Market News

Stock Market Weekly Recap: NIFTY, SENSEX end 7-week decline after stellar Friday rally

.png)

6 min read | Updated on November 23, 2024, 09:31 IST

SUMMARY

SENSEX and NIFTY staged a dramatic rebound on Friday on strong US jobs data and gains in Asian stocks. Recovery in banking, oil, IT shares and Adani group shares helped notch best single-day gains since June 7, 2024. The key indices soared by more than 2% each.

Stock list

- SENSEX soared 2060 points while NIFTY shot up 606 points intraday on Friday.

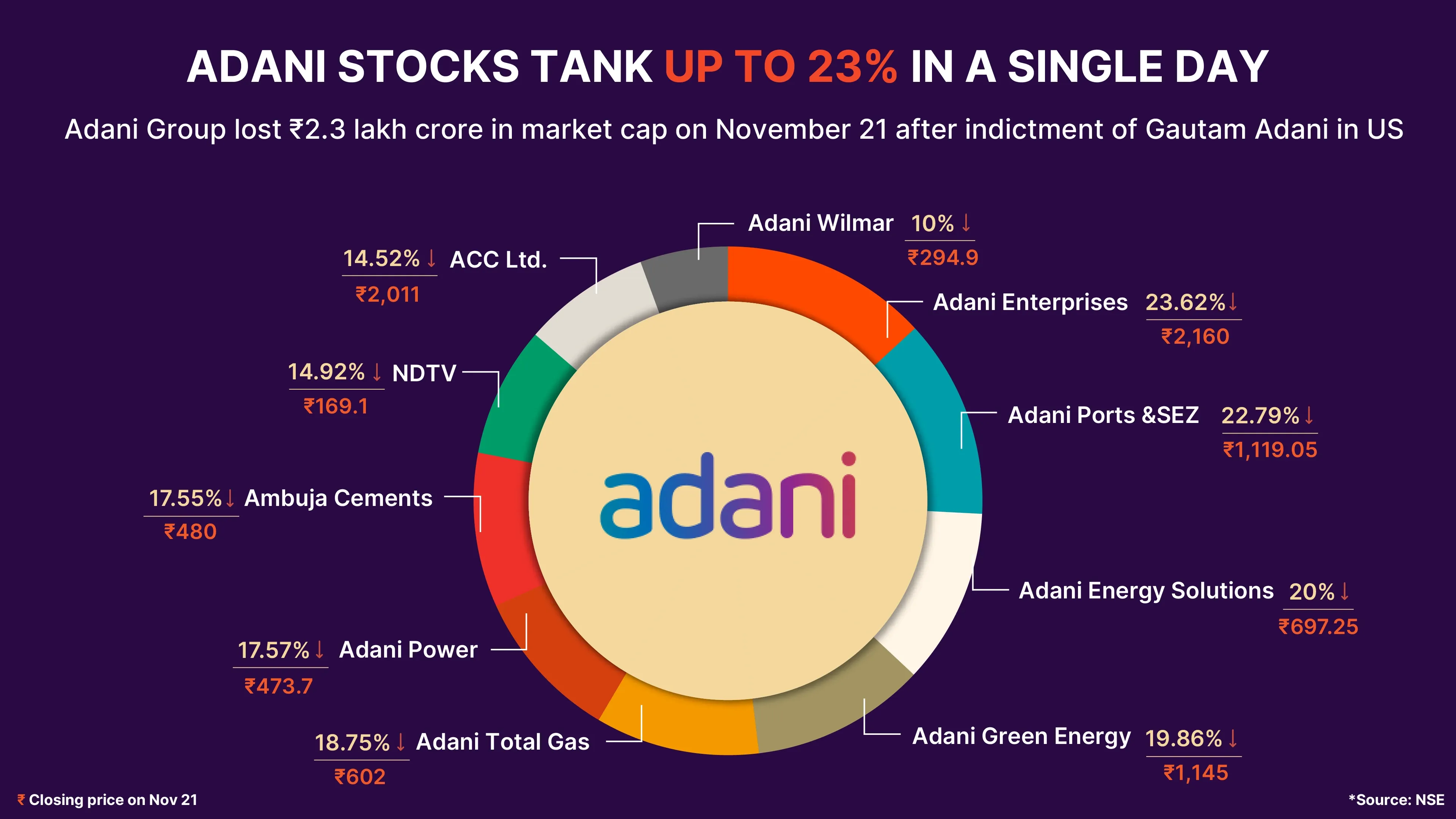

- The market capitalisation of Adani Group companies declined by nearly ₹2.3 lakh crore in a single day on November 21.

- Mamaearth shares declined around 37% after weak Q2 results.

Hey there! We are back with a quick recap of the markets in a holiday-truncated week marked by a sharp decline and a dramatic recovery.

SENSEX and NIFTY ended their seven-week decline, helped by a sharp rebound in Indian equities on Friday, November 22. The key indices soared by more than 2% each on the last trading day of the week, notching up their best single-day gains since June 7, 2024.

A stellar show towards the end helped recover losses of the week, which was marred by a host of factors. FII selling, weak Q2 results, rising Russia-Ukraine tensions and Adani Group stocks’ meltdown on bribery and fraud charges in the US were the major drags.

However, the key indices ended the week higher by nearly 2%. SENSEX and NIFTY had been on a decline since the week ended on October 4 due to persistent FII selling and weak Q2 results.

In line with a sombre trend, stock markets started the week on a weak note. NIFTY declined for the seventh consecutive day falling below 23, 500 and SENSEX for the fourth day, on Monday. IT and pharma shares were hit the most while metal and FMCG shares cushioned losses.

Benchmark mark indices cut their losses on Tuesday helped by bottom-fishing by domestic investors ahead of Maharashtra Assembly polls. Global markets were mixed after increased tensions between Ukraine and Russia as the former fired Western long-range weapons deep inside Russia. NIFTY and SENSEX rebounded more than 1% intra-day but increased selling by FIIs dragged them down at the close. NIFTY settled above 23,500 levels while SENSEX closed marginally higher than 77,500.

After a brief recovery, key indices again closed in the red on Thursday led by losses in Adani Group shares as allegations of kickbacks and fraud hit billionaire chairman Gautam Adani. Escalating Russia-Ukraine conflict also heightened geopolitical tensions and nuclear concerns. FII selling and the fresh Adani case with the US department of justice and securities commission added to the woes.

NIFTY tanked 168 points to close below 23,400 while SENSEX dropped 422 points after witnessing sharp losses during the day.

SENSEX and NIFTY staged a dramatic rebound on Friday on strong US jobs data and gains in Asian stocks. Recovery in banking, oil, IT shares and Adani group shares helped notch the best single-day gains since June 7.

SENSEX soared 2060 points while NIFTY shot up 606 points during the day. SENSEX closed at 79,117.11, up by 1961.32, or 2.54%. NIFTY settled at 23,907.25, up by 557.35, or 2.39%.

M&M, Power Grid lead weekly gainers

Broader markets also witnessed recovery with midcap indices advancing up to 2% and NIFTY smallcap indices by 1%.

Among NIFTY sectoral indices, NIFTY Realty was the biggest gainer rising by around 6%. NIFTY Auto, IT, FMCG and Financial Services advanced 2% each. Media and Oil & Gas were the main losers.

Adani Group stocks plunge after bribery, fraud allegations

Some stocks hit their lower circuits. In total, the market valuation of all listed Adani Group companies declined by around ₹2.3 lakh crore in a single day. Adani group stocks, however, recouped some of the losses on Friday on bargain hunting. Most Adani stocks closed higher on Friday.

Waaree Energies share tank after quarterly results

Waaree Energies shares dropped around 13% in three days after the company reported weaker-than-expected quarterly earnings for the September quarter. The stock declined nearly 7% on November 19 after the company reported a sequential decline in net profit to ₹361.65 crore for the September quarter of FY25. Revenue was up at ₹3,574.37 crore. The stock corrected in the next two sessions, taking the total loss to around 13%. The stock made its market debut on October 28 with a premium of 66% over the issue price. The stock still trades around 15% higher than the issue price of ₹1,503 per share.

Poor Q2 results drag Honasa Consumer shares down 37%

Paytm shares trade near 52-week high

What lies ahead?

Next week, investors will keep a watch on the impact of the Maharashtra Assembly elections 2024 results, scheduled on November 23. The poll outcomes may impact the market sentiments on Monday, especially in the early hours, according to experts. Geopolitical tensions and an upbeat momentum in Asian markets may also affect the market movements next week. The investors are expected to keep a keen watch on the sector-specific movements after Friday’s recovery.

About The Author

Next Story