Market News

KEI Industries, Polycab, and other cable & wire stocks crash up to 15% on this move by Adani Enterprises

.png)

3 min read | Updated on March 20, 2025, 12:23 IST

SUMMARY

Stock market today: In an exchange filing, Adani Enterprises said that Kutch Copper Limited (“KCL”), its wholly owned subsidiary, has completed the incorporation process of a joint venture company, namely “Praneetha Ecocables Limited” (“PEL”), on March 19, 2025, with Praneetha Ventures Private Limited. KCL shall hold 50% equity share capital of PEL.

The wires and cables industry has witnessed a revenue CAGR of around 13% between FY19 and FY24 | Image: Unsplash

In an exchange filing, Adani Enterprises said that Kutch Copper Limited (“KCL”), its wholly owned subsidiary, has completed the incorporation process of a joint venture company, namely “Praneetha Ecocables Limited” (“PEL”), on March 19, 2025, with Praneetha Ventures Private Limited. KCL shall hold 50% equity share capital of PEL.

The purpose of the acquisition is the manufacturing, marketing, distribution, buying, and selling of metal products, cables, and wires, it added.

Following the announcement, Polycab India shares slipped as much as 7.8% to ₹5,015.60 apiece on the BSE, Finolex Cables slipped around 2% to ₹852.95. KEI Industries shares slipped as much as 14.5% to ₹3067.95 apiece on the BSE, while Havells India was trading over 3% lower at ₹1,508.80 on the BSE.

Meanwhile, Adani Enterprises was trading flat with a positive bias at ₹2,329.55 on the BSE. On the other hand, UltraTech Cement shares were trading nearly half a percent lower at ₹10,884.10 apiece on the BSE.

The announcement by Adani Enterprises comes nearly a month after cement giant Ultratech Cement in February after the company announced its entry into the wires and cables segment.

UltraTech Cement said it would invest ₹1,800 crore to set up a plant in Gujarat over the next two years as part of plans to expand its footprint in the construction value chain. The plant will be set up near Bharuch in Gujarat and is expected to be commissioned by December 2026.

The board of the Aditya Birla Group firm approved the proposal to extend its footprint in the construction value chain through its Building Products Division.

This is in accordance with the "company’s strategy to strengthen its position as a comprehensive building solutions provider," said UltraTech.

The wires and cables industry has witnessed a revenue CAGR of around 13% between FY19 and FY24, and with the migration from the unorganised to the organised market, the outlook continues to remain robust, which provides an attractive opportunity for a new trusted player in the sector, it said.

"The company believes that this proposed entry in the sector is likely to be value accretive to its shareholders," said UltraTech.

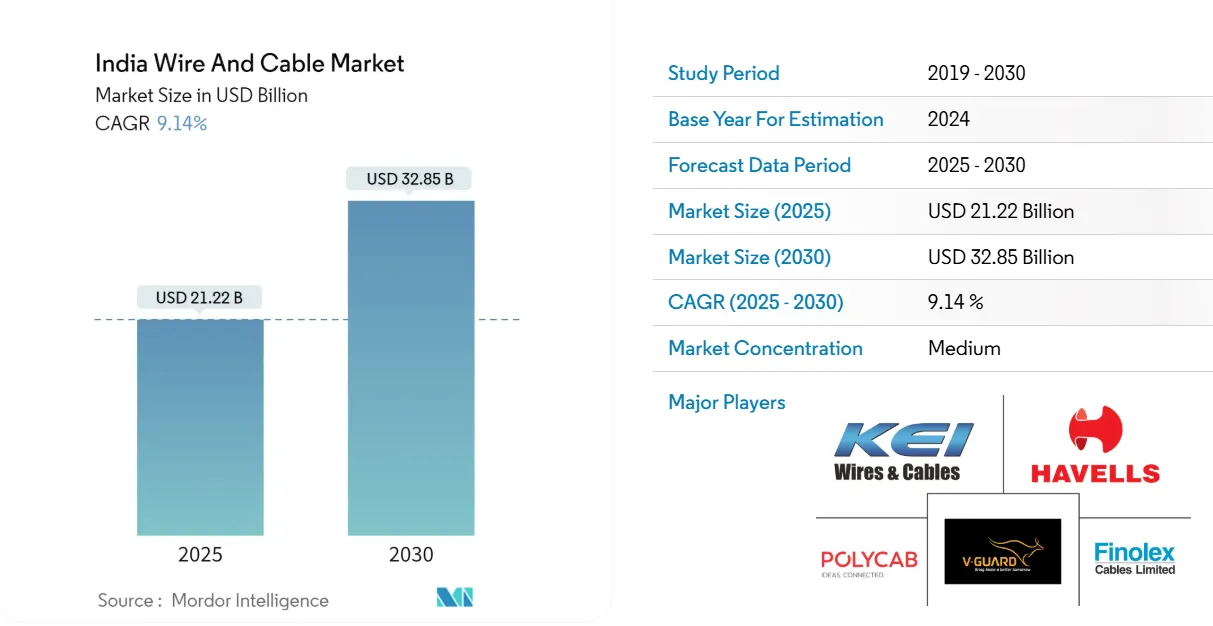

India Wire And Cable Market Outlook

According to Mordor Intelligence, the India wire and cable market size is estimated at $21.22 billion in 2025 and is expected to reach $32.85 billion by 2030, at a CAGR of 9.14% during the forecast period (2025-2030).

The Indian wire and cable market is experiencing significant growth, driven by multiple factors, including growing renewable energy production, increasing reserves in smart grid technology, industrialisation, and government initiatives.

This sector, vital for electricity distribution and telecommunications, is expanding at an impressive rate and is expected to continue this trajectory in the coming years.

"India is undergoing a massive infrastructure transformation. The Indian government continuously takes various initiatives to provide affordable housing and improved urban infrastructure. For instance, in January 2024, the finance minister of India announced that the government plans to raise the allocation for low-cost housing by more than 15% to $12 billion for 2024/25. Such initiatives have led to a substantial increase in the country's demand for wires and cables," the research firm added.

About The Author

Next Story