Upstox Originals

Steady aim: Why defence is becoming a serious bet for long-term investors

.png)

4 min read | Updated on June 11, 2025, 18:35 IST

SUMMARY

India’s defence sector is no longer flying under the radar. Rising government support, private innovation, and a growing push for self-reliance. With rising order books, strong export growth over the years, and an expanding manufacturing base, defense is no longer a news play but a strategic play with long-term potential.

Stock list

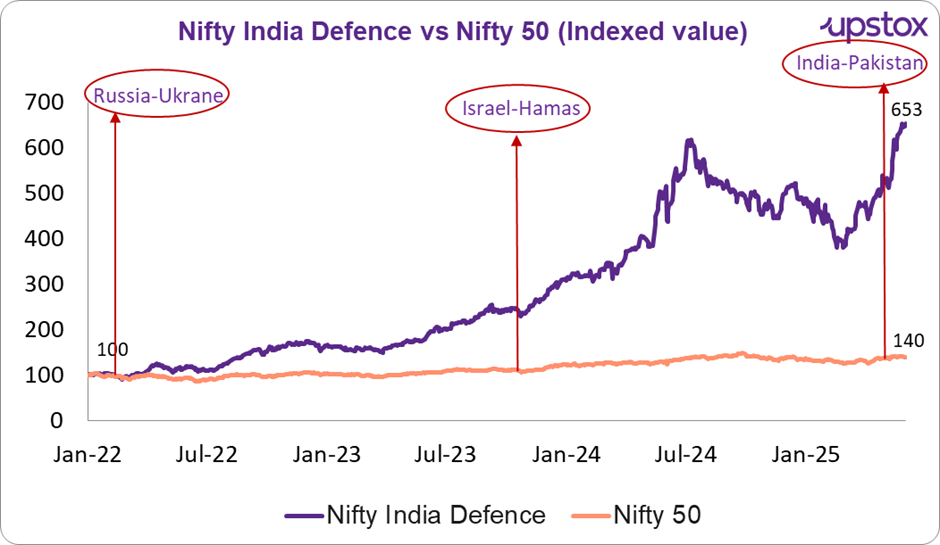

Over the past three years the Nifty India Defence Index has grown by 6x

Over the past three years, the Nifty India Defence Index has delivered a robust return, growing by 6x, and outperforming the Nifty India index by a wide margin.

Global conflicts (Russia-Ukraine, Israel-Hamas) brought back the spotlight on defence stocks. This, coupled with the government’s focus on building domestic capabilities, has further bolstered this sector. Finally, the recent India-Pakistan conflict has further heightened security concerns.

Source - niftyindices.com; Data till 03-06-2025

Let's explore this in more detail:-

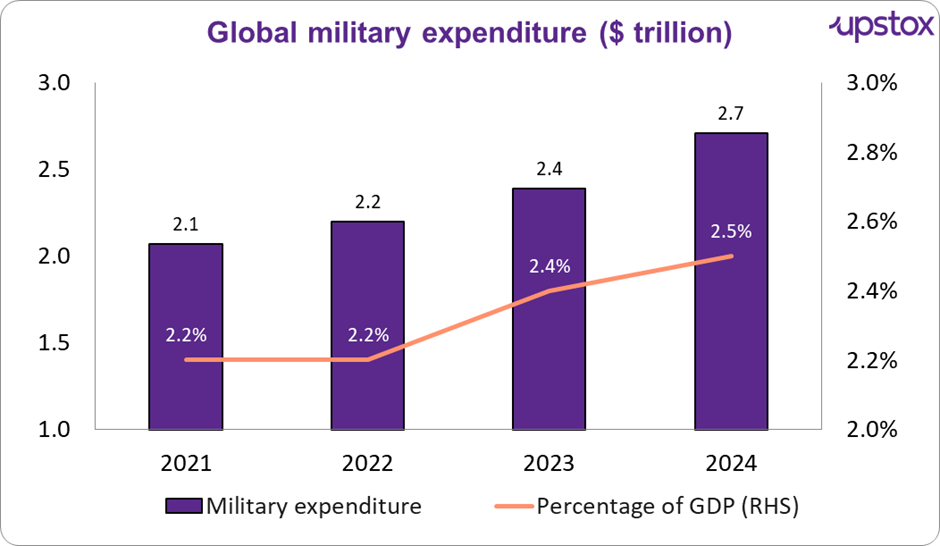

First, rising geopolitical tensions, including the Russia-Ukraine war, Israel’s Gaza offensive, and unrest in the Middle East have pushed global defence spending significantly higher. This has led to an increase in defence spending in multiple countries, including India. So far, there has been an average of approximately 9% increase in global military expenditure every year for the last 4 years.

Source: World Bank, new articles

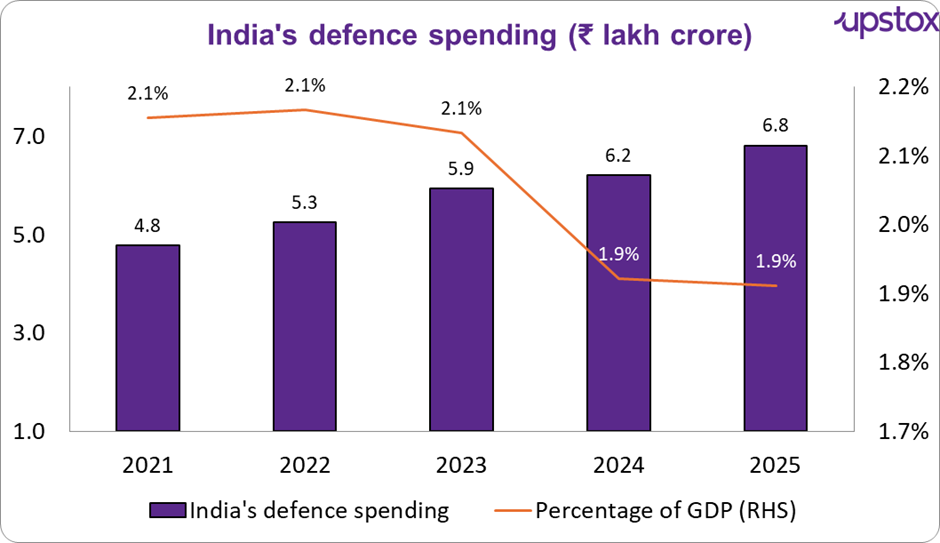

Secondly, the above trend has also impacted India’s defence priorities as can be seen India has also increased its defence spending at a comparable pace. In 2025 alone the defence spending was at ₹ 6.8 lakh crore which is almost 13% of the Union budget.

Source: Ministry of defence

Thirdly, initiatives by the government, such as ‘Make in India’ and 'Strategic Partnership Model', also play a big role as these initiatives have increased the involvement of private sector players such as L&T, Mahindra, and Reliance who are now major contributors to India’s defence manufacturing ecosystem.

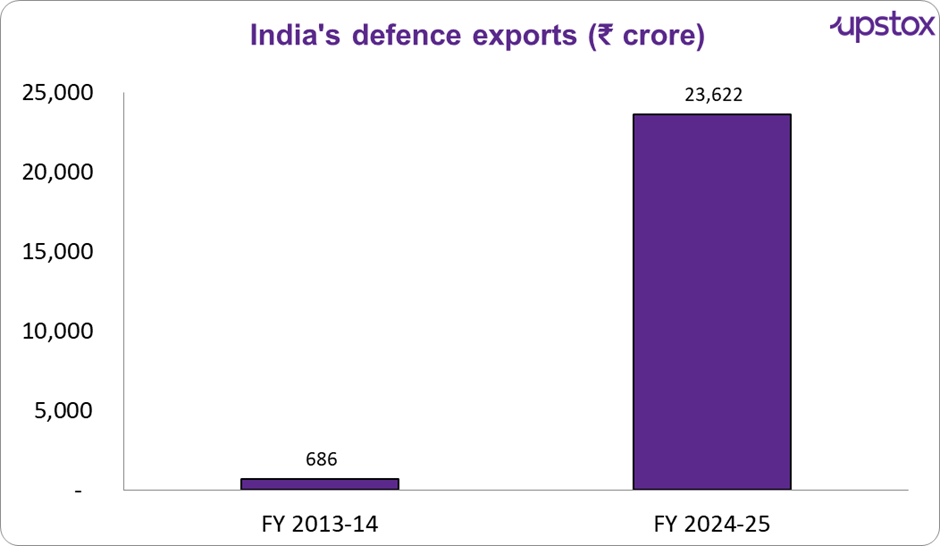

Lastly, India has seen its defense exports grow by almost 34x in the past 10-11 years. It is gradually becoming a self-reliant producer with strong indigenous capabilities.

Source: Ministry of Defence

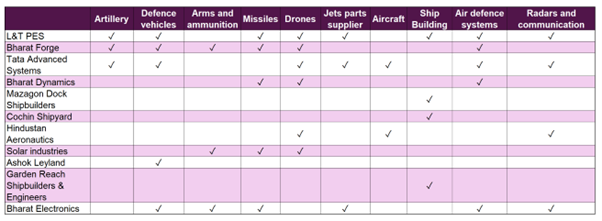

Now that we’ve got your attention on why defence stocks have been rallying, let’s take a look at the top companies and what they actually make.

Source: Company website

The above table showcases the different product portfolios of the top companies of the sector. Companies have been ramping up their R&D investments, increasing international partnerships to meet the needs of modern-day warfare.

Here’s a brief breakdown of some of the key products offered by these top companies and how they are used in modern defence operations:-

Drones & UAVs

Used for surveillance, reconnaissance, and precision strikes in border and high-altitude areas. Examples: ALS‑250 loitering munition (Tata Advanced Systems), CATS Warrior UCAV (HAL), Nagastra-1 (Solar Industries)

Radars & communication systems

Enable early warning, target tracking, and secure military communication. Examples: BFSR-SR portable radar, Swathi Weapon Locating Radar, D4 Anti-Drone System (Bharat Electronics Ltd)

Missiles & air defence systems

Used for airspace defence and precision targeting. Examples: Akash Surface-to-Air Missile (BEL & BDL), Project Kusha (BEL), QRSAM systems (L&T & DRDO)

Defence vehicles & artillery

Support troop mobility, logistics, and battlefield artillery deployment. Examples: Stallion 4x4 & Super Stallion (Ashok Leyland), ATAGS artillery system (Bharat Forge)

Ship building

Strengthen India’s maritime defence through warships and submarines. Examples: Kalvari-class submarines, Nilgiri-class stealth frigates (Mazagon Dock), OPVs and patrol vessels (Cochin Shipyard, GRSE)

Aircraft & helicopters

Used for combat, training, and transport missions. Examples: Tejas fighter jet, Prachand attack helicopter, LUH (HAL)

Outlook - Where is the sector headed?

India’s defence sector is no longer just reacting to threats—it's planning for strategic dominance. Between January and June 2025, over 45 major defence orders were announced, pointing to three clear trends: modernisation, indigenisation, and global integration.

Companies like BEL, HAL, BDL, GRSE, and Solar Industries have secured massive contracts for everything from integrated drone systems and AESA radars to loitering munitions and submarines. Notably, BEL alone received over ₹18,000 crore in orders this financial year, covering AI-enabled systems, communication terminals, and base spares for missile platforms.

Meanwhile, HAL's ₹62,700 crore deal for 156 Prachand Light Combat Helicopters, and Solar Industries' ₹6,084 crore deal for Pinaka MLRS rockets, illustrate India's commitment to large-scale local production in the Aatmanirbhar Bharat banner.

What's more, exports are picking up speed—Apollo Micro Systems and Nibe Limited won overseas orders for avionics and rocket systems, illustrating that "Make in India" is now confidently evolving into "Make for the World."

If the current order flow is any indication, India is not just preparing for future — it’s investing in becoming a global hub for advanced defence systems, spanning space, air, land, and sea.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story