Upstox Originals

India’s multi-metal rally of 2025

.png)

7 min read | Updated on August 06, 2025, 18:20 IST

SUMMARY

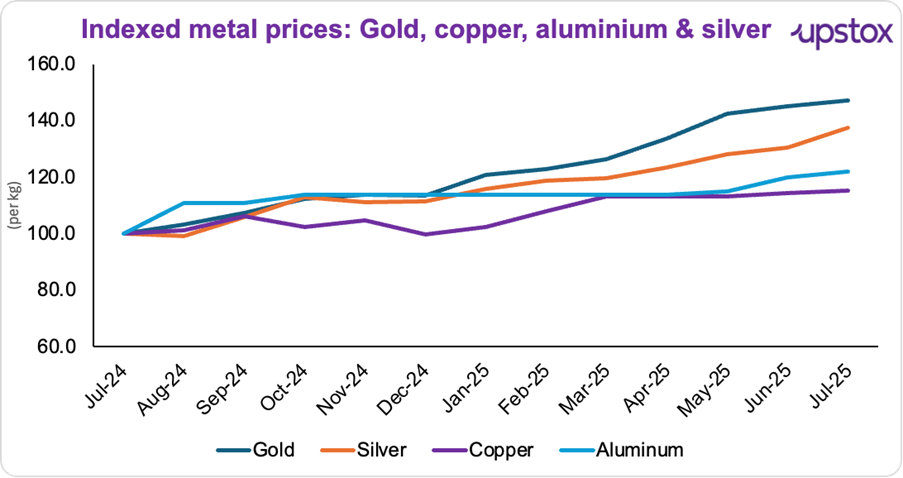

Gold is up ~10% and silver ~28% from July 2024 to July 2025 - and they’re not alone. Copper and aluminium are rising too. India is witnessing a “multi-metal rally,” driven by a mix of safe-haven demand and industrial growth. What does this unusual surge mean for the economy? Let us quickly dive in

In 2025, India is seeing a simultaneous surge in precious as well as industrial metals

Have you noticed gold prices crossing ₹100,000 per 10g, silver inching towards ₹116,000 per kg, copper staying strong above ₹890 per kg, and aluminium hovering steadily near ₹250 per kg?

Analysts call this a "multi metal rally" - an event where both precious metals like gold and silver, and industrial ones like copper and aluminium, are rising together. Usually, they move in opposite directions: precious metals gain during uncertainty, while industrial metals rally with economic growth. But in 2025, India is seeing both surge at once.

Gold prices in India rose from ~₹90,000/10g in July 2024 to between ₹97,360 and ₹100,009 per 10 grams in July 2025, up ~8-10%. Silver surged ~28%, from ₹80,000-85,000 to ~₹113,000-116,000/kg. Aluminium and copper also climbed, with aluminium up ~10-15% to ~₹185-210/kg and copper soaring nearly 40% to ~₹900/kg.

Source: ET

What are the key drivers of this surge?

India’s metal rally is driven by two big forces: investment demand and industrial demand.

Investment demand: Safe-haven surge

When uncertainty strikes - wars, inflation, currency shocks, investors rush to safety. In 2025, metals like gold and silver have become go-to assets for wealth protection.

Gold

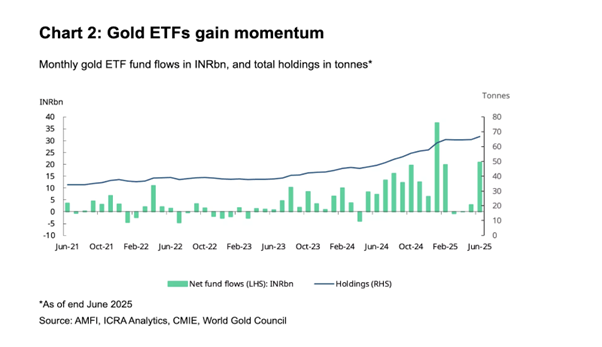

In 2025, gold is shining bright, and for good reason. With rising geopolitical tensions and economic jitters, Indian investors are flocking to safety. Just in June 2025, gold ETFs saw net inflows of ₹20.8 billion (US$242 million) — the highest since January. Holdings surged to 66.7 tonnes, marking the largest half-yearly addition ever.

Silver

Silver plays a double role, both as a safe-haven like gold and a key industrial metal. Recently, silver ETFs have gained popularity in India, with more retail investors opting for digital platforms over physical silver, highlighting its growing value as both an investment asset and industrial input. We recently did a more detailed analysis on silver’s price in Silver shining, what’s driving it?

In most crises, silver shines as investors seek safety. But COVID-19 flipped the script, factory shutdowns crushed industrial demand, pulling prices down despite its safe-haven label. The silver lining? Its dual role fuels a fast rebound when economies reopen, making it a smart bet for both security and strong returns.

| Issue | Start date | End date | Period (days) | Gold returns | Silver returns | Nifty 50 returns |

|---|---|---|---|---|---|---|

| Global financial crisis | Dec 2007 | May 2009 | 547 | 29.6% | 17.2% | -17.6% |

| Greek debt crisis | Sept 2010 | April 2012 | 607 | 28.9% | 42.9% | -4.8% |

| Covid 19 crisis | Jan 2020 | June 2020 | 152 | 5.1% | -20.0% | -18.5% |

| Russia Ukraine war | Oct 2021 | April 2023 | 576 | 17.9% | 14.6% | 1.9% |

Source: ET

And interestingly, the gold-silver ratio is much higher than its usual average of 65, meaning it takes more ounces of silver to equal one ounce of gold , increasing its appeal for investors looking to diversify or hedge against market risks.

| Quarter | Gold-Silver Ratio |

|---|---|

| Jul-Sep 2023 | 86 |

| Oct-Dec 2023 | 89 |

| Jan-Mar 2024 | 91 |

| Apr-Jun 2024 | 93 |

| Jul-Sep 2024 | 94 |

| Oct-Dec 2024 | 95 |

| Jan-Mar 2025 | 91 |

| Apr-Jun 2025 | 92 |

| Long-term avg. | 65 |

Source: TOI

Industrial demand: Fuelling the future

While gold and silver are booming as safe-havens, copper and aluminium are rising on the back of real economic growth, especially in India’s clean energy and infrastructure sectors.

Copper

Thanks to India’s clean energy and EV boom, copper’s demand is increasing. India’s push for EVs and renewables will boost copper demand 5.4x by 2047. No wonder Asia, led by India and China, now accounts for 74% of global consumption.

An average electric vehicle (EV) uses around 83 kg of copper in batteries, motors, and wiring. A single wind turbine needs up to 4 tonnes of copper for its generators, transformers, and cables.

| Company | Copper Consumed in 2024 (Rs Cr) | Copper % of Total Materials Consumed |

|---|---|---|

| Polycab India | 7,827 | 62 |

| KEI Industries | 3,221 | 54 |

Source: NDTV

This shows why copper is called the “metal of electrification.”

Aluminium

Aluminium prices are firm in 2025, driven by strong demand from automotive, construction, and FMCG packaging. Automakers use it to lightweight vehicles and boost fuel efficiency, while FMCG firms rely on it for cans and foils to keep products fresh.

What are the economic implications?

-

The US has doubled steel and aluminium import tariffs to 50% (from 25%), hitting India’s ₹7.32 lakh crore metal exports hard in FY25 (GTRI). A proposed 25% copper import duty by end-2025 is already lifting global copper prices. And what about precious metals? With over 90% of India’s gold and silver imported from Switzerland, UAE, and South Africa, any global price swings from these moves quickly ripple into Indian markets, raising costs for jewellers and industries alike.

-

Dollar drop = metal surge. Between Feb and July 2025, the US dollar index fell over 8%, thanks to rising US fiscal deficits and a dovish Fed. Since metals are priced in dollars, they’ve become cheaper for global buyers, spurring demand and pushing prices higher across the board.

-

Geopolitical tensions are shaking metal markets. Conflicts in Eastern Europe, the South China Sea, and the Middle East are disrupting mining, transport, and trade, triggering supply shortages. Sanctions on Russia, a key aluminium producer, have restricted exports, while instability in African copper hubs like the DRC is hitting supply reliability. These shocks are fuelling trader speculation and risk premiums, pushing metal prices even higher.

Has this happened in the past 10 years and why did it happen?

Yes, this has happened before, and quite recently too. In February 2022, as Russia deployed troops into eastern Ukraine, markets were rattled and investors rushed to safe havens. Gold prices on MCX jumped to near one-year high of ₹50,467.0 per 10g, while silver rose to ₹64,225.0 per kg.

Aluminium wasn’t left behind, it surged to a record ₹3,368.5 per kg in India, marking a 25%+ jump from late 2021 levels. The reason? Russia is a key global supplier of aluminium, and fears of supply shocks, along with rising energy costs and inflationary pressure, triggered a broad-based rally across both precious and industrial metals, much like the trend we’re witnessing again today.

Investor outlook

Over the past six years, gold has cemented its role as a wealth preserver, soaring 200% from ₹30,000 in May 2019 to over ₹1,00,000 per 10 grams by June 2025, outpacing the Nifty 50’s ~120% return. Analysts expect continued festive demand to support prices.

Silver could soon hit ₹1,20,000 per kg, though the rally may pause around $42 per ounce; festive demand and industrial use keep its long-term outlook positive.

Meanwhile, copper is catching investor interest – as prices hit record highs, Hindustan Copper’s shares jumped 6%, reflecting optimism from EVs, green energy, and infrastructure demand. Still, US tariff uncertainties remain a key risk to watch.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story