Upstox Originals

Evaluating the current challenges in the IT sector and potential triggers for a turnaround

.png)

5 min read | Updated on July 02, 2024, 17:24 IST

SUMMARY

Indian IT companies are grappling with slowing growth rates due to multiple economic headwinds. Here are the key factors that investors can track to check if the tide is turning.

IT sector is currently facing multiple headwinds

The $250-billion Indian IT industry is currently navigating turbulent times. After reporting strong performance in FY22 and FY23, revenue growth has softened in FY24 and the outlook for FY25 also remains muted, as seen in the table below.

Revenue growth in constant currency terms over the years

| Company | FY22 | FY23 | FY24E | FY25E* |

|---|---|---|---|---|

| Infosys | 19.7% | 15.6% | 1.4% | 1-3% |

| TCS | 15.4% | 13.7% | 3.4% | NA |

| HCL Tech | 14.9% | 13.7% | 5.0% | 3-5% |

| Wipro | 28.5% | 11.5% | -4.4% | -1.5%-0.5% (sequential growth for Q1 FY25) |

Source: Company reports; *estimated revenue guidance; Wipro guides for the quarter ahead in contrast to Infosys and HCLTech which guide for the full year. TCS does not provide guidance

Top-level exits and layoffs

Revenue weakness has also percolated to operations, with all major IT firms reporting layoffs last year.

| Company | March 2023 headcount | March 2024 headcount | Change (#) | % change |

|---|---|---|---|---|

| Wipro | 2,58,570 | 2,34,054 | -24,516 | -9.5% |

| Infosys | 3,43,234 | 3,17,240 | -25,994 | -7.6% |

| TCS | 6,14,795 | 6,01,546 | -13,249 | -2.1% |

| HCL Tech | 2,24,407 | 2,25,944 | 1,537 | 0.7% |

Source: Company reports

Besides this, top-level exits across top IT firms also remained a challenge.

TCS saw its CEO and MD Rajesh Gopinathan resign after a 22-year stint in March 2023. Infosys saw nearly nine senior-level exits in 2023, including CFO Nilanjan Roy and president Mohit Joshi. Wipro too saw its CFO Jatin Dalal part ways with the organisation.

IT sector - market performance

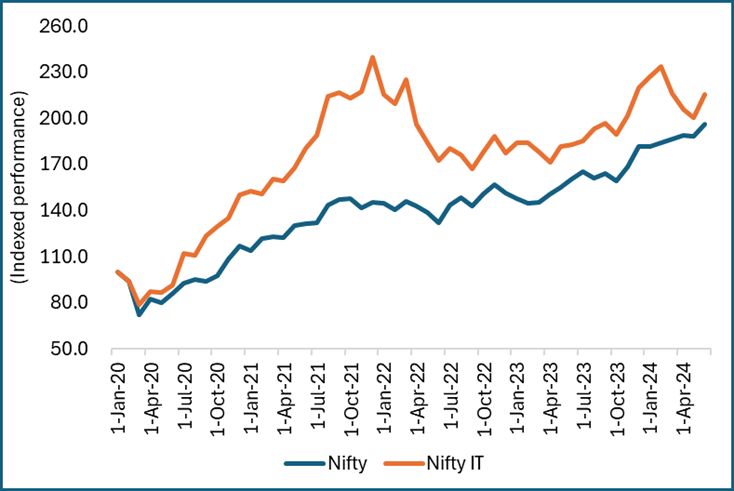

This has also been reflected in the price performance. The IT sector, which saw robust growth since 2020 (after the pandemic) has seen outperformance diminishing versus the broader index.

Indexed performance - Nifty50 and Nifty IT index since 2020

Source: Investing.com

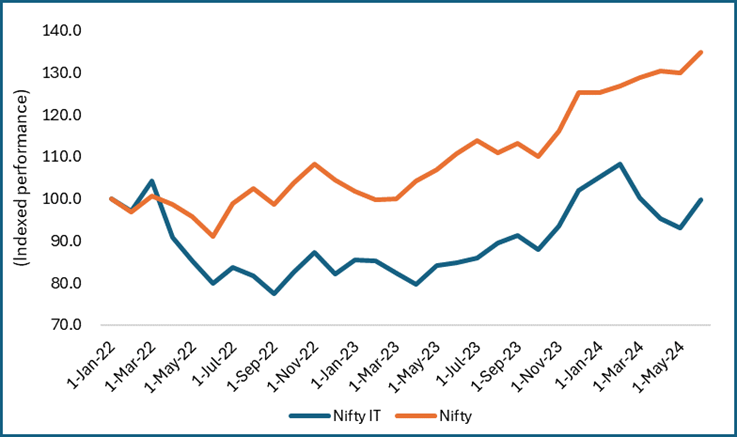

In fact, any investor who entered the sector after 2022, would have seen a relative underperformance of over 30% versus the broader market index, as seen below.

Indexed performance - Nifty50 and Nifty IT Index since 2022

Source: Investing.com

What are the major causes of this slowdown?

Besides the sector’s inherent cyclicality, the sector has also been plagued by:

- Ongoing global geopolitical tensions

- Growth challenges in major Western economies

- Uncertainties around interest rate cuts

- Cut in discretionary spending by corporates

What are some of the key measures for investors to track for any potential turnaround of the sector?

The expected interest rate cut by the US Federal Reserve will ease client pressure and boost spending, which could aid the IT sector. This could also lead to a revival of stalled projects and further help build momentum. As of June 2024, the US Fed has indicated that there would be one cut possible in 2024 (versus three that were estimated in Jan 2024).

- Any normalising in ongoing global tensions could further support growth

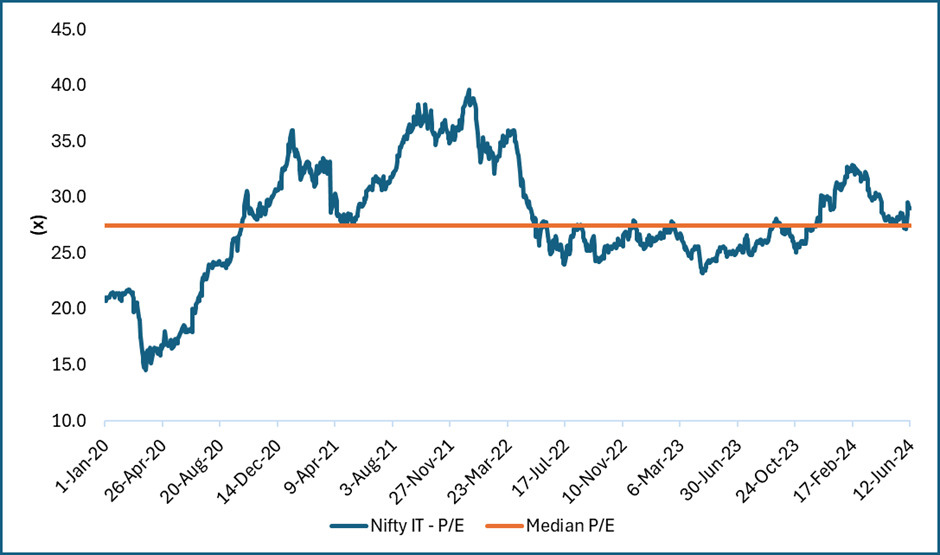

- Finally, as valuations once again start to mean revert (chart below), the sector could once again gain favour with investors

Nifty IT trailing valuations

Source: NSE

Generative AI – next big trigger?

Despite the challenges, the focus on generative AI can create new opportunities for the tech sector in India.

Top IT firms have already started preparations to take advantage of this opportunity by building on their AI offerings.

Infosys has launched Topaz, an AI-first set of services, solutions and platforms using generative AI technologies. Similarly, Wipro introduced Wipro ai360 and is planning to invest $1 billion in AI over the next three years.

Select company performance

| Company | Market cap (₹ crore) | Revenue CAGR (last 3 years in %) | ROE (%) | P/E | EV/EBITDA | 3 yr CAGR stock Price growth (in %) |

|---|---|---|---|---|---|---|

| Large Cap IT Companies | ||||||

| TCS | 14,01,285.0 | 14.0 | 51.5 | 29.7 | 20.1 | 6.0 |

| Infosys | 6,20,293.0 | 15.0 | 31.8 | 23.8 | 14.9 | 1.0 |

| HCL Tech | 3,92,178.0 | 13.0 | 23.5 | 24.8 | 14.6 | 13.0 |

| Wipro | 2,52,024.0 | 13.0 | 14.5 | 22.6 | 13.2 | -5.0 |

| LTI Mindtree | 1,49,266.0 | 42.0 | 25.0 | 32.0 | 21.0 | 6.0 |

| Average | 5,63,009.2 | 19.4 | 29.3 | 26.6 | 16.8 | 4.2 |

| Mid Cap IT companies | ||||||

| Oracle Fin Serv | 84,108.0 | 9.0 | 29.0 | 34.1 | 22.5 | 32.0 |

| Persistent Systems | 58,370.0 | 33.0 | 24.5 | 53.6 | 32.2 | 44.0 |

| L&T Technology Services | 51,874.0 | 20.0 | 25.8 | 43.4 | 26.1 | 19.0 |

| Mphasis Ltd | 46,294.7 | 11.0 | 18.6 | 29.9 | 18.2 | 6.0 |

| Tata Elxsi | 45,057.0 | 25.0 | 34.5 | 56.9 | 37.6 | 23.0 |

| Average | 57,140.7 | 19.6 | 26.5 | 43.6 | 27.3 | 24.8 |

Source: Screener

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story