Upstox Originals

Is the GST relief actually leading to a festive cheer?

6 min read | Updated on October 10, 2025, 14:58 IST

SUMMARY

The government has taken multiple steps to sustainably bolster consumption in India, a key growth driver. The latest is the GST 2.0 relief. With the ongoing festive as a key litmus test, are these measures working? On one hand, reports suggest e-commerce sales have surged, but some others suggest growth would’ve been muted without policy support. The key question, therefore, is - Is this a short-term festive bump or the start of a more durable recovery?

According to Datum Intelligence, online sales in India during the festive season hit ₹60,700 crore in the first week of 2025.

Why festivals matter for India’s consumption

The moment of truth is finally here!

Festive 2025 is now underway and is a sort of litmus test to check if these measures will help achieve the final goal.

Bolstered by these measures, most agencies also seem to share the optimism. For instance, RedSeer Consulting says that the combination of lower repo rates, higher incomes for rural households, and more money to spend for the middle class could lead to the best festive season in a long time.

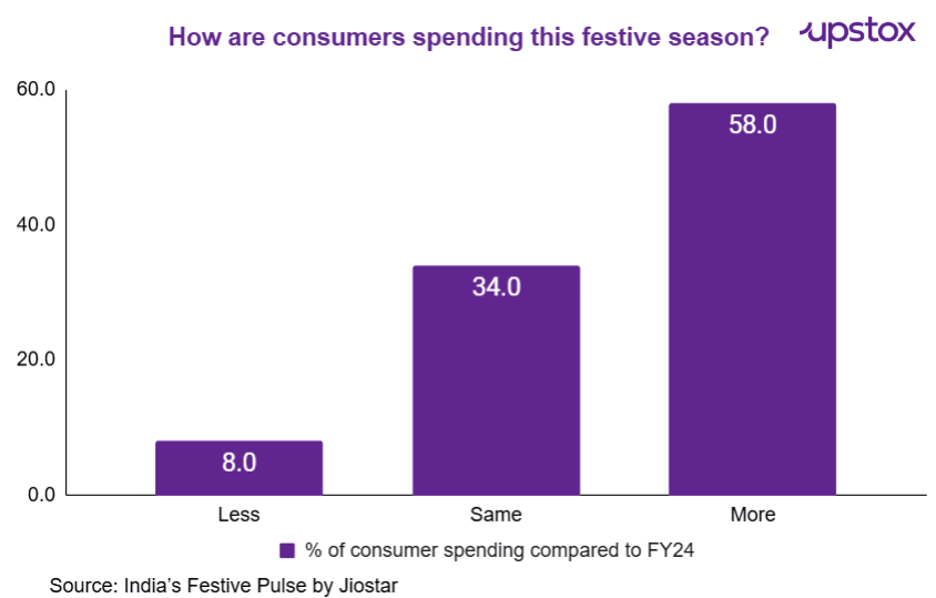

The 2025 JioStar Festive Sentiment Survey says that 92% of Indian shoppers plan to keep or increase their festive spending this year.

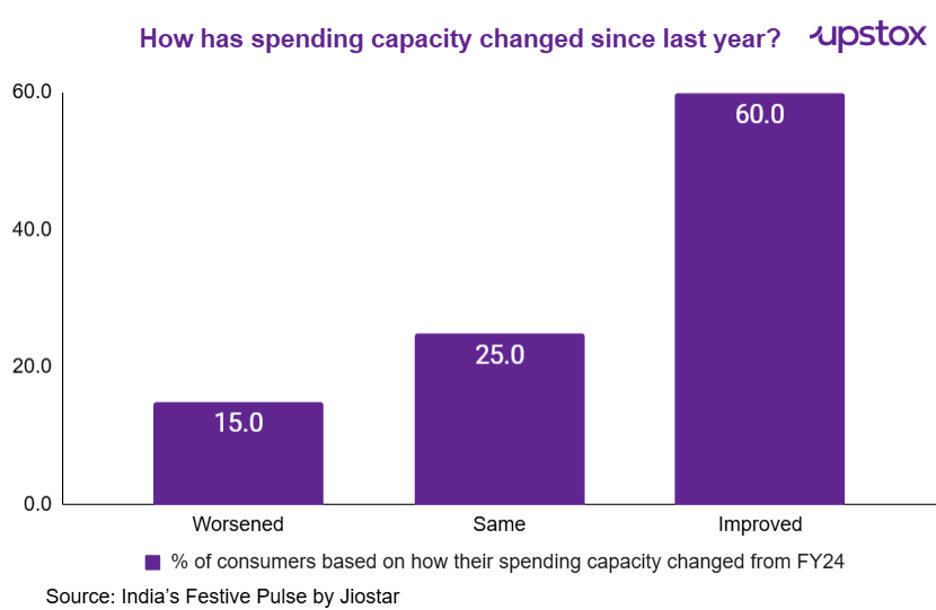

And 85% of consumers feel their spending capacity has improved or stayed the same compared to last year.

Key drivers of this growth?

E-Commerce

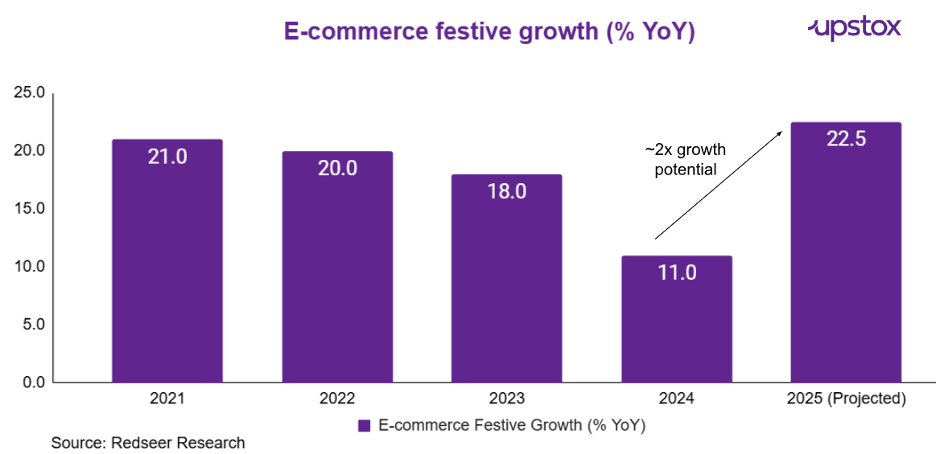

This festive season, e-commerce is expected to grow by 20–25% YoY, which is twice as fast as last year. It is expected that GMV from this festive season will be more than ₹115,000 crore.

According to Datum Intelligence, online sales in India during the festive season hit ₹60,700 crore in the first week of 2025. This was a record-breaking 29% YoY increase, making it the best opening ever for digital retail. Incredibly, almost half of the season's total GMV came in the first week.

Mobile phones had the biggest share at 42%, but appliances (up 41%) and groceries (up 44%) were the fastest-growing categories. This was because of GST 2.0 price cuts and the rise of quick commerce. Consumer electronics and home goods also saw strong growth in the double digits.

Offline / Brick-and-Mortar Retail

Offline retail is expected to bring in more than ₹4.8 lakh crore in sales during the festive season, which is an 11% increase from last year. Retailers are also using omnichannel strategies to make sure that customers can easily browse and buy.

Quick and value commerce

Quick commerce platforms like Zepto, Blinkit, and Swiggy Instamart are growing at an amazing rate of about 150% year-on-year before the festive season. Value commerce, on the other hand, is growing at a rate of 30–35% because it focuses on low prices and a wide range of products.

Below is a quick summary of select platform-wise highlights:

| Platform | Festive-specific Commentary (2025) |

|---|---|

| Flipkart | With GST reforms improving affordability and sellers gaining renewed confidence, the conditions are ripe for sustained consumption across categories through October and beyond. |

| Amazon | Amazon saw a record 38 crore visits in the first 48 hours, with more than 70% coming from beyond the top nine metros. Premiumisation was a clear theme, with smartphones priced above ₹20,000 growing 50% YoY, QLED TVs up 23%, and Mini-LED TVs up 27%. |

| Zepto | Zepto brought back its ‘Fastest Sale Ever’ on September 11, offering discounts of up to 90 per cent across categories from gadgets and toys to festive decor. |

| Blinkit | This is the first festive season we are delivering iPhones and premium electronics within minutes. We’ve doubled our SKU count and added high-value gift hampers, lighting kits, and festive decor to match demand peaks. |

Source: Company reports, news articles

Mid festive check - what are the underlying trends telling us

With Navratri now behind us and Diwali fast approaching, we take stock of some key on-ground developments.

Please note that some of the data referenced here may be subject to a reporting lag and is primarily sourced from news reports. As such, we recommend interpreting these figures as indicative of broader trends rather than definitive metrics.

We will continue to closely monitor these patterns through the Diwali season, keeping an eye out for any meaningful uptick—or, conversely, any signs of a negative divergence.

| Category | Updates |

|---|---|

| Electronics and Appliances | Release in pent up demand due to GST relief and interest rate cut have translated into good growth in ACs, refrigeration and TVs. Early reports point towards a continued premiumisation |

| Fashion, Beauty & Personal Care, and Home | Fashion and Beauty are driving almost half of the revenue. |

| Mobiles | According to Redseer, on Day 0+Day1 (22nd , 23rd sept), online retail GMV grew ~25% YoY, which is almost 4-5x of the same time last year. |

| Luxury and Aspirational Goods | Premiumisation remained a defining trend in the current season as per Amazon Growth. Demand from smaller towns has also been strong. |

| Automobile | Automobile festive sales grew 34% YoY during the last week of September. Passenger vehicle sales grew 34.8%, while 2W sales were up 36% |

| FMCG goods | Most of the FMCG saw 5-15% volume growth, led by E-commerce and Quick-commerce sales channels. There are some signs of a pick up in urban consumption |

| Jewellery | Despite higher gold prices, organised jewellery players saw strong growth (as high as 60% in some cases). The reduction of gold content in jewelry has made product offerings affordable |

Source: Media Articles, Company commentary

Broader trend of festive sales 2025

As per data released by the Confederation of All India Traders (CAIT), festive sales in India have increased almost 4x between 2021 and 2024. This year the agency estimates that the festive sales are expected to increase by another ~10-11% YoY.

According to Praveen Khandelwal, Secretary General of CAIT, the projected record festive sales are fuelled by two primary, interlocking factors: the recent GST rate cuts and the massive surge in demand for 'Swadeshi' (indigenous) goods.

On an absolute basis, this number may seem to be an all-time high, but the growth rate of 11% is slower than 13% growth last year, and much lower than the previous years. While one can argue that the base of consumption has grown and so a moderated growth rate is expected, it can also be argued that without most of these government measures, consumption might not have meaningfully increased this festive season.

Is this the inflexion point for India’s consumption story?

India's 2025 festive season could be a turning point in the consumption cycle, thanks to supportive policies, more online channels, and a good macroeconomic environment.

There are strong early signs in e-commerce, quick commerce, appliances, fashion, and cars. This year's festive demand points to a bigger change in how people shop, as families make their first big purchases and hit new lifestyle goals.

This year could be the start of a long-lasting, consumption-led growth phase for India if it can balance festive cheer with structural reform and fiscal discipline, and get through the immediate logistical and supply chain problems.

About The Author

Next Story