Upstox Originals

Is Paytm clawing back its UPI share?

7 min read | Updated on December 10, 2025, 15:27 IST

SUMMARY

The past couple of years have been a rollercoaster for One 97 Communications, shaped by regulatory shocks and a fiercely competitive UPI landscape. Yet its latest numbers show a positive shift that warrants a closer look. Is this the result of strategic tweaks, changing merchant behaviour, or simply the rise of UPI itself? The answer isn’t obvious, and that’s what makes the trend interesting.

Stock list

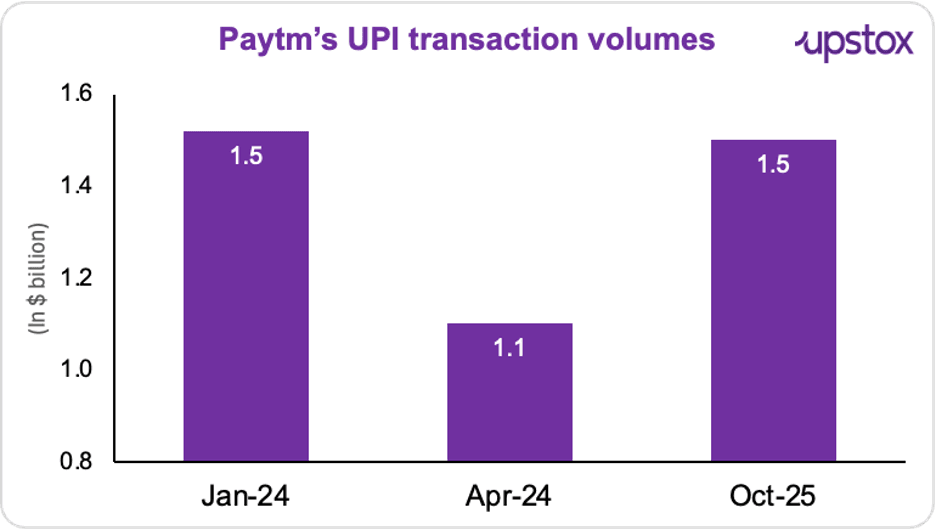

In October, Paytm logged 1.52 billion UPI transactions, its best showing in 20 months.

Remember when Paytm felt like the default way to pay?

Those blue QR boards at every kirana shop, autos casually asking “Paytm chalega?” - it was a time when the brand sat comfortably in the middle of India’s digital payments boom.

Then the RBI landed a curveball of restrictions that even Paytm didn’t see coming.

The action against its payments bank (in Jan 2024) led to a sharp slowdown; UPI volumes slipped from 1.56 billion in January to nearly 1.1 billion by April. For a brand used to momentum, this wasn’t a fall… it was a moment of uncertainty.

But the trend didn’t stay flat for long. In October, Paytm logged 1.52 billion UPI transactions, its best showing in 20 months. Founder Vijay Shekhar Sharma even hinted at market-share gains, and interestingly, this recovery came without splashy marketing spends.

Source: ET

Financially too, the mood has shifted. After recording its first operationally profitable quarter in Q1 FY26, One 97 Communications (Paytm’s parent company) eked out profits in the quarter ended September 2025. That said, profits fell 98% YoY and 83% sequentially to ₹21 crore; so the sustainability of the recovery remains a key monitorable.

Meanwhile, the broader UPI universe is booming. India processed 20.7 billion UPI transactions in October 2025, up from 12.2 billion in January 2024; a 70% jump in under two years.

As of October 2025, PhonePe continues to dominate with a 46.29% share, followed by Google Pay at 35.24%. Paytm holds on to the third spot (7.48%), while smaller players like Navi (2.82%) and Super.money (1.30%) nibble at the tail.

The backdrop

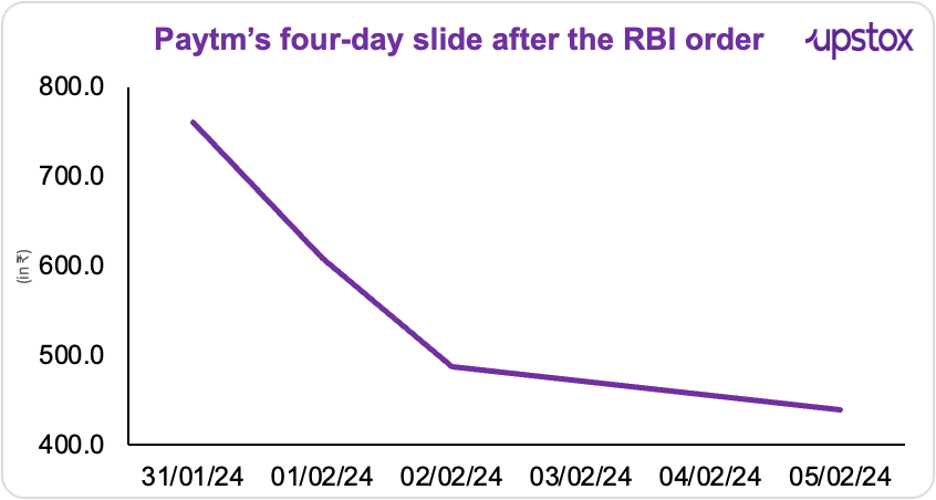

On 31 January 2024, the RBI flipped Paytm’s world upside down. It slapped strict curbs on Paytm Payments Bank Limited (PPBL); the engine that powered Paytm’s UPI, wallet top-ups, and deposits. The order was blunt: stop all new transactions. No money transfers, no deposits, no top-ups. And once existing balances dried up, users were stuck.

Since PPBL was the banking backbone of the Paytm app, Paytm’s UPI operations were suddenly hanging by a thread. The markets didn’t take it well.

Source: Investing.com

From 29 February, PPBL would be barred from accepting deposits, supporting wallet top-ups, or handling credit transactions. In short, most of Paytm’s financial pipes were turned off overnight.

But fast-forward to late 2025, and there’s a surprising twist.

Paytm’s other subsidiary; Paytm Payments Services Limited (PPSL), has finally received what it waited years for: a permit to operate as a payment aggregator. The RBI gave an in-principle approval in August 2025, and on 26 November 2025, it issued the full Certificate of Authorisation (CoA) under the Payment and Settlement Systems Act.

How Paytm rebuilt transaction flows (the playbook)

Merchant retention & incentives

Paytm doubled down on merchant-facing fixes; faster settlements via acquiring partners, targeted cashback and merchant incentives, and outreach to large chain merchants to avoid QR migration. These moves slowed merchant churn and brought many merchants back onto Paytm-linked QR flows.

Product nudges & UX pushes

The company pushed UPI Lite, rolled out personalised UPI IDs, and revamped its soundbox and PoS integrations so that payments at stores felt smooth for both merchants and customers. And that mattered. These tiny UX fixes slowly brought back the high-frequency, everyday payments that Paytm depends on. And it didn’t stop there.

Paytm also rolled out a new ‘Hide Payments’ feature; a privacy-first tool that lets users tuck away selected UPI transactions. Think of it as a cleaner, more controlled view of your payment history, with access only when you really want it. Small changes, big behavioural nudges; and together, they helped Paytm rebuild trust one transaction at a time.

Soundbox ecosystem helped pull volumes back

Even during the decline, Paytm retained one of India’s largest soundbox bases. This hardware acted as a sticky anchor, because merchants who already had a soundbox rarely switched apps permanently. Industry data highlights:

-

Paytm installed 13 million+ soundboxes by FY26

-

Soundbox devices became a major driver of micro-payments (₹50–₹200 range)

And.. It didn’t stop here.

In October 2025, the company unveiled India’s first AI-powered Soundbox; a Made-in-India device built for businesses of every size. What used to be a simple payment alert machine has now been turned into a full-blown AI business assistant.

The new Soundbox doesn’t just announce payments. It dishes out instant summaries, business insights, and financial intelligence; all in 11 local languages. It works on both 4G and WiFi, supports dynamic QR, and even allows customers to tap or insert cards for quick payments. There’s also a fair-use AI token model, with additional usage billed only if merchants exceed their limits.

The launch fits neatly into Paytm’s broader bet on AI. The company has been leaning heavily on automation to tighten costs; trimming employee expenses by 32% YoY in Q1 FY26, and by 20% YoY in Q2, bringing them down to ₹663 crore.

Bank re-routing and regulatory compliance

After the curbs on its own payments bank in early 2024, Paytm moved to the “third-party app provider (TPAP)” model, partnering with sponsor banks (Axis, HDFC, SBI, Yes Bank) to ensure UPI routing and settlement.New users onboarding on Paytm for UPI after March–April 2024 create VPAs that are directly linked to SBI, Axis, HDFC or Yes Bank (for example name@sbi via the Paytm app), with these banks maintaining the underlying accounts and connectivity to NPCI, and Paytm just acting as the TPAP layer.

What’s next?

Paytm’s UPI comeback is in motion. But the real question is; what takes it forward from here?

One big bet is credit on UPI. Paytm has quietly brought back its Postpaid product, now reimagined as a simple “Spend Now, Pay Next Month” line of credit. Users can scan any UPI QR, shop online, pay bills or do recharges, and settle the amount the following month. For users with strong credit scores, this could even come with zero fees, while others may pay 1–2%. It’s still in early rollout, so it isn’t what’s driving today’s surge, but it could make UPI payments even stickier in the months ahead.

Meanwhile, the UPI ecosystem itself is about to get smoother. NPCI is rolling out biometric authentication, which means you’ll soon be able to approve payments with your fingerprint or face, without typing a PIN. The feature is being pushed across Google Pay, PhonePe and Paytm.

And on the merchant side, Paytm’s vast network of soundboxes and PoS devices remains its biggest anchor. With fresh regulatory clarity for its payments arm and stable partnerships with banks like SBI, HDFC, Axis and Yes Bank, Paytm’s UPI rails should only get sturdier over time.

All of this sets the stage for Paytm’s next chapter, one shaped by ecosystem upgrades, shifting regulations, and a more competitive UPI landscape. Can it sustain this upswing in a field dominated by PhonePe and Google Pay, while navigating regulatory shifts and a still-fragile financial base? With new products, tighter compliance, and a changing payments stack, the risks haven’t disappeared; they’ve simply evolved. So the real question is; can Paytm hold on to this momentum, and what hurdles still lie ahead?

About The Author

Next Story