand; in fact, India could become a significant net exporter by late decade, helping offset China’s pullback in exports under global pressure.

| Company | FY2025 Capacity (MT) | Target FY2030 Capacity (MT) |

|---|---|---|

| JSW Steel | 27 | 50 |

| Tata Steel | 26 | 40 |

| SAIL (PSU) | 20 | 35 |

| Jindal Steel & Power | 9.6 | 25 |

| AM/NS India (JV) | 9 | 24 |

Source: Fortune India, company filings, NDTV Profit, Economic Times, Business Standard

What needs to be kept in mind?

Some important potential risk factors need to be kept in mind:

- The landed cost of imports, even post-duty, could decline further if global steel prices weaken due to persistent oversupply and rising trade protectionism.

- A substantial increase in domestic steel supply (with 10-12 MTPA planned for fiscal 2026) may put downward pressure on prices, particularly if domestic demand does not keep pace with the new capacities.

- The rising debt from ongoing capacity expansions has led to a net leverage (net debt-to-EBITDA ratio) above 3x in fiscal 2025 presents a risk if financial performance doesn’t meet expectations.

In summary

India doesn’t need to compete with China solely on price. Its structural domestic demand, strategic policy actions, ESG credentials, and product differentiation secure its growth trajectory in the global steel industry.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story