Upstox Originals

Is the AI ecosystem at risk?

6 min read | Updated on November 25, 2025, 21:57 IST

SUMMARY

Recent news has but a spotlight on a potential AI bubble. While the focus is only on the top players, an entire ecosystem could possibly be looking at tough times if the bubble indeed bursts. Global AI funding tripled to $97 billion in Q3 2025, now 34% of all VC capital. Speculative pricing, circular financing, and unchecked optimism echo the patterns of past tech bubbles.

Despite being predicted to lose $10 billion in 2025, OpenAI reached a $500 billion private valuation in early October 2025

A market high on momentum

The stats from OpenAI's most recent investment round will blow your mind. Despite being predicted to lose $10 billion in 2025, the company reached a $500 billion private valuation in early October 2025. Headlines proclaim "AI reshaping the world," and investors are applauding.

When you zoom out, global AI venture funding tripled from $32 billion in Q2 2024 to $97 billion in Q3 2025 alone. While the situation seems thrilling, it does bring back memories of the dot-com boom of the late 1990s, when values outpaced fundamentals by a wide margin.

Market context: Numbers you can’t ignore

AI now accounts for an unprecedented portion of venture funding worldwide. According to the most recent data from Finrofca and Qubit Capital, AI firms raised $89.4 billion globally in 2025, or 34% of all venture funding.

While late-stage acquisitions frequently reach 30–50x, early-stage AI businesses increasingly attract revenue multiples of 10–25x. In a select few cases, businesses are also trading at multiples more than 100x sales.

| Stage | Min Multiple | Median Multiple | Max Multiple |

|---|---|---|---|

| Seed | 10 | 17 | 25 |

| Series A | 15 | 21 | 30 |

| Growth/Late-Stage | 30 | 40 | 50 |

Source: Company reports, news articles

This illustrates not only the network moat of AI but also speculative pricing. According to Harvard research, AI infrastructure capital expenditures, not profits, accounted for 92% of the rise in the IT GDP in 2025.

Source: News articles, government documents

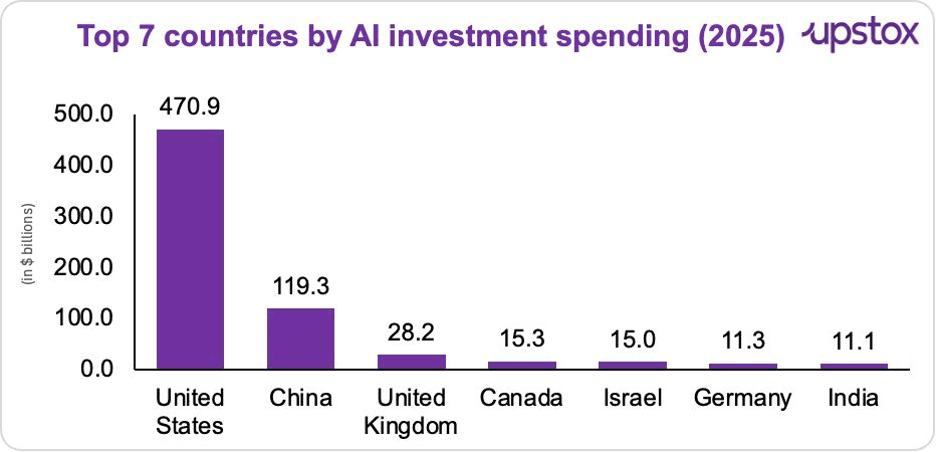

Global AI investment is highly concentrated, led by US hyperscalers and Asia’s sovereign-backed ventures.

How AI funding works: The Illusion of infinite growth

Then there's circular financing. AI firms are funded by major chipmakers like AMD and Nvidia. Even while real customer income isn't increasing, these businesses utilize that money to purchase more Nvidia and AMD chips, which increases demand, raises chip revenues, and justifies valuations.

It's a cycle where money continues to flow within the AI ecosystem rather than from actual clients. This is comparable to the "round-trip" investments of the dot-com era, in which funds were transferred between venture capitalists and entrepreneurs to provide the impression of traction and market growth.

Everyone appears to be winning on paper!

What’s fuelling this: The ingredients behind the hype

Several powerful forces explain the frenzy:

-

Technology leap: GPT-5 and multimodal systems now handle language, vision, and decision-making seamlessly pushing industries from finance to healthcare into transformation mode.

-

Venture capital surge: Funding has more than doubled in 12 months, from $72 billion in FY24 to $150 billion in FY25.

-

Institutional endorsements: SoftBank’s Vision Fund, BlackRock, and sovereign funds are all piling in, making AI appear “too big to ignore.”

-

Global competition: Governments are racing to secure AI sovereignty. Incentives, tax breaks, and public–private partnerships have turned AI into an arms race for innovation leadership.

AI companies in focus

A small number of companies are reaping the majority of the benefits, not because they are lucrative, but because they control the AI stack's choke points.

OpenAI is at the center of gravity, where each new model release broadens its licensing reach and eliminates entire product categories with a single API. Anthropic and xAI are riding the same wave, raising billion-dollar rounds with little revenue because investors believe the foundation-model race will result in only a few global winners.

However, the real money is in the hardware. Nvidia and AMD do not require AI apps to thrive; all they need is the training treadmill to keep running. Every dollar raised by AI startups translates into GPU demand.

Finally, the services layer, where some of the largest accounting and consulting companies are able to package AI transformation services for banks, insurers, consumer brands, and pharmaceutical companies. They do not need to invent AI; deployment pays exceptionally handsomely.

Are we ignoring the risks?

Despite the excitement, several warning signs have emerged:

-

Extreme volatility: Nvidia’s stock swung over 25% in a week in May 2024, wiping out nearly $400 billion in market cap before bouncing back. AI-focused ETFs like Global X AI & Tech (AIQ) have seen trading volumes triple, hinting that speculation not fundamentals is driving sentiment.

-

Revenue mismatch: About 65% of AI unicorns earned under $50 million in 2024, per CB Insights.

-

Regulatory uncertainty: The EU’s AI Act and upcoming U.S. disclosure rules could sharply raise compliance costs and reshape tech earnings overnight.

-

Environmental strain: Training large models consumes massive energy one run can power 5,000 homes for a year. Microsoft’s AI-linked water use rose 34% in FY24, Google’s 20%, drawing ESG concerns.

-

Expert warnings: JP Morgan compares the rally to “late-cycle crypto exuberance.” Global regulators, from the Bank of England to the IMF, warn AI ETFs could amplify market volatility.

Even OpenAI’s CEO Sam Altman concedes that parts of the sector are “kind of bubbly,” underscoring how exuberance may be outpacing value creation.

How could this burst?

History shows bubbles don’t just deflate, they snap, often spreading damage beyond their origin. AI could follow a similar trajectory, marked by concentration risk, governance failures, and technological disruption.

-

Concentration risk: The top five companies Nvidia, Microsoft, Amazon, Alphabet, and Meta account for nearly 70% of all AI-related market cap gains in 2024–25. A stumble by even one could erase trillions in equity value and ripple across indexes from the Nasdaq 100 to India’s IT sector.

-

Governance and legal risks: AI’s growth is outpacing regulation, leading to rising lawsuits and compliance hurdles. Over 200 AI-related cases were filed globally in 2024, triple 2022 levels over data bias and copyright breaches.

-

Tech disruption risk: New technologies like quantum or neuromorphic chips could replace GPUs, making today’s AI hardware and even giants like Nvidia obsolete. While no one can time the tipping point, the pattern feels familiar: exuberance meets fragility, momentum turns to correction and when it does, the fallout could redraw the global tech landscape.

Lessons from history

AI isn’t the first tech craze to grip investors.

During the dot-com era, the NASDAQ Composite rose 400% between 1995 and 2000, only to crash 78% within 30 months. Companies with no revenue but lofty visions vanished. Yet firms like Amazon, Google, and Microsoft survived, evolved, and went on to command a combined market cap exceeding $8 trillion today.

Parting thought

The biggest lesson for investors is this - don’t confuse momentum with durability. Hype can make valuations explode, but long-term returns still come from companies with product-market fit, repeatable revenue, and real moats. And remember VC money isn’t loyal. It chases heat.

The moment confidence cracks, capital disappears. Just look at web3: in the 2022 crypto unwind, venture funding collapsed almost 80% in half a year. AI could face the same whiplash if the narrative shifts from promise to disappointment.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story