Market News

India's fastest-growing sectors to watch in 2025

9 min read | Updated on March 18, 2025, 13:41 IST

SUMMARY

India’s economy is set for growth in 2025, driven by sectors like automobile, healthcare, technology, renewable energy, and FMCG. With technological advances, innovation, sustainable development, growing consumer demands and government initiatives as key enablers, these sectors are reshaping the country's economy and positioning it as one of the world’s fastest-growing markets.

where-is-the-next-big-growth-happening-india-s-fastest-growing-sectors-in-2025 | Image: Shutterstock

Source: World Bank

Recently, Prime Minister Narendra Modi also expressed confidence in India’s economic growth potential and investment opportunities at the Madhya Pradesh Global Investors Summit.

With the Indian economy on the rise, investment opportunities are also expanding across multiple sectors. Let’s look at the major sectors that are likely to grow the fastest in India in 2025.

Top 5 fastest-growing sectors in India (2025)

1. Automobiles

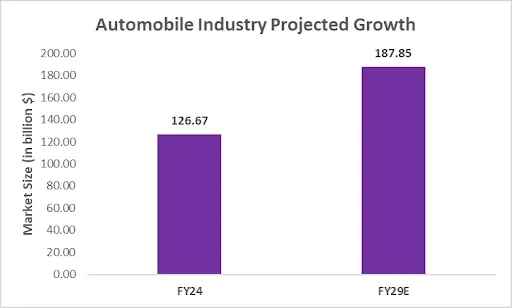

India is the world’s third-largest automobile market and contributes about 7% to the country’s GDP. Besides, India’s status as the world’s largest producer of tractors and a significant player in the heavy vehicles market further adds to its global significance. The automobile industry in India is expected to grow from $126.67 billion in 2024 to $187.85 billion by 2029, at a CAGR of 8.20%.

Source: Trade Brains

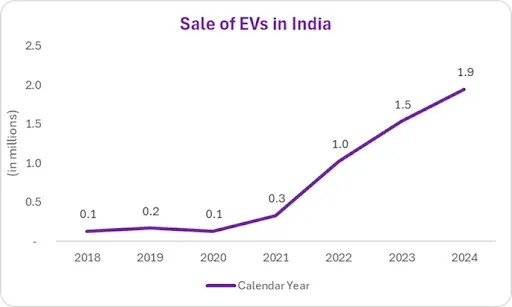

The fastest-growing sector in India within transportation is the Electric Vehicle (EV) industry. As fuel prices rise and environmental concerns grow, India is shifting towards sustainable and energy-efficient vehicles. As per Grand View Research, India's EV market was valued at $8.5 billion in 2024 and is expected to grow at a significant CAGR of 40.7% from 2025 to 2030. The Indian government has also set an ambitious target of 30% EV penetration by 2030.

Source: Vahan

Key growth drivers

Key market players in the sector

| Maruti Suzuki |

|---|

| Mahindra & Mahindra |

| Tata Motors |

| Bajaj Auto |

| Eicher Motors |

2. Healthcare and pharmaceuticals

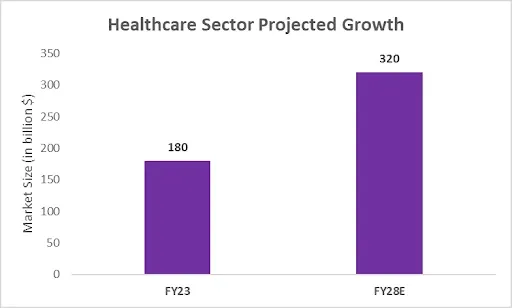

One of the largest and fastest-growing sectors in India in recent years is healthcare and pharmaceuticals, especially after the COVID-19 pandemic.

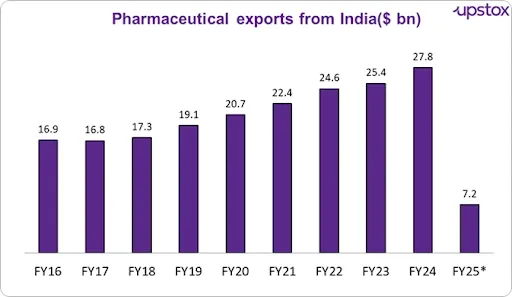

Did you know? India is the world's largest supplier of generic medicines, fulfilling approximately 20% of global generic drug demand. Besides, India caters to 60% of the world's vaccine demand. Not just this, India is becoming a hub for medical tourism, attracting patients from across the world due to high-quality yet affordable healthcare services.

Source: IBEF, Till FY25* (April-June)

India’s healthcare sector is projected to grow from $180 billion in FY2023 to $320 billion by FY2028. The pharmaceutical sector is projected to grow at a CAGR of over 10% to reach a size of $130 billion by 2030.

Source: 2024 India's Best Workplaces in Pharmaceuticals, Healthcare and Biotech Report

The growth in this sector is driven by increasing focus on technological integration and improving access to services. Innovations in biotechnology and telemedicine are also opening new avenues and fuelling growth in the healthcare and pharma sector.

Key growth drivers

Key market players in the sector

| Sun Pharma |

|---|

| Cipla |

| Dr. Reddy’s Laboratories |

| Divi’s Laboratories |

| Apollo Hospitals |

3. Renewable energy

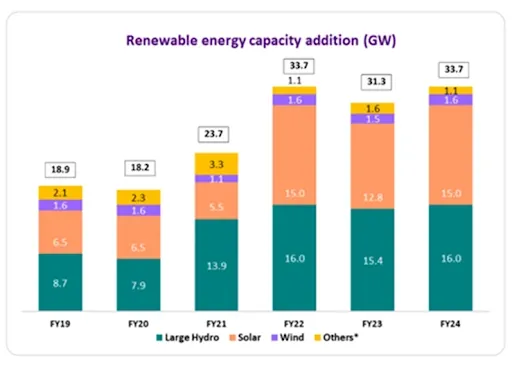

The renewable energy sector in India is growing rapidly, with the country ranking 4th globally for wind and solar power capacity. In 2024, the sector achieved remarkable growth with a total installed capacity increasing by 15.84% YoY.

In the quest to reduce dependence on fossil fuels and move towards clean energy solutions, India aims to achieve 500 GW of renewable energy capacity by 2030. The significant capacity expansion opens new avenues for solar panel manufacturing, wind turbine production, energy storage solutions, and grid infrastructure development.

Source: DRHP; *Others include biomass, small hydro, geothermal, and tidal

As per the CRISIL report, India's renewable energy capacity, excluding large hydro projects, is projected to reach 360-370 GW by fiscal 2030, growing at a CAGR of 17%.

Key growth drivers

Key market players in the sector

| Adani Green Energy |

|---|

| Tata Power Solar |

| Suzlon Energy |

| NTPC Renewable Energy Ltd. |

| Waaree Energies |

4. Information technology (IT) and innovation

The IT sector in India is expanding quickly and is likely to hit the $350 billion mark by 2026, growing at a CAGR of around 22-23%. The sector currently contributes 7.5% towards the country's GDP and is likely to contribute 10% by 2026.

The future of the IT industry in India looks promising as the country is well-positioned to become a global leader in cloud technologies, 5G, and artificial intelligence. Plus, the robust talent pool, technological advancements, and outsourcing capabilities have positioned India as a significant player in the global IT sector.

In FY 2024, the IT and Business Process Management (IT-BPM) industry generated approximately $254 billion in revenue. A significant part of the industry’s revenue comes from exports and IT exports are projected to reach $210 billion in FY25, representing 18% of global IT outsourcing spending.

Key growth drivers

Key market players in the sector

| Tata Consultancy Services (TCS) |

|---|

| Infosys |

| HCL Technologies |

| Wipro |

| Tech Mahindra |

5. Fast-moving consumer goods (FMCG)

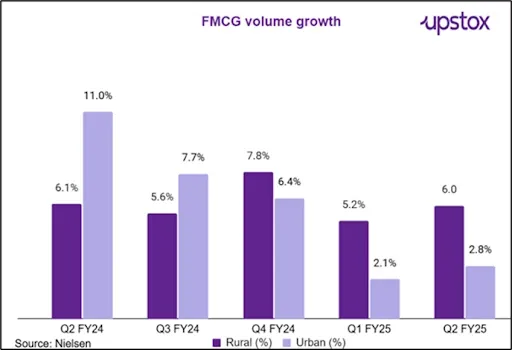

India's FMCG sector has been experiencing steady growth over the past several years owing to rising earnings, shifting lifestyles, and increased urbanisation. As consumers become health-conscious, there is a growing demand for healthy, organic and natural products. Additionally, aspirational India is also seeing a rising demand for premium FMCG products.

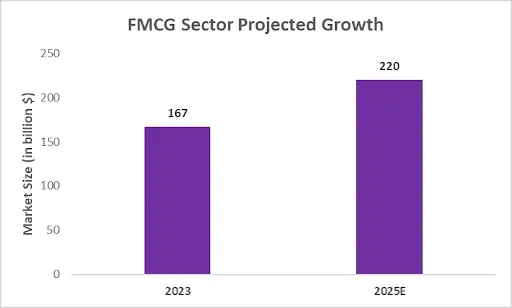

The FMCG sector in India is projected to grow at a 14.9% CAGR, surging from $167 billion in 2023 to $220 billion by 2025.

Source: Financial Express

Even the rural FMCG market is set for substantial growth, estimated to reach US$ 100 billion by 2025. According to industry projections, FMCG demand in rural India is growing at 400 basis points (4%) faster than urban demand. And, with over 488 million internet users in rural India, FMCG sector growth is only expected to drive further.

Key growth drivers

Key market players in the sector

| Hindustan Unilever Limited (HUL) |

|---|

| ITC Limited |

| Nestle India |

| Tata Consumer Products Limited |

| Godrej Consumer Products Limited |

Well, this was a list of the fastest-growing sectors in India that we think can do well in 2025.

Keeping a close watch on these growth-driving sectors can help you capitalise on the opportunities shaping India’s economic future.

However, there is an important lesson to learn here. Not every growing sector will provide attractive returns, so the best approach to investing is diversification i.e. allocating funds to various sectors that you believe will grow. This approach will ensure that your risks are covered, and you do not miss out on any booming sectors.

About The Author

Next Story