Upstox Originals

Rupee falling against Yuan: Trouble or tailwind for India?

7 min read | Updated on September 08, 2025, 15:45 IST

SUMMARY

Hold on to your wallets. The rupee is sliding against the yuan, hitting 12.3862 on 29 August 2025. India’s $99.2 billion trade deficit with China, rising tariffs, and global investor flows are adding pressure. But a weaker rupee could make Indian exports cheaper and tap into India’s $161 billion untapped export potential in China. The real question: can India turn this currency challenge into an opportunity?

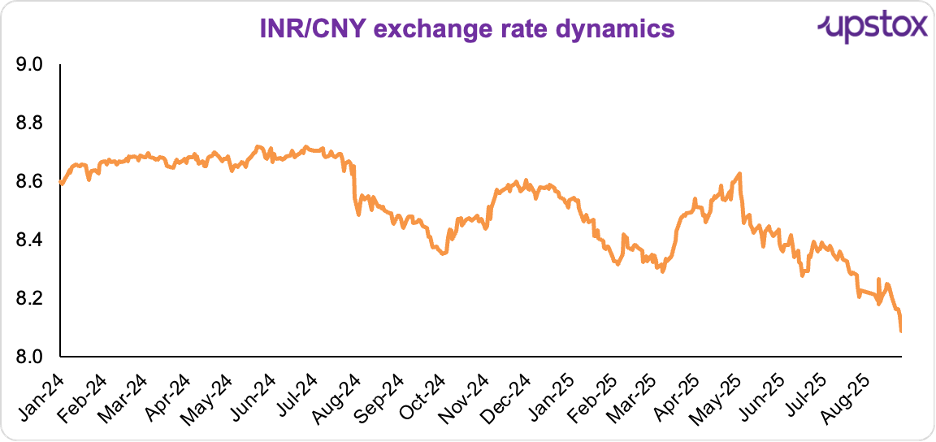

The INR has depreciated ~1.6% against the CNY in the past month

Rupee-watchers, brace yourselves. On 29 August 2025, the rupee slipped to 12.3862 per offshore yuan. Weekly fall? 1.2%. Monthly fall? 1.6%. But here’s the kicker, this isn’t just about forex charts.

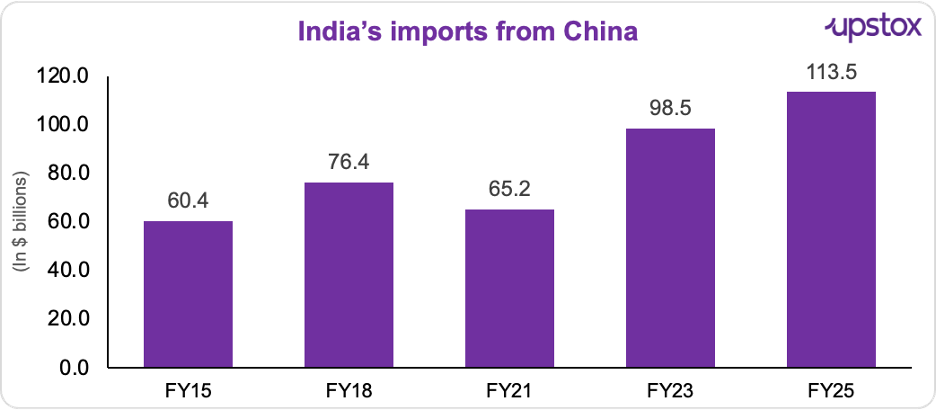

Why should you care if the rupee weakens against the yuan? Well, because it’s not just currencies moving. It’s about India’s $99.2 billion trade deficit with China, the highest ever. It’s about two neighbours competing in textiles, engineering goods, and chemicals.

And it’s about whether this slide is simply a market blip… or a sign that India’s trade resilience is being tested.

Here’s how the INR/CNY exchange rate has moved over the past year:

Source: Investing.com, Data as on 29/08/2025

Why is this happening?

Tariffs… no surprises here

Let’s start with the global angle.

The US has been busy raising tariffs, and India’s taken a bigger hit. In August 2025, Washington doubled tariffs on Indian goods to 50%, while Chinese exports still face a lower average of 30%. The result? Indian products suddenly look less competitive in global markets.

Currency traders didn’t miss the signal. Over the past four months alone, the rupee has slumped nearly 6% against the yuan. And that’s a big deal because India and China go head-to-head in the US market, especially in textiles, engineering goods, and chemicals.

FIIs are voting with their wallets

In 2025 alone, FIIs have yanked out $12.8 billion from Indian stocks. Between June, July, and August, the exodus got louder. Why? Because markets like China, South Korea, and Taiwan suddenly looked shinier, better earnings upgrades, cheaper valuations, and stronger growth tailwinds. Take March 2025, for example: FII inflows into China hit $1.2 billion in a single week, the largest in the last five months.

Hedging + Speculators = Rupee pressure

Indian importers are hedging more to protect against currency swings. That means higher demand for yuan, and less love for the rupee. Add speculators piling on bearish bets amid the volatility, and you’ve got another reason why the rupee is sliding against the yuan.

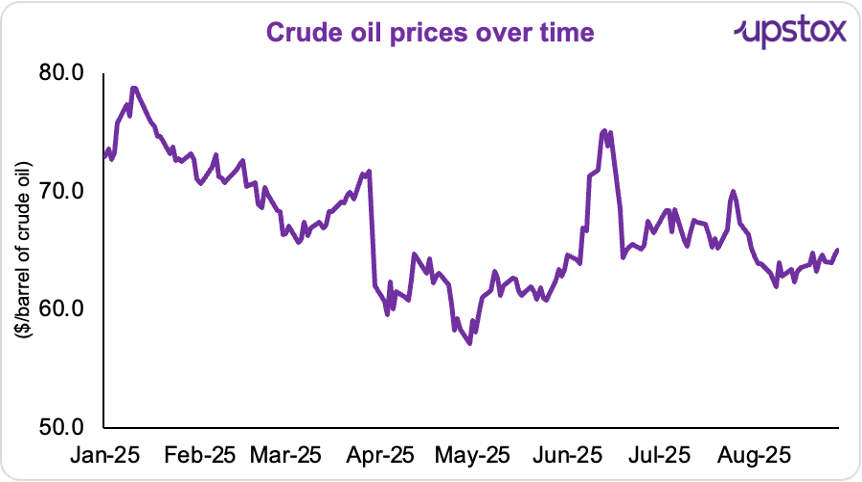

Rising crude oil price

Crude prices surged earlier this year, pushing up India’s oil import bill. More imports mean more dollars leaving the country, which limits the rupee’s room to maneuver. Add rising oil costs to the mix, and India’s trade deficit widens, putting extra pressure on the INR against major currencies.

Source: Investing.com, data as on 29 Aug, 2025

Huge trade deficit

India’s trade with China hit $127.7 billion in FY25, but the deficit is widening fast, from $44 billion in FY21 to $99.2 billion. A high trade deficit means more money flowing out to pay for imports, pushing up demand for yuan. So, who’s buying all that yuan? And who ends up bearing the cost? The rupee, which keeps sliding against the Chinese currency.

Source: ET

What’s the real impact?

First, the silver lining..

Export competitiveness

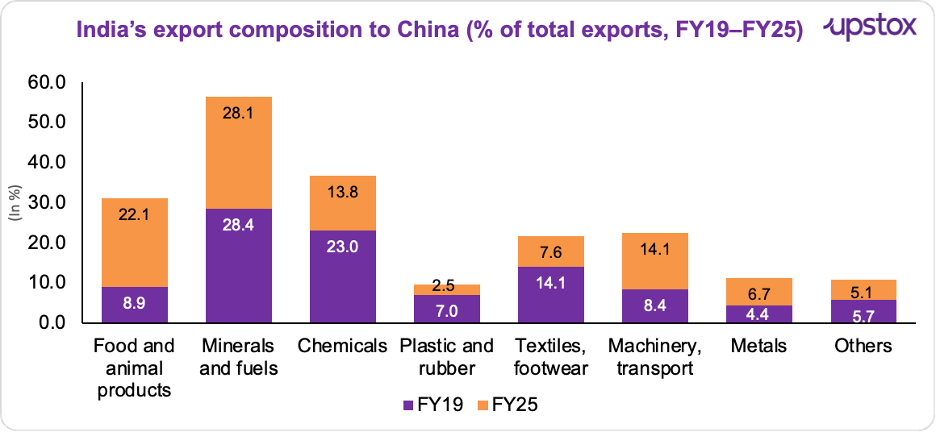

Two decades ago, India made up 42.3% of its bilateral trade with China. Today, that share has shrunk to just 11.2%. A weaker rupee against the yuan could actually help India claw back some of that lost ground.

Why? Because when the rupee drops, Indian goods suddenly look cheaper to Chinese buyers. Agriculture and fuels may not respond much to currency shifts, but manufacturing-heavy sectors - textiles, chemicals, and machinery, are a different story. These are price-sensitive markets where even a small cost edge can swing contracts India’s way.

And the opportunity is massive. ICRIER studies show India’s untapped export potential to China is $161 billion, almost ten times what we currently ship. Nearly 74% of this potential lies in medium and high-tech sectors, compared to today’s exports that are still dominated by low-value raw materials.

That means India could use the weaker rupee as a lever to diversify its export basket, tapping into products like telephone sets, aircraft, turbojets, motor vehicle parts, and photo-semiconductor devices.

Right now, exports to China are ~$14.3billion. These are led by ores, slag and ash ($2.5B), organic chemicals ($1.2B), mineral fuels, oils, and distillation products ($1.2B), among others.

In short, the sliding rupee may look like bad news on the surface, but for Indian exporters eyeing the Chinese market, it could be the very tailwind they’ve been waiting for.

Source: Moneycontrol

Increased remittances

If you know someone living in China, you’ve probably heard how they quietly cheer when the rupee weakens against the yuan. Why? Because every remittance suddenly packs more punch.

For instance, if an NRI wires back 1,000 yuan, it now converts into more rupees than before. And that extra bit can go a long way, helping families in India pay bills, cover school fees, or simply stretch their monthly budget further.

...Now, the dark side

Higher import costs

When the rupee weakens against the yuan, imports get pricier. That widens the trade deficit, puts more pressure on the rupee, and creates a vicious cycle of depreciation and cost-push inflation.

And here’s the real kicker, India is heavily dependent on China for some of its most critical products. According to GTRI analysis:

- In antibiotics like erythromycin, China supplies a staggering 97.7% of India’s needs.

- In electronics, it controls 96.8% of silicon wafers and 86% of flat panel displays.

- In renewable energy, the reliance is just as stark—82.7% of solar cells and 75.2% of lithium-ion batteries come from China.

- Even in everyday items, China dominates, 80.5% of laptops and 91.4% of embroidery machinery are sourced from across the border.

And the more we rely on these Chinese imports, the bigger the bill we end up footing every time the rupee slips.

Source: Investing.com

Inflationary pressures

When the rupee weakens, imports don’t just get pricier on paper; they hit your wallet directly. Everyday essentials that rely on foreign components suddenly cost more.

Think about it: your laptop, your car, even certain food items on your plate, if they’re imported or depend on imported parts, the final bill goes up. And when that happens, it eats into people’s savings and makes the monthly budget a whole lot tighter.

What is the RBI doing about this?

Now, the Reserve Bank of India (RBI) isn’t just sitting back and watching the rupee slide. It’s been quietly stepping in to smoothen the ride. In June, for instance, the central bank sold $3.6 billion in the forex market to manage the currency’s volatility.

But here’s the thing, the RBI isn’t trying to fight depreciation tooth and nail. The real effective exchange rate (REER), which measures the rupee against a basket of six currencies, stayed stable at 98.35 in July. Translation? The RBI is okay with some weakness as long as it doesn’t spiral out of control.

So what’s the RBI’s game plan? It’s a balancing act. On one hand, it curbs excess volatility to keep markets stable. On the other, it’s not losing sleep over the rupee’s fall against the yuan, because that actually makes Indian exports cheaper and helps trim the trade deficit with China.

Looking ahead…

Trade tensions, tariffs, and a sliding rupee, what does it all mean for India? Simply put, it’s a competitiveness crisis. Can India fix its manufacturing gaps and build real industrial muscle before the deficit with China grows even bigger?

The RBI isn’t panicking. Could it tolerate a sharper rupee drop if China weakens the yuan to cushion US tariffs? Yes. After all, both countries compete in machinery, electronics, pharma, chemicals, and textiles. Sources said a weaker yuan makes the RBI watch the rupee closely while mostly staying hands-off.

A weaker rupee may cushion exports in the short term, but the real test will be whether India can compete with China on scale, efficiency, and innovation.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story