Market News

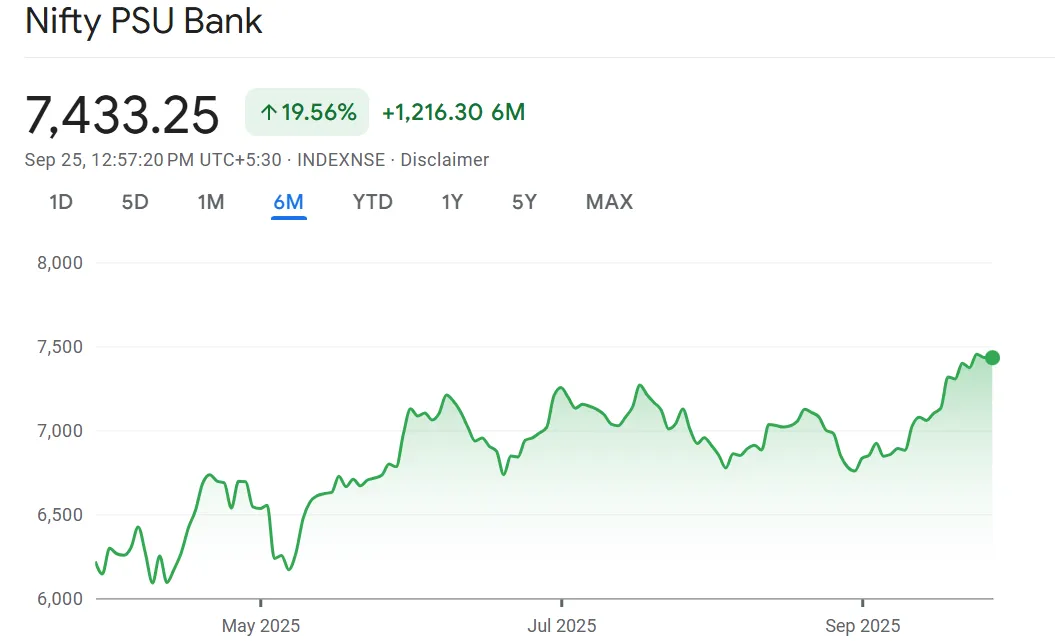

Canara Bank, PNB, Indian Bank: NIFTY PSU Bank index surges 20% in 6 months; what lies ahead?

5 min read | Updated on September 26, 2025, 07:48 IST

SUMMARY

PSU bank stocks: The Nifty PSU Bank Index represents the performance of India's leading public sector banks. It includes the 12 largest public sector banks, where the government holds more than 50% ownership, based on free-float market capitalisation. This index serves as a sectoral benchmark for the public banking sector in India.

Stock list

Among constituents, Punjab National Bank (PNB) shares have jumped 19.5% in six months. | Image: Shutterstock

The Nifty PSU Bank Index represents the performance of India's leading public sector banks. It includes the 12 largest public sector banks, where the government holds more than 50% ownership, based on free-float market capitalisation. This index serves as a sectoral benchmark for the public banking sector in India.

Among constituents, Punjab National Bank (PNB) shares have jumped 19.5% during the window, while Canara Bank has jumped 38% on the NSE. Indian Bank shares have risen 30%, and State Bank of India (SBI) has advanced 12.5%.

Bank of Maharashtra has gained over 20%, and Bank of Baroda shares have seen a rise of around 13.5%.

What is behind the rally in PSBs?

Healthy credit growth, stable asset quality, and attractive valuations are the key factors behind the rally in PSU bank stocks. Investors, analysts say, are rewarding the improving loan growth trajectory and stable balance sheets, which suggest that the sector’s momentum may extend further.

While some moderation in margins is likely, the combination of healthy credit demand, stable asset quality, and sustainable profitability provides a constructive medium-term outlook, they add.

PSU bank sector: A detailed look

The rally in state-owned lenders has been driven by improving fundamentals and stronger earnings visibility, says Anil Rego, Founder and Fund Manager at Right Horizons PMS. Credit growth remains healthy, led by retail, agriculture, and MSME segments, with larger banks like SBI and Bank of Baroda guiding for around 3–4% sequential growth and others such as PNB, Canara, and Indian Bank expecting about 2.5%.

"Corporate lending is still seeing disintermediation from capital markets and mutual funds, but selective AAA-rated borrowers are supporting growth pockets," the expert adds.

Besides, asset quality is another supportive factor. No large slippages are anticipated, and in fact, some banks expect improvements. Recoveries from previously written-off accounts continue to bolster performance, while provisioning levels remain comfortable. The absence of any near-term plans for fresh bank mergers also reduces sectoral uncertainty.

Another factor that is supporting growth in the stock prices of PSU banks is valuations. Rego notes that valuations remain compelling, with most names trading at 0.8–1.3X FY27E book value, still at a discount to private sector peers despite the recent outperformance.

"Margins, however, are likely to face some pressure in the near term. Most banks are guiding for flat to slightly lower net interest margins, with declines expected in the range of 5–10 basis points. Despite this, profitability remains resilient, with ROA expected to hold above the 1% mark for the stronger players, aided by steady core income," Rego added.

ROA stands for return on assets. It is a financial metric that measures a company's profitability by showing how much net income it generates from its total assets.

PSU Banks: Fresh triggers

Early in September 2025, M Nagaraju, Department of Financial Services (DFS) Secretary, said that the public sector banks (PSBs) have transitioned from a phase of survival and stability and are now positioned to play a larger role as champions of growth, innovation, and leadership in the journey towards Viksit Bharat 2047.

Addressing the two-day PSB Manthan, which was held this month, Nagaraju also highlighted the need for PSBs to aspire to global competitiveness, strengthen governance and operational resilience, and expand their role as sectoral champions across both traditional and emerging industries.

It was further suggested that public sector banks put in place robust governance frameworks for Artificial Intelligence (AI), aimed at strengthening model risk management, nurturing responsible AI adoption, and instituting appropriate safeguards against emerging risks, it said.

All these developments bode well for the state-run lenders.

PSBs' Q1 FY26 Review

In August 2025, the finance ministry held a meeting of heads of public sector banks (PSBs) to review their first-quarter financial performance.

The three-hour-long meeting was chaired by Nagaraju.

During the meeting, the secretary urged the MDs and CEOs of state-owned banks to increase lending towards the productive sector of the economy, according to sources.

The review meeting with public sector banks assessed the performance of the first quarter of 2025-26.

Led by State Bank of India (SBI), public sector banks, cumulatively, logged a record profit of ₹44,218 crore in the first quarter of the current fiscal year (Q1 FY26), with an 11% year-on-year (YoY) growth.

Besides, public sector banks grew their home loan market share significantly in the April-June quarter despite witnessing a higher incidence of stress, a credit information company said in early September 2025.

Share of public sector banks (PSBs) in the overall home loan outstanding grew to 46.2% in June 2025, from 37.6% seen in the year-ago period, the report by Crif High Mark said.

Private sector banks' share has reduced to 28.2% from 35.2% during the same period, the report said.

About The Author

Next Story