Upstox Originals

Deep dive into Viceroy’s concerns and allegations about Vedanta

.png)

10 min read | Updated on July 11, 2025, 13:10 IST

SUMMARY

A foreign short seller has published a critical report on the Vedanta Group. The claim is that Vedanta is using its listed Indian company to repay its debt. The report makes serious claims about Vedanta's capital allocation, legal challenges, and contingent liabilities, among others. Interestingly, share price reaction remains muted.

Stock list

Short seller Viceroy has made multiple allegations against the Vedanta group

Something like Adani-Hindenburg happened again. A foreign short seller, Viceroy Research, released an 87-page report detailing its thesis on the Vedanta Group. Before we delve into the subject matter, please note:

- Viceroy has released its note for educational purposes.

- These are just allegations and have not been confirmed.

- Viceroy has certain short positions in the Vedanta Group.

- Vedanta has denied these allegations.

- Figures and calculations mentioned in this article are as per Viceroy Research’s calculations

Key players involved are

- Viceroy Research - The short seller who has published this note

- Vedanta Resources (VRL) - Vedanta Limited’s holding company. It has a 56.38% stake in Vedanta Limited, along with its other sister companies

- Vedanta Limited (VEDL) - Listed play in the Indian markets with operations primarily in energy.

The primary thesis

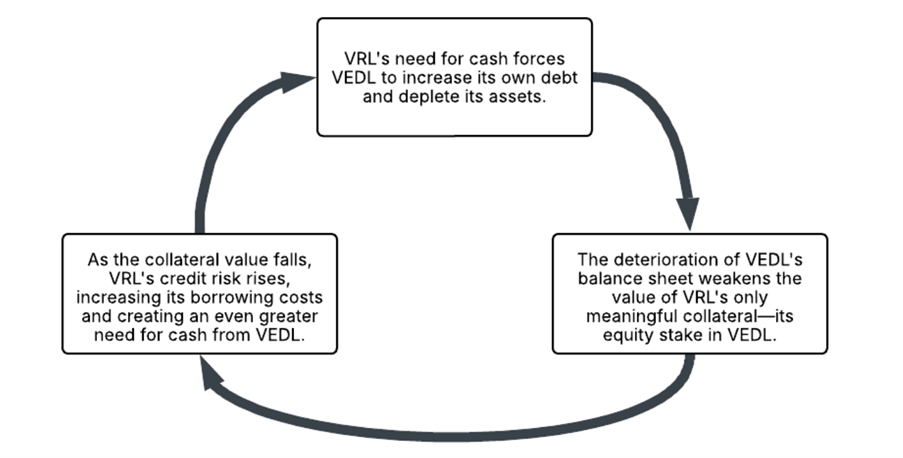

As per Viceroy, VRL is burdened by substantial debt, and so it operates as a "parasite" holding company. It relies heavily on cash received from its operating subsidiary, VEDL. The report argues that, has pushed the overall group to the brink of insolvency, sustained only by a precarious cycle of debt and aggressive accounting techniques.

Source: Viceroy Research

Dividend funded through debt.

VRL’s gross debt levels are reportedly at ~$13 billion. So, VEDL’s cash flows are increasingly being diverted to service this burden. This threatens the group’s financial stability. VEDL has accrued a $5.8b free cash flow shortfall against dividend payments of $8.0b over the last 3 years.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Net Profit before Tax | 2,318 | 4,407 | 2,527 | 2,460 | 3,213 |

| Cash from operating activities | 2,509 | 3,969 | 3,431 | 3,120 | 3,479 |

| Viceroy Estimated FCF | 850 | 2,235 | 335 | 887 | 953 |

| Dividend | -474 | -2,230 | -3,733 | -2,244 | -2,005 |

| Shortfall | NA | NA | -3,398 | -1,356 | -1,052 |

Source: Viceroy Research; Cash flow from operations excludes dividends from Hindustan Zinc and BALCO.

This aggressive debt-funded dividend distribution has led to:

-

Rising net debt: VEDL’s net debt has risen to $8.1 billion in 2025 from $4.2 billion in 2021, indicating the use of borrowed funds for dividend payouts, reducing available cash for reinvestment.

-

Higher interest costs: The effective interest rate on gross liabilities has increased from 10.8% in 2021 to 12.7% in 2025.

-

Decline in cash reserves from $2.3 billion in 2021 to $944 million in 2025, raising liquidity concerns.

-

Vedanta’s tangible asset base has grown modestly from $16.2 billion in 2021 to $17.1 billion in 2025 without meaningful capex, raising questions on the company’s growth plans, especially at times when the company is foraying into semiconductors, liquid display, etc.

-

By April 2025, 99.8% of the VRL promoter stake in VEDL was pledged as collateral, giving creditors substantial influence over the company.

-

As a result, key restrictions are now in place at VEDL-any mergers, asset sales, borrowings, dividend payments, or loans to group entities now require lender approval. This limits the company’s operational freedom and reduces the role of minority shareholders in key decisions.

Debt metrics of VEDL (in $ Mn)

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Gross interest-bearing liabilities | 9,010 | 8,868 | 9,666 | 10,403 | 10,856 |

| Gross cash & short-term investments | 4,851 | 4,802 | 3,104 | 2,229 | 2,720 |

| Net debt | 4,159 | 4,066 | 6,562 | 8,174 | 8,136 |

| Tangible Asset base | 16,204 | 17,134 | 14,700 | 15,311 | 17,056 |

| Total interest cost | 750 | 692 | 798 | 1,232 | 1,347 |

| Effective rate on gross liabilities | 10.80% | 7.80% | 8.50% | 12.30% | 12.70% |

Source: Viceroy Research

Brand fees

Companies usually pay a brand fee to a holding company for using its brand. Tata Steel pays brand fees to Tata Sons for using the brand and trademark of “Tata” held by Tata Sons. As per Viceroy Research, Vedanta Limited (VEDL) is paying large brand fees in advance to its parent, Vedanta Resources (VRL). These payments don’t follow usual royalty/ brand fees norms and seem to give VRL quick and upfront cash.

In FY25, Vedanta paid $361 million in brand fees ~15% of its net profit. For comparison, Tata Steel pays just $24 million.

Hindustan Zinc Limited (a subsidiary of Vedanta Limited) has paid ₹1,562 crore over the past three years, equivalent to 5% of its profits, for a brand it doesn’t use (no ‘Vedanta’ in the name). Vedanta Limited then passes on ~70% of this fee further to the parent Vedanta Resources (VRL).

Brand fees (in $ Mn)

| FY23 | FY24 | FY25 | |

|---|---|---|---|

| Brand fees from VEDL to VRL | 261.1 | 338.5 | 361.3 |

| VEDL Net Profit ($m) | 2,787.0 | 904.6 | 2,402.7 |

| Brand Fees as % of Net Profit | 9% | 37% | 15% |

| Brand fees from HZL to VEDL | 343 | 561 | 658 |

| % of Net Profit | 3.26% | 7.2% | 6.4% |

Source: Viceroy Research

Loan used for promoter share purchases.

In June 2020, Vedanta Limited (VEDL) gave a $956 million loan to its parent company, Vedanta Resources (VRL), to help fund a proposed delisting of VEDL. When the delisting plan did not go through, VRL instead used the funds to increase its shareholding in VEDL, as per Viceroy.

Section 67(2) of the Indian Companies Act restricts public companies from offering financial assistance for the purchase of their own shares.

Over time, the loan terms were revised in VRL’s favour, chief amongst which was that the repayment timeline was extended multiple times. Viceroy mentions that the main reason VRL did not repay the loan was its need for cash to repay a $1.4 billion bond with a high 13% interest rate.

Vedanta facing ‘Event of Default’

Vedanta did not move forward with the Kapasan Project, a 100 MTPA zinc smelter expansion project that was a key part of the original disinvestment agreement with the Government of India (GoI). As a result, it triggered an important clause in the agreement known as an “Event of Default.”

For the sake of simplicity, if the GOI GoI exercises its options, it could create major financial pressure.

Vedanta’s subsidiaries are facing multiple operational weaknesses listed below:

| Subsidiary | Allegations summary |

|---|---|

| Fujairah Gold | Faced scrutiny for moving gold with unusual feedstock and is suspected of ties to questionable financial sources. |

| International Zinc Assets (Skorpion Mine, Black Mountain Mining) | Skorpion Mine in Namibia has remained shut since a 2020 pit wall collapse, with reopening pushed to 2027. Its associated refinery is idle. Meanwhile, Black Mountain Mining reported a $504 million reversal of earlier losses, raising concerns about balance sheet adjustments |

| Konkola Copper Mines (KCM) | Mines, which were earlier liquidated, have been brought back on the books at a $1.6 billion valuation despite ongoing financial struggles |

| Talwandi Sabo Power (TSPL) | Has contingent liability worth $350m. |

| ESL Steel | Loss-making plant with ‘Material Uncertainty Related to Going Concern’ audit opinion. |

Source: Viceroy Research

Bold claims

Viceroy Research alleged that VEDL’s practice of announcing multi-billion-dollar investment plans in trendy sectors like semiconductors, glass manufacturing, and even nuclear power. These announcements are used to generate positive headlines and justify new debt raises. However, the projects rarely materialise, and the capital is instead diverted to sustain the dividend flow to VRL.

Senior management resignations

Vedanta has seen a steady departure of senior leaders since September 23, raising questions over leadership succession and potential disagreement between management and promoters.

| KMPs | Designation | Period of service |

|---|---|---|

| John Slaven | CEO of Vedanta Aluminium | 10 months |

| Krishnamohan Narayan | Deputy CEO of HZL | 18 months |

| Omar Davis | Vedanta Resources’ President of Strategy | 11 months |

| Sonal Shrivastava | CFO, Vedanta Resources | ~3 months |

| Sanjeev Gemawat | General Counsel, Vedanta | 2 years 3 months |

| Nick Walker | CEO of Cairn Oil and Gas | 7 months |

| David Reed | CEO of Vedanta Semiconductor | 1 year 2 months |

| Hugo Schumann | CEO of Hindustan Zinc Silver | 8 months |

Source: Viceroy Research

Higher legal issues as compared to peers

Compared to industry peers such as Tata Steel and JSW Steel, Vedanta is a significant outlier, issuing 107 liability-related announcements between February 2022 and February 2025.

| Company | # |

|---|---|

| Vedanta Limited | 107 |

| Gravita | 12 |

| Tata Steel | 8 |

| Hindalco | 6 |

| JSW Steel | 3 |

| NALCO | 1 |

| NDMC | 0 |

Source: Viceroy Research

Vedanta’s reply to Viceroy.

Vedanta has denied these allegations; the rationale for the same is awaited. It further said the report is a malicious combination of selective misinformation and baseless allegations to discredit the groups with the sole objective of creating false propaganda.

In closing

Viceroy has raised many questions, some of which have been broadly covered by Indian media and analysts. For instance, Vedanta’s rising debt has been a topic of discussion for many years now.

In fact, a look at recent financials shows that the company has made attempts to improve that situation. As of FY25, VRL’s gross debt has reduced from $13.8 billion in FY24 to $13.2 billion. VRL’s interest coverage has improved from 2.7x in FY24 to 3.2x. Over the course of calendar year 2024, multiple credit rating agencies have actually upgraded their ratings on various issues and at the group level.

Even at the VEDL level, interest coverage stands at around ~3.5x. In simple words, this ratio describes if the company has the resources to simply pay back the interest. In the past 3 years, VEDL has generated operating cash flows to the tune of ₹36,000 crore (average), which speaks to its operating capabilities and cash-generating ability.

So far, market regulator SEBI has also not initiated any action. Maybe this also explains the market reaction. Since the time of this report, the shares have corrected a mere ~4-5% (close of July 10).

Market experts have also cited that Vedanta’s upcoming demerger could unlock significant value for the company and further strengthen its financial position. As such, the demerger coupled with Vedanta’s response (if they choose to provide it) remains a key monitorable for investors.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story