Upstox Originals

Shining silver, what’s driving it?

.png)

6 min read | Updated on June 25, 2025, 15:16 IST

SUMMARY

Silver's recent price surge is not market mania, it's years in the making. From all-time industrial demand to shortage of supplies and a change of investment strategies, silver is finally breaking away from the shadow of gold and forging its own path in today's uncertain world.

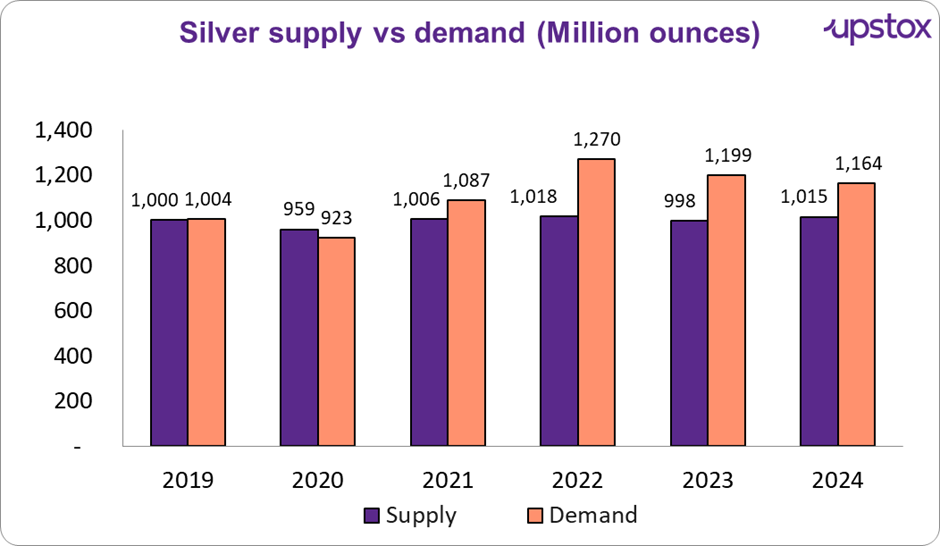

The 2024 silver shortfall of 149 million ounces marks one of the steepest in recent memory

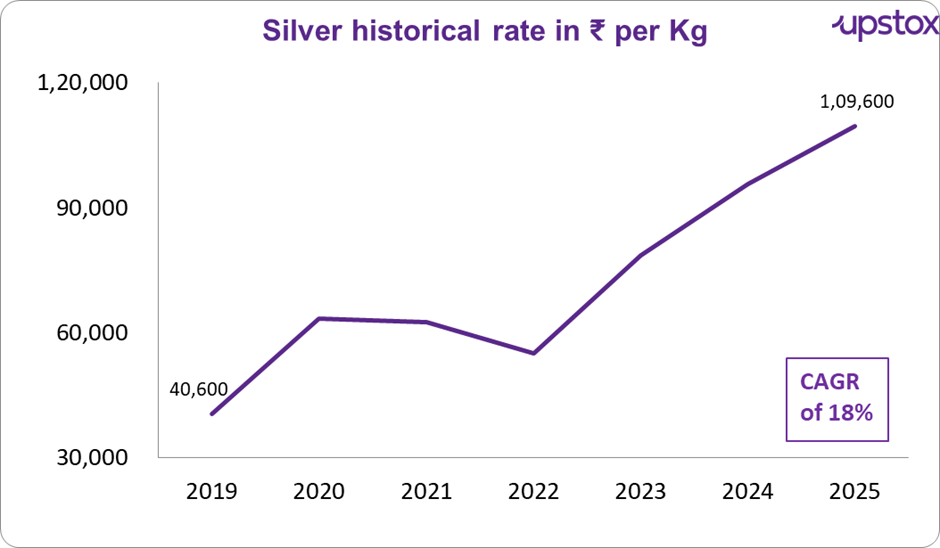

Silver recently broke an all-time high of ₹1,10,000 per kg (as on 23-06-25), and it's no accident. It was stashed away in temple treasuries and jewellery boxes, and now it's powering some of the deepest technical and economic revolutions of our era.

From solar panels to semiconductors, silver is an industrial imperative, and its application in 2025 is expected to rise for all the right reasons, as evidenced by its unexpected 11.2% CAGR recovery over the past decade.

Source: Bankbaazar.com; Note: 2025 prices as of 18th June 2025.

A rising supply shortage, rising investor appetite, and international economic uncertainty are all supporting this rise in the price. This is not another safe-haven trade. It's a tale of relevance, strength, and live growth.

We will unpack what’s fuelling the metal’s moment in the sun, why the timing matters now more than ever, and how Indian investors can participate through modern, accessible investment options.

Now what’s really driving the shine?

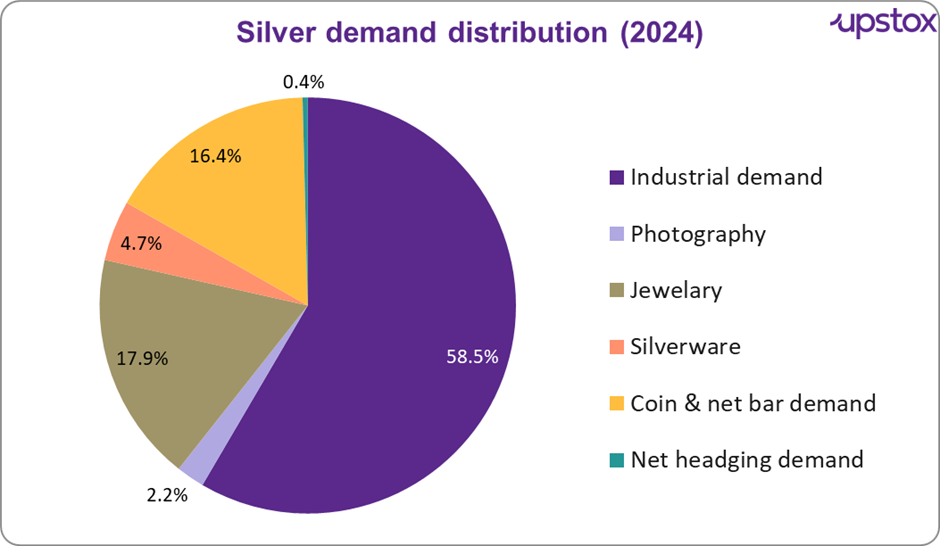

A good place to start is with how the metal is actually being used today.

Source: Silverinstitute.org

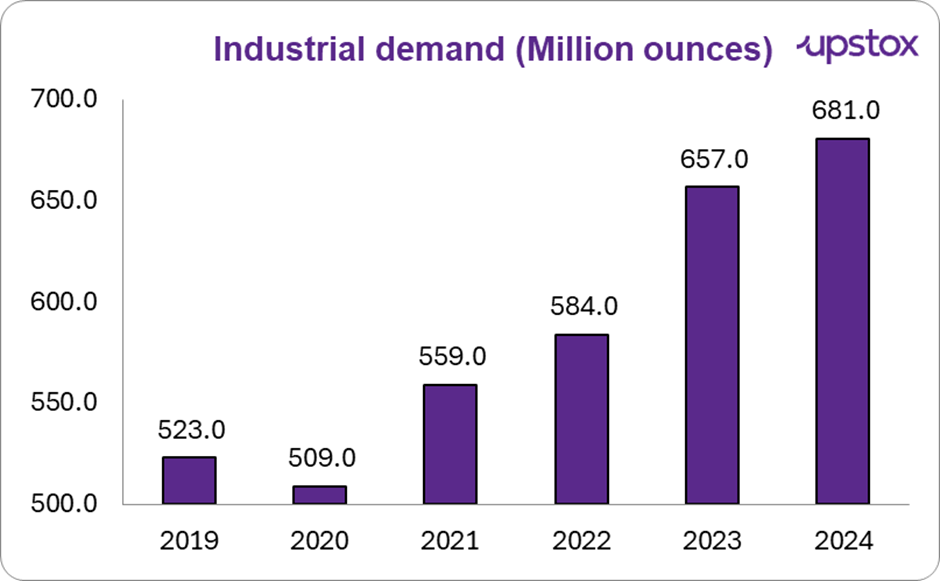

Growing Industrial Demand

Silver isn’t simply a shiny object anymore. In fact, over 58% of global silver demand now comes from industrial uses ranging from EVs and solar panels to AI chips and 5G infrastructure.

And this isn't just theoretical. Industrial demand for silver has grown at a CAGR of 7% over the last 3 years, backed by booming solar installations and high-end electronics manufacturing across Asia.

Source: Silverinstitute.org

Monetary and Investment Considerations

-

Silver glows when inflation increases and currencies falter. With rate reductions looming and debt running rampant, it's a safe haven once more.

-

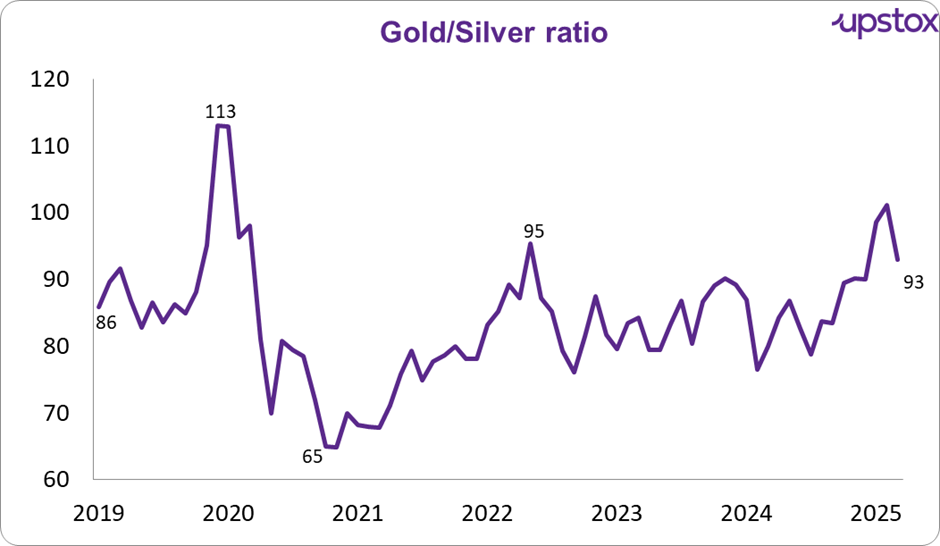

Silver seems to be cheaper than gold right now. One way people compare them is by using something called the gold-to-silver ratio, as shown in the chart below.

Source: Investing.com

Geopolitical and economic uncertainty causing safe-haven demand

Macroeconomic triggers are amplifying silver’s rise. Ongoing geopolitical tensions from Ukraine to the Middle East, are pushing investors toward hard assets.

At the same time, whispers of rate cuts and surging global debt are making precious metals look attractive again. Silver, with its industrial tailwind, is uniquely positioned to benefit from both fear and future bets.

But fundamentals don’t end with demand. What’s making this rally more pronounced is what’s happening, or rather not happening on the supply side.

Supply deficit

According to the World Silver Survey 2025, silver has faced four consecutive years of supply deficits.

Source: Silverinstitute.org

The 2024 shortfall of 149 million ounces marks one of the steepest in recent memory. Global mine output has fallen by 7% compared to 2014 levels, even as demand keeps climbing.

This mismatch is now visible in market pricing and the investors are starting to price in a long-term scarcity premium.

That covers the ‘why’. But what about the ‘how much’? Let’s see how silver stacks up against the investments you already know.

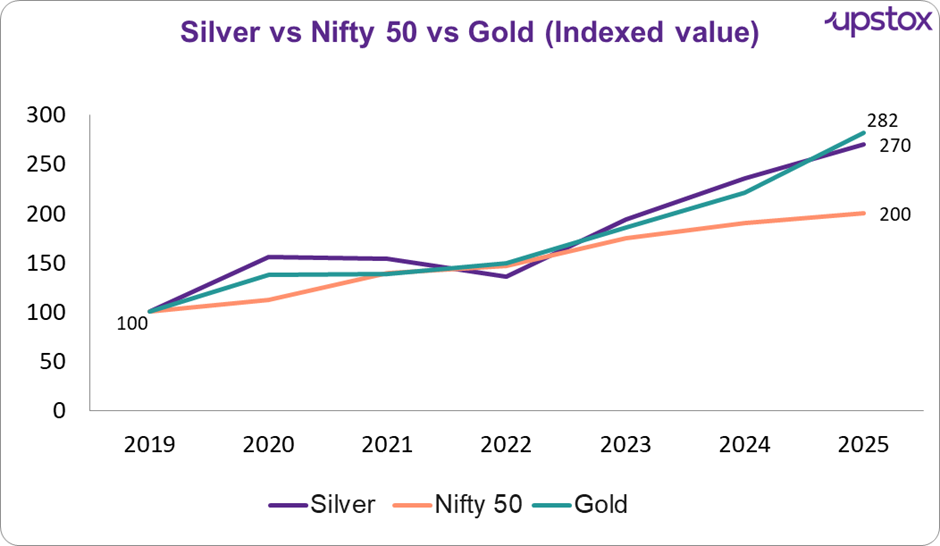

Silver versus your typical investment options.

Source: TradingEconomics

Let's talk returns. Since 2019, silver has quietly outperformed some of the most trusted investment options. While the Nifty 50 has doubled, silver has surged nearly 170% over this same period. However, when stacked against gold it has trailed by 10%.

So what does this mean for you? Well, silver isn't just a glittery sideshow anymore. It has offered growth potential just like equities, with the added benefit of being a hedge during economic uncertainty (COVID-19), something even Nifty can’t always promise. And compared to gold, it brings both industrial relevance and price accessibility.

Silver has grabbed the spotlight, but it’s always been in a quiet competition with its more glamorous cousin gold. Let’s take a closer look at how the two stack up across key dimensions.

Silver vs Gold

| Feature | Silver | Gold |

|---|---|---|

| Industrial Demand | Higher—used in electronics, solar panels, medicine, and more. | Lower—limited to electronics, dentistry, and some industrial uses. |

| Investment Demand | Moderate—attracts investors seeking growth and inflation hedge. | Higher—predominantly held as a store of value and inflation hedge. |

| Volatility | Higher—prices can swing dramatically due to industrial cycles. | Lower—generally more stable, less influenced by industrial demand. |

| Liquidity | Good, but less than gold. | Excellent—higher trading volumes and easier to buy/sell. |

| Affordability | More accessible for retail investors due to lower price per ounce. | Less accessible for small investors due to higher price per ounce. |

| Historical Returns | Higher short-term gains in bull markets, but more volatile. | More consistent long-term returns, less volatility. |

| Correlation | Moderate positive correlation with equities and commodities. | Lower/negative correlation with equities, strong diversifier. |

Source: Morgan Stanley, Bajaj Finserv

Investors have several ways to gain exposure in silver. Coins and bars of physical form are the traditional methods, which provide direct possession but have storage issues. High-risk but high-return trading is possible with silver futures, which are suitable for sophisticated investors. Silver ETFs are an easy, convenient way of accessing the market without having to store physical silver.

Top 5 Silver ETFs (CAGR)

| ETF | AUM (₹ Cr) | 1 Year | 3 Year | Since inception |

|---|---|---|---|---|

| Nippon India Silver ETF | 7,331 | 17.0% | 19.9% | 16.9% |

| ICICI Prudential Silver ETF | 5,949 | 17.3% | 20.3% | 14.8% |

| Kotak Silver ETF | 1,271 | 17.3% | - | 18.3% |

| SBI Silver ETF | 872 | - | - | 18.9% |

| HDFC Silver ETF | 764 | 16.4% | - | 25.2% |

Source: Money control; Data as of 23rd June 2025

Pros and Cons of Investing in Silver ETFs:

| Pros | Cons |

|---|---|

| No storage hassle: No need for physical storage, insurance, or GST. | High volatility: Silver prices can swing sharply due to market conditions. |

| Lower costs: Avoids dealer markups and physical premiums. | Limited track record: Silver ETFs are relatively new in India (launched in 2022). |

| High liquidity: Traded on exchanges like regular stocks. | Tracking errors: NAV may deviate slightly from actual silver price. |

| SEBI-regulated: Transparent, regularly audited, and standardized quality. | Tactical allocation only: Experts recommend only 5–10% of portfolio in silver. |

| Inflation hedge: Acts as a shield against inflation and economic instability. | ETF costs: Investors still pay brokerage and fund expenses. |

Source: Livemint

Outlook

Silver's strong surge is backed by more than just market momentum, it's being driven by rising industrial demand, widening supply deficit, and worldwide economic uncertainty. As industries like renewable energy, electronics, and AI keep growing, silver's strategic significance will become ever more profound.

While price volatility must continue, the long-term fundamentals suggest silver is set for consistent relevancy. For Indian investors, it is a compelling one to diversify, hedge inflation, and tap into future-facing growth themes.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story