Market News

Trade Setup for August 21: BANK NIFTY ends 10-day consolidation, targets 51,000 resistance level

.png)

5 min read | Updated on August 21, 2024, 08:04 IST

SUMMARY

The technical structure of BANK NIFTY on a smaller time frame suggests range-bound activity between the 51,000 and 50,500 zones. However, a breach of either level on an intraday basis will provide traders with directional moves.

Stock list

Currently, the NIFTY50 index is standing at a crucial juncture. If the index sustains its gains above 24,700 and reclaims the 24,800 level on closing basis, then it may extend the gains till 25,000 mark.

Asian markets update at 7 am

The GIFT NIFTY is trading around 24,700 level, indicating a flat start for the NIFTY50 today. Meanwhile, other Asian markets are trading in red. Japan’s Nikkei 225 is down 0.8%, while Hong Kong’s Hang Seng index slipped 1.5%.

U.S. market update

- Dow Jones: 40,834 (▼0.1%)

- S&P 500: 5,597 (▼0.2%)

- Nasdaq Composite: 17,816 (▼0.3%)

U.S. indices took a breather and snapped eight-day winning streak and closed Tuesday’s session in the red. The indices have rebound and the volatility has dropped significantly since early August. Strong retail sales data and a soft inflation report have calmed the recession fears. As a result, both S&P 500 and Nasdaq are up over 1% for the month.

Investors are now focusing on today's release of the July FOMC Minutes and Fed Chairman Jerome Powell's upcoming speech at the Jackson Hole Economic Symposium on Friday, both of which are key for insights into future monetary policy.

NIFTY50

- August Futures: 24,711 (▲0.4%)

- Open Interest: 4,30,907 (▼1.7%)

After a positive start, the NIFTY50 index sustained its opening gains and closed Tuesday’s session in green, above the previous day’s high. Led by buying across sectors, the index filled the bearish gap formed on 5 August.

Currently, the NIFTY50 index is standing at a crucial juncture. If the index sustains its gains above 24,700 and reclaims the 24,800 level on closing basis, then it may extend the gains till 25,000 mark. It is important to note that the index is currently trading above all the key moving averages and has not shown any sign of reversal. The weakness will only emerge if the index slips below its crucial support of 24,500 zone.

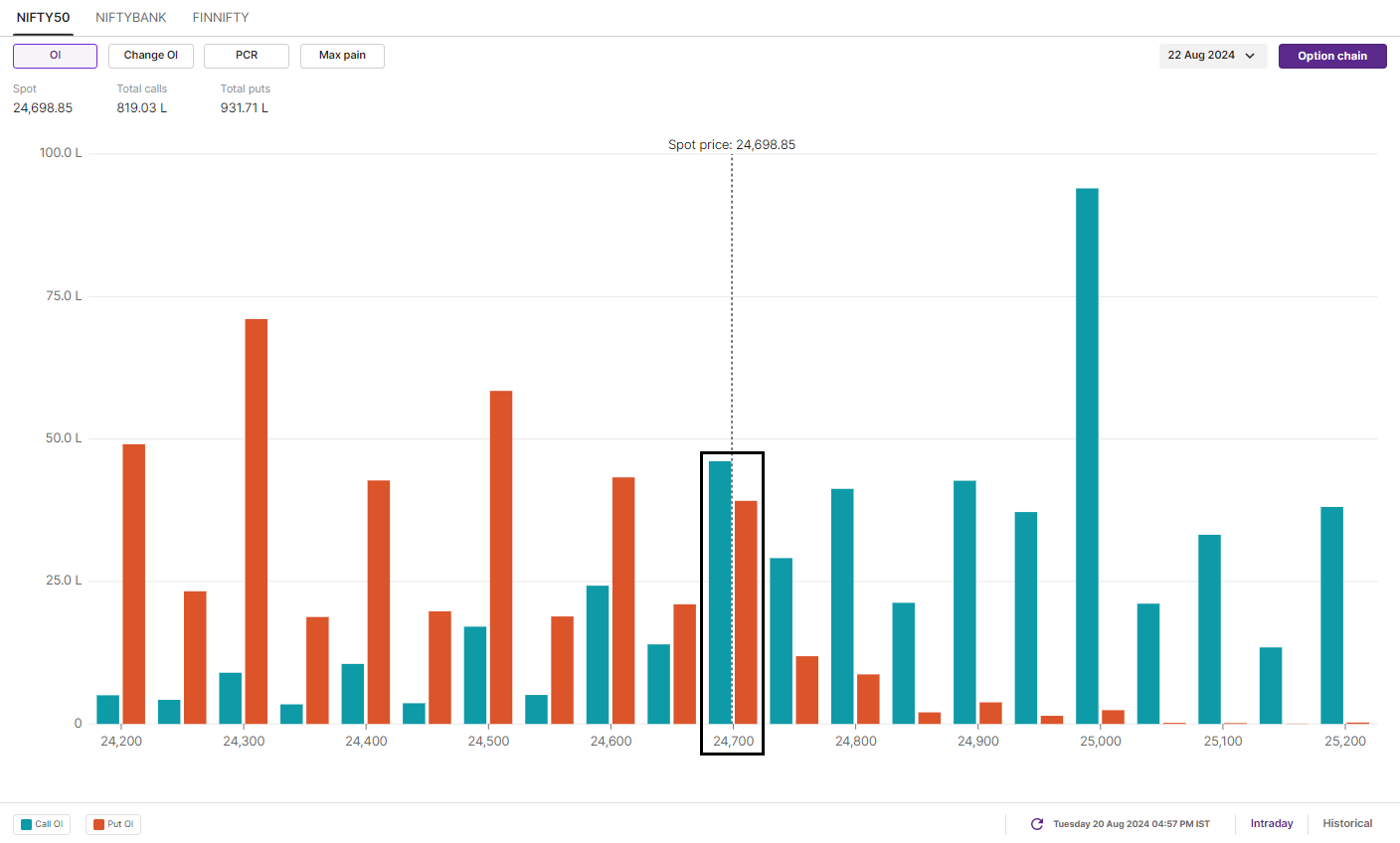

The open interest build-up for 22 August expiry has maximum call base at 25,000 level, indicating it as a resistance. On the flip side, 24,300 and 24,500 strikes has maxiimu put open interest, which will act as support. Additionally, 24,700 strike witnessed significant call and put addition, hinting at range-bound activity between 24,900 and 24,500 zone.

BANK NIFTY

- August Futures: 50,485 (▼0.2%)

- Open Interest:2,02,142 (▲2.7%)

The BANK NIFTY broke out of its 10-day consolidation and closed above the 5 August high, led by a rebound in private banks. However, the index experienced some selling pressure towards the close, forming a small upper shadow indicating the presence of sellers around the 51,000 level.

On the daily chart, the index has reclaimed its 20-day moving average (DMA), suggesting a rebound from lower levels. However, we believe that the index is currently trading between its 50 and 100 DMAs. The index may remain range-bound until it breaks out of this range on a closing or intraday basis.

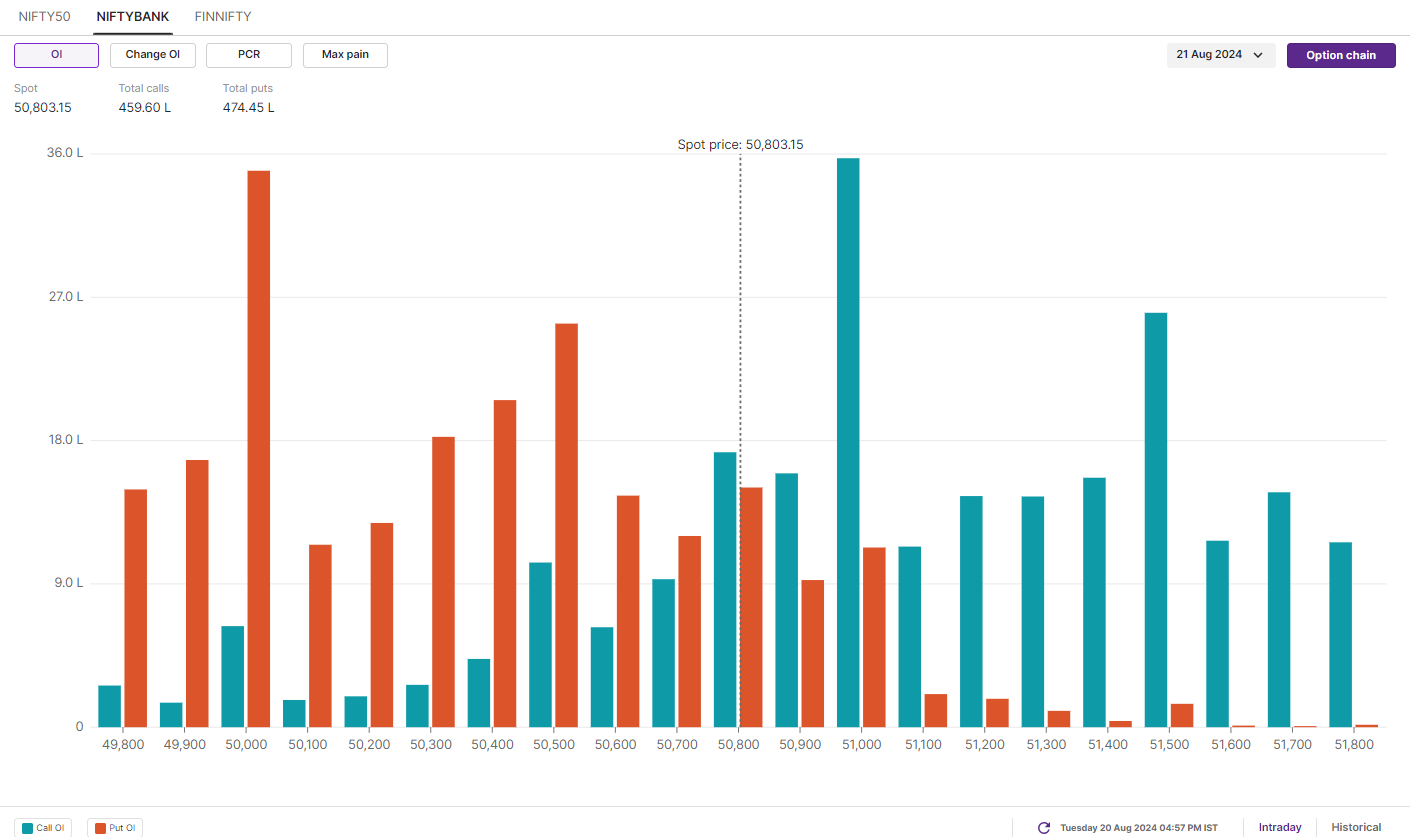

For today's expiry, the 15 minute timeframe suggests range-bound activity between the 51,000 and 50,500 zones. However, a breach of either level on an intraday basis will provide traders with directional moves.

The positioning of open interest suggests range-bound activity with a significant call base at the 51,000 strike and put base at the 50,000 strike. Any unwinding of open interest at these strikes will give traders further clues.

FII-DII activity

Stock scanner

Out of F&O ban: Chambal Fertilisers, IndiaMART InterMESH, NMDC and Punjab National Bank

Added under F&O ban: National Aluminium

Under F&O ban: Aarti Industries, Aditya Birla Fashion and Retail, Balrampur Chini, Bandhan Bank, Birlasoft, Gujarat Narmada Valley Fertilizers & Chemicals (GNFC), Granules India, Hindustan Copper, India Cements, LIC Housing Finance, Manappuram Finance, National Aluminium, Piramal Enterprises, RBL Bank, Steel Authority of India and Sun TV

In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with an increase in price, and short build-up means an increase in Open Interest(OI) along with a decrease in price.

Source: Upstox and NSE.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client and such material should not be redistributed. We do not recommend any particular stock, securities and strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story