Market News

Stock Market Weekly Recap: SENSEX, NIFTY drop for third week as Q3 results fail to fire up sentiment

.png)

5 min read | Updated on January 25, 2025, 10:23 IST

SUMMARY

Stock markets witnessed volatile sessions this week as new US President Donald Trump kept investors guessing about his much-hyped tariff policy.

Stock list

On a weekly basis, SENSEX dropped 428 points and NIFTY 111 points | Image source: Shutterstock

- Investors lost more than ₹7 lakh crore in a single day on January 21.

- On a weekly basis, SENSEX dropped 428 points and NIFTY50 111 points.

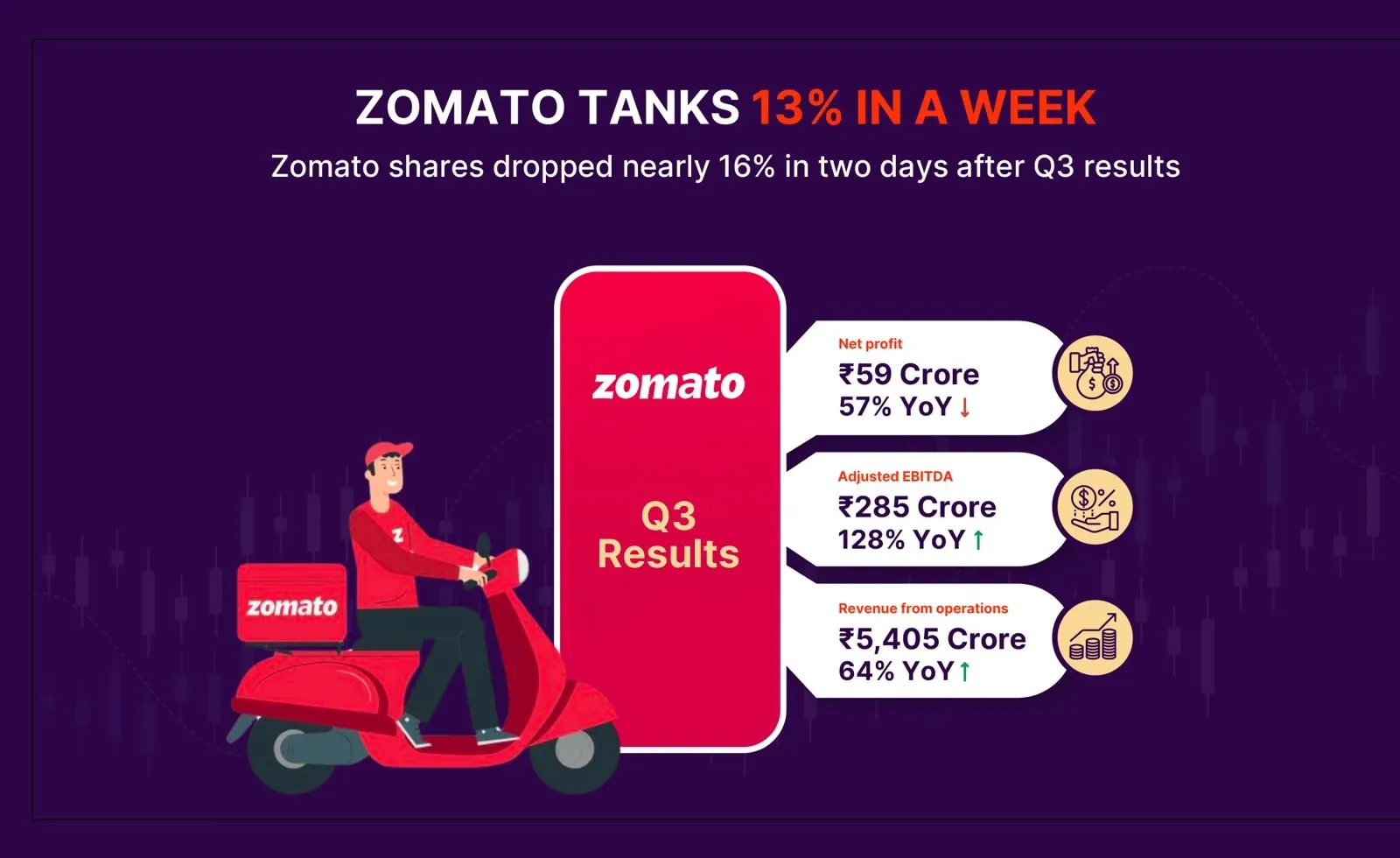

- Zomato shares decline up to 16% in two days after Q3 results.

We are back with a quick recap of the markets this week marked by volatility ahead of Union Budget 2025.

Key stock indices SENSEX and NIFTY50 declined more than half a per cent this week, marking their third consecutive week of losses.

Stock markets witnessed volatile sessions this week as new US President Donald Trump kept investors guessing about his much-hyped tariff policy. A firm US dollar and the US bond yields hovering near 4.65% this week drained out foreign capital from the Indian markets. Financial results by Indian companies were in line with expectations but management commentary remained uninspiring, which triggered selling.

However, the Q3 results of IT companies and management commentary indicating positive prospects for the sector came as a breather amid weak trends.

Boosted by comments of Donald Trump on China, stock markets started the week on strong footing. SENSEX gained more than 400 points and NIFTY50 added 141 points on Monday as banking, financial and power stocks advanced. Kotak Mahindra Bank rallied 9% after Q3 results helped indices post gains.

The euphoria was, however, short-lived as markets tanked around 1.5% to close at more than seven-month low levels on Tuesday. Heavy selling by FPIs and trade war fears over Trump tariff policy hit the sentiment.

Investors lost more than ₹7 lakh crore in a single day as realty, consumer durables and discretionary, power and services stocks declined sharply. SENSEX plunged 1,235 points to 75,838.36 and NIFTY50 sank 320 points to 23,024.65.

After an intense selling, stock markets saw recovery amid bouts of selling and buying in the next two days. Largecaps like Ultratech Cement and private banks posted better-than-expected results, which helped markets recover losses.

Stock indices witnessed volatile movements on Friday and snapped their two-day gaining streak as realty, oil&gas and healthcare shares dropped. Indices swung between gains and losses during the day before settling lower. SENSEX closed at 76,190.46, down by nearly 330 points. NIFTY50 ended at 23,092.20, down by 113 points.

On a weekly basis, SENSEX dropped 428 points and NIFTY50 111 points.

In the broader market, smallcap indices fell by 4% while midcap indices dropped by 2%, underperforming the benchmark index.

The majority of the sectoral indices ended lower with the BSE realty index tanking the most by 9%. BSE IT index was an outlier, rising by 4%.

Top NIFTY50 gainers/losers

| Gainers | Losers |

|---|---|

| Wipro (11%) | Trent Ltd (-11.6%) |

| Ultratech Cement (6.1%) | Axis Bank (-8.6%) |

| Grasim Industries (6%) | Dr Reddys (-6%) |

Top NIFTY50 sectoral gainers/losers

| Gainer | Loser |

|---|---|

| NIFTY IT (4%) | Realty (-9%) |

| NIFTY FMCG (0.48%) | Oil & Gas (-4%) |

| NIFTY Pvt Bank (0.29%) | Consumer Durables (-3%) |

US Markets

| Index | Change |

|---|---|

| Dow Jones | +2.15% |

| S&P 500 | +1.74% |

| Nasdaq | +1.65% |

| NYSE | +1.89% |

Commodity gainers/losers (gold, silver) (MCX)

| Commodity | Price | Change |

|---|---|---|

| Gold (24K 10gm) | ₹80,215 | +1.53% |

| Silver (1kg) | ₹91,625 | -0.09% |

Currency gainers/losers (USD, GBP)

| Currency | Change |

|---|---|

| US Dollar Index | -1.57% |

| GBP | +2.13% |

Kotak Bank rallies after Q3 results

Zomato shares drop 16% after poor Q3 results

Food delivery platform Zomato dropped nearly 16% in two sessions after the company reported a 57% drop in profit for the December quarter on Monday. Losses were inflated by its quick commerce arm Blinkit, which went for store expansion during the quarter. The stock recovered in the next two days but dropped on Friday again by 3% to end the week with a decline of 13%.

What lies ahead?

Stock markets are expected to remain volatile next week amid uncertainty surrounding Trump's economic policies. In-line, Q3 results are unlikely to help markets amid weak management commentary. Investors will focus on the FOMC meet and Union Budget for further bets. While the FOMC keeps a hawkish stance, Trump's push for rate cuts can add a positive undertone.

About The Author

Next Story