Market News

RBL Bank shares soar nearly 96% in 2025; here is why

3 min read | Updated on October 09, 2025, 15:49 IST

SUMMARY

RBL Bank stood as the strong outperformer in 2025 among all the private and public sector banks, with nearly 96% gains in 2025. The sharp turnaround in the outlook was led by improving lending standards and reducing regulatory overhang on the stock. The sharp rally in the stock was primarily led by robust buying by the domestic institutions, like mutual funds.

Stock list

RBL Bank share price jumped 96% in 2025, outperforming its peers by huge margin. Image source: Shutterstock.

Indian benchmark indices have posted a lacklustre performance in 2025 with mid-single-digit returns. At the sectoral level, the NIFTY IT, NIFTY FMCG are among the top losers. However, the banking sector continues to remain an outperformer, with NIFTY Bank gaining 10% in 2025 on a YTD basis. Among banks, PSU Banks have outperformed their private peers at the index level as the NIFTY PSU Bank index jumped 15.5% in 2025, while the NIFTY Private Bank index jumped 10% in the same period. However, on private bank stock has outperformed all its private and public peers by a huge margin.

The Kolhapur-based RBL Bank Ltd has nearly doubled, with 96% gains in 2025, holding the top position among its peers. The shares of the bank were under tremendous selling pressure since 2021 after the RBI took a slew of regulatory actions against the company. The shares fell over 60% to hit an all-time low of ₹72.9 in June 2022.

The shares recouped the majority of the losses and traded at ₹280 apiece in January 2024. However, the shares again went into free-fall mode owing to poor fundamentals. From July 2024 to January 2025, the shares slumped by over 43% in a period of six months. The bank reported a sharp decline in profit, deteriorating asset quality and termination of co-branded credit card issuance, a high unsecured lending portfolio made the investors pessimistic about the stock.

What led to a turnaround in sentiment?

The bank shifted its focus from high-risk unsecured lending to a more secure retail credit system. The results of which were visible in the financial results from Q2FY25 to Q1FY26, where net interest income for the bank came down from ₹1615 crore to ₹1481 crore. In Q1FY26, the net interest income dropped 13% YoY owing to lower contribution from the unsecured portfolio and external benchmark resets. Owing to the restructuring and change in the strategy, and improved corporate governance, investors turned optimistic on the stock.

What led to a sharp surge in the share price in 2025?

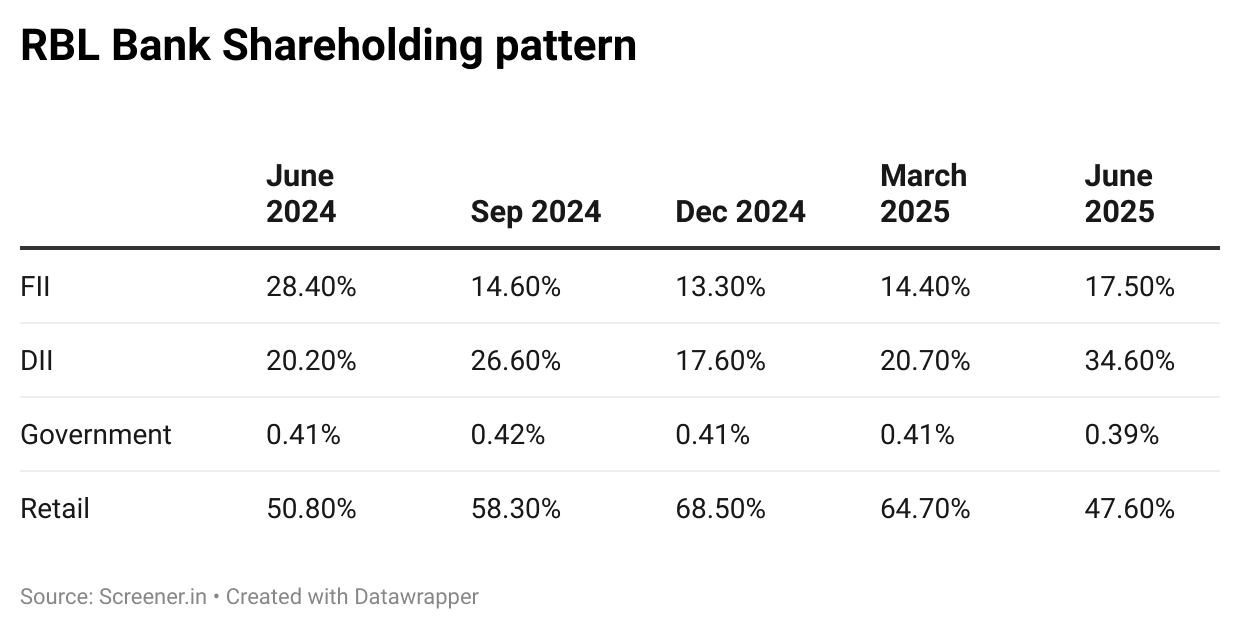

The latest shareholding pattern as of Q1FY26 displayed major changes in the composition. The foreign investors liquidated their stake from 28.4% in June 2024 to 17.5% in June 2025. While DIIs, which include mutual funds in the majority, increased their stake from 20% to 34% in the same period. The public shareholding also witnessed a sharp fall in the June quarter at 47.6% from 68.5% in December 2024. The changes in shareholding patterns reflect the respective outlook of the investor category. Despite reducing stake, FIIs have started increasing their stake back with a QoQ jump from 14.4% to 17.5% in the June quarter.

The sharp rally in the share price is primarily led by large institutional buying in the first nine months of 2025, where retailers liquidated their stake, while domestic mutual funds like Quant Mutual Funds cashed in on the opportunity and added stake. As the regulatory overhang reduces and the company shows strong growth in financials, the optimism around RBL Bank could again boost the momentum in the share price.

Related News

About The Author

Next Story