Market News

Stock Market Weekly Recap: NIFTY, SENSEX tank 2% to over 7-week low on unabated FII outflows

.png)

5 min read | Updated on January 10, 2025, 20:55 IST

SUMMARY

Benchmark indices NIFTY and SENSEX dropped over 2% weekly to close on Friday, January 10, at more than seven-week low levels. Profit booking and FII selling dragged the indices even as good TCS results raised hopes of a better show by the IT players in the December quarter.

Stock list

- The market crash on Monday wiped out around ₹11 lakh crore of investors’ wealth in a single session.

- On a weekly basis, SENSEX tanked 2.37%, or 1,844 points, and NIFTY by 662 points, or 2.80%.

- FIIs sold shares worth more than ₹16,800 crore during the week.

We are back with a quick recap of the markets this week marked by seesaw trading through gains and losses, as markets snapped two-week rally.

Benchmark indices NIFTY and SENSEX dropped over 2% weekly to close on Friday, January 10, at more than seven-week low levels. Profit booking and FII selling dragged the indices even as good TCS results raised hopes of a better show by the IT players in the December quarter.

US bond yields climbed to the highest since April 2024, and the US dollar traded at 109 over speculation of President-elect Donald Trump’s likely actions on the trade front, which hit market sentiment. A downgrade in the Indian GDP growth estimate to 6.4% for FY25 also cast a shadow on the equity markets.

Disappointing inflation data from China also added pressure on the Indian stock market this week. Investors turned cautious amid the start of the Q3 earnings season.

Stock markets started the week amid the HMPV scare as rising cases of the influenza strain in China made investors jittery. SENSEX tanked 1,258 points, while NIFTY50 shed 388 points, or 1.6%, to close at 23,600 level due to panic selling across sectors. Lacklustre quarterly updates dragged banking stocks. The market crash wiped out around ₹11 lakh crore of investors’ wealth.

Stock markets recovered some ground on Tuesday due to value buying by investors and easing concerns over the HMPV virus strain. SENSEX gained 234.12 points, or 0.30%, to close above the 78,000 mark, while NIFTY added 91 points to close above 23,700.

SENSEX and NIFTY declined over half a percent on Thursday due to surging US bond yields caution ahead of the TCS results. FII selling also hit the market sentiment. SENSEX declined by 528.28 points to close below the 78,000 level, while NIFTY tanked 162.45 points, or 0.69%, to endat 23,526.5.

Stock markets continued to decline on Friday even as IT shares advanced following TCS's stellar results. Market sentiment was subdued due to rising crude oil prices and a strong dollar.

Falling for the third day, SENSEX dropped 241.3 points, or 0.31%, to 77,378.91. NIFTY closed lower by 95 points, or 0.40%, to 23,431.5.

On a weekly basis, SENSEX tanked 2.37%, or 1,844 points, and NIFTY by 573.25 points, or 2.38%.

The broader market witnessed sharp losses as FIIs sold shares worth more than ₹16,800 crore during the week. NIFTY Midcap indices tanked up to 6%, while Smallcap indices sank up to 7%.

PSU Banks, Realty, Consumer durables lead sectoral losers

PSU Banks, Realty and Consumer durables were lead sectoral losers this week. Except for NIFTY IT (up 2%), all the sectoral indices closed in the red due to FII selling. PSU Bank and Realty tanked 8% each, while consumer durables and media shares dropped 6%. Metal dropped 5% while auto, pharma and oil &gas shares tanked up to 4%.

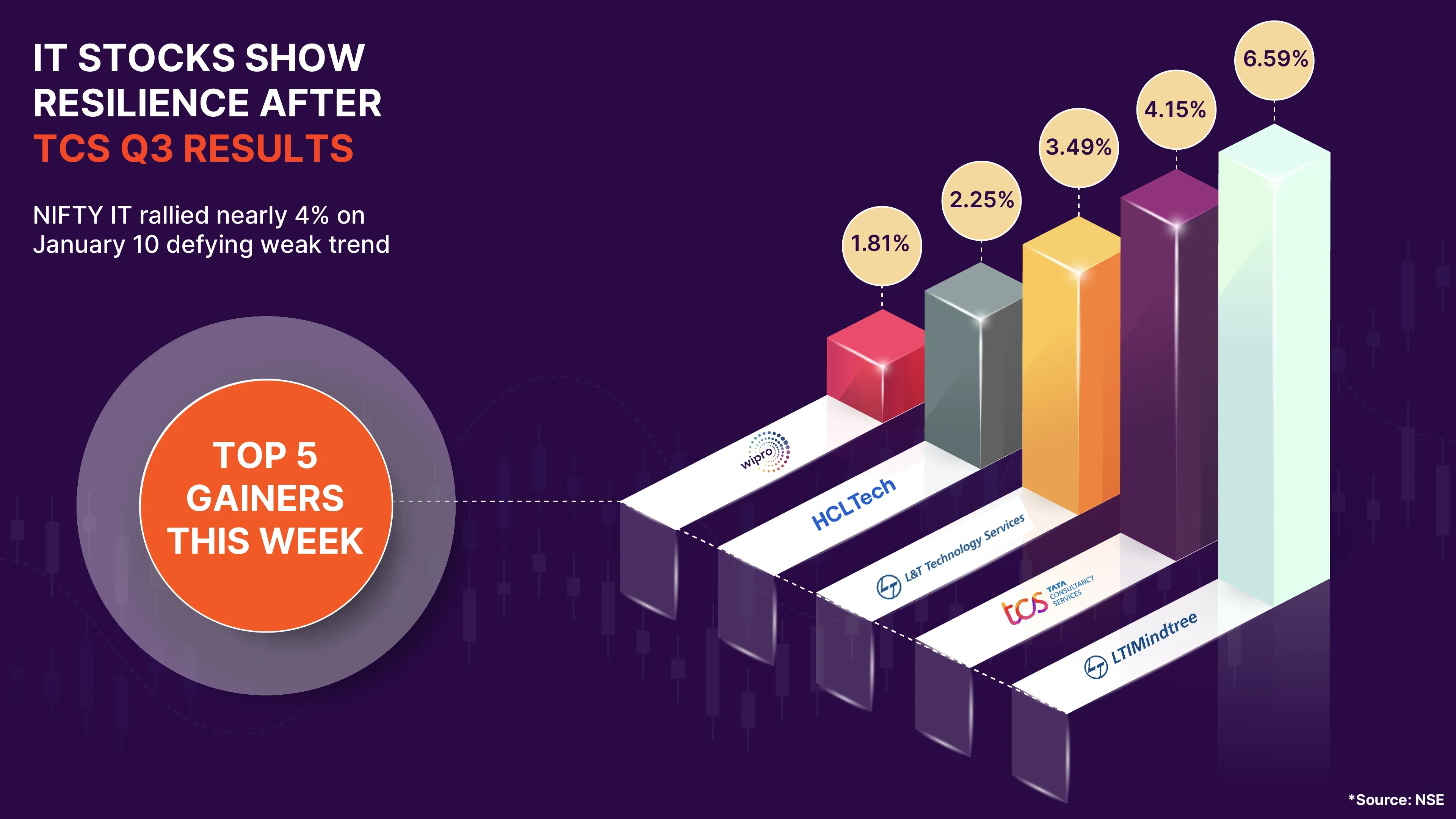

IT shares buck weak trend on positive TCS results

Most of the NIFTY IT constituents traded in the green on Friday after TCS Q3 results indicated that the IT sector will continue to remain resilient. NIFTY IT gained nearly 4% in intraday trade to touch a high of 44,798.65. On a weekly basis, the NIFTY IT index gained 2%.

Shares of TCS, Infosys, Tech Mahindra and LTIM rallied up to 6%.

TCS reported a 12% YoY rise in net profit in Q3FY25 while revenue increased by 5.6%. A weak rupee also aided its financial results.

Adani Wilmar shares tanked 10%

Other Adani stocks such as Adani Enterprises, Adani Green Energy, Adani Power, and Adani Energy Solutions also declined up to 4%. Adani Group is selling the stake as part of the strategy to exit non-core businesses and focus on the core infrastructure segment.

What lies ahead?

Macroeconomic data, such as inflation and industrial production figures, will also play a key role. On the global front, US labour market data and inflation trends may impact FII flows.

About The Author

Next Story