Market News

Wipro, Persistent, Infosys, TCS: NIFTY IT index jumps 4.6% in 1 month; what lies ahead after 3rd Fed rate cut?

.png)

7 min read | Updated on December 11, 2025, 08:46 IST

SUMMARY

IT stocks: HSBC Research, in its latest report on Indian equities, highlighted that global AI exuberance is solid; however, it seems India, at this stage, is at a distinct disadvantage in the AI ‘revolution’.

Data show that the NIFTY IT index has rallied 4.63% over the past one month (from the November 11 to December 10 closing level). | Image: Shutterstock

Data show that the NIFTY IT index has rallied 4.63% over the past one month (from the November 11 to December 10 closing level).

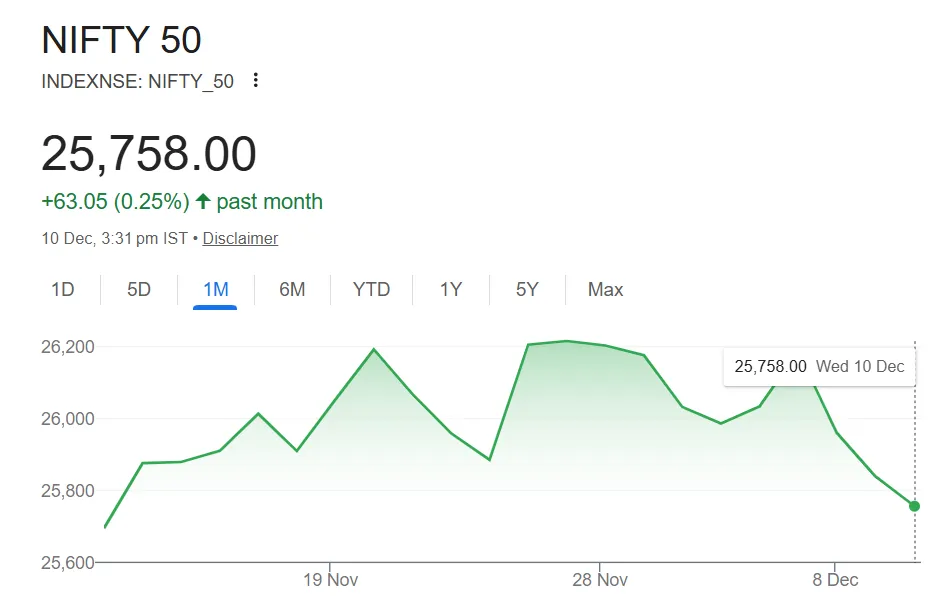

In comparison, the benchmark NIFTY50 index has gained just 0.25%.

Nifty IT provides investors and market intermediaries with an appropriate benchmark that captures the performance of the IT segment of the market in India. At present, there are 10 constituents of the NIFTY IT index.

Why have IT stocks gained momentum of late?

The buying of Indian IT shares could be attributed to factors such as a weak rupee, fresh investments in AI, a strong revenue outlook by Salesforce recently, and analysts' views that the recovery is on the cards.

Weak Rupee

IT services majors such as Tata Consultancy Services (TCS), Infosys, Tech Mahindra, Wipro, and HCL Technologies, among others, earn a substantial amount of their revenue from outside India and are paid in US dollars. When the rupee becomes weaker, one dollar converts into more rupees, so even if a company’s dollar income stays the same, its income looks larger in rupee terms, making profits appear higher and often pushing the stock price up.

The domestic currency has been in a freefall this year, with depreciation appreciating over the past few sessions. On Monday, the rupee depreciated 14 paise to close at 90.09 (provisional) against the US dollar, as elevated crude oil prices and persistent foreign fund outflows dented investor sentiments.

Forex traders said multiple pressures, such as sustained importer demand for the American currency, foreign fund outflows from equities, and lingering uncertainty over the India-US trade deal, are keeping investor sentiment fragile.

However, last week, Reserve Bank Governor Sanjay Malhotra said the central bank does not target any band for the rupee in the forex market and allows the domestic currency to find its own correct level.

Investments in AI

Of late, leading IT services companies have announced their collaboration or partnerships in the AI fields, thus spawning interest among investors. For instance, Infosys in November 2025 introduced an AI-first model aimed at speeding up the establishment and transformation of global capability centres into AI-driven hubs that promote innovation and growth.

The solution allows enterprises to redefine their Global Capability Centres (GCCs) as strategic assets that drive innovation, enhance agility, and create competitive advantages in an AI-driven world, the company said in a regulatory filing.

Similarly, Tata Consultancy Services (TCS) in late November 2025 said it has signed a five-year deal with SAP to support the European enterprise software major in streamlining its IT operations and enhancing AI-driven capabilities.

The partnership aims to deliver faster development cycles, lower total cost of ownership, and better alignment between IT and business goals, TCS said in a regulatory filing.

The agreement builds on a two-decade partnership under which TCS has established and scaled SAP's enterprise cloud services, helping shift its business model from licence maintenance to pay-per-use cloud offerings.

Besides, the IT services major in November also announced a tie-up with private equity major TPG for its upcoming data centre business, in which both partners aim to invest ₹18,000 crore.

TPG will invest $1 billion, or around ₹8,870 crore, in the AI data centre business christened as 'Hypervault' and hold a stake between 27.5 and 49% in the venture.

Salesforce's upbeat outlook

Another reason why IT stocks have seen a sharp rebound is the encouraging revenue outlook by Salesforce. Salesforce is a major American cloud-based software company, firmly within the IT industry (Information Technology), providing CRM (Customer Relationship Management) and other business applications for sales, service, marketing, and analytics, powered by AI on a unified platform, making it a key player in enterprise tech.

The company posted earnings per share (EPS) of $3.25 for the quarter ended on October 31, beating Bloomberg consensus estimates of $2.86. "Revenue rose by 8.6% versus a year earlier to $10.3 billion, slightly ahead of forecast as well. Subscription and support revenue, in particular, jumped 10% year-over-year," according to Investing.com.

Fiscal 2026 revenue is forecast to come in at $41.45 billion to $41.55 billion, compared with a previous outlook of $41.1 billion to $41.3 billion. For the fourth quarter, Salesforce projected EPS of $3.02 to $3.04 and revenue of $11.13 billion to $11.23 billion.

"Underpinning the upbeat outlook were projections for strong growth in demand for the group’s AI-enhanced agent platform, especially among its enterprise clients," the report added.

A strong outlook at Salesforce tends to ripple positively to many Indian IT companies, especially those offering services around Salesforce, cloud, CRM and digital transformation.

The Outlook

HSBC Research, in its latest report on Indian equities, highlighted that global AI exuberance is solid; however, it seems India, at this stage, is at a distinct disadvantage in the AI ‘revolution’.

"Throughout 2025, in our interactions with global investors, we saw India being positioned as a global AI alternative play. Though in the past few weeks, there has been some unwinding of this theme," HSBC notes.

The report added that growth and hiring have slowed in the IT sector, which remains the top white-collar job sector in the country. They expect an 8-10% negative impact on revenue in Indian IT due to the adoption of AI tools across the technology stack over 3-4 years, although AI could be accretive to growth in the medium to long term.

Top cloud companies are likely to spend $2 trillion in AI infrastructure over the next 4-5 years, which could generate downstream IT services opportunities.

What does a 3rd-rate cut by the Fed mean?

It is important to note that the U.S. Federal Reserve’s rate cuts do not directly influence Indian IT stock prices, since these companies are listed in India and their valuations primarily depend on domestic market factors and company fundamentals.

However, Fed rate changes have several indirect but meaningful effects on Indian IT stocks. For example, a rate cut typically increases global liquidity, which improves overall risk appetite. As a result, foreign investors often channel more funds into emerging markets such as India. Indian IT companies—being large-cap, stable, and export-driven—tend to benefit from this rise in Foreign Portfolio Investment (FPI) flows.

Additionally, Indian IT firms like Infosys, TCS, and Wipro derive 60–70% of their revenues from U.S. clients. Fed rate cuts usually support U.S. economic growth, which in turn boosts corporate IT spending. A stronger U.S. business environment leads to higher budgets for outsourcing and digital transformation, thereby improving the revenue growth outlook for Indian IT companies and providing support to their stock prices.

On Wednesday, the Federal Reserve reduced its key interest rate by a quarter-point for the third time in a row on Wednesday but signalled that it may leave rates unchanged in the coming months.

Chair Jerome Powell signalled at a news conference that the Fed would likely hold off on further rate cuts in the coming months while it evaluated the health of the economy. And in a set of quarterly economic projections, Fed officials signalled they expect to lower rates just once next year.

Related News

About The Author

Next Story