Market News

NHPC, JSW Energy, GIPCL, NTPC: Utility stocks rally in trade; BSE Utility index trades 2% higher

.png)

4 min read | Updated on February 20, 2025, 13:54 IST

SUMMARY

At the time of writing this article, NHPC shares were trading around 5.7% higher at ₹78.83 apiece on the BSE, while KP Energy's stock was locked in the 5% upper circuit band at ₹416.15. Gujarat Industries Power Company Limited (GIPCL) shares were up 4.85% at ₹178.30 apiece.

Stock list

The renewable segment is demonstrating remarkable growth potential in India's power generation market, as per a report. Image: Shutterstock

The BSE Utilities index was trading at 4,804.98 levels, up 93.57 points, or 1.99%.

The BSE Utilities index has been designed to provide investors with a benchmark reflecting companies included in the BSE AllCap that are classified as members of the utilities sector. It was launched on February 25, 2022, per BSE.

Utility stocks are shares of those companies that are engaged in public services such as electricity, gas, and telephone. The companies include power producers, electricity distributors, pipeline operators, and city gas distribution companies, among others.

Gujarat Industries Power Company Limited (GIPCL) shares were up 4.85% at ₹178.30 apiece, while Antony Waste Handling Cell's stock price was trading 4.60% higher at ₹557.50.

However, a few stocks from the pack were trading in the red. For instance, Torrent Power and NLC India, among others.

Q3 FY25 Results

State-owned power giant NTPC reported a marginal dip in its consolidated net profit to ₹5,169.69 crore for the October-December quarter compared to the year-ago period due to higher tax expenses and adjustments.

The company had a consolidated net profit of ₹5,208.87 crore in the quarter ended on December 31, 2023.

Total income rose to ₹45,597.95 crore in the third quarter from ₹43,574.65 crore in the same period a year ago.

Total tax expenses in the quarter increased to ₹2,075.12 crore from ₹1,361.75 crore a year ago. Similarly, net movement in regulatory deferral account balances (net of tax) was (minus) ₹343.09 crore in the quarter against ₹1,436.24 crore (plus) in the same period a year ago.

JSW Energy

JSW Energy reported over a 27% dip in its consolidated net profit to ₹168 crore in the October-December quarter compared to ₹231 crore in the year-ago period.

Total revenue decreased by 1% year-on-year to ₹2,640 crore in the third quarter of 2024-25 from ₹2,661 crore in the corresponding period last year, a company statement said.

The finance cost for the quarter rose to ₹565 crore in Q3 FY25 from ₹521 crore as a result of capitalisation of projects, with the weighted average cost of debt standing at 8.87%.

Power Sector in India

The India power market size in terms of installed base is expected to grow from 536.23 gigawatts in 2025 to 817.52 gigawatts by 2030, at a CAGR of 8.8% during 2025-2030.

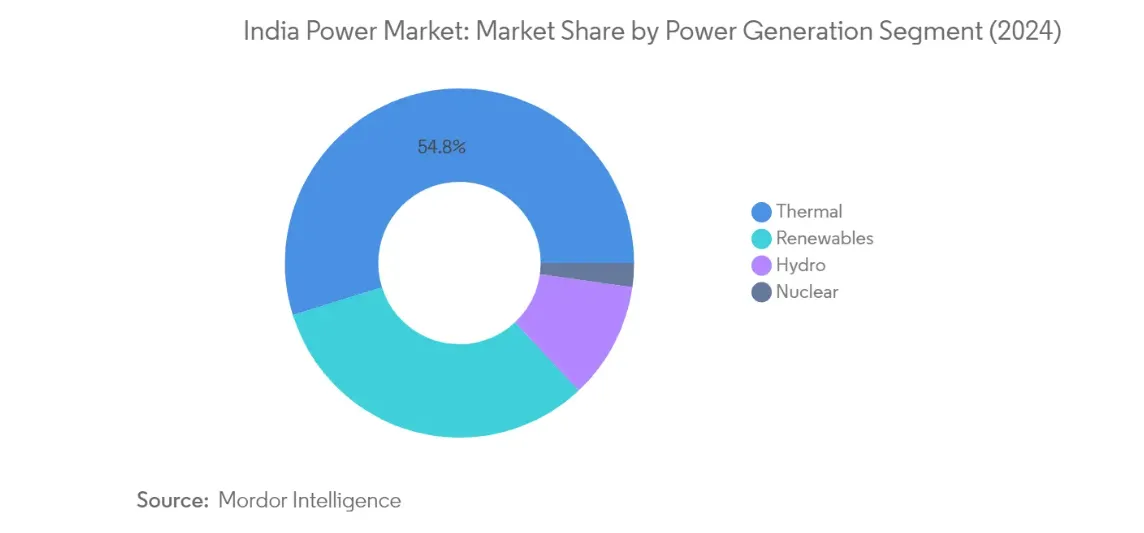

The thermal power segment continues to dominate India's power generation landscape, holding approximately 55% of the total installed capacity in 2024, according to a report by Mordor Intelligence.

The power generation landscape has evolved to accommodate diverse energy sources, including thermal, hydro, nuclear power, and renewable energy, creating a more balanced and sustainable energy mix, the report further says.

The power generation sector has demonstrated robust operational performance, with major players achieving significant milestones. NTPC, India's largest power utility, recorded an impressive power generation of 399.2 BU in FY 2022-23, marking an 11% growth compared to the previous year, the report adds.

As regards renewables, the report notes that the segment is demonstrating remarkable growth potential in India's power generation market, with an expected growth rate of approximately 10% from 2024 to 2029. This expansion is driven by ambitious government initiatives targeting 500 GW of renewable energy capacity by 2030.

About The Author

Next Story