Upstox Originals

Mauritius, Dubai, Singapore... GIFT?

.png)

6 min read | Updated on July 09, 2025, 18:22 IST

SUMMARY

What happens when India sets up a new financial district with competitive tax structures, modern infrastructure, and a long-term vision to attract global capital? GIFT City - India’s first International Financial Services Centre - aims to answer that. With over 680 registered entities, a monthly exchange turnover exceeding $100 billion, and targeted policy incentives, GIFT City is positioning itself as a credible addition to the world’s financial hubs.

GIFT supports over 680 registered firms, records $102 billion in average monthly trading turnover

What does it take to build a credible international financial centre from the ground up? A blend of regulatory clarity, long-term planning, and infrastructure tailored to global finance.

In April 2015, the Indian government approved the development of its first International Financial Services Centre (IFSC) at GIFT City in Gandhinagar, Gujarat. Structured as a Special Economic Zone (SEZ), it was designed to streamline both inbound and outbound capital flows through a regulated Indian platform.

The stated objective, as outlined by PM Narendra Modi, was: “To create a world-class finance and IT zone for India to provide services not only to India but to the entire world.”

A decade later, GIFT City has evolved from vision to execution. It now hosts a range of financial and professional service entities - 31 banks, over 80 capital market intermediaries, 37 insurance and reinsurance firms, 55 fintech companies, and more than 140 alternative investment funds.

Several global technology firms including Google, IBM, and Oracle have also established a presence.

From a performance standpoint, the city supports over 680 registered firms, records $102 billion in average monthly trading turnover, and has facilitated cumulative banking transactions close to $1 trillion.

A quick comparison

| Feature | GIFT City | Mauritius | Dubai (DIFC) | Singapore |

|---|---|---|---|---|

| Max NRI Ownership in AIFs | 100% | <50% | <50% | <50% |

| Corporate Tax Rate | 100% exemption for any 10 out of 15 years - your pick. | 15% standard, 3% effective on foreign income | 0% for 50 years (non-mainland) | 17% standard, with selective incentives |

| STT / CTT / Dividend Distribution Tax | None | None | None | None for STT/CTT, GST may apply |

| KYC & AML Process Alignment | Aligned with Indian norms | Offshore norms | DIFC-standard compliance | MAS regulations, stringent |

| Average AUM | ~$10 billion | $80 billion+ | ~$4.0 trillion | $770 billion+ |

Source: Tree Life, Economic Times

While Singapore and Dubai remain global financial hubs, GIFT City is catching up, offering similar benefits at lower costs. “Why would you go to Singapore, Mauritius, or elsewhere if you can access the same benefits here at GIFT City IFSC?” asks Anil Joshi of Unicorn India Ventures.

The shift? NRIs and OCIs can now own 100% of a fund’s capital in GIFT City, versus the earlier 50% cap. “That rule change is pushing more FPIs toward GIFT over Mauritius or Singapore,” says Joseph. Add 0% capital gains tax (via IFSC exchanges) and 0% GST on expenses, and GIFT becomes hard to beat.

“The GST exemption saves fund managers a lot—regular funds need to grow 1.33x just to return principal,” says Siddharth Mody, Partner, J. Sagar Associates.

And ease of setup? “It’s now as simple as in Singapore or Mauritius,” says Siddarth Pai of 3one4 Capital. Global-grade perks, minus global-level costs.

The blueprint: GIFT

The core GIFT City currently spans 886 acres - but it's just getting started. Plans are in motion to expand beyond 3,300 acres, transforming it into one of the largest financial and tech hubs in Asia.

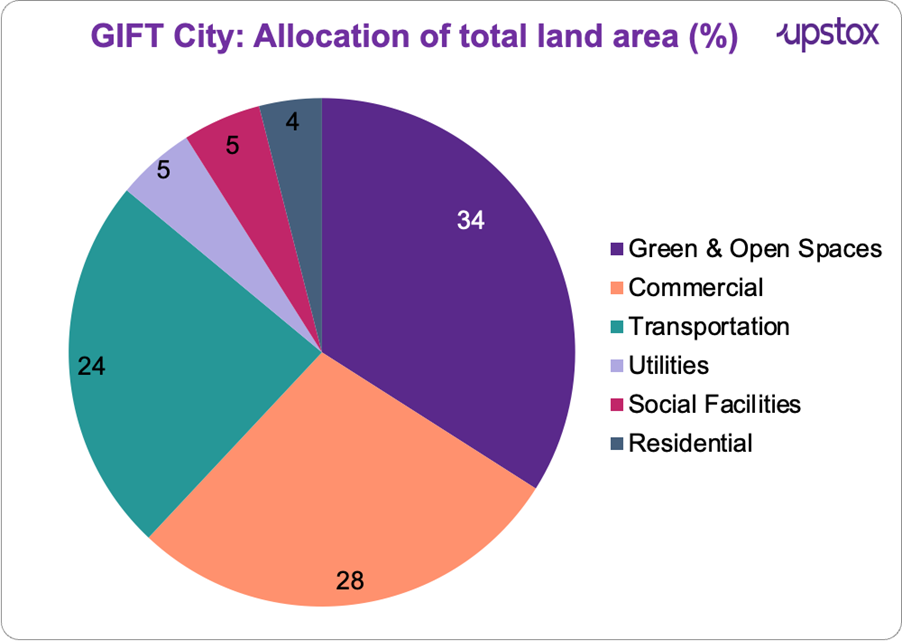

The current land use reveals a smart and future-ready blueprint. Of the 272.35 hectares (673 acres) in play, green and open spaces claim the largest slice at 34%, underscoring GIFT’s sustainability-first ethos. Commercial zones follow at 28%, while 24% is allocated to transportation. The rest includes 5% each for utilities and social infrastructure, and 4% for residential areas.

But when it comes to what’s actually been built—62 million square feet of developed space—the tilt toward business is clear - 67% is commercial, 22% residential, and 11% social infrastructure.

Source: The Hindu

Additionally, GIFT showcases urban innovation with the 158m GIFT Eye Ferris wheel, district cooling, automated waste systems, dual power supply, and smart water management—all coordinated by a 24/7 integrated control center.

Climbing the global ladder

As Tapan Ray, Managing Director and Group CEO of GIFT City puts it, “I am happy to share that GIFT City has climbed 5 places in the 2024 Global Financial Centres Index (GFCI), now ranking 52nd.” Since its debut in 2018, GIFT City’s steady climb in the GFCI reflects rising global confidence in its potential.

The fund magnet

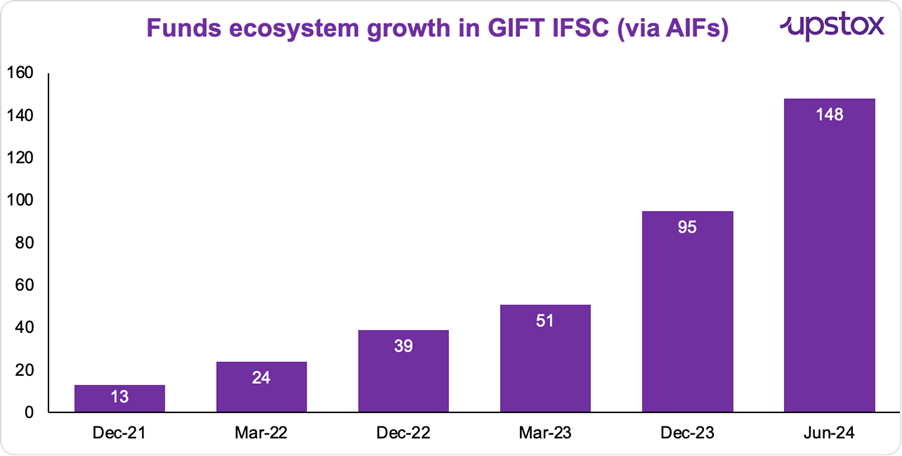

From borrowing flexibility to regulatory ease, GIFT City gives fund managers the tools to focus on what matters: performance. It’s no surprise the ecosystem here is scaling fast. The figures below represent the number of Alternative Investment Funds (AIFs) registered in GIFT IFSC as of the respective dates:

Source: Longfinance.net

Banking boom

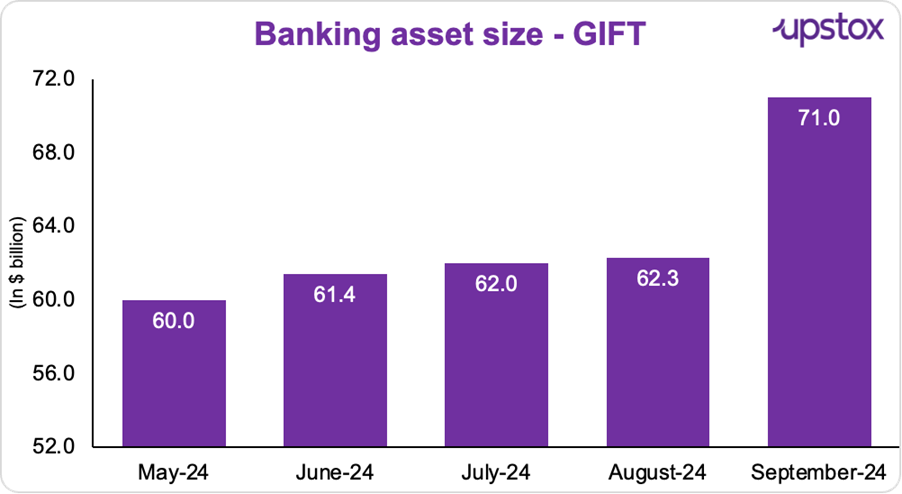

From balance sheet strength to investor traction, GIFT IFSC’s banking play is getting louder. Asset sizes have surged steadily in 2024—and it’s not just month-on-month. Zoom out, and the long-term story is even bigger.

As Akshay Kumar of BNP Paribas put it at the IFR Asia GIFT City Financing Roundtable 2024: “Speaking specifically about the GIFT City ecosystem and looking at the bank’s balance sheets, the asset size has probably grown by more than tenfold over the last four or five years.”

And what’s fuelling that? A mix of liberalised rules, international banks deepening presence, and growing fund flows looking for a competitive, India-linked base.

Source: Zyen.com

Sustainability gets real

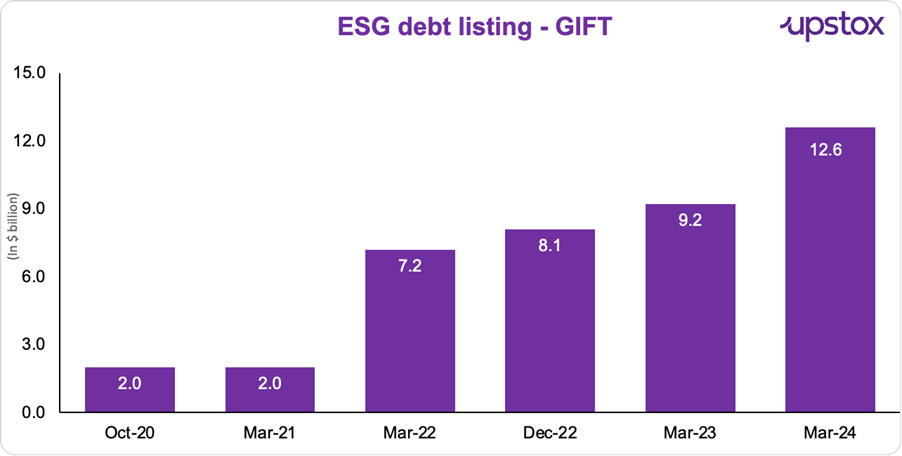

GIFT IFSC is fast emerging as a sustainability-first financial centre, integrating ESG principles into its core architecture. Debt markets have seen a massive rise in ESG debt listings—jumping from $2B in 2021 to $12.6B by March 2024. NSE IFSC has also launched an international sustainability platform.

In banking, policies now mandate 5% of loans to be ESG-focused, with $700M in green lending already deployed in FY24.

Source: Zyen.com

Final thoughts

GIFT City is quietly but confidently stepping onto the global financial stage. With enabling policies, improving infrastructure, and rising interest from international players, it’s beginning to show what a homegrown financial hub can look like.

The goal isn’t to replicate Singapore or Dubai, but to create a model that serves India’s scale and ambition. The vision is long-term, and the early signs suggest that GIFT is moving in the right direction.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story