Market News

Titan shares hit all-time high; Senco Gold zooms 14%: Jewellery stocks sparkle on robust Q3 updates; key points to know

.png)

7 min read | Updated on January 07, 2026, 11:09 IST

SUMMARY

Titan Q3 updates: Titan Company said that towards the end of the quarter, the company launched ‘beYon’, its lab-grown diamond jewellery brand, enhancing its portfolio play in the evolving jewellery category.

Stock list

The companies, as a whole, have reported an encouraging set of numbers, given the buoyant festive season. | Image: Shutterstock

The companies, as a whole, have reported an encouraging set of numbers, given the buoyant festive season.

Reacting to the robust numbers, Titan Company shares rallied as much as 4.5% to hit a record high of ₹4,300 apiece on the NSE, while Senco Gold shares zoomed as much as 13.9% to hit the day's high of ₹368.40.

Kalyan Jewellers was trading 1.52% higher at ₹507.75 on the NSE.

The positive sentiment spilt over to other jewellery names as well. For instance, Thangamayil Jewellery shares were trading 6.27% higher at ₹3,705.60 apiece on the NSE, while Tribhovandas Bhimji Zaveri shares were up 10% at ₹178.50 on the NSE.

PC Jeweller was trading nearly 3% higher at ₹10.61.

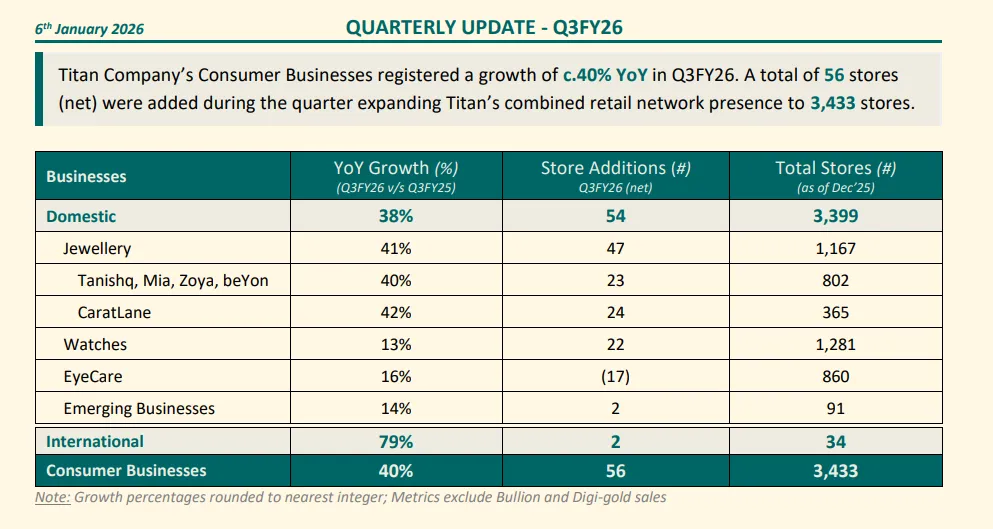

Titan Company

The jewel of the Tata Group said that, buoyed by a vibrant festive demand, the jewellery portfolio clocked a robust 41% YoY growth in Q3 FY26. Revenue growth was driven by substantial average selling price (‘ASP’) increases, offsetting flattish buyer growth.

To navigate the elevated gold price environment, Tanishq deployed a powerful gold exchange offer that sustained consumer engagement beyond the traditional festive window.

Distinct consumer patterns were observed across product categories (all brands combined); gold coins nearly doubled in sales vs. Q3FY25, reinforcing their strong investment proposition. The gold (plain) category grew strongly in the late thirties, reflecting a preference for design-led, aesthetic premium. offerings during the wedding and festive season.

Studded jewellery clocked its best performance (yet) for FY26, exhibiting healthy double-digit growth in the mid-twenties and well supported by buyer growth in the sub-segment. The like-for-like growths (secondary) across all jewellery retail formats (combined) were in the low thirties, Titan said in its press release.

Titan Company said that towards the end of the quarter, the company launched ‘beYon’, Titan’s lab-grown diamond jewellery brand, enhancing its portfolio play in the evolving jewellery category.

While the natural diamonds in Tanishq, Mia, Zoya and CaratLane would continue to anchor emotionally significant and milestone-led purchases for customers seeking value and adornment, beYon aspires to address an emerging consumer fashion need for affordable, everyday diamond-studded jewellery that is driven by self-expression and styling.

Of the 47 new store additions (net) in India, 10 were in Tanishq, 11 in Mia, 1 in Zoya, 1 in beYon and 24 in CaratLane, respectively.

Titan's Watches division saw a growth of around 13% YoY. It was primarily led by analogue watches, recording a healthy festive performance of around 17% YoY growth for the quarter.

"Premiumisation trends resulted in solid double-digit gains for the Titan brand, complemented by healthy volume expansion during the festive period. Sonata and Fastrack also witnessed notable consumer traction, delivering robust double-digit value growth and being well supported by strong volume momentum," the company added.

The division added 22 new stores (net), consisting of 9 stores in Titan World, 9 stores in Fastrack, 3 stores in Helios and 1 store in Helios Luxe, respectively.

The division achieved around 16% YoY growth, led by both international and house brands, contributing well to the overall product mix.

Runway, the premium sunglass destination, added 2 new stores during the quarter. As part of the network optimisation in Titan Eye+, the division opened 11 new stores, renovated 20 stores and closed 30 stores during this period.

Fragrances grew around 22% YoY, led by double-digit volume growth in Fastrack and Skinn, with ASPs remaining at similar levels as Q3FY25.

Women’s bags grew around 111% YoY, driven by nearly twofold growth in overall volumes and healthy double-digit ASP growth in Fastrack and Irth brands.

Across Fashion Accessories, the e-commerce channel drove much of the festive uptick with a significant contribution to overall sales.

Taneira’s sales declined around 6% YoY; despite double-digit ASP growth across sarees and the ready-to-wear portfolio, lower volumes more than offset this benefit, resulting in an overall YoY decline.

Irth added 2 stores during the quarter in the cities of Delhi and Kolkata.

The international businesses primarily comprising jewellery (Tanishq, Mia and CaratLane) grew around 81% YoY, led by robust performance in all the markets of the GCC, Singapore and North America (NA).

During the quarter, Tanishq opened two new stores in the NA market, one each in Boston and Orlando.

Senco Gold

-

Senco achieved a growth of 51% YoY in the backdrop of 6.5% growth in Q2 and 28% in Q1, thus achieving nearly 31% growth during the first nine months. "Our TTM revenue has already reached ~₹8,000 crore, reflecting consistent YoY growth, a loyal customer base and brand positioning," it added.

-

The Q3 YoY growth includes retail business growth of nearly 49% and SSSG of around 39% growth. The nine-month topline growth of 31% includes SSSG of around 21% growth.

-

This uplift was led by targeted festive campaigns, new design launches, and intensive customer engagement during Dhanteras & Diwali, as well as the shift in demand from Q2 to the festive season.

-

Diamond jewellery sales continued to maintain strong growth momentum in Q3, with nearly 36% YoY growth and nine-month growth of nearly 34%.

The company said it launched four new franchise showrooms, taking the total showroom network to 196 (inclusive of 8 Sennes and 2 international showrooms).

The company said that gold prices continued to rise even in Q3 FY26, with nearly 23% QoQ growth and around 65% YoY (on average), leading to major demand from global central banks and investment-led demand for ETFs, but a muted volume rise.

The gold price range in Q3 FY26 peaked at the highest ever level of ₹1,40,000/10gm, as against ₹ 1,17,000 in Q2 FY26 and ₹79,800 in Q3 FY25.

The company said it is prepared for the upcoming Q4 wedding season, Valentine's Day and International Women's Day, and other local festivals and is targeting growth in the studded category through curated collections with 18%~20% growth.

Senco Gold said it is firmly on course to achieve its annual target of 20 new showroom openings for FY26.

"We expect to launch another 3 to 4 showrooms under the COCO and FOCO models to achieve the milestone of 200 showrooms and have a robust pipeline for H1 next year. We are thus confident of achieving 25%+ YoY growth for FY26, riding on 31% YoY in 9 months so far," the company added.

Kalyan Jewellers

The company said it recorded consolidated revenue growth of approximately 42% when compared to the same period in the previous financial year.

"Our India operations witnessed revenue growth of approximately 42% during Q3 FY2026 as compared to Q3 FY2025, driven primarily by strong festive demand. Demand during the period after Diwali also continued to remain robust despite volatility in gold prices," the company said.

Growth was broad-based across plain gold and studded categories. The quarter recorded healthy same-store sales growth of approximately 27%.

Its international operations recorded revenue growth of approximately 36% for the recently concluded quarter when compared to the same period during the previous financial year.

Kalyan Jewellers said its digital-first jewellery platform, Candere, recorded a revenue growth of approximately 147% during the recently concluded quarter as compared to the same period during the last year.

"During the recently concluded quarter, we launched 21 Kalyan showrooms in India, 1 Kalyan showroom in the United Kingdom and 14 Candere showrooms in India," the company said.

As of December 31, 2025, its total number of showrooms across India and international markets stood at 469 (Kalyan India – 318, Kalyan Middle East – 38, Kalyan USA – 2, Kalyan UK – 1, Candere – 110).

Related News

About The Author

Next Story