Upstox Originals

Why foreign investors are bullish on India's small banks and NBFCs

8 min read | Updated on November 24, 2025, 15:01 IST

SUMMARY

In 2025, foreign investors are putting more than ₹1.25 lakh crore into India’s small banks and NBFCs. Their confidence comes from stronger balance sheets, supportive RBI policies, and low leverage. This new capital is already helping lenders grow faster and enter a new phase of long-term expansion.

Over ₹1.25 lakh crore of foreign money has come into Indian banks and NBFCs

Over ₹1.25 lakh crore of foreign money has come into Indian banks and NBFCs which is something we have not seen at this scale before. And this is not “hot money” or short-term trading interest. It is long-term capital from global institutions that believe India’s credit story is only getting started.

But this confidence did not appear overnight. India opened up the NBFC sector back in 2016 by allowing 100% FDI, yet foreign investors still stayed cautious because the IL&FS and DHFL crises shook trust. The system needed time to repair itself.

Over the next several years, India went through a thorough clean-up cycle, with:

- tighter regulations

- stricter supervision

- balance-sheet repair

- a clear shift to healthier, secured lending

After COVID, balance sheets got better, governance got stronger, and digital reporting got stricter. As these changes became visible, confidence began returning. S&P Global Ratings says that Indian banks are now better able to handle global volatility than they were in previous cycles.

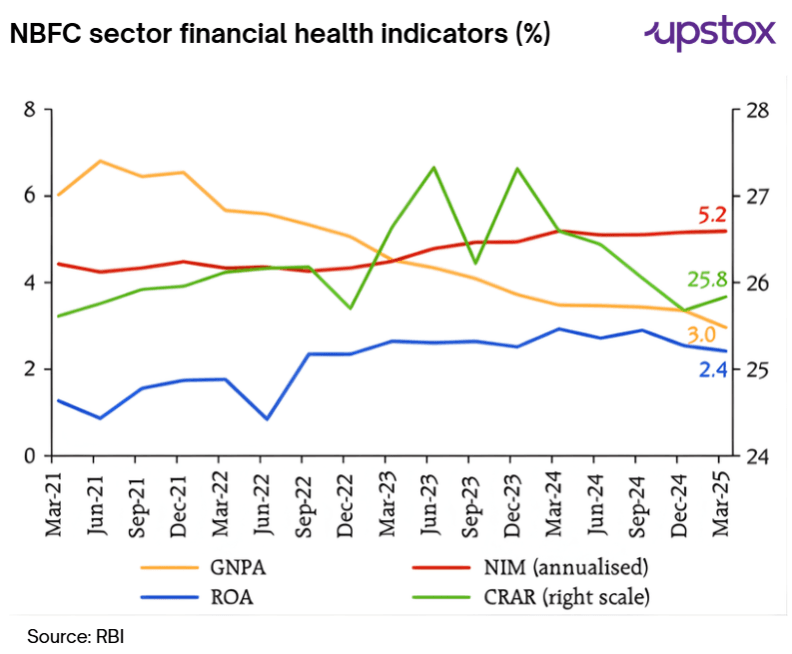

RBI’s own data supports this. GNPA (Gross Non-Performing Assets) across NBFCs have fallen from above 6% in 2021 to nearly 3% in FY25, showing cleaner books. ROA (Return on Assets) has improved steadily, touching around 2.4%. NIM (Net Interest Margin) has remained stable despite global rate shocks, and CRAR (Capital to Risk-Weighted Assets Ratio) has consistently stayed around 25–27%, far above regulatory requirements.

This gradual repair is the foundation behind today’s surge in foreign investment.

A wave of large-scale global investments

In the last few months, some of the biggest financial institutions in the world have invested in small and mid-sized Indian banks and NBFCs. These deals show that investors around the world are becoming more sure of the sector's future.

Major global investments in small Indian banks & NBFCs (2025)

| Institution | Global Investor | Nature of Investment | Deal Value (₹ crore) | Entry Price (₹/share) | Strategic Outcome |

|---|---|---|---|---|---|

| RBL Bank | Emirates NBD, UAE | 60% | 26,853 | 280 | Make it possible to improve credit ratings, lower the cost of borrowing money, and make the balance sheet stronger. |

| YES Bank | Sumitomo Mitsui Banking Corporation (SMBC), Japan | 24.20% | 11,379 | 21.5 | SMBC’s entry will guide the bank through the next leg of growth, profitability, and operational discipline, leveraging SMBC’s global banking expertise. |

| Federal Bank | Blackstone Group (Singapore arm) | 9.99% | 6,196 | 227 | Make it possible to improve credit ratings, lower the cost of borrowing money, and make the balance sheet stronger. |

| Sammaan Capital | International Holding Company (IHC), Abu Dhabi | Controlling stake near 41% (open offer could take it up to 67%) | 8,850 | 139 | Help Sammaan Capital's goal of helping middle-class families and small businesses in India move faster. |

Source: Company Data, Exchange Filings

It's interesting that foreign interest isn't just in banks and NBFCs; it also includes other parts of India's financial sector. For example, Zurich Insurance bought a 70% stake in Kotak General Insurance, which shows that people have faith in the company.

The RBI has also allowed Canada’s Fairfax to retain its majority stake in CSB Bank for five years which is a rare exception that signals support for committed long-term foreign ownership.

Why investors around the world are more confident

Regulations that help

The RBI has made a number of announcements recently to make borrowing easier, cheaper, and safer. These changes are freeing up capital throughout the system and giving banks and NBFCs more room to lend without having to raise new equity.

| Announcement | Action | Impact |

|---|---|---|

| Bank Credit to Microfinance | Lowered the capital requirements for loans to microfinance institutions | Banks can lend more money because they have more money available. |

| Bank Credit to NBFCs | Capital requirements on bank lending to NBFCs have reduced | NBFCs get cheaper funding |

| Cash Reserve Ratio (CRR) Cut | 100 bps CRR cut (Sept–Nov 2025, phased) | It gives out liquidity equal to about 1.3% of system credit. |

Some are aimed at certain sectors where India wants credit to grow more quickly. By lowering risk weights, the RBI has made it easier for banks and NBFCs to lend to these sectors.

| Announcement | Action | Impact |

|---|---|---|

| MSME Lending | 15–25% lower risk weights for MSME loans | Frees up 20–40 bps of extra capital and makes it easier for small businesses to get loans. |

| Housing Loans to Individuals | 10–15% lower risk weights for some housing loans | Unlocks 15 to 40 basis points of capital and boosts retail housing credit |

| Corporate Loan Exposure | Rated corporations get a 10–50% cut in risk weights. | Reduces the amount of capital needed by about 20% for the best projects; encourages lending for big purchases |

| Infrastructure Lending by NBFCs | Lower risk weights on infra loans for well-rated projects | Let's NBFCs pay for bigger infrastructure projects without having to give up more equity |

Other changes make things run more smoothly. Banks can now better manage risk, make more money, and lend money in new areas with clearer rules.

| Announcement | Action | Impact |

|---|---|---|

| Deposit Insurance Premium Framework | Banks with better ratings will now pay less for deposit insurance. | Supports profitability and pricing flexibility. |

| Credit Card Receivables | Risk weights on credit card receivables are down by 25% to 75%. | Releases 5–8 basis points of system capital. |

| Capital Market Exposure | Lending scope to markets expanded | Marginally positive; adds diversification |

| Commercial Real Estate Loans | Slight tightening of capital norms | Keeps leverage in check; overall, it's neutral. |

Large & underbanked market

Investors from all over the world know that India has more than 400 million people who don't have access to banking services. Add to that:

- The widespread use of digital payments

- A huge informal credit market

- Rising income levels

This mix makes it possible to lend money on a large scale. According to McKinsey, Indian banks made $46 billion in net income in 2024, a 31% increase from the previous year. However, credit penetration is still much lower than the global average. In short, this means that the market is large, not well served, and makes money.

Low leverage

Many NBFCs that are getting money from outside the country have a lot less debt than other companies in the same field. Low gearing means safer growth, more borrowing power, and the ability to quickly scale up assets without hurting the balance sheet for investors.

Stronger balance sheets

Finally, the whole financial sector is in better shape than it was before. Indian banks and NBFCs have better capital positions, fewer non-performing assets (NPAs), and more disciplined risk frameworks after years of cleaning up. Digital monitoring has made credit processes stronger, and governance standards have gotten better.

Risks that still need to be looked at

Things may look good, but there are still some risks. In some cases, foreign companies may buy a majority stake, which could cause problems if important decisions are made outside of India. More foreign ownership also means that the company is more vulnerable to global shocks, such as a sudden rise in interest rates or a lack of cash.

Regulators need to keep a close eye on things, especially when it comes to complicated deals that cross borders. The RBI has been fair by supporting strategic investments while still enforcing strict rules about who can and can't invest.

Parting thought

Years of hard work, cleaner books, better rules, and stronger governance have led to the foreign money that is now going into India's banks and NBFCs. India's financial sector is entering a new growth phase. There are easier rules for lending, a huge market that isn't served by banks, and more trust from global institutions.

This capital brings more than just money; it also brings global knowledge and a long-term commitment. For investors, it's an early chance to get in on India's next decade of credit growth. It shows that the world trusts India's financial system. And when trust and strong fundamentals come together, they can change the whole industry.

About The Author

Next Story