Upstox Originals

RBI is turning India’s household silver into a source of credit

8 min read | Updated on November 14, 2025, 18:43 IST

SUMMARY

RBI’s updated rules bring silver loans under formal regulation for the first time. Loans can now be issued against silver jewellery, ornaments, and coins, with clear LTV limits. The move could unlock household silver worth billions and widen access to credit across India.

The RBI has amended its Lending Against Gold and Silver Collateral Directions, creating a unified regulatory framework for silver-backed loans

Gold has long been India’s go-to collateral for small and short term loans, it is widely accepted by lenders, and easy to borrow against.

Silver, though equally precious in culture, never enjoyed that same economic prestige. The reasons were practical. It is bulky and costly to store. That means higher storage, insurance, and logistics costs for lenders.

Then there’s volatility. Silver prices are perceived to fluctuate more than gold’s, largely because 50% of global silver demand comes from industries like electronics and solar. When manufacturing slows, prices crash. And since silver isn’t as liquid as gold, lenders face big risks if borrowers default.

Finally, one of the biggest reasons was regulation or the lack of it. Until now, there was no standard framework for lending against silver. Each lender followed its own rules for purity checks, valuation, and recovery, which led to disputes and losses. All that changes with the RBI’s updated rules, which now make silver-backed lending possible under a formal framework.

The new RBI rule for Silver loans

In a major move toward standardisation, the RBI has amended its Lending Against Gold and Silver Collateral Directions, creating a unified regulatory framework for silver-backed loans. The new rules apply to all commercial banks, co-operative banks, NBFCs, and housing finance companies (except payments banks), which must comply by April 1, 2026.

Under this framework, only silver jewellery, ornaments, and coins can be accepted as collateral, while raw bullion like bars or biscuits and financial assets such as ETFs or mutual funds are not allowed.

Borrowers can take loans for consumption or income generation purposes, including farm credit or small business needs. However, using these loans to buy more gold or silver or for speculative trading is not allowed. Banks can still extend working capital loans to businesses or manufacturers that use gold or silver as raw materials.

The RBI has also set limits on how much metal can be pledged for loans. The total weight of ornaments pledged by a borrower cannot exceed 1 kilogram for gold and 10 kilograms for silver. Similarly, for coins, the limit is 50 grams for gold and 500 grams for silver across all loans taken by the borrower. These limits help lenders manage risk as silver prices are more volatile than gold.

Further, lenders must verify the borrower’s ownership of the pledged metal and monitor large or repeated loans carefully. They cannot use the pledged metals to raise their own funds or lend against assets that are already pledged elsewhere. Personal loans must be repaid within 12 months, following a bullet repayment structure, where the entire amount is paid at the end of the term instead of through monthly installments.

Loan-to-Value (LTV): The RBI has also fixed how much a borrower can get as a loan based on the value of the gold or silver pledged. Lenders must ensure these limits are followed at all times during the loan period.

| Total consumption loan amount per borrower | Maximum LTV ratio |

|---|---|

| ≤ ₹2.5 lakh | 85% |

| > ₹2.5 lakh and ≤ ₹5 lakh | 80% |

| > ₹5 lakh | 75% |

Source: News articles

Making silver lending safer and fairer

To strengthen trust and transparency, the RBI has set clear standards for how lenders must handle silver-backed loans.

Fair valuation

The official market prices from IBJA or SEBI-approved exchanges will now be used to value gold and silver. The lower of the 30-day average or the previous day's closing price will be used. Only the metal's purity will be taken into account, not any gems or stones. This will make sure that borrowers get a fair loan amount.

Secure storage

Pledged metals must only be kept in branch vaults that are secure and run by trained staff. To make sure the collateral stays safe and sound, it needs to be checked for purity and surprise checks on a regular basis.

Transparent auctions

If a borrower doesn't pay back their loan, lenders must give proper notice, make the auction public, and set a reserve price of at least 90% of the current value (which can drop to 85% after two failed auctions). This makes sure that everyone gets a fair amount back and keeps borrowers from being undervalued.

Timely return and compensation

Lenders must give back the pledged metal within seven business days of the loan being fully paid back. If the lender causes any damage or delay, they must pay a fine of ₹5,000 per day for each day the release is late.

Silver’s growing story

The RBI’s move to include silver as loan collateral comes at a time when the its importance in both households and industries is rising fast.

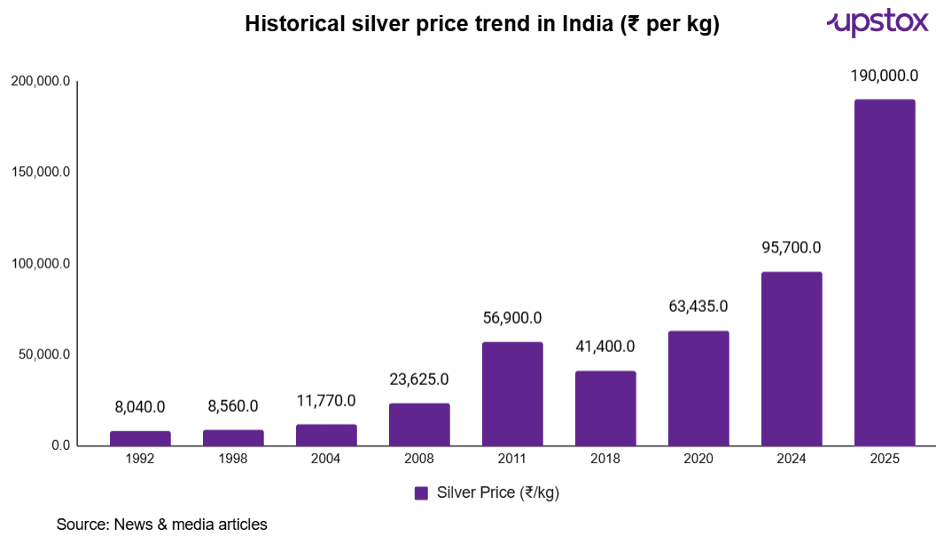

Silver prices recently touched nearly ₹1,90,000 per kg, which is the highest in decades, showing its growing demand as both an investment and an industrial commodity used for solar panels, EVs, and electronics.

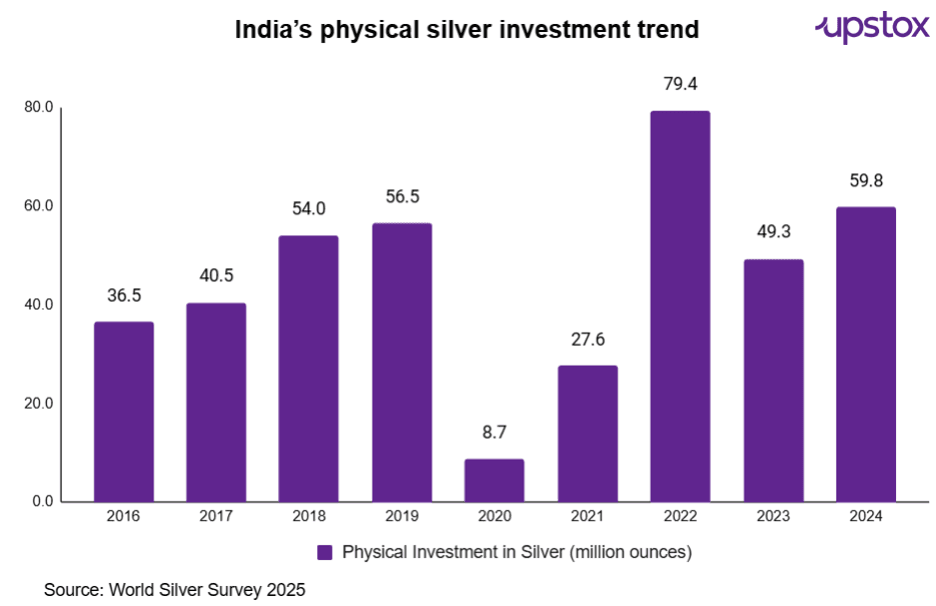

Investor interest has also increased, physical silver demand in 2024 jumped 21% year-on-year to 59.8 million ounces. Investments in silver bars, coins, and ETPs also rose to 195%, as many saw it as a more affordable alternative to gold.

India’s silver imports also rose 115% in 2024 to 7,695 tonnes, supported by stronger industrial demand and a cut in import duty from 15% to 6%, signaling structural, not seasonal, demand.

Broader impact

With RBI’s new framework silver can now be used as collateral for formal credit more easily by households, especially women, farmers, gig workers, and small traders. With nearly 57% of Indian women owning silver jewellery (World Gold Council), this move could unlock billions of rupees in idle household wealth. For loans up to ₹2.5 lakh, no detailed credit history is required, helping first-time borrowers build their financial track record.

The silver-loan market, once largely informal, will now follow uniform rules for valuation, storage, audits, and auctions. This reduces risk for lenders and ensures fair treatment for borrowers.

In essence, the RBI is turning household silver into a productive financial asset, widening access to credit and deepening financial inclusion in India.

Industry expansion

While some local NBFCs have already been offering silver loans informally, the RBI’s new guidelines aim to bring uniformity and regulation to this space. This change opens the door for leading Indian NBFCs and banks to explore silver as a new category of secured lending.

Although no major player has yet commented on the potential of silver loans, the coming year could see growing interest as the framework takes shape and silver’s role in the economy continues to rise.

Risks: What lenders and borrowers must watch out for

While the RBI’s framework adds much-needed structure to silver-backed lending, certain risks remain:

-

Volatility: Silver prices tend to be more volatile than gold due to their industrial usage. If sectors like electronics or solar slow down, prices could drop quickly, which would lower the value of pledged collateral and lead to more loan defaults.

-

Liquidity risk: Silver is less liquid than gold in secondary markets. If borrowers default, lenders may face challenges in timely auctions or getting fair value, especially for non-standardised jewellery or ornaments.

-

Purity and quality assessment risk: Unlike gold, where hallmarking is widespread, silver jewellery often lacks uniform purity certification. This can lead to disputes or reduced loan amounts due to valuation uncertainties.

-

Storage and handling costs: Silver is bulkier than gold. Lenders will incur higher costs for safe storage, logistics, and insurance. This may reduce the profitability of such loans, especially for small-ticket sizes.

-

Operational burden for lenders: Monitoring collateral limits (10 kg silver per borrower) and ensuring compliance with valuation and auction rules will increase operational overheads for banks and NBFCs, especially those unfamiliar with handling silver.

-

Risk of informal leakage: If formal lenders set too many rules or give low valuations, borrowers may still choose unregulated or informal silver pawnbrokers, which goes against the goal of financial inclusion.

These risks highlight the need for careful rollout, borrower awareness, and lender capacity building a full stack risk framework to ensure silver-backed lending scales sustainably.

Conclusion

The Lending Against Gold and Silver Collateral Directions, 2025 marks a major shift in how India views silver. From April 2026, silver will officially be accepted as collateral alongside gold. This change will help women, farmers, gig workers, and small business owners unlock the financial value of their silver, making it easier to access loans and bringing more fairness and transparency to lending.

As the framework takes effect, banks and NBFCs are expected to participate more actively, paving the way for a regulated market for silver-backed credit. Silver, which has long been seen as a symbol of tradition, is now about to play a big part in India's modern credit story.

About The Author

Next Story