Upstox Originals

When safe isn’t safe: The ignored volatility in gold prices

8 min read | Updated on October 18, 2025, 10:21 IST

SUMMARY

If someone told you that gold prices can fall up to 50%, would you believe it? How can a safe-haven investment fall like a stock! But just like any financial asset, gold also has its cycles and there have been long periods (20 years in one case) when gold significantly underperformed. After an almost 50% rise in gold prices in the past year, a key question is can prices continue to rise? Can the past teach us something and what should you consider before going ahead? Read to find out.

For almost two decades (1980-2000), gold prices delivered negative or flat returns.

When it comes to investing, there are two schools of thought in my family. My father, who is nearly 70, is a firm advocate of gold, while I am more of a believer in equity’s power of long-term compounding.

Seeing the movements in the markets and gold over the last two years, my father seems to have been right. While equity markets have returned single-digit returns over each of the past two calendar years, gold has rallied more than 50% just in the past year. The rally seems unstoppable, with most financial news portals publishing articles on gold prices hitting all-time highs almost on a daily basis!

Gold investors are now not sure what to do. Is it a good time to keep investing or should one simply take the win? (book profits). Those who are in the former camp will argue that gold is a safe asset and even if it has a year of low returns, it will still keep your capital safe.

This belief, it seems, is coming more from anecdotes rather than past experiences. Would you believe it if I told you that there have been multiple periods where gold prices have corrected as much as 20%, finally falling as much as 50%! This could be expected from equity, but is it possible for gold?

In this article, let’s look at periods when gold prices corrected more than 20%, highlighting two major case studies. We look at reasons why gold prices rallied (and if there are similarities to today’s scenario) and analyse reasons for its fall.

In the article, we will look at gold prices in USD per ounce. The US is the central point of our analysis, as the country has long held the largest gold reserves in the world and has a major influence on gold prices.

Case study 1: 1970 to 2000

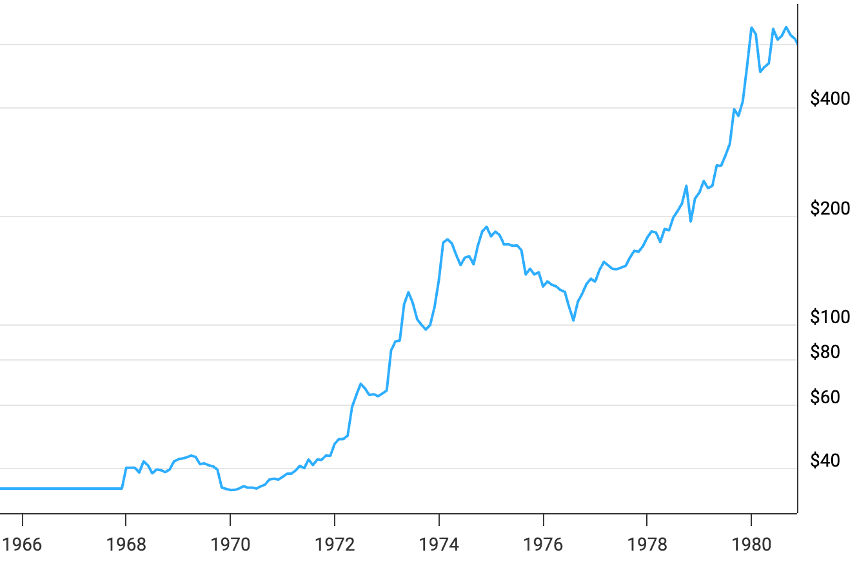

The rise: 1970 to 1980

As you can see from the chart below, in the 1960s, gold prices were mostly flat. A key reason here was that most currencies, mainly the US dollar, were linked to gold. The ‘gold moment’ came in the 1970s. US President Richard Nixon delinked the dollar from gold. Post that, gold prices were market-linked.

Since the 1970s, gold has seen a meteoric rise. Just between 1970 and 1972, gold prices nearly doubled from ~$25/oz to ~$50/oz, reaching highs of over $500/oz by 1980s.

Gold prices in USD per ounce (1960-80)

Source: https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

A few key reasons for this rise are mentioned below. See if you can spot some similarities with today’s scenario.

Naturally, these factors roiled the equity markets. Stocks were out of favour and housing took a hit, so gold prices rallied.

Now, let’s switch to what happened in the next two decades, when gold lost its momentum!

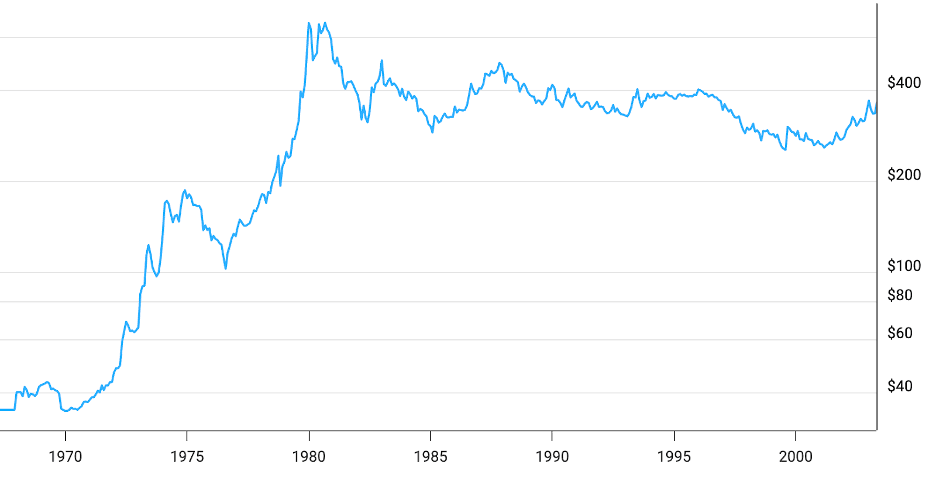

The fall: 1980 to 2000

For almost two decades, gold prices delivered negative or flat returns. In fact, from the highs of the 1980s, gold prices corrected over 50%. That sounds more like equities, rather than a safe asset, correct?

Gold prices in USD per ounce (1980-2000)

Source: https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

Here is what happened.

Case study 2: 2000 to 2020

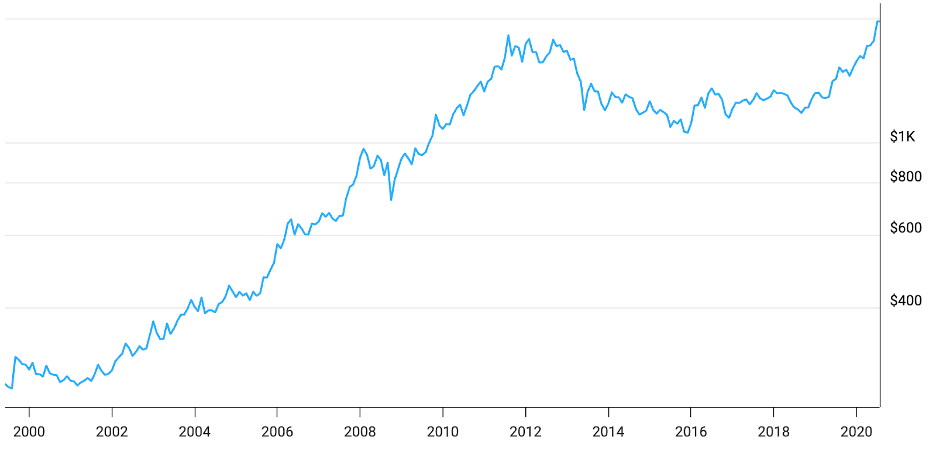

2000 to 2011: The rise

Starting in the 2000s, gold once again saw a very strong rally for almost a decade. Post the tech bubble, stocks again lost favour and gold saw a strong rise. This started a decade-long rise in gold prices, which was boosted by rising household incomes in America, the overall market boom from 2004 to 2007 and economic growth in the US.

2012 to 2020: 8 years of underperformance

However, the period from 2012 to 2020, once again saw a meaningful corrections and stagnation in gold prices. Besides the fact that gold had run up quite a bit, as overall economic growth resumed, investors once again pulled back focus from gold and turned their attention to the markets. Gold’s most pronounced price fall happened from October 2012 to July 2013, when the yellow metal lost more than 25% of its value.

Source: https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

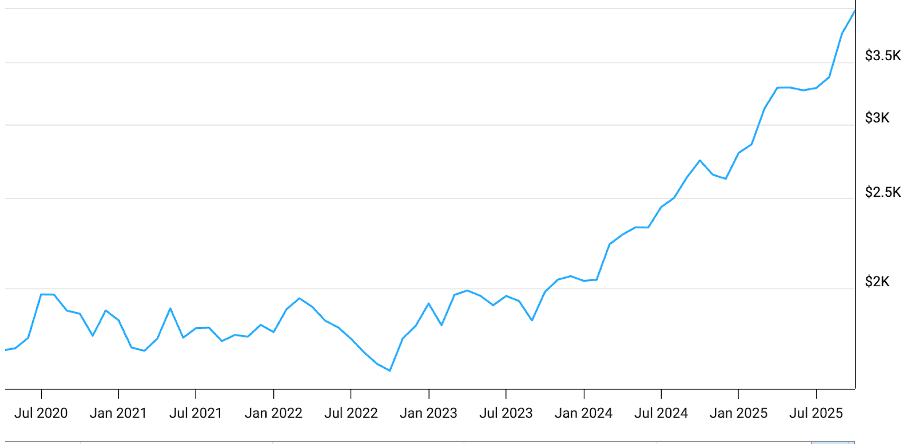

Performance since 2020.

Since COVID-19, gold has once again seen a robust rally. It has returned ~22% CAGR over this time. Returns like are enough to make even the staunchest equity investor question their portfolio allocation and consider adding gold.

Source: https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

A lot has been written about the increase in the recent gold prices. Interested readers can read these articles to understand this better

- Gold prices hit all-time high of ₹1.10 lakh per 10 gram

- Here’s why the safe-haven metal has been rallying

- The rise and risks of gold-backed credit in India

- Gold: Decoding macro and demand trends

That said, the question now is, where does gold go from here (Will I finally be vindicated or continue being subjected to my father’s barbs!). Frustratingly, there are two ways to think about this:

- We are only 5 years in a typical decade long rally. So there is a lot more to go!

OR

- If the geopolitical issues stabilise, can markets once again come in favour? Will gold see another slump?

Here are a few points that one might consider before going ahead.

Factors that favour the market:

-

With the Israel-Gaza skirmish now potentially ending, global uncertainty might reduce.

-

Even though the US president continues to throw recurring curve balls, their impact on the markets has started to wane. Just recently, the US announced new China tariffs, and the US markets fell ~2%. Indian and other global markets have however remained relatively resilient.

-

Inflation, not only in India, but globally, is well under control with most central banks now focussed on growth.

-

Indian equity markets have already seen a two-year cooling off. Last calendar year, market returns were about 7-9% and so far in 2025, markets have given below 5% returns.

Factors that favour gold:

-

Rapidly growing electronics and AI has led to an increase in gold demand. Not only is it just an investment now, it has industrial applications, further boosting its demand.

-

Given the increased global volatility, central banks have, so far, been aggressively accumulating gold. If the trend continues, gold prices could continue rising.

-

In India, recent earnings growth has largely disappointed investors, with no significant triggers visible for future growth. Thus, 2026 could also be a year of underwhelming equity returns.

In conclusion

At the current stage, caution seems to be a good idea. Before investing, one must realise that you could potentially be investing around the top.

Systematic investment, rather than lumpsum allocations, could be a good idea. Just like equity investors, gold investors should also temper their expectations of the future returns.

It is not just about returns from gold, an investor should also consider the opportunity cost. For example, the 1980s and 1990s were more or less a wash for gold investors who bought to hold their investment. Worse, they missed out on the massive run in stocks during the same period.

Finally, as always, a well diversified portfolio could help you participate in at least one, if not both the upsides. I'm going to try convincing my father of that!

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story