Upstox Originals

The IPO party is in full swing, but are neighbours starting to complain?

3 min read | Updated on December 30, 2025, 20:06 IST

SUMMARY

2025 has been one of the best IPO years with a cumulative raise of ~₹1.93 trillion, higher than ~₹1.89 trillion of 2024 (another record year). However, a deeper look reveals a sharp decline in average listing gains - from 9% to an average of 28% over the past two calendar years - and a drop in overall subscription levels. Additionally, the sharp rise in SME IPOs also indicates an increasing risk profile. The question to be asked is - are investors prepared in case the cycle turns?

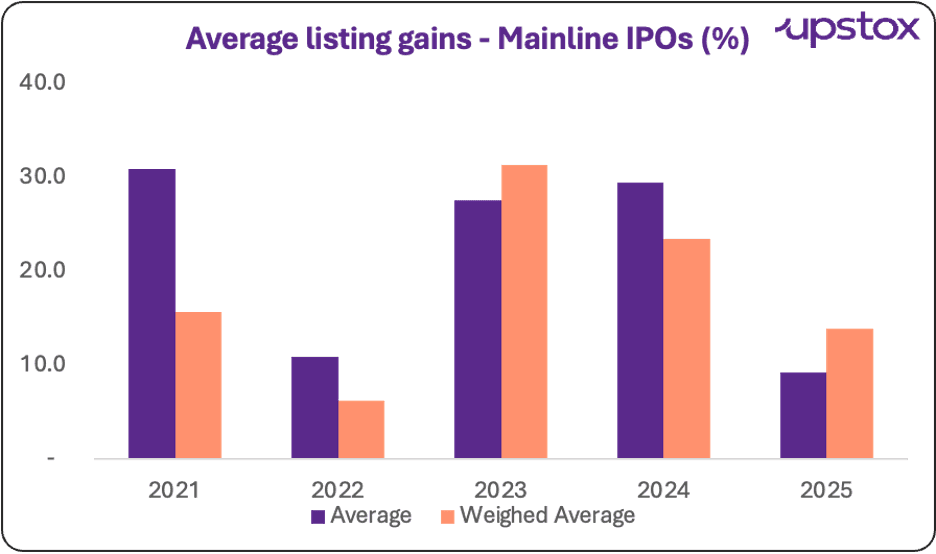

For mainline IPOs the average listing gain (closing price / issue price) has reduced from an average of 28% over the past years to about 9% in 2025.

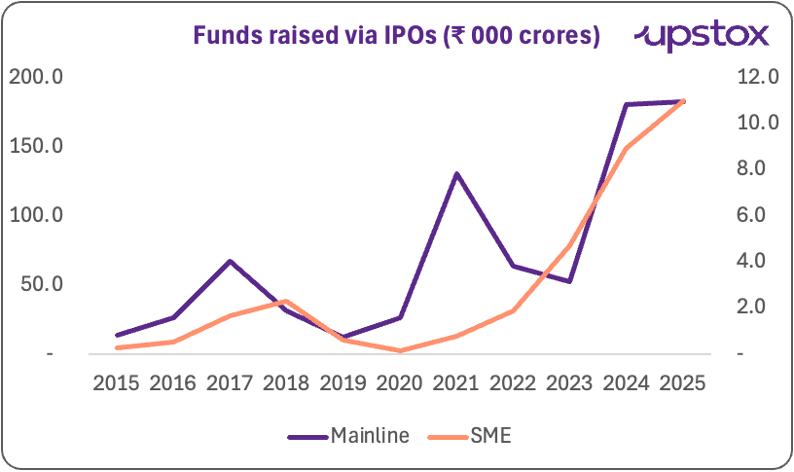

2024 and 2025 have been stellar years for IPOs. Seen over a decade, the performance of these two years looks even more impressive. Funds raised via mainline IPOs have increased almost 13x and those via SME IPOs have increased over 42x.

Source: Chittorgarh; *2025 data till December 24

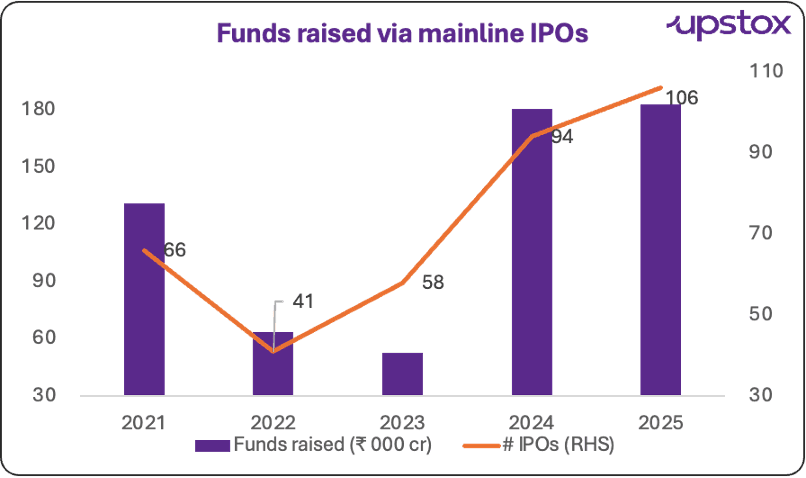

On a standalone basis, 2025 saw over 100 mainline IPOs, which raised over ₹1.8 trillion.

Source: Chittorgarh; *2025 data till December 24

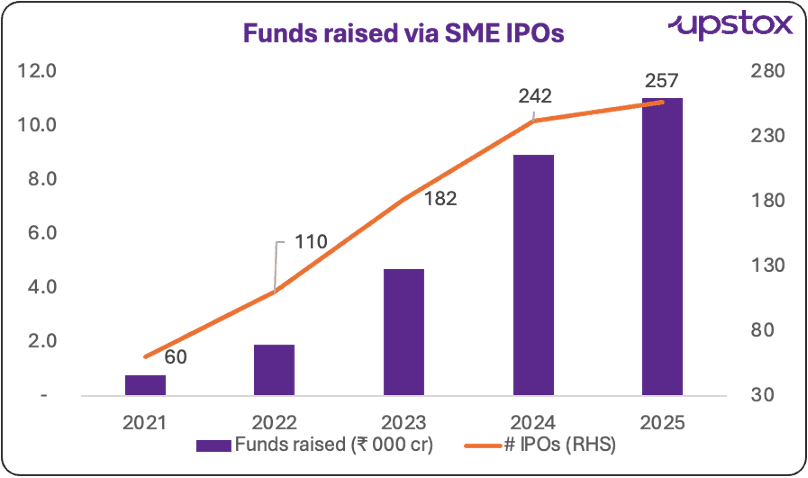

Similarly, SME IPOs also delivered an all-time best performance with over 250 IPOs raising ₹110 billion, an impressive 23% growth over last year.

Source: Chittorgarh; *2025 data till December 24

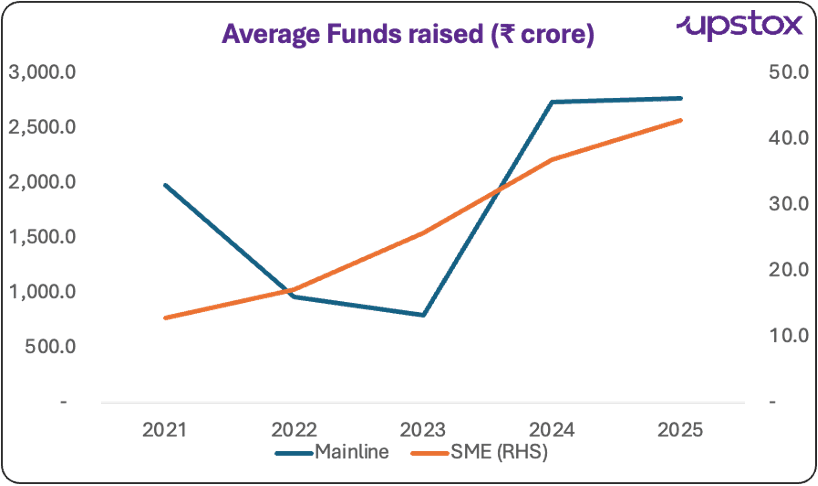

Not only have the number of IPOs and funds raised increased, but the average funds raised across each of these categories has also increased. For 2025, average funds raised via mainline IPOs were ~₹2,770 crore and ~₹43 crore via SME IPOs.

Source: Chittorgarh; *2025 data till December 24

On the surface, these facts look encouraging, but a deeper look points towards a few reasons for caution.

Average listing gains

Average listing gains (simple and weighted) have both shown a marked decline in 2025. A few reasons for the same:

- General increase in valuations of companies at the time of listing

- Increased volatility in the markets (largely due to global events)

- Sharp metal rally drawing away investor interest

For mainline IPOs the average listing gain (closing price / issue price) has reduced from an average of 28% over the past years to about 9% in 2025.

Source: Chittorgarh; *2025 data till December 24

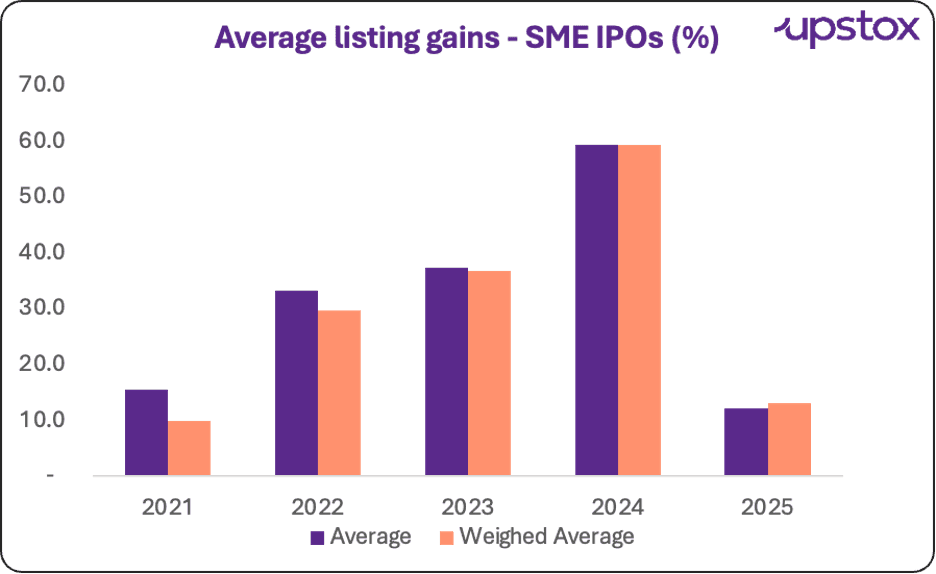

For SME IPOs the average listing gain has reduced from an average of 48% over the past years to about 12% in 2025.

Source: Chittorgarh; *2025 data till December 24

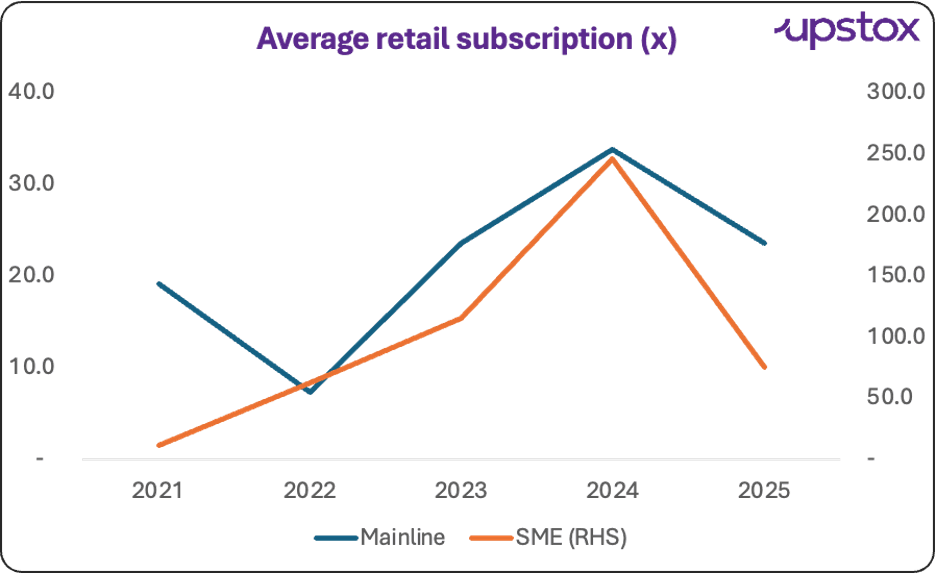

Easing of overall subscription

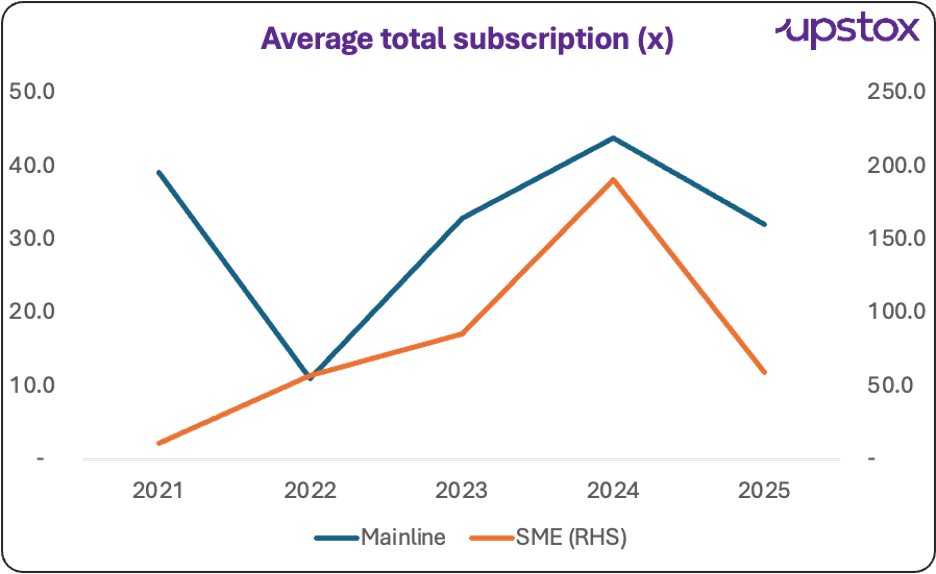

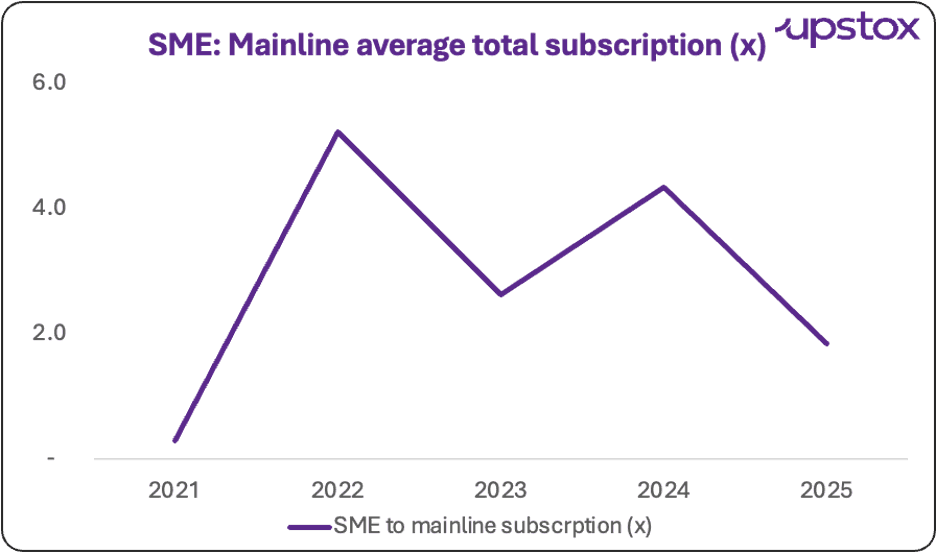

Retail and total subscription have eased for both mainline and SME IPOs, once again pointing towards a cooling off in investor interest and appetite for IPOs.

Source: Chittorgarh; *2025 data till December 24

Source: Chittorgarh; *2025 data till December 24

Finally, a word of caution

If you look at the first chart again, a clear standout is the sharp rise in SME IPOs. While mainline companies have seen their ebbs and flows, since 2021, their SME peers have seen a straight rise, increasing almost 14x versus a modest 1.5x increase in funds raised via mainline IPOs.

Unsurprisingly, total subscriptions in SME IPOs versus mainline IPOs have also seen a sharp spike.

Source: Chittorgarh; *2025 data till December 24

This begs the question: have investors taken on more risk than is prudent? Not only are SME companies relatively illiquid, but their business models are inherently riskier. While the underlying momentum remains strong, if the cycle turns, investors could see heightened volatility in their portfolios.

The question, therefore, is – have investors (specifically retail investors) priced in this potential increase in risk, incase the cycle turns?

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story