Upstox Originals

The global resource race is on; can India catch up?

.png)

6 min read | Updated on June 27, 2025, 13:32 IST

SUMMARY

Natural resources are the lifeblood of today’s global economy, fueling everything from security to growth. Wondering why lithium, cobalt, and rare earths are the new oil? They power clean tech and digital revolutions, reshaping trade, industry, and diplomacy. The real winners? Countries that master extraction, processing, and smart alliances.

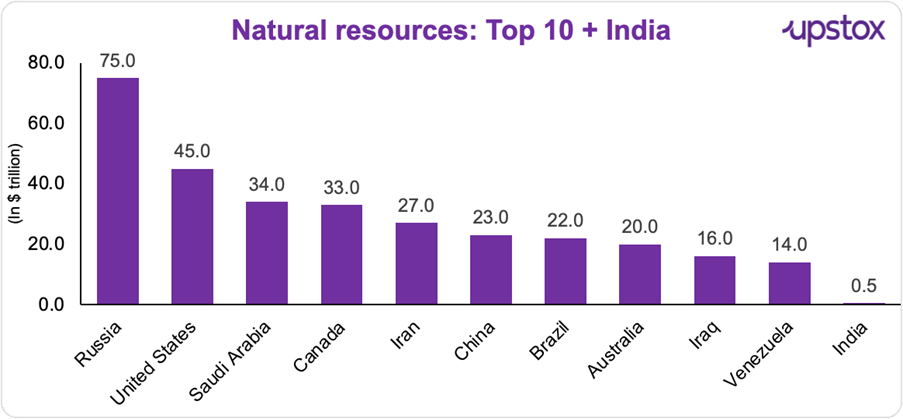

India holds resources valued at around $0.5 trillion

Natural resources have long shaped global influence, but in today’s world, it’s not just about owning the reserves; it’s about how nations convert them into strategic and economic gains.

Russia, with an estimated $75 trillion worth of mineral wealth, commands the world’s largest natural gas reserves and ranks among the top producers of gold, oil, and diamonds. The US, through its shale revolution, has flipped from energy importer to exporter, redrawing trade routes and geopolitical alignments.

Natural resources have long been key drivers of economic growth. They generate export revenue, attract foreign investment, create jobs, and fuel industrialisation. For example, oil-rich nations often leverage their petroleum exports to fund infrastructure, education, and social programs. Mineral wealth can help finance new industries, support technological development, and provide a buffer against global shocks.

But, where does India stand? It holds resources valued at around $0.5 trillion - less in monetary terms, but rich in variety and opportunity. It ranks among the top globally in coal, iron ore, bauxite, and is now exploring lithium. It’s also a powerhouse in agriculture, solar energy, and hydropower.

Source: India Today; *Data as of April 2025

Top countries by control over critical minerals

Which countries really run the show when it comes to powering electric cars and clean tech? It’s all about critical minerals - like lithium, cobalt, natural graphite, and rare earths.

This table reveals who’s got the power:

- Who digs them up? (Mining)

- Who turns them into usable stuff? (Processing)

- Who’s sitting on the biggest underground stash? (Reserves)

These minerals are the lifeblood of batteries, electronics, and green energy. If you want to know who’s calling the shots, dive into the table below!

| Mineral | Reserves | Mining | Processing |

|---|---|---|---|

| Lithium | Chile (34%) | Australia (51%) | China (65%) |

| Cobalt | Congo (57%) | Congo (73%) | China (74%) |

| Natural Graphite | China (28%) | China (72%) | China (100%) |

| Rare Earths | China (38%) | China (70%) | China (90%) |

Source: EV Boosters

While Australia digs up 51% of the world’s lithium and Congo 73% of cobalt, it’s China that really calls the shots - processing 65% of lithium, 74% of cobalt, 100% of natural graphite, and a whopping 90% of rare earths! Even underground, China’s got the edge: 28% of graphite reserves and 38% of rare earths.

Why resources don’t always translate to economic strength

Just having resources doesn’t automatically mean instant wealth. Venezuela and the DRC, despite their oil and cobalt endowments, are grappling with governance and economic hurdles that keep them from unlocking real development.

Meanwhile, countries like Chile and Australia are showing how it’s done - strong regulations, solid infrastructure, and investor-friendly policies keep their resource industries humming and their economies growing.

And let’s not forget the global jitters: in 2022, rare earth prices shot up thanks to geopolitical tensions, proving that a handful of key suppliers can shake up the entire market.

India’s resource landscape

India is richly endowed with diverse natural resources, including coal (111 billion metric tons in 2022), iron ore (3.4 billion metric tons), bauxite, thorium, and crude oil (4.6 billion barrels).

It has over 7,000 km of coastline supporting major fishing and salt industries. Hydropower contributed 14% of energy capacity in 2016, and India is the 6th largest hydroelectric producer globally (2022).

The challenge

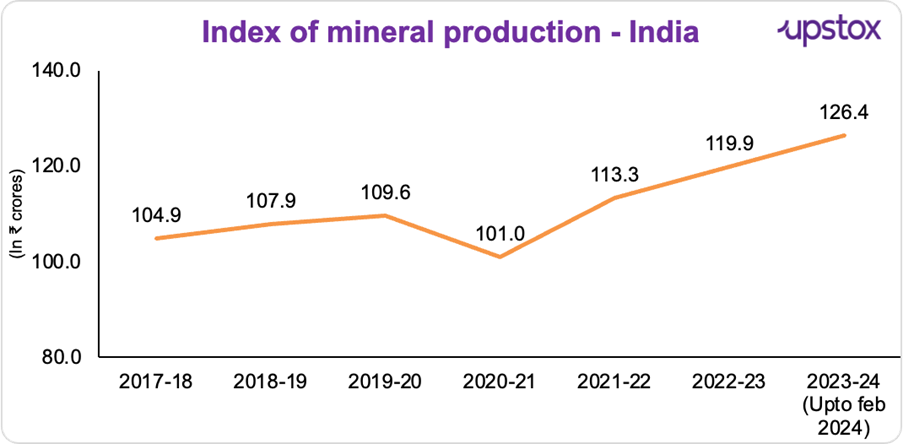

India’s mining sector has recorded consistent output growth in recent years. The Index of Mineral Production (base year 2011–12) reached 126.4 by February 2024, up from 119.9 in the previous year—an annual growth of 5.4%.

Source: Ministry of Mines

This upward trend reflects increased activity in core segments like coal, iron ore, and limestone, aligned with India's infrastructure and industrial push.

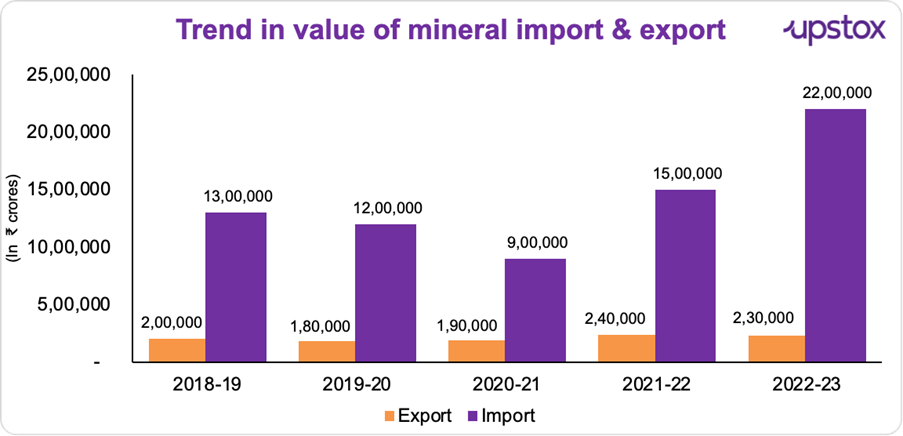

Source: Ministry of Mines

The import value of minerals surged to ₹22 lakh crore in FY23, more than doubling from 2020–21, while export levels remained flat around ₹2–2.4 lakh crore. This widening gap reflects India’s growing dependence on external sources - especially for minerals where domestic reserves are underutilised.

A major factor behind this reliance is China’s overwhelming dominance across the global critical mineral supply chain. India currently lacks the domestic refining, separation, and value-add infrastructure required for processing critical minerals.

China is not just the world’s largest mining nation but also the most dominant in refining and midstream processing. From 2019 to 2024, India’s dependency on China exceeded 40% for six critical minerals:

- Bismuth (85.6%)

- Lithium (82%)

- Silicon (76%)

- Titanium (50.6%)

- Tellurium (48.8%)

- Graphite (42.4%)

Now scratch the surface, and the real picture starts to crack. India’s mineral engine is throttled by deep internal challenges - some old, some systemic, and all urgent.

For starters, over 70% of our geological potential remains unexplored. Why? Delayed clearances, complex permits, and a maze of regulatory steps choke progress before it begins. Mining leases take years to process, and even then, projects often stall due to outdated infrastructure or pushback over environmental and tribal rights.

Private players remain wary too. Most auctioned mineral blocks are backed only by shallow surveys (G3 or G4), offering little clarity on resource potential. Add poor connectivity, old machinery, and weak enforcement, and it’s no surprise that long-term investments are hard to come by.

Tapping untapped potential

Vedanta Chairman Anil Agarwal, during the company's 59th AGM, noted that “India has explored only 30% of its geological potential, despite imports of minerals, metals, oil and gas already crossing $350 billion annually. This figure could double as India’s economy grows, presenting a $1 trillion opportunity in the natural resources sector.”

The government has taken early steps, such as setting up KABIL (with a combined workforce of the promoters of around 7800 full-time employees and a combined market capitalisation of ~$3 billion), initiating lithium block auctions, and committing over ₹8 lakh crore investment towards the green hydrogen mission.

India could consider the following:

- Developing domestic refining zones and battery materials clusters

- Establishing stockpiles for strategic minerals

- Forming resource agreements with mineral-rich nations in Africa and Latin America

Final thoughts

In 2025, it’s not just about digging up resources — it’s about building smart strategies across the entire value chain. With the energy transition and digital boom driving demand for critical minerals, countries need more than just reserves; they need strong policies, tech investments, and stable supply chains.

India has a big opportunity here. With the right mix of government action, industry leadership, and cutting-edge R&D, it can lock in its place in the global materials economy. The question is: will it seize the moment?

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story