Upstox Originals

Why trouble in Japanese markets should worry Indian investors

6 min read | Updated on December 01, 2025, 18:57 IST

SUMMARY

Japanese yields are at 3.4% - an all-time high. The first thought would be - why does this matter to us here in India? The (complex) interlinks in the global markets make it our problem as well! Rising Japanese yields make their markets more attractive and can lead to outflows from Indian markets, creating further volatility here. In this article, we demystify this two decadal change in Japanese markets and its impact on India.

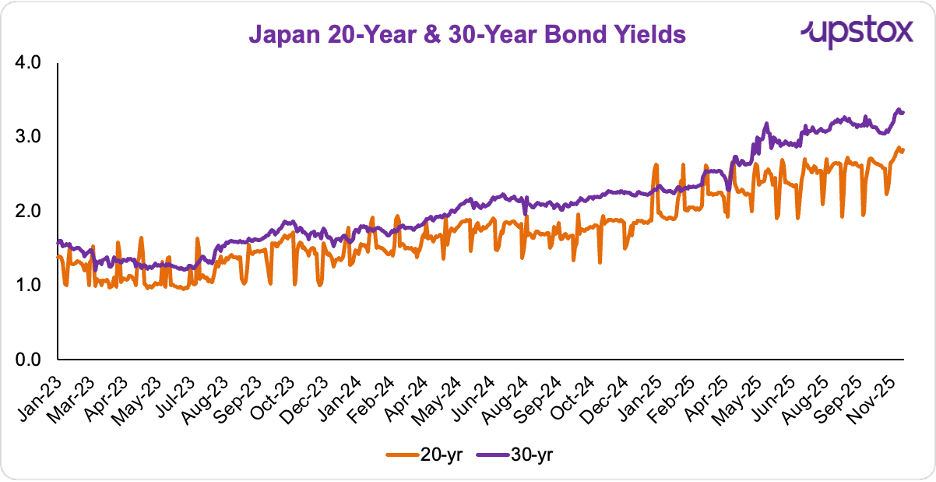

In late November 2025, the 30-year JGB yield hit 3.39%, the highest in Japan’s history.

Japan’s government bond market isn’t usually the kind of place where things “happen.” It’s long been one of the world’s most tightly managed markets; low volatility, low drama, and a central bank that kept a firm hand on the wheel.

Even in the recent past, movements were modest. Between 2021 and 2024, the 20-year JGB yield mostly hovered between 0.4% and 1.8%, while the benchmark 10-year yield stayed in a narrow 0% to 1% band.

But, over the past weeks (late October 2025 to 25 November 2025), something snapped. Japanese government bonds (JGBs) saw a massive sell-off, and yields on long-term bonds jumped to levels the country hasn’t seen in decades. Investors are suddenly nervous about Japan’s ballooning fiscal burden. The yen has sunk to a 10-month low. And the calmest bond market on earth is behaving… well, like every other bond market.

Remember, when bond prices fall, yields rise. And that rise has been dramatic.

As of 25 November 2025, the 30-year JGB yield hit 3.39%, the highest in Japan’s history. The 20-year yield shot up to 2.85%, a level last seen in 1999. Even the benchmark 10-year touched 1.835%, a figure that takes us back to the 2008 financial crisis. And shorter-term yields aren’t far behind either; the 2-year is now at 0.96%, and the 5-year sits at 1.305%, both at their highest in nearly 17 years.

Source: Investing.com

So, why is this happening?

A fresh fiscal surge

Let’s start with Japan’s biggest elephant in the room - public debt. Japan’s debt is over 260% of GDP, the highest of any major economy. Investors have long tolerated this because interest rates were essentially zero. But with yields rising sharply, the cost of servicing that debt balloons too.

And just when investors were hoping Japan might slow down on spending, the government announced a fresh 21.3 trillion yen stimulus package. It’s the largest since the pandemic and far bigger than the previous year’s 13.9 trillion yen budget.

Why the spending spree? Because Japan’s economy shrank nearly 2% in the July–September quarter. Exports took a hit, especially after US tariffs, marking the first contraction in six quarters. So the government stepped in with fiscal support, but that support requires more bond issuance.

More bonds mean more supply. More supply means higher yields.

Weakening currency

The second nudge to rising Japanese bond yields comes from the currency itself.

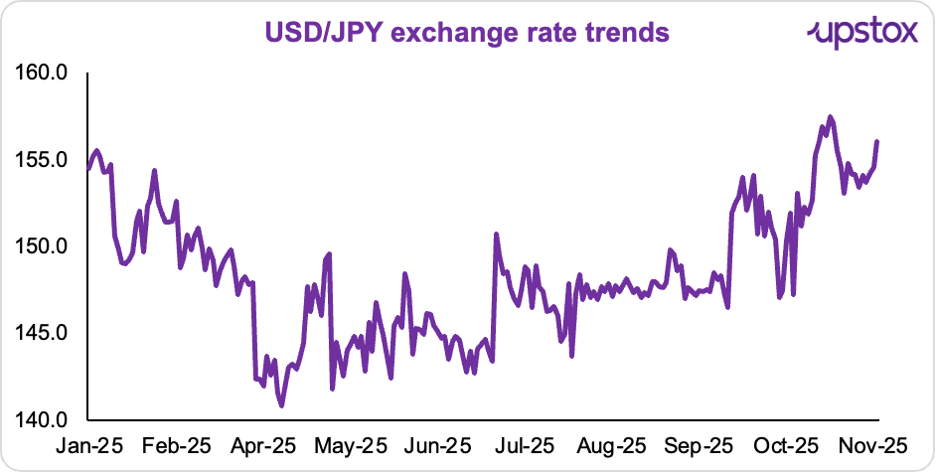

Between January and November 2025, the USD/JPY rate shifted from around ~147 to ~156; a move that translates to roughly a 1% depreciation on a trade-weighted basis. That might sound small, but the yen has been extremely volatile through this period. And when the currency whipsaws, overseas investors get jittery about potential FX losses and start demanding higher returns to compensate.

So even this seemingly modest slide in the yen has fed into the pressure pushing Japanese bond yields higher.

Source: Investing.com

Markets are bracing for a BOJ rate hike

Another big reason for the jump in Japanese bond yields is the growing belief that the Bank of Japan is finally gearing up for a rate hike. Traders are now pricing in a 70–80% chance that the BOJ will raise rates in December 2025. And the central bank isn’t exactly hiding it either; as Naomi Muguruma from Mitsubishi UFJ Morgan Stanley Securities puts it, the BOJ seems to be “intentionally dropping signals so it won’t surprise markets.”

A Reuters poll shows a slight majority of economists expecting a hike at the BOJ’s meeting on December 18–19, and every single one predicts rates will touch 0.75% by March.

Even within the BOJ, the tone is shifting. Board member Junko Koeda recently said the bank needs to keep lifting real interest rates because prices remain “relatively strong.” Another member, Kazuyuki Masu, went a step further, saying the timing of a hike is “nearing.” His comments alone pushed the 5-year government bond yield to a 17-year high on November 25.

And inflation isn’t helping either

Japan’s core inflation came in at 3% in October, staying well above the BOJ’s 2% target. With prices still running hot, markets believe the central bank may have no choice but to tighten soon. And that expectation of a looming rate hike is adding yet another push to Japanese bond yields.

What changed in Japan?

The safety net is gone. For years, the BoJ kept markets cushioned with negative rates, unlimited bond buying and Yield Curve Control (YCC). But over the past year, that entire framework has been dismantled; negative rates ended, YCC scrapped and the policy rate lifted to 0.5%, a 17-year high.

With those props removed, the world’s most managed bond market is suddenly being asked to stand on its own. As Bloomberg put it, Japan’s market is now “trying to walk without a safety net.”

And the instability is starting to show.

For investors, the old yen strategy was simple - borrow at near-zero rates, convert to dollars and chase higher returns in US stocks, Indian bonds or emerging-market debt. This is what’s referred to as the yen “carry trade”, and it was a reliable money-maker for years.

But once Japanese yields begin rising, that equation stops working.

What does this mean for India?

Japan is one of the world’s biggest creditors. Japanese investors hold trillions of dollars in global bonds and equities. When yields rise at home, they don’t need to look abroad for returns anymore; their own government bonds suddenly look attractive.

And that can drain capital from markets like India.

Higher developed-market yields typically make emerging-market debt less appealing. And with the yen carry trade becoming less profitable, as we explained above, global investors may simply dial back EM (emerging markets) exposure. That’s exactly what we’re seeing now. Foreign portfolio flows into India’s Fully Accessible Route (FAR) segment have been muted this month (November) after heavy inflows in the previous two months.

But interestingly, Indian bond markets have remained stable.

The 10-year Indian benchmark yield has eased by 5–7 bps this month, supported by strong domestic demand from pension funds, insurers, mutual funds, and banks. The yield is currently around 6.51%.

Economists say India won’t feel an immediate pinch. A BoB economist noted that Indian yields will be driven more by domestic liquidity and the upcoming RBI policy than what’s playing out in Japan.

But that doesn’t mean the risk is gone.

If Japanese yields continue to rise, global portfolios will slowly rebalance toward developed-market debt. That could nudge Indian yields higher, weaken bond prices, and tighten conditions for corporates that rely on the bond market.

Nothing breaks right now. But the pressure is forming in the background, partly because the carry trade equation has shifted.

About The Author

Next Story