Upstox Originals

What GST rate cut mean for the economy, markets and consumers?

9 min read | Updated on August 20, 2025, 11:43 IST

SUMMARY

India is set for its biggest GST reform since 2017. After earlier tax cuts and income tax relief, this marks the government’s third major push to boost consumption and private capex. Markets are buzzing, and we break down the reform, its sector impact, and why it could be a twin-engine growth trigger for the economy.

The government intends to replace the current four-tier system with a dual-slab structure of 5% and 18%

After years of grappling with a complex GST structure, India may finally be heading toward a simpler, more consumption-friendly tax regime. The timing could not be better. Despite multiple efforts by the government, which include corporate as well as personal tax cuts, private capex in India has yet to pick up (utilisation has never crossed 80%), and consumption has yet to show a nationwide sustained improvement.

Indirect taxation (such as GST) could have a much wider impact on the economy since they are borne by every citizen and corporate in one way or another. Point being, GST rate cut, once implemented, could be a critical tool to bolster consumption and so, even corporate spirits and put India on a faster growth path.

Not to mention, it would help mitigate the impact of tariff related challenges for Indian business.

What has happened?

PM Modi declared in his Independence Day speech that a task force would be established to work on next-generation economic reforms, such as a significant overhaul of the GST system, with a clear timeline for implementation by Diwali this year.

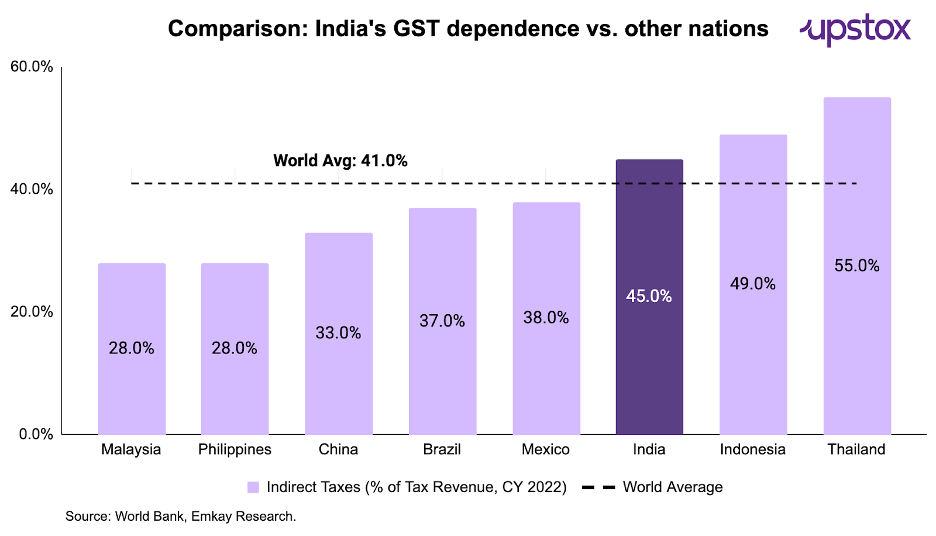

These reforms aim to simplify laws, expedite administrative procedures, and improve the growth-oriented and citizen-friendly nature of India's tax system, especially by reducing the burden on necessities and mass-consumption goods. India has one of the highest indirect tax/tax revenue ratios among key EMs.

The announcement was followed by a press release from the Ministry of Finance detailing the three main pillars that form the framework for GST reform:

-

Structural reform to enhance efficiency

-

Rate rationalisation to reduce complexities

-

Ease of living for consumers and small businesses

Within the rate rationalisation theme, the ministry proposed to:

-

Reduced taxes on commonly used items to increase affordability and boost domestic demand

-

Adopt a more straightforward two-slab system with a standard rate and a merit rate, saving the higher "special" rates for a select few luxury or sinful goods.

-

To support these structural changes, make use of the fiscal space created by the compensation cess's expiration, which was initially intended to assist states during the GST transition.

As you read the following parts of the article, a disclaimer would be, no formal announcement around rate cuts has come yet from the government. This part has been collated based on our own internal analysis, media reports and yes, maybe our own wish list.

Potential changes in GST rate structure as per media reports

The government intends to replace the current four-tier system with a dual-slab structure of 5% and 18%. It is anticipated that the higher 40% slab for luxury and sin goods will continue to exist as a distinct category. Nearly all of the items in the 12% slab are expected to move to the 5% slab, and about 90% of the items in the 28% slab will move to the 18% slab.

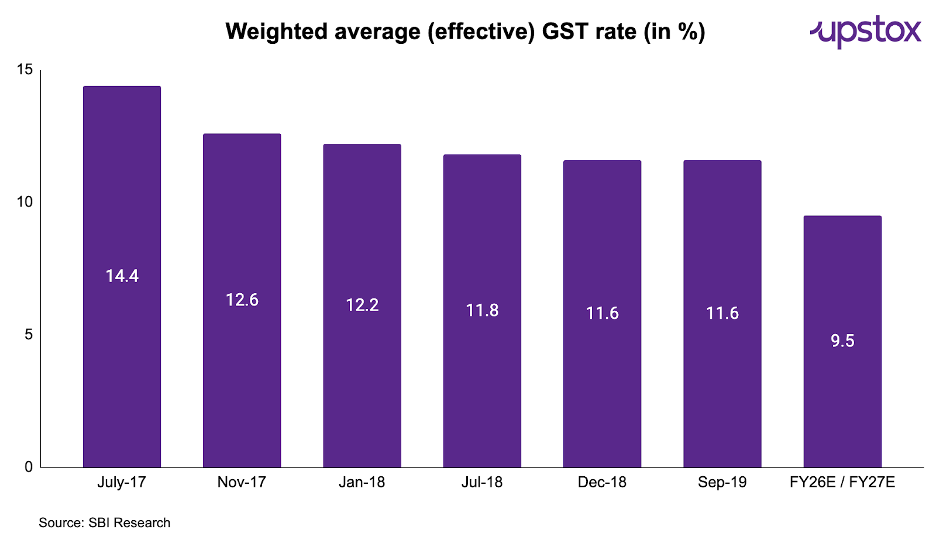

Notably, some items in the highest GST slab (28%) also attract compensation cess, taking their effective rate to over 40%. Considering the above proposed changes, the effective GST rate is expected to come down by 2% which is significant.

The following sectors are likely to emerge as key beneficiaries

| Sectors | Key Stocks | Rationale |

|---|---|---|

| Autos | Maruti, Tata Motors, Ashok Leyland | 4-wheelers and CVs are in the 28% slab; shifting to 18% will directly reduce prices, boosting affordability and demand. However, vehicles with a certain higher engine capacity threshold might not see any benefits. Details awaited |

| Banks | ICICI Bank, HDFC Bank, IDFC First Bank | If consumption rises, credit demand may increase, benefiting consumer-heavy lenders and card issuers. |

| NBFCs | Bajaj Finance | Lower EMIs on durables stimulate demand and benefit NBFCs lending to this segment. |

| Cement | Ultratech, JK Cement | Lower GST from 28% to 18% may cut cement prices by 7.5–8%, a positive for sentiment, although demand is relatively price inelastic. |

| Consumer Staples | HUL, Britannia | Several raw materials are taxed at 12–18%; a cut in input GST may provide room to pass on the benefit to the consumer, while supporting operating margins |

| Consumer Durables | Voltas, Havells | Products like air conditioners moving from 28% to 18% will reduce costs for consumers. In the near term, durable sales could suffer, since most people will wait for lower prices and therefore delay purchases. |

| Hotels | Lemon Tree, Indian Hotels | Hotel rooms with sub-₹7,500 ARR can move from 12% to 5%, improving affordability for mid-range travel. |

| Insurance | Niva Bupa, Max Life, HDFC Life, Star Health | Senior citizen policies may shift from 18% to 5% or be exempted, boosting health and life insurers. |

| Logistics | Delhivery | Higher volume demand in consumer durables and electronics could benefit logistics players like Delhivery. |

| Quick Commerce | Eternal, Swiggy | The expected rise in small-ticket consumption will benefit Q-commerce players due to volume-driven growth. |

| Retail | Relaxo, Bata, Campus | Footwear < ₹1,000 was earlier moved from 5% to 18%, hurting demand; a rollback will help organised players |

Source: MOSL, Media reports

What implications does this have for the revival of consumption?

Although the final structure of the revised GST regime is yet to be confirmed, these proposed changes signal the most meaningful restructuring of GST since its launch in 2017, with the potential to deliver tangible benefits across consumption, compliance, and administrative efficiency.

As explained earlier, several measures have been taken to revive consumption. These measures together have the potential to boost consumption by around ₹6.5-7.5 lakh crores, with the potential to uplift GDP growth by 2%.

The calculation below is an estimate by various agencies/organisations. The basic premise of their estimate is the consumption multiplier of ~2-3x. Meaning, for every one ₹1 spent, it would lead to additional follow-on spending of ₹2-3 in the economy.

| Policy Measure | Estimated boost in consumption (in ₹ lakh crore) | Consumption Impact |

|---|---|---|

| Interest rate cuts | 0.3 | Mortgage savings leading to increased disposable income |

| Income tax cuts | 2.0 -3.0 | Direct boost to household consumption |

| 8th pay commission (15% hike) | 2.2 | Salary hike for the government. & defence employees, driving discretionary spending |

| GST rate cuts | 2.0 | Uptick in discretionary consumption due to lower inflation |

| Total potential stimulus | 6.5-7.5 | Potential to uplift GDP growth rate by 1.6-2% as per the SBI |

Source: Internal analysis, SBI Research, Nomura, Jefferies, Economic Times, HSBC

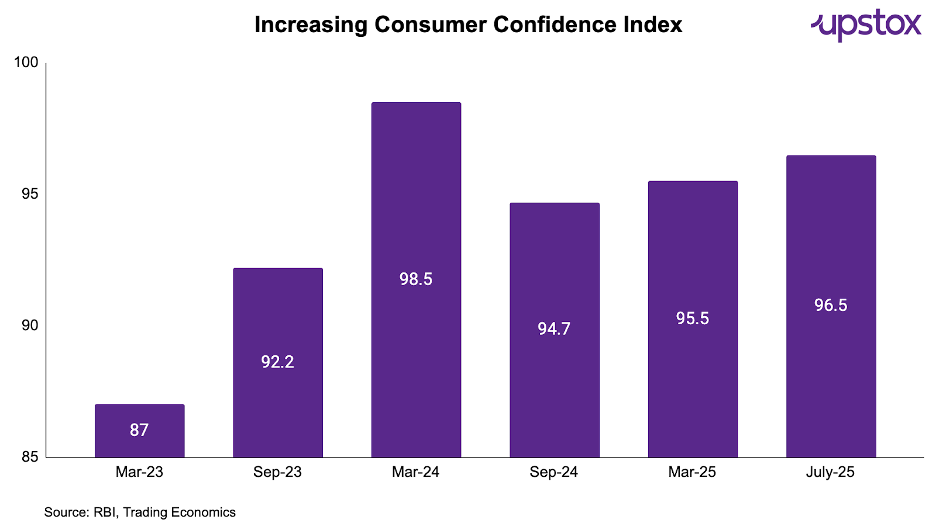

According to NielsenIQ, India’s FMCG industry recorded 13.9% value growth in Q2 FY25, supported by a 6.5% volume rise and a 7.4% increase in prices. Notably, rural India continues to outpace urban markets, marking its sixth consecutive quarter of stronger volume growth. However, the urban-rural gap is narrowing, driven by sequential recovery in smaller towns, while metros still face pressure due to shifting consumption channels

“Collectively, these tailwinds are helping to sustain the gradual recovery in consumption demand in the country. Consequently, consumption demand trends for the last three months reflected a sequential improvement,” says HUL CEO Rohit Jawa

A GST rate cut would also lower inflationary pressures (0.2% - 0.25% fall in CPI inflation expected as per SBI Research) and likely increase the probability of further monetary easing (a 1.4%-1.9% further rate cut as per UBS) by the RBI.

Are there any pitfalls?

While India’s long-term story remains robust, there is one major potential pitfall to watch against. As highlighted here, people only spend money when they have clarity about future security; otherwise, they tend to save money. On one hand, we have the government’s effort to boost consumption, helped further by the RBI’s recent rate cut, but on the other hand, there are many reports of major companies delaying pay hikes. As such, sustained improvement in the economy is a key factor to trigger this consumption boom in the near term.

Another problem in revival we can face is the lower festive spending in the upcoming season, if clarity does not emerge on the rate cut, consumers will delay their spending.

What does it mean for government finances?

If enacted, the proposed GST rate cuts are predicted to cost the exchequer more than ₹1.2 lakh crore per year, or about 0.4% of India's GDP. Currently, 70–75% of GST revenues are collected from items in the 18% slab, while the 28%, 12%, and 5% slabs contribute approximately 14%, 5%, and 7%, respectively. This change could drastically lower overall collections, as the majority of goods are anticipated to shift to the 5% or 18% slabs.

Linking the dots: capex revival and consumption tailwinds

Although short-term consumption is anticipated to be stimulated by the proposed GST rate cuts, private sector capital expenditures are another important economic engine that is showing signs of recovery.

In a recent interview, L&T CEO S.N. Subrahmanyan stated that private businesses are starting to make investments once more in industries such as electronics, chemicals, renewable energy, and auto parts. Strong balance sheets, better capacity utilisation, and focused policy support like PLI schemes are driving the revival.

This creates a positive feedback loop: GST reductions increase consumer demand, particularly for durable, fast-moving consumer goods, and discretionary items; higher demand leads to better utilisation; and businesses can justify new capital expenditures. More jobs and higher incomes due to private investments encourage more consumption.

Parting thought

India's consumption engine is beginning to recover, driven primarily by demand in rural areas and a slow recovery in urban areas. By bringing down the cost of necessities and luxury items, the proposed GST rate reductions may give the economy the much-needed boost it needs to stimulate spending.

GST reform has the potential to do more than just streamline taxes if it is executed quickly and clearly. It could also align India's fiscal momentum, investment, and consumption for a more robust growth cycle.

About The Author

Next Story