Market News

Kalyan Jewellers Q3 results: Check earnings preview and technical structure ahead of results

.png)

4 min read | Updated on January 30, 2025, 12:54 IST

SUMMARY

As per the options data of Kalyan Jewellers February expiry, the traders are expecting a ±17.4% move in either direction. Meanwhile, it has corrected over 40% from its recent all-time high of January 2025 and has slipped to the crucial support zone of ₹430-₹450.

Stock list

Kalyan Jewellers Q3 results: Earnings preview, technical structure and options strategy ahead of results | Image: Shutterstock

According to the company’s quarterly business update, India operations saw a 41% YoY revenue growth in Q3FY25, with same-store sales increasing by approximately 24%. The company also expanded its presence by launching 24 new showrooms, bringing its total store count to 349 (Kalyan India: 253, Kalyan Middle East: 36, Kalyan USA: 1, Candere: 59).

In the Middle East, revenue grew by 22% YoY, contributing approximately 11% to overall consolidated revenue. Meanwhile, Candere, Kalyan Jewellers' digital-first jewellery platform, recorded an impressive 89% YoY revenue growth.

In Q2FY25 (September quarter), the company reported a net profit of ₹130 crore, down 3.7% YoY, while revenue from operations stood at ₹6,065 crore, up 37.3% YoY. For comparison, in Q3FY24, Kalyan Jewellers posted ₹5,223 crore in revenue and a net profit of ₹180 crore.

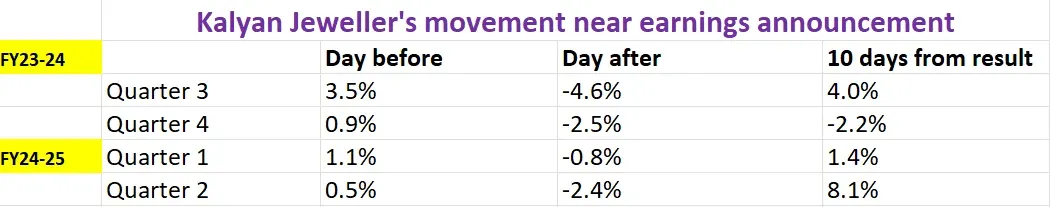

As the Q3FY25 results approach, investors will closely monitor management commentary on demand outlook and same-store sales growth. Kalyan Jewellers’ stock has been volatile, currently down over 41% from it's all-time high of ₹795.4 per share.

Ahead of its earnings announcement, Kalyan Jewellers' stock gained 2.4%, closing the Thursday, January 30 session at ₹448.

Technical View

Shares of Kalyan Jewellers have sharply corrected over 40% from its all-time high in January 2025 and are currently trading below all the key daily exponential moving averages (EMAs). It has taken support around crucial ₹430-₹450 zone, the breakout zone of June 2024. Traders can monitor this support level closely as a close below this zone will signal further weakness. Meanwhile, immediate resistance is around 50 EMA.

Options outlook

The open interest (OI) data for the 27 February expiry shows a significant concentration of call OI at the 500 strike. This indicates that shares of Kalyan Jewellers may face resistance around this zone. In addition, significant call and put base was also seen at 440 strike, signalling range-bound activity around this level.

Options strategy for Kalyan Jewellers

Given the implied move of ±17.4% from the options data, traders can initiate either a long or short volatility trade, taking into account the price movement. To trade based on volatility, a trader can take a Long or Short Straddle route.

Meanwhile, traders seeking a more strategic approach to bullish or bearish options trading can explore directional spreads, which provide a refined alternative to simple option buying.

-

For a bullish outlook, a bull call spread involves buying a call option while simultaneously selling a higher strike call with the same expiration, reducing cost while capping potential gains.

-

Conversely, for a bearish stance, a bear put spread consists of buying a put option and selling a lower strike put, balancing risk and reward.

Disclaimer

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for educational purposes. We do not recommend any particular stock, securities and strategies for trading. The stock names mentioned in this article are purely for showing how to do analysis. Take your own decision before investing.

About The Author

Next Story