Market News

Trade setup for Jan 15: NIFTY50 forms inside candle, holds steady near 23,200

.png)

4 min read | Updated on January 15, 2025, 07:16 IST

SUMMARY

The NIFTY50 formed a inside candle on the daily chart on 14 January and failed to confirm the inverted hammer pattern formed a day before. For the upcoming trading session, traders can monitor the high and the low of 13 January. A breakout of these levels on closing basis will provide further directional clues.

Stock list

The NIFTY50 index snapped its four-day losing streak and ended Tuesday's session on a positive note.

Asian markets @ 7 am

- GIFT NIFTY: 23,304 (+0.17%)

- Nikkei 225: 38,433 (-0.11%)

- Hang Seng: 19,149 (-0.36%)

U.S. market update

- Dow Jones: 42,518 (▲0.5%)

- S&P 500: 5,848 (▲0.1%)

- Nasdaq Composite: 19,044 (▼0.2%)

U.S. indices ended the Tuesday’s session on a mixed note as investors digested the first of two key inflation reports. The producer price index, which highlights the inflation at the wholesale level rose 3.3% over last year, up from 3% in November but less than street estimates. Meanwhile, the investors will be looking forward to Wednesday’s consumer price index.

NIFTY50

- January Futures: 23,271 (▲0.5%)

- Open interest: 5,50,154 (▼0.8%)

The NIFTY50 index snapped its four-day losing streak and ended Tuesday's session on a positive note. The index formed an inside candlestick pattern on the daily chart, signalling consolidation after a sharp fall correction of over four sessions.

On the daily chart, the index formed an inverted hammer candlestick pattern on 13 January and failed to confirm the reversal pattern on the daily chart. The index formed a inside candle on 14 January, resembling the doji candlestick pattern on the daily chart.

For the upcoming sessions, traders can monitor the high and the low of the inverted hammer formed on 13 January. A breakout of this range on the closing basis will provide further directional clues.

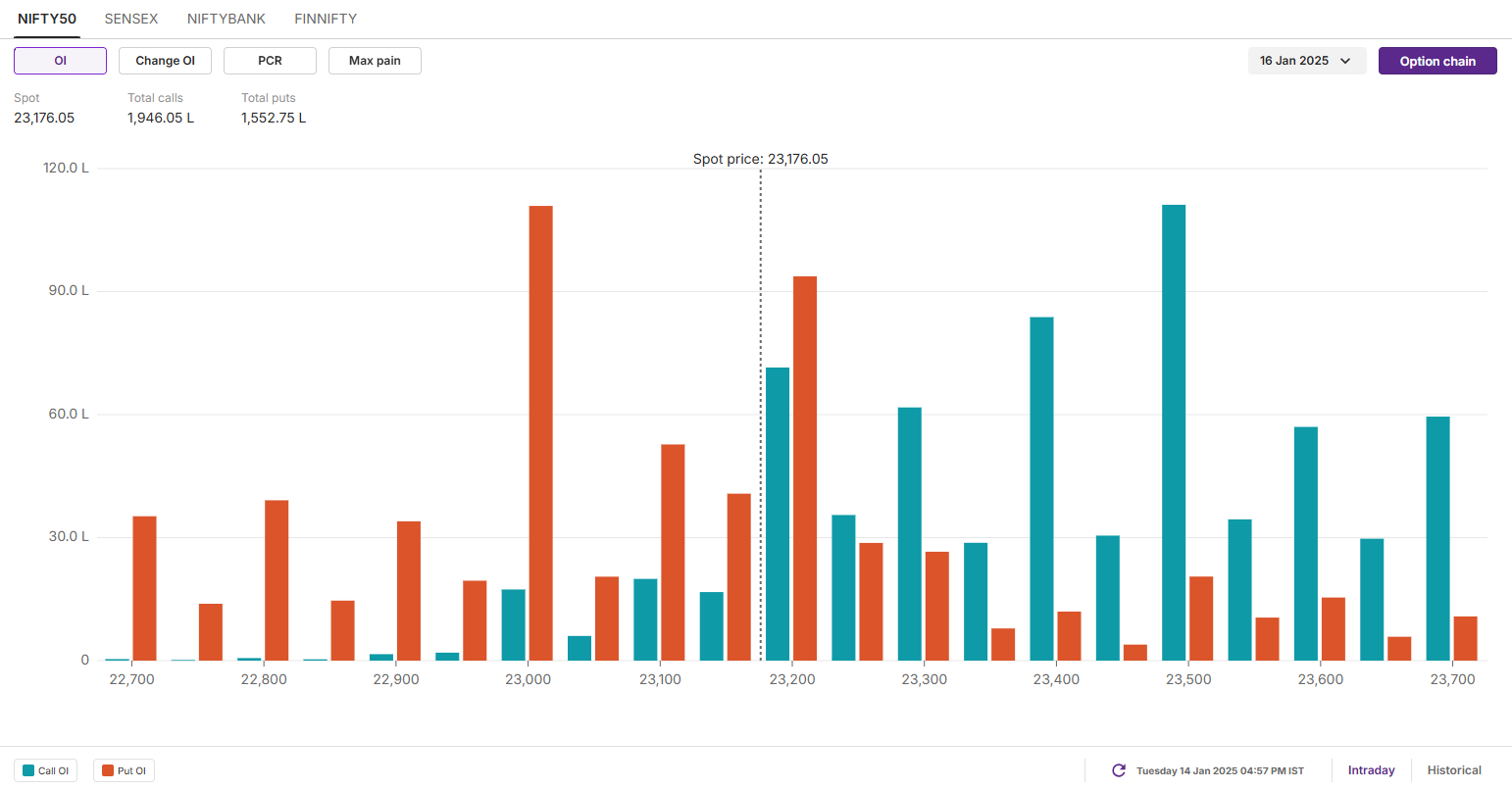

The open interest data for the 16 January expiry saw significant build-up of put open interest at 23,000 strike, signalling support for the index around this zone. On the other hand, the call base remains established at 23,500 strike, indicating resistance for the index around this strike.

SENSEX

- Max call OI: 76,500

- Max put OI: 76,500

- (Expiry: 21 Jan)

The SENSEX also formed an inside candle on the daily chart and ended the weekly expiry of its options contracts in a narrow range around 76,000 mark.

From the technical standpoint, the broader trend of the SENSEX remains bearish as per the daily chart. The index is currently trading below all the key daily exponential moving averages like 21, 50 and 200. However, the index formed a inverted hammer pattern on 13 January, awaiting confirmation.

For the upcoming sessions, traders can monitor the high and low of the 13 January’s inverted hammer candlestick pattern. A close above the high of the inverted hammer will confirm the bullish reversal pattern. Meanwhile, a close below the inverted hammer will invalidate the reversal pattern.

FII-DII activity

Stock scanner

- Long build-up: Adani Green, Kalyan Jewellers, APL Apollo Tubes, Bajaj Finserv and Can Fin Homes

- Short build-up: HCL Technologies, United Spirits, LTIMindtree, Angel One and Dr. Lal PathLabs

- Under F&O ban: Aarti Industries, Angel One, Bandhan Bank, Hindustan Copper, L&T Finance and RBL Bank

- Added under F&O ban: Angel One

- Out of F&O ban: Manappuram Finance

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price. Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story