Upstox Originals

Will India’s IPO market keep its momentum in 2025?

7 min read | Updated on August 25, 2025, 18:16 IST

SUMMARY

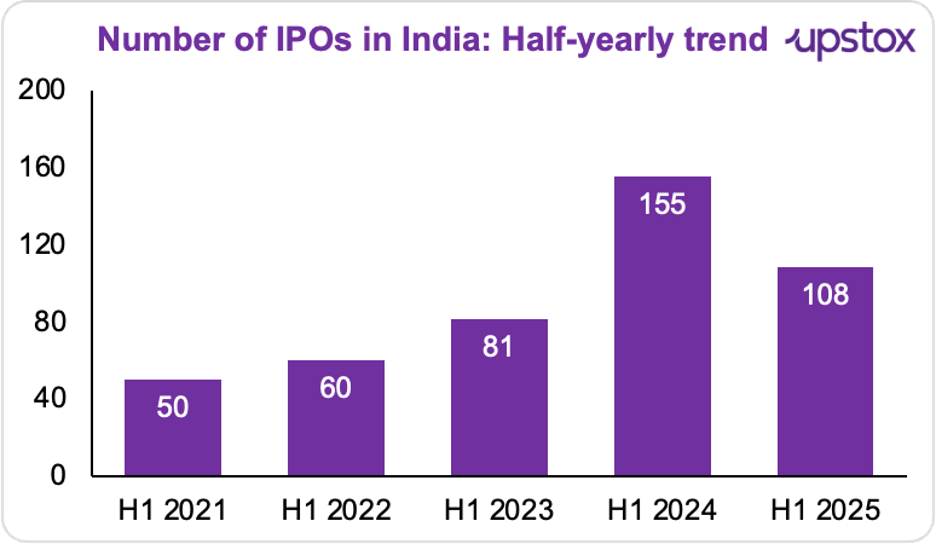

What’s happening in India’s IPO market this year? H1 CY2025 saw 108 listings, accounting for 20% of the total global IPO market deals. With a potential ₹2.6 lakh crore pipeline in H2, from fresh startups to big names, domestic investors are keeping activity steady. Fewer deals haven’t slowed interest, investors are still actively participating. Let’s unpack what this fast-evolving market has in store for the months ahead.

Stock list

In the first half of CY2025 India saw 108 IPOs raising $4.6 billion

Let us kick off this story with a striking fact.

Did you know that in the first half of CY2025, India saw 108 IPOs raising $4.6 billion?

What’s even more interesting is that this came despite a 30% drop in the number of deals compared with the previous period. Fundraising itself hardly flinched; proceeds slipped just 2%, proving that while fewer companies tapped the markets, the quality and scale of offerings stayed rock solid.

Now, let’s zoom out a bit. Last year, India raised a record $20.5 billion (~₹1.6 lakh crore), smashing its previous high of ₹1.2 lakh crore in 2021. October 2024 alone saw ₹38,700 crore raised, the highest ever in a single month. And here’s a kicker: 11 IPOs were priced above $500 million.

Fast forward to 2025, and the market isn’t just raising money; it’s rewarding investors, too. Out of 30 mainboard listings, 27 are trading above their issue price, with average gains of 25%. Nearly 150 DRHPs have already been filed this year, way above the five-year average. For context, 2024 saw 157 filings, 2022 and 2023 had 89 and 84, and 2021 recorded 123. At this pace, 2025 is on track to beat last year’s numbers.

A quick glance at the numbers..

Source: News articles

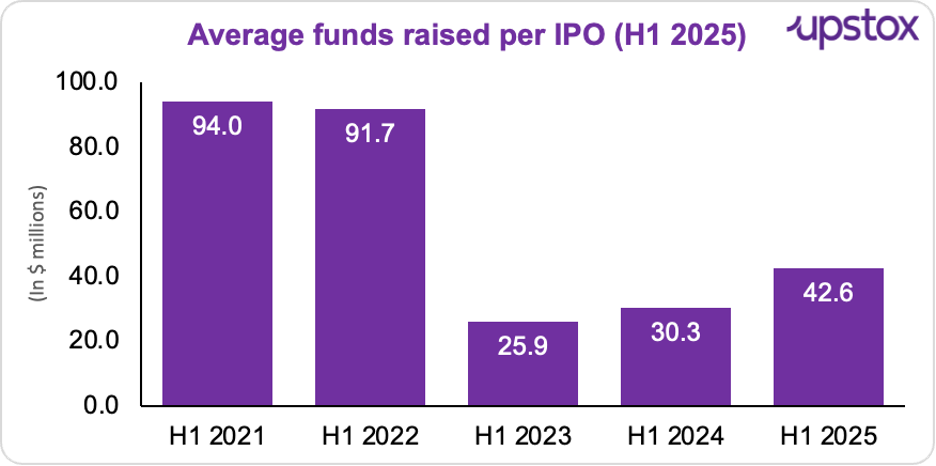

Now, let’s dive into the average funds raised per IPO and see what the numbers reveal:

Source: News articles

Inside the top IPOs of 2025

The IPO market has already seen some big-ticket listings in FY26. Among the top ones, HDB Financial Services led the way, raising ₹12,500 crore with a 13% listing gain.

| Company | Amount Raised (₹ crore) | Listing Date | Issue Price (₹) | Listing Price (₹) | Listing Gain/Loss |

|---|---|---|---|---|---|

| HDB Financial Services | 12,500 | Jul 2, 2025 | 740 | 835 | +13% |

| NSDL | 4,011 | Aug 6, 2025 | 800 | 880 | +10% |

| Schloss Bangalore | 3,500 | Jun 2, 2025 | 435 | 407 | -7% |

| Ather Energy | 2,981 | May 6, 2025 | 321 | 326 | +2% |

| Aegis Vopak Terminals | 2,800 | Jun 2, 2025 | 235 | 220 | -6% |

| Belrise Industries | 2,150 | May 28, 2025 | 90 | 99 | +9% |

| JSW Cement | 3,600 | Aug 14, 2025 | 147 | 153 | +4% |

| Hexaware Technologies | 8,759 | Feb 19, 2025 | 708 | 755 | +6% |

Source: CNBC, Chittorgarh.com

The forces driving 2025’s momentum…

Big bucks on the block

India’s IPO street is heating up, not only the first half, but the second half of 2025 could be a blockbuster too! Everyone wants a slice of the action. How big are we talking? ₹2.6 lakh crore in the queue in the 2nd half, as per Economic Times. Yup, you read that right. ₹1.2 lakh crore already has SEBI’s stamp of approval, and another ₹1.4 lakh crore is waiting at the turnstile.

Now, it’s showtime. Tata Capital (₹17,200 crore), LG Electronics (₹15,000 crore), and Groww (₹5,950 crore) are ready to roll. And wait for the new-age parade - Meesho, PhonePe, Lenskart, Boat, WeWork India, Physics Wallah, Shadowfax, and more - each floating offers between ₹1,500 crore and ₹9,000 crore.

Oh, and don’t forget - Pine Labs, Urban Company, Wakefit, Shiprocket, Amagi, and TableSpace, also preparing to list.

Small-town India, big-time investors

Guess who’s gate-crashing the IPO game? Tier 2 and Tier 3 cities. Over 35% of new IPO demat accounts in 2025 came from beyond the metros, says CAMS and Kfintech. Surat, Jaipur, Indore, Bhubaneswar, Coimbatore - they’re not just watching, they’re driving subscriptions like pros.

Homegrown money, heavy lifting

Over 75% of IPO funds are coming straight from local mutual funds and retail investors. SIP inflows? A strong ₹27,000 crore every month. Equity mutual fund assets? Up 22% year-on-year, hitting ₹32.69 lakh crore in June 2025. In short, India’s investors are keeping India’s IPO machine running.

The great PE exit rush

Private equity (PE) and venture capital (VC) firms aren’t sitting out, they’re cashing in big. As fintech, tech, and consumer internet companies mature, IPO exits have become the new norm.. “IPOs are picking up as many PE funds are nearing the end of their life cycle and need exits,” says Mihir Vora, Chief Investment Officer at Trust Mutual Fund.

In 2024, there were 1,021 PE investments worth USD 31.11 billion, with 292 exits unlocking $24.01 billion. It’s no surprise that Bain & Company named India one of Asia-Pacific’s hottest exit hubs in 2025.

Sectoral diversity

The market mix has changed too. Industrials and consumer-facing firms are dominating IPO activity, while financial services and IT continue to play more selective but high-value roles. The lineup looks something like this:

| Sector | Number of IPOs |

|---|---|

| Industrials | 38 |

| Consumer | 27 |

| Real Estate, Hospitality & Construction | 16 |

Source: EY, Data reflects the period from January 1 to June 30, 2025.

How does India compare to global markets?

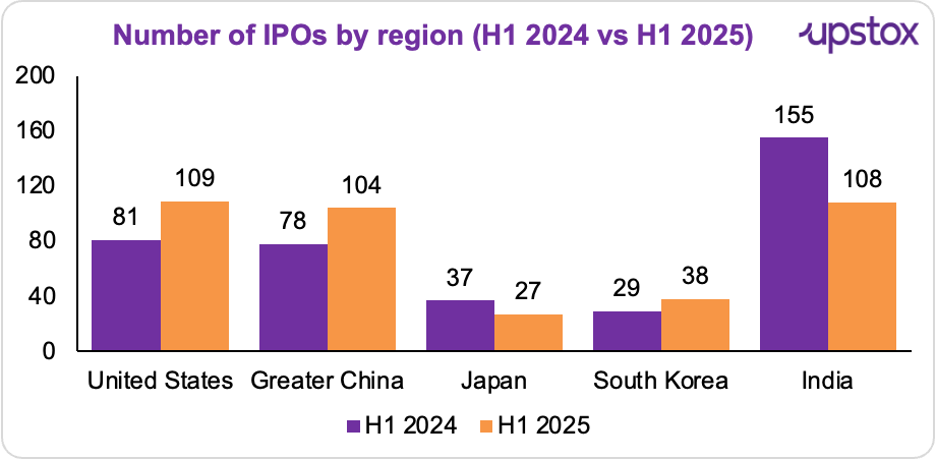

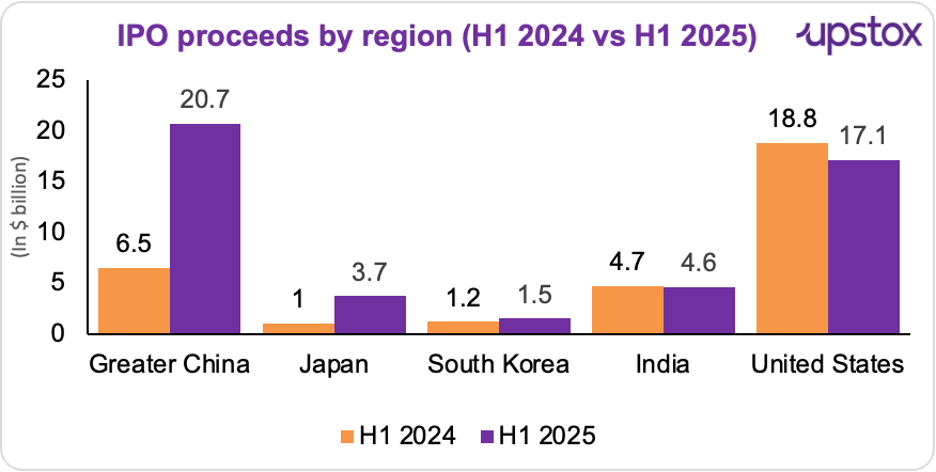

Globally, IPO proceeds held flat at about $61.4 billion across 539 deals. And India contributed nearly 1 in every 5 IPOs launched. But here’s where it gets interesting: only three markets - India, the U.S., and Greater China, managed to cross the 100-IPO mark. The US led with 109.

Source: EY

In the first half of 2025, India grabbed 8% of global IPO proceeds, not bad when you size it up against the US at 28% and China at 34%.

Source: EY

But.. The backdrop tells its own story, 2025 has been anything but calm. Geopolitics, tariff wars, and flip-flopping central banks have kept global investors on edge.

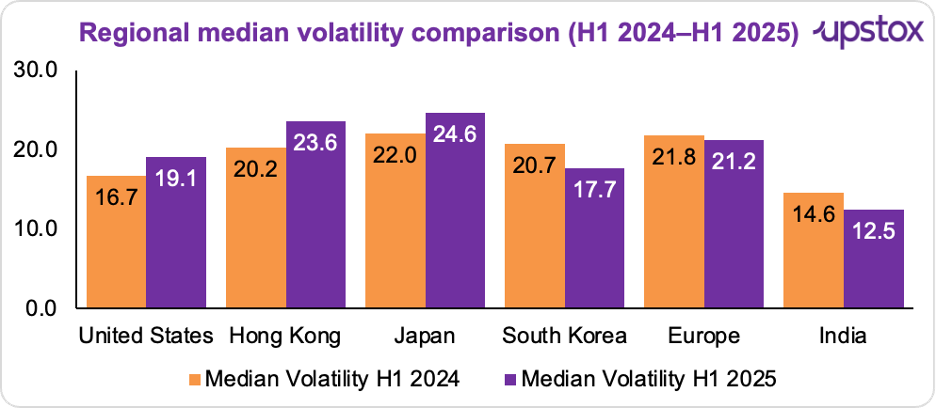

So how do we really measure the nervousness in the market? That’s where the Volatility Index, or VIX, comes in. Often called the “fear gauge,” it tracks the expected ups and downs in the market over the next 30 days based on options prices.

The interesting part: India stood out as an island of stability.

While America, Europe, and Asia saw sharp volatility spikes, India’s median volatility actually dropped from 14.6 in H1 2024 to 12.5 in H1 2025. That means despite global uncertainty, Indian markets have stayed steady.

Source: EY

Outlook

After a steady first half, what could H2 2025 hold for India’s IPOs? Could the companies that paused their listings due to market volatility finally make their move? With SEBI’s new five-slab framework, big firms now have a smoother path to list, no more getting tangled in tricky rules.

Here’s what it means in simple terms:

-

Companies worth ₹50,000 crore–₹1 trillion: need to sell at least ₹1,000 crore worth of shares, offering 8% of total equity.

-

Companies worth ₹1–5 trillion: need to sell ₹6,250 crore, offering 2.75% equity.

-

Companies above ₹5 trillion: need to sell ₹15,000 crore, with at least 2.5% of equity offered.

Who’s likely to keep the IPO engine running? Domestic investors, with retail and mutual funds providing most of the funding. And what about the big players? PE-backed companies may finally take the IPO route to exit.

Will valuations stay measured or surprise us? Will deferred IPOs deliver the kind of returns investors are hoping for? And with global markets so volatile, could India’s relative stability make it the market to watch? The second half of 2025 could be where the IPO story really unfolds.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story