Upstox Originals

Inflation is falling, but why doesn’t it feel like it?

5 min read | Updated on October 09, 2025, 15:46 IST

SUMMARY

Inflation at 2.6% for FY26, sounds like good news, doesn’t it? But step outside the reports, and the story feels different. Prices of rent, healthcare, and education keep climbing, even as the data says things are cooling. The gap between what the charts show and what wallets feel is growing - and it’s changing how India lives, spends, and saves. So, is inflation really easing, or are we just measuring it wrong?

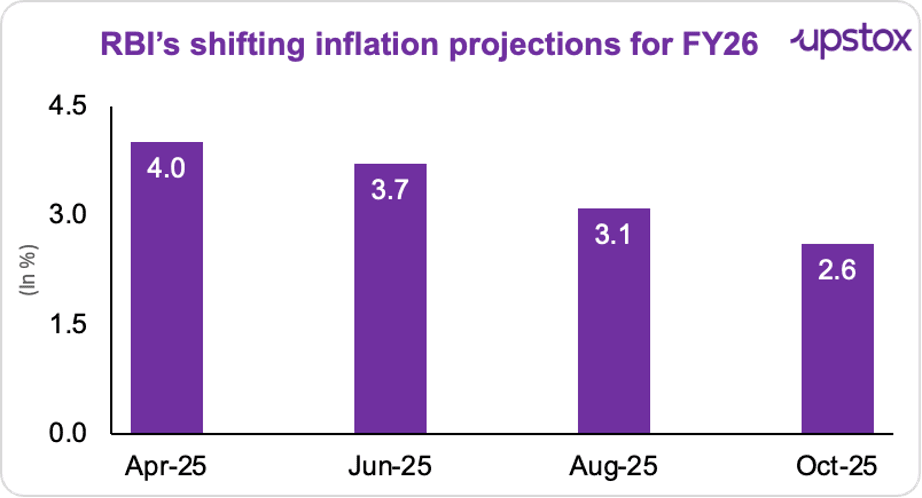

RBI has recently lowered its inflation projection for FY26 by another 50 bps to 2.6%

Your rent just got pricier. The school fee slip was higher than last year. And hospital bills? Let’s not even start. Meanwhile, official reports tell a different story. According to the RBI, FY23–24 saw inflation at 5.4%, FY24–25 cooled slightly to 4.6%, and now the RBI says FY26 will hit just 2.6%.

Here’s how RBI’s projections for FY26 have shifted over the year:

Source: CNBC

On paper, prices are cooling. In reality? Cloud services, rent, healthcare, education, and lifestyle costs are climbing faster than these numbers suggest. That gap between official CPI and what you actually pay is where the story gets interesting.

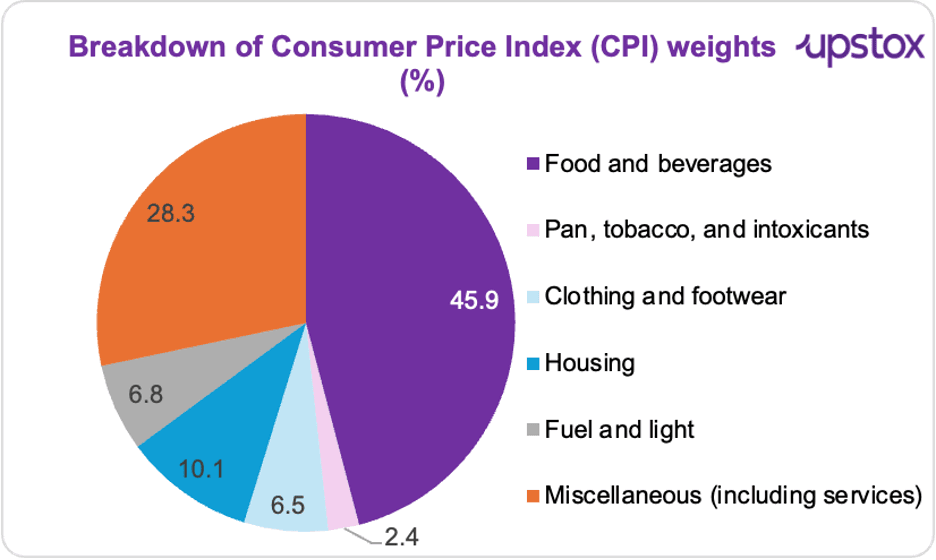

So how does the RBI arrive at a number that feels so out of touch with reality? The answer lies in the CPI basket, the official way India measures inflation.

Understanding CPI and why it feels different in your wallet

The Consumer Price Index (CPI) is how India officially measures inflation. It looks at the price of a basket of things people buy - food, fuel, rent, school fees, healthcare, transport, and more. Each item in this basket is assigned a weight, reflecting how much it contributes to your overall spending.

Source: RBI

But.. CPI feels out of step AND often doesn’t reflect reality. Why?

Outdated items in the CPI basket

India’s CPI is still based on a 2012 consumption basket. Back then, smartphones, laptops, Swiggy, Zomato, Netflix, OTT subscriptions, gym memberships, cab rides, and online education were either luxuries or didn’t exist. Historically, CPI included items like radios, tape recorders, cassettes, CDs, DVDs, and trunks, things most people don’t buy anymore, but they’re still counted today.

Weightings and urban-rural differences

Here’s the catch: For the poorest 40% of households, food alone takes up about half of spending. Overall, food and fuel combine to roughly 60% of household budgets. That’s why cheap onions or petrol can make inflation look low, even when rent and healthcare are climbing.

Urban households spend around 60% on non-food items - housing, healthcare, school fees, lifestyle, but CPI doesn’t fully account for this. And data backs it up. Household Consumption Expenditure Survey 2023–24 shows rural households spent 47% on food and 53% on everything else; urban households spent 40% on food, 60% on non-food items. One number, one basket, and yet it fits no one perfectly.

So, what “REAL” inflation feels like?

Now, step outside the spreadsheets for a second.

Look at the rising healthcare costs.

It’s rising faster than your salary can keep up. Costs in India are projected to jump 13% in 2025, above the global average of 10%, and up from 12% a year earlier. And health insurance growth slowed to 9% in 2024–25 (from 20% last year) because premiums are becoming more expensive, fewer people are renewing their policies, and hospital bills are costing more.

Education costs are climbing

A LocalCircles survey found that 80% of parents in private schools saw fees rise over 10% this year. In Delhi, Mumbai, Bengaluru? Some schools hiked fees by 30%.

No centralised rules. Maharashtra allows 15% rises every two years, Karnataka 10% per year with audit justification, but enforcement is weak. Families often get stuck in multi-year legal battles.

The bigger picture: NSSO data shows urban private unaided school fees have grown 169% in the last decade, far outpacing inflation and salary growth. Middle-class metro families now shell out ₹1.5–5 lakh per year per child on tuition, uniforms, transport, and miscellaneous charges.

Housing

Rents typically see annual increases of 5–10%, often outpacing inflation. Median home prices in India have more than doubled in the last 10 years. Analysts now forecast a rise of 6.3% in 2025 and 7% in 2026, according to a Reuters survey of 20 property analysts. In the CPI basket, healthcare weighs moderate and dining out or entertainment is tucked into “miscellaneous.”

Actual costs for these items are rising much faster than the official CPI suggests, which is why your wallet feels the pinch even when inflation looks tame on paper.

Why you should care?

This isn’t just an academic quibble. The RBI’s inflation numbers shape decisions that affect your wallet every single day:

-

Interest rates: If inflation is lower, RBI may cut rates. Sounds good if you’re a borrower, but dangerous if real inflation is 8%, your savings are getting silently eroded.

-

Salary hikes: Companies benchmark raises to CPI data. If official inflation is 2.6%, don’t expect HR to justify 12% increments, even if your rent just went up 20%.

-

Investments: Bond yields, stock valuations, even real estate demand, all hinge on the inflation outlook. A flawed measure means flawed investment strategies.

-

Policy design: Subsidy allocations, tax breaks, pension adjustments, all use CPI as a reference. If CPI underestimates the true cost of living, millions lose out.

-

Essentially, when RBI misreads inflation, the entire economic system gets misaligned.

Before you go

In every home, wallets are stretching in different ways - school fees, rent, healthcare, and daily essentials all climbing. Is 2.6% inflation really what people are feeling in Mumbai, Bangalore, or Delhi? With costs in cities and towns evolving so differently, wouldn’t separate inflation indexes give a clearer picture? May, that’s when the real picture of cost-of-living pressure comes alive..

So next time you see a low inflation headline, ask yourself, does it really match your wallet’s story?

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story