Upstox Originals

What does 2026 hold for the Indian economy and markets?

7 min read | Updated on January 06, 2026, 15:47 IST

SUMMARY

Every new year feels like a reset. We make resolutions, rethink priorities, and ask what to do differently this time. After 2025, what is in store for the markets this year. Growth remains steady, inflation benign and consumption robust. On the other hand, trade tensions, currency swings, carbon costs and fresh geopolitical shocks are still in play. In this story, we unpack what 2026 might bring for India.

The 8th Pay Commission becomes effective on 1 January 2026

In our article - An overview of 2025, we saw a snapshot of the major events that shaped the year gone by. From GDP growth, inflation to FPI flows, 2025 was a complicated year. As the new year starts, the global economy has already seen a major upheaval in North and Latin America.

In uncertain times, what does 2026 look like with a particular focus on India?

Will growth continue to remain consumption-led?

As we step into 2026, India’s growth story is becoming more home-driven. Global risks remain, but domestic consumption is stepping into the lead role. What matters more for 2026 is demand. Consumption enters the year with momentum built in late 2025, when:

- Inflation eased sharply; falling to 2.82% in May and 0.71% in November;

- Tax relief and GST cuts left about ₹1.5 trillion in households’ hands; and

- RBI cut policy rates by a cumulative 125 basis points

Lower inflation and easier credit explain why consumption restarted. But what keeps it going in 2026 is income certainty, especially for a large section of salaried households.

GDP & The "Secret" Stimulus: The 8th Pay Commission

When we think of pay commissions, we usually think of one thing; salary hikes. Bigger payslips. More money in hand. And eventually, more spending.

The 8th Pay Commission becomes effective on 1 January 2026, as the 7th CPC expires, with arrears payable from January even if final pay slabs are notified later. It impacts ~1 crore beneficiaries; around 50 lakh central government employees and 50 lakh pensioners.

| Pay Commission | Effective Year | Salary Hike | Estimated Fiscal Impact |

|---|---|---|---|

| 6th Pay Commission | 2008 | ~40% | ~₹26,000–31,000 crore (recurring + arrears) |

| 7th Pay Commission | 2016 | ~23–25% | ~₹1.02 lakh crore |

| 8th Pay Commission | 2026 | ~30–34% | ~₹3.7–3.9 lakh crore |

Source: News articles, Clear Tax, JP Morgan

And where might this demand show up first? JPMorgan expects the impact to be especially visible in automobiles, consumer durables, and mid- and low-income housing, with the consumption boost most pronounced in Tier II and Tier III cities, where a large share of government employees reside.

Rupee

After a weak 2025, according to a report by SBI, the rupee could still face pressure in the near term. SBI expects the currency to decline by around 2% in the next financial year, with USD/INR hovering near 92. That said, the bank sees several buffers limiting downside risks:

- India’s current account deficit is expected to stay below 1% of GDP

- Inflation is likely to remain close to the RBI’s 4% target, reducing the risk of sharp currency shocks

- On the global side, as the US Federal Reserve nears the end of its easing cycle, conditions could turn more supportive for emerging-market currencies, including the rupee

But trade shocks remain the swing factor and a key monitorable for investors.

Macro Data Framework: FY27 (Projected)

| Indicator | FY27 Projection | Sources |

|---|---|---|

| Real GDP Growth | ~6.3%–6.7% | Fitch Ratings (FY27: 6.3%), S&P Global Ratings (FY26: 6.5%), United Nations (FY27: 6.4%) |

| Nominal GDP | ~11.0% | SBI Mutual Fund |

| CPI Inflation | Near ~4.0% | Axis Bank, International Monetary Fund |

| Current Account Deficit (CAD) | Below ~1.0% of GDP | SBI |

| Fiscal Deficit (Centre) | ~4.2% of GDP | SBI Mutual Fund |

| USD/INR (Average) | ₹88–92 | Nomura, S&P Global Market Intelligence, Bank of America Global Research |

Source: DD news, ETBFSI

What are the risks to watch for?

The "Carbon Shock" (CBAM) & Exports

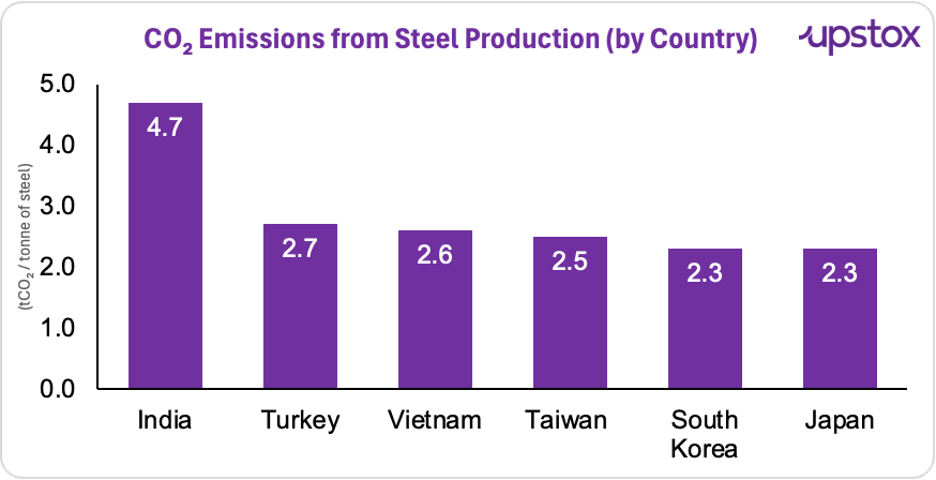

From January 1, 2026, Indian steel and aluminium exports to Europe get costlier. not due to tariffs, but carbon, as the EU’s Carbon Border Adjustment Mechanism (CBAM) shifts from reporting to pricing.

CBAM charges imports for the CO₂ emitted during production, aligning them with the carbon costs EU producers already bear. Until now, exporters only disclosed emissions. From 2026, each shipment carries a carbon-linked charge.

This matters for India, one of the more carbon-intensive steel producers, especially since the EU absorbs ~22% of India’s steel and aluminium exports. GTRI estimates exporters may need to cut prices by 15–22%, implying a 16–22% hit to realised export prices.

Source: European Commission *NOTE: Calculation year: 2026 (tCO₂e/t): Tonnes of carbon dioxide equivalent per tonne of product; Figures are provisional and liable to change in Q1 CY26

Although EU importers formally pay CBAM, the cost typically flows back to suppliers through lower prices and tighter contracts. While certificate surrender begins in 2027, carbon costs are expected to be built into pricing from the first shipment of 2026.

The Market Outlook

Analysts at leading firms like Nomura are increasingly bullish for the next 12–18 months. The "earnings upgrade cycle," which was missing for five quarters, has finally returned. Recent corporate data already hints at resilience. Aggregate Nifty revenues grew in mid-single digits while profits rose at a double-digit pace; suggesting margin normalisation and operating leverage.

| Benchmark Index | 2026 Projection | Expected Return | Key Driver |

|---|---|---|---|

| Nifty 50 | 29,100 – 29,300 (Nomura, PL Capitals, Kotak) | 12% – 15% | BFSI & IT Recovery |

| Sensex | ~98,000 | 11% – 14% | Large-cap stability |

| Corporate Earnings | 12.5% - 15% Growth (Axis Securities) | Recovery from FY25 lows | Lower interest costs, resilient GDP growth, revival in demand, and a supportive policy environment |

Source: Reuters, PL Capital, Fortune India, TOI

The Multi-Cap landscape

According to Nilesh Shah, MD of Kotak Mahindra AMC, mid-cap stocks are expected to outperform both large-cap and small-cap stocks, though the margin of outperformance is likely to remain narrow. Large caps are expected to deliver steadier returns, supported by earnings recovery and balance-sheet strength. Small caps are likely to lag on a broad basis, with performance remaining selective and dependent on earnings delivery rather than market momentum.

Commodities

Gold, silver and copper are expected to stay supported in 2026, driven by tight supply, strong investment demand and long-term themes like electrification and AI.

-

Gold: The tone remains constructive. Standard Chartered sees prices averaging ~$4,488 in 2026, with upside toward $4,700+ possible.

-

Silver: Seen as a dual play, both a precious metal and an industrial input. BofA expects silver to move toward ~$65/oz, supported by supply deficits and its growing role in solar, electronics and electrification.

-

Copper: Structural tightness keeps the outlook firm. Standard Chartered sees prices holding above $11,000/tonne, while BofA flags upside toward $13,000.

-

Oil: Oil doesn’t look set for big price shocks as we head into 2026, and that works in India’s favour. The recent flare-up in Venezuela drew attention, but its impact on prices has been limited. Despite holding large reserves, Venezuela accounts for less than 1% of global supply. The disruption has come at a time when the global oil market is already oversupplied, with demand seasonally weak in the first quarter.

In a nutshell

What makes 2026 interesting isn’t acceleration, but alignment. When consumption, earnings, and policy move in the same direction, growth becomes harder to derail. External shocks will still test the system; through trade, currency and carbon costs; but the economy is entering the year with more internal shock absorbers than before. If that alignment holds, 2026 may reshape India’s growth story from cyclical recovery to structural resilience.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story