Upstox Originals

Richer and younger India set to propel Indian aviation to newer heights

.png)

8 min read | Updated on June 10, 2025, 18:02 IST

SUMMARY

India’s aviation industry is entering a golden phase, propelled by favorable demographics. With India set to double its consumption by 2035, the country’s airline passenger base is expected to follow suit by 2030. One leader of this transformation is IndiGo, backed by robust operational efficiency, to expand aggressively, tripling its fleet by 2035 and stretching its wings into new international markets.

Stock list

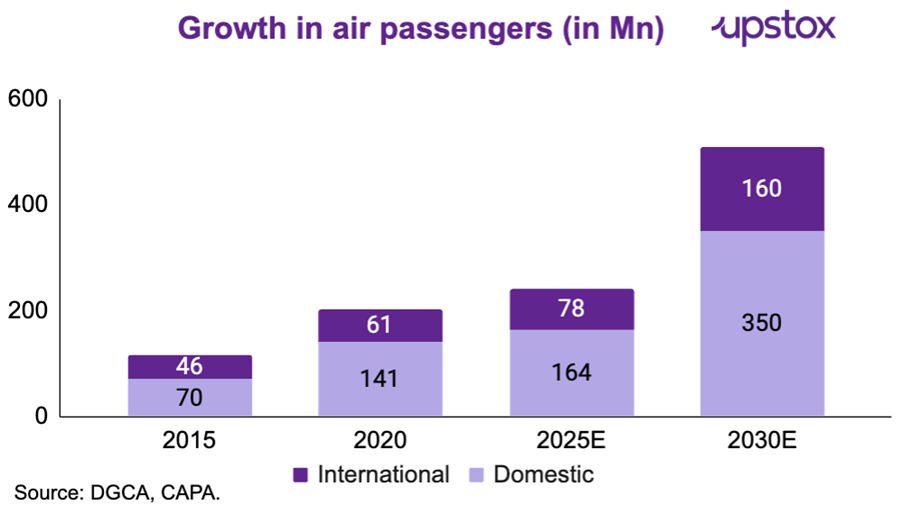

India's airline passenger count is expected to double by 2030 as per the DGCA

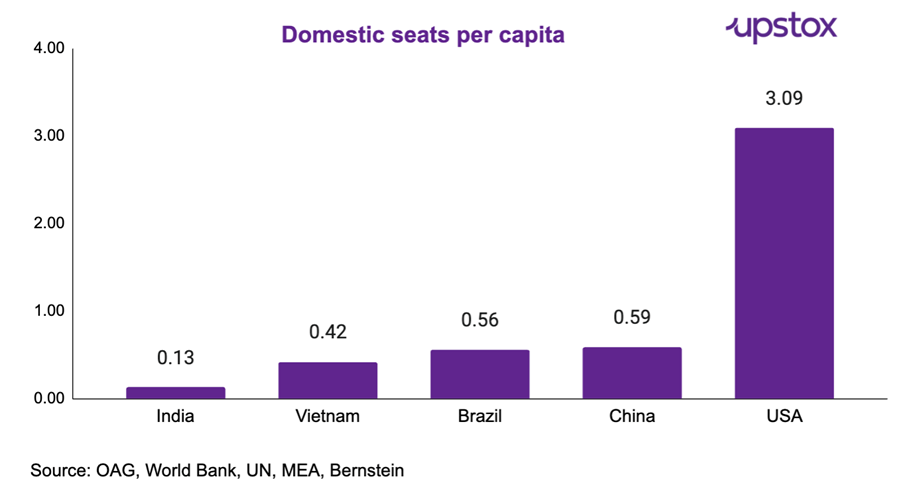

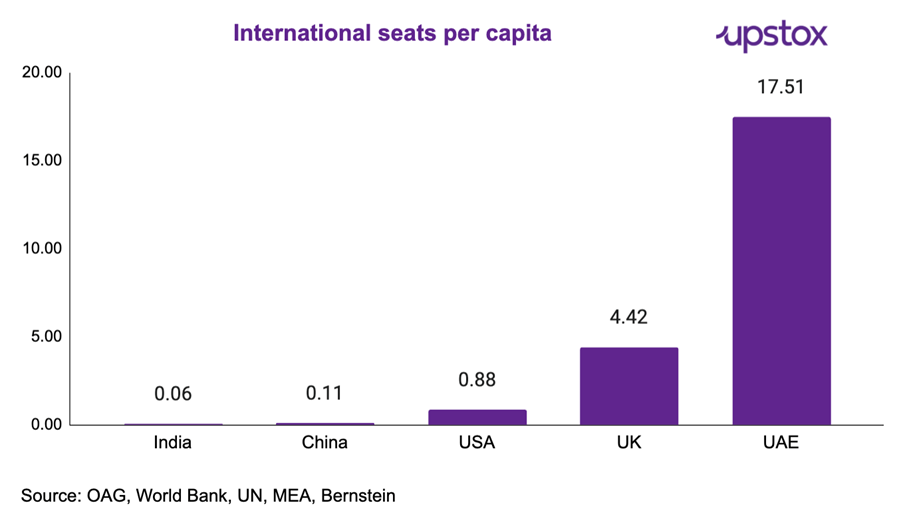

India is now the third-largest domestic aviation market in the world, yet it remains structurally underpenetrated.

“Despite India representing 18% of the world’s population, its air travel market remains significantly under-penetrated. In FY25, while 715 crore traveled by rail, according to the Ministry of Railways, only 16.6 crore flew domestically by air, as per the DGCA (Directorate General of Civil Aviation).

Air travel penetration in India remains a fraction of that seen in developed economies, but the long-term direction is clear: more Indians are flying, more frequently, to more destinations.

Why consumption is expected to double by 2035

As income levels rise, so does the appetite for luxury, including travel. Per the DGCA, this is expected to double the country’s airline passenger count by 2030. This demand boom is being supported by a parallel expansion in aviation infrastructure. The government’s UDAN scheme, new airport additions, and improving affordability are all expanding the demand base for air travel.

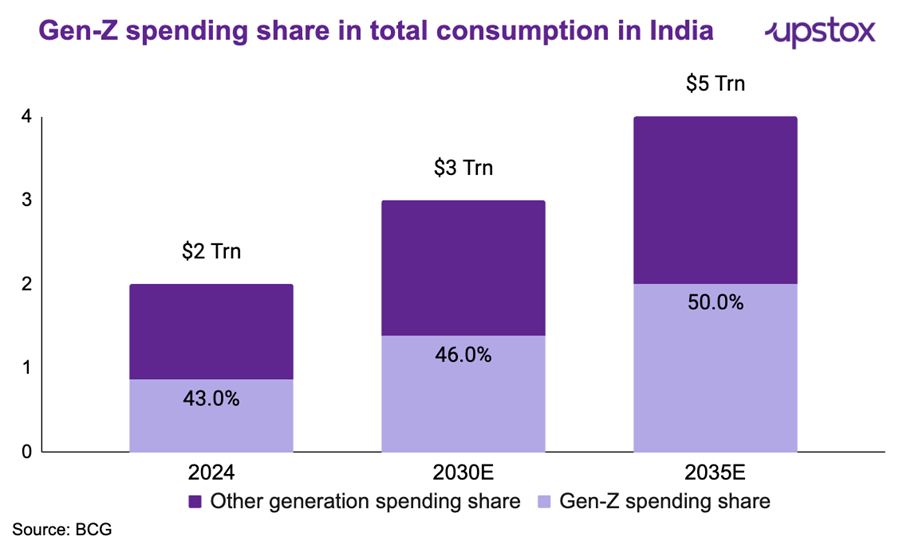

The Indian demographic dividend is underway and is projected to continue until 2055 as per S&P. With over 600 million individuals between the ages of 18 and 35, India is one of the youngest major economies in the world. Notably, the dividend is projected to persist until at least 2055, offering India a long runway for productivity gains, consumption growth, and labour-intensive industrial expansion.

This translates into a rising income and increased spending power among its vast population. This trend is already evident, with India’s total consumption spending set to double by 2035 as per BCG.

Supply is rising to meet the increasing demand as well. The number of operational airports has more than doubled, rising from 70 in 2014 to 157 in 2024, with plans to further expand to 350-400 airports by 2047 as per the Ministry of Civil Aviation.

Infrastructure is catching up: India has doubled its airports in the last decade by spending $25 billion on airport infrastructure capex between 2020-24 and is further set to double the number of airports by 2047.

This growth reflects the sector’s increasing importance and the government’s commitment to enhancing air connectivity across the country.

Further, IndiGo and Air India have placed huge aircraft orders in 2023, with IndiGo alone ordering 500 aircrafts. To put it in perspective, IndiGo’s fleet is set to more than triple by 2035, rising from 406 aircraft today to an estimated 1,361 deliveries over the next decade.

This marks one of the most ambitious expansion plans in global aviation, reflecting both India’s booming air travel potential and IndiGo’s strategic intent to dominate the skies.

Challenges

The aviation industry is known for being high-risk and expensive, with airlines often facing tight profit margins. Running an airline involves huge costs, often funded by debt, and it takes a long time to see a return on investment.

Managing an airline is difficult. The cost of maintaining airplanes is very high, and these expenses don’t go away, even if flights aren’t full.

Additionally, airlines must meet strict regulations, which add even more costs. This is why airlines like Jet Airways and Go First shut down, Air India was sold, and Akasa Air needed to raise funds just four years after starting.

Additionally, an airline’s revenue depends on factors outside its control, such as the economy, consumer demand, and unexpected events like rising fuel costs, pandemics, or geopolitical crises. Government regulators also keep a close watch on the industry to ensure safety, which can lead to more rules and costs.

Basically, running an airline means investing large sums of money with no guarantee of making a profit, which is why many airlines go bankrupt. The key to success is operating efficiently and hoping for good market conditions.

But turning the tide, Indigo Airlines (Interglobe Aviation) consistently remained operationally profitable since 2019, they have not gone into operational losses during 2020.

Let’s understand key terms of the business first

-

ASK (Available Seat Kilometers): This tells us how much space an airline has available to sell on its flights, based on the number of seats and how far the flight goes.

-

RASK (Revenue per Available Seat Kilometer): This measures how much money the airline makes for each seat it offers, for every kilometer flown.

-

CASK (Cost per Available Seat Kilometer): This shows how much it costs the airline to operate each seat for every kilometer flown.

-

EBITDAR (Earnings Before Interest, Taxes, Depreciation, Amortization, and Rentals): This shows how much profit an airline makes from its core operations, without considering other costs like taxes, interest, or leasing.

Indigo’s Financial and Operational Excellence

IndiGo’s Q4 FY25 results are strong, despite being the largest airline in India with a massive operating base, IndiGo managed to expand revenue, grow profits, and contain costs.

Total income rose by nearly 25% YoY to ₹230,975 million, while expenses only increased by ~19.1%. This led to a surge in operating profitability. IndiGo’s EBITDAR jumped 57.5% YoY to ₹69,482 million, with margins expanding a stellar 660 bps to 31.4%.

Financial summary of Indigo

| Particulars | Q4 FY24 | Q4 FY25 | YoY Change |

|---|---|---|---|

| ASK (billion) | 34.8 | 42.1 | 21.0% |

| Total income (₹ million) | 185,051.0 | 230,975.0 | 24.8% |

| RASK (INR) | 5.1 | 5.3 | 2.5% |

| Total expenses (₹ million) | 167,341.0 | 199,281.0 | -19.1% |

| CASK (INR) | 4.6 | 4.5 | 2.5% |

| CASK ex fuel (INR) | 2.9 | 2.9 | 0.0% |

| EBITDAR (₹ million) | 44,123.0 | 69,482.0 | 57.5% |

| EBITDAR Margin (%) | 24.8% | 31.4% | 6.6 pts |

| PAT | 18,948.0 | 30,675.0 | 61.9% |

| PAT Margin (%) | 10.6% | 13.8% | 3.2 pts |

Source: Indigo Investor Presentation

What explains Indigo’s operational excellence?

-

Bulk aircraft orders - Lower ownership costs.

-

New-generation planes - Reduced fuel consumption.

-

High seat density (high gauge) - Lower unit costs.

-

Better aircraft utilisation - Optimised fixed costs per flight.

-

Strong on-time performance & high completion rate - Reduced delays and operational waste.

-

In-house engineering & crew training - Faster turnaround and lower maintenance downtime.

-

Efficient network planning - Route optimisation and low distribution expenses.

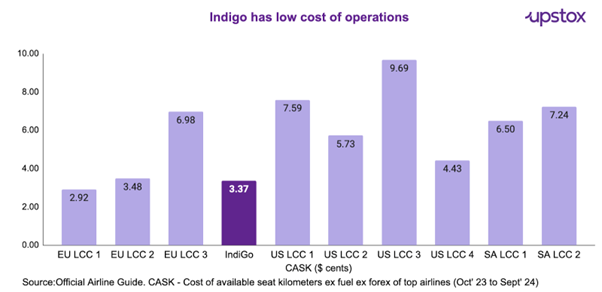

Indigo has the 2nd lowest CASK in the world when compared with top 10 airlines.

This chart below highlights IndiGo’s operational reliability among the world’s top airlines. On-Time Performance (OTP): This shows the percentage of IndiGo’s flights that arrive on time. 74.7% means about 75 out of every 100 flights are on time.

Flight Completion Rate: This shows how often flights take off as scheduled. 99.6% means nearly all of IndiGo’s flights operate without cancellations.

In short, OTP measures punctuality, and Flight Completion Rate shows how reliable IndiGo is in avoiding cancellations.

Source: OAG.com, Official Airline Guide

Growth triggers: Laying the Runway for Scale and Diversification: What's next for Indigo?

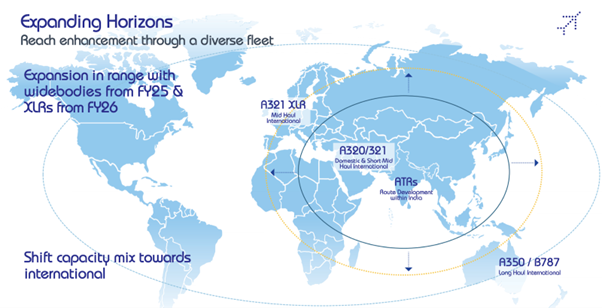

IndiGo’s growth trajectory is being propelled by a multi-layered strategy that spans fleet expansion, international diversification, premiumisation, and ancillary monetisation.

The airline is steadily shifting from a purely domestic low-cost operator to a global player with long-haul ambitions. As part of its fleet modernisation and capacity enhancement, IndiGo is adding more than one aircraft per week by FY30. This includes wide-body Boeing 787s and long-range narrow-body A321XLRs (Extra Long Range), which will enable 7.5–8.5 hour flights and open up new direct routes across Europe and Asia.

Source: Indigo Investor Presentation

The recent launch of business class under ‘IndiGo Stretch’ - a premium seating product at 3x pricing - marks a shift toward revenue enhancement through aspirational offerings.

IndiGo’s international expansion has been equally aggressive. From 25 destinations in FY22, it now connects to over 41 global cities, and with the incoming wide-body and XLR aircraft, it plans to further penetrate underserved international leisure and business routes.

Complementing this network growth is its focus on ancillary revenue - non-ticket income from baggage, meals, add-ons, and services. IndiGo has seen a ~30% growth in per-passenger ancillary revenue, driven by offerings like pre-travel assistance, loyalty programs, bundled services, and flexible fare classes.

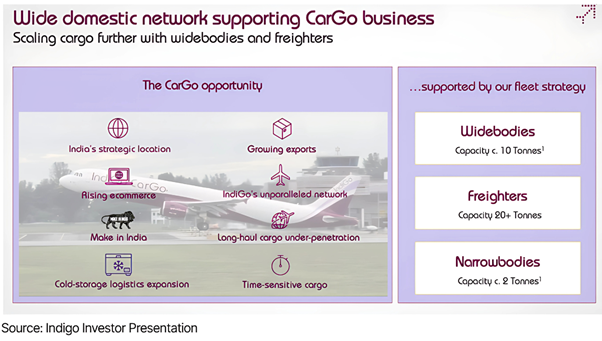

Importantly, the addition of wide-body aircraft has opened up a new revenue stream in cargo operations.

With larger cargo holds, IndiGo is now able to carry 8–10 tonnes per international flight - a significant jump from narrow-body aircraft capacities - further capitalising on India’s growing manufacturing and export potential.

Lastly, with a projected early double-digit growth in capacity, fleet, and passenger volumes in FY26, along with 14 new destinations and 3,000 additional employees, IndiGo is clearly scaling not just in size, but in complexity, capabilities, and profitability.

In summary

IndiGo’s journey reflects a rare combination of disciplined cost control, strategic expansion, and timely product innovation. Whether it’s rolling out premium offerings like ‘Stretch,’ deploying wide-body aircraft for global operations, or monetising ancillary services and cargo, the airline is firing on multiple engines.

As India’s skies open wider—literally and figuratively—IndiGo is perfectly positioned to ride this wave, not just as a volume leader, but as a profitable, agile, and globally competitive airline. Amidst the turbulence of the aviation industry, IndiGo’s consistent execution and forward-looking strategy give it the altitude to lead India’s aviation boom for years to come.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story