Upstox Originals

India’s market shift: FIIs exit, DIIs lead

.png)

6 min read | Updated on August 14, 2025, 14:36 IST

SUMMARY

They came, they bought, and in 2025, they sold ₹79,344 crore (~$9.2 billion) worth of Indian equities by July. FIIs have been playing hot-and-cold all year - one month buying big, the next dumping stocks. This seesaw has battered IT and financial sectors, while domestic investors quietly snapped up deals. So what’s really going on? And how will FIIs’ pivot to debt and small-caps reshape the market?

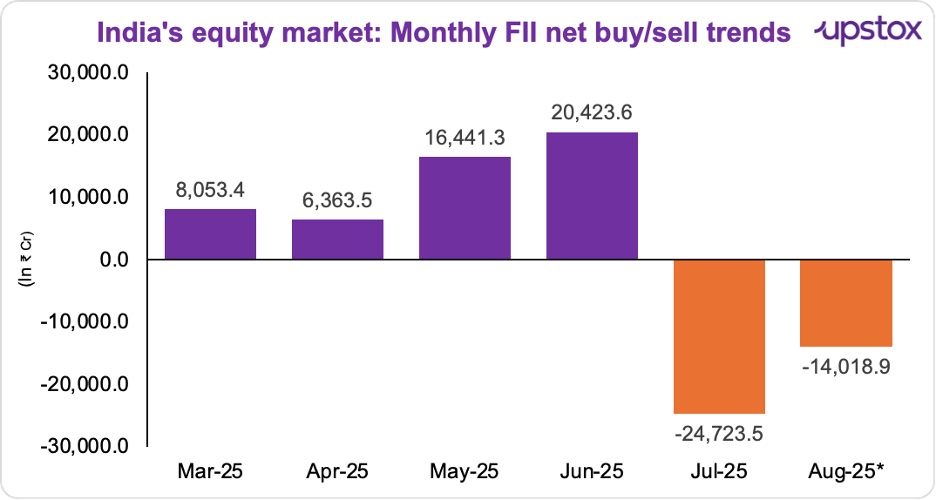

FIIs have offloaded ~₹40,000 crore worth of Indian equities in July-Aug 2025

FIIs in 2025? Think of a high-speed rollercoaster with no seatbelts. One month, they’re buying like there’s no tomorrow; the next, they’re stampeding out the door.

June 2025 saw a buying spree - foreign investors scooped up Indian stocks with both hands. But come July, the mood flipped hard. They offloaded ₹24,723 crore in just 31 days. August isn’t offering any relief either, with almost ₹14,000 crore already gone.

The real plot twist? How they’re betting. The FII long–short ratio — basically a “market confidence score” — was a bullish 36.4 in late June. By late July, it had crashed to 14.8, signalling a heavy tilt towards bearish bets. Net contracts nosedived from -38,123 to a jaw-dropping -1.45 lakh.

Source: Moneycontrol as on Aug 7, 2025

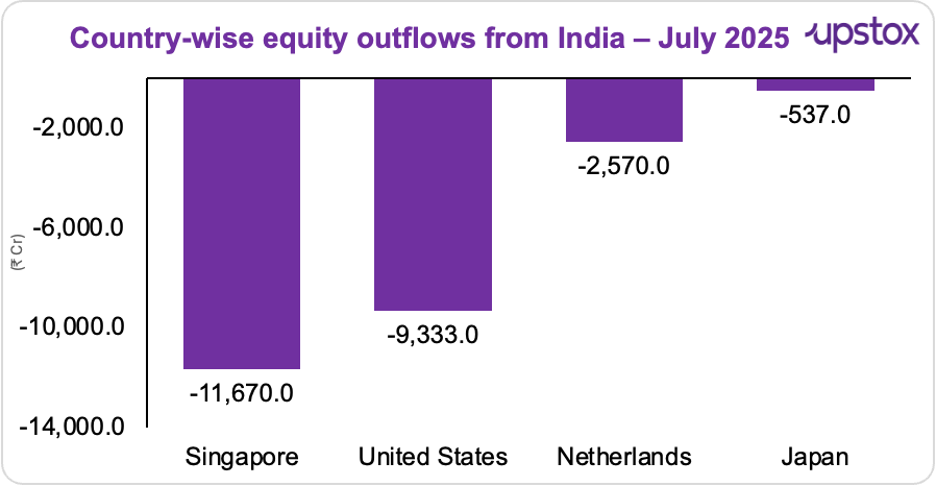

So which countries led the big sell-off? Singapore was on top, pulling out over ₹11,000 crore, no surprise, since a lot of foreign money into India flows through there. Let us take a look:

Source: ET

As highlighted in Silent Equity Transformation, while the overall FII holding in India has been steadily reducing, they still own ~17-18% of all companies listed on the NSE - that’s a pretty big slice of the pie.

What’s driving FIIs’ volatility?

Several converging factors explain the significant FII selling in Indian equities:

Sectoral weakness

The MSCI India Index is strutting around at 23.3x earnings — that’s not just pricey, that’s 82% costlier than your average emerging market.

Now picture this: investors are lined up for the much-awaited earnings buffet… and when the lid lifts, the food’s cold.

FIIs, who’d been side-eyeing the exit all along, didn’t wait for dessert. July 2025? That’s when the dam burst.

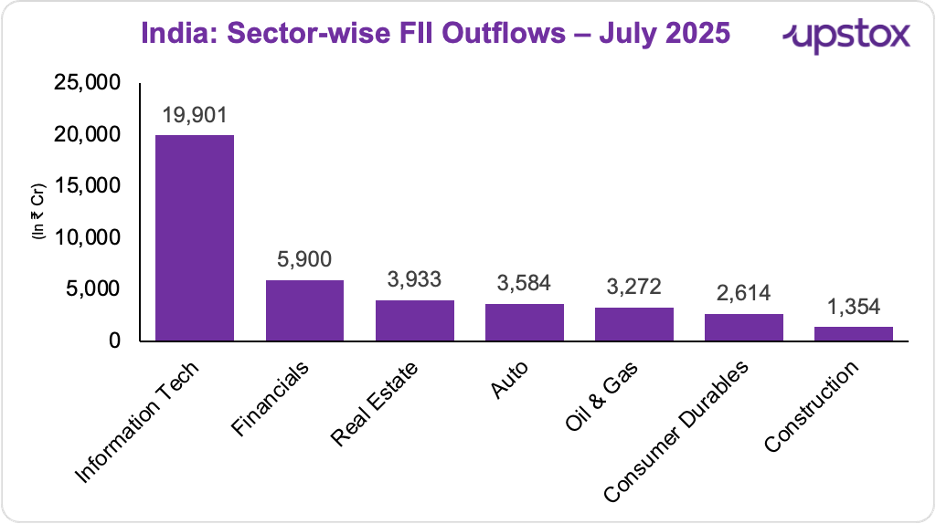

IT cracked first. A Jefferies' mid-quarter review of 113 IT companies showed 50% had earnings estimates cut, while only 40% got upgrades.

By then, FIIs had dumped over ₹50,000 crore worth of IT stocks in 2025. And it wasn’t just tech. Metals, PSU banks, and pharma indices all took hits. India Inc.’s profit growth? Down to a nine-quarter low of 7.3%.

Beyond IT, the foreign money exodus has been widespread and severe. Let us take a look:

Source: NSDL, Economic Times

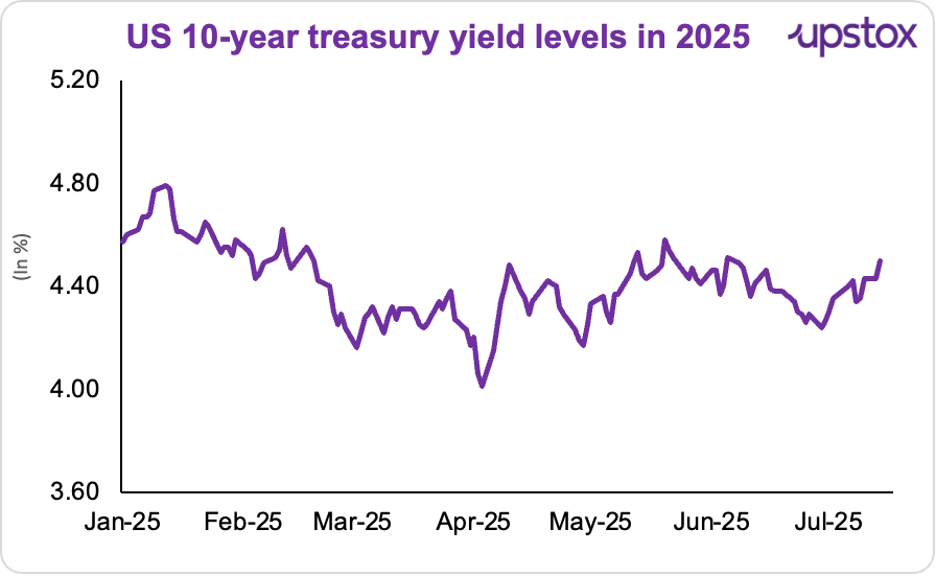

Tactical tilt amid US yields

As the US 10-year Treasury yield climbs, global investors are pumping money into safer US assets. FIIs in India? They’re playing it cool - over 80% of their index futures are short, basically hedging their bets rather than going all-in bearish.

Source: Investing.com

Political risks

Since early 2025, risk aversion is on the rise, thanks to global economic worries culminating into the recently announced 50% tariffs on India. All of this has soured investment sentiment, which has led to investors adopting a more risk-off mode, making everyone a bit cautious.

What are FIIs investing in instead?

While FIIs are selling off the big, flashy large-cap stocks, they’re not jumping ship. Instead, they’re shifting their bets, moving more into small- and mid-cap stocks that don’t feel the global shocks as much. Smart move, right?

Select small- and mid-cap stocks

In 2025, FIIs have been busy ramping up their stakes in more than 260 small-cap companies! They’re zeroing in on sectors that are showing real grit and growth potential. Curious about who’s winning big? Here are some notable gainers:

| Company | Price change 2025 | FII holding change (%) |

|---|---|---|

| Force Motors | +165% | 8.36% → 9.77% |

| Camlin Fine Sciences | +125% | 1.47% → 2.88% |

| Gabriel India | +107% | 5.23% → 5.97% |

| Apollo Micro Systems | +56% | 0.93% → 7.16% |

| Narayana Hrudayalaya | +51% | 9.58% → 10.46% |

Source: ET

Key favored sectors include auto ancillaries, specialty chemicals, defense manufacturing, healthcare, and select financial services.

Debt markets

July 2025 saw a healthy flow of foreign money into Indian government and corporate bonds. Japan led the charge with ₹7,420 crore, followed by France at ₹3,300 crore, the Netherlands with ₹2,570 crore, and the US chipped in ₹1,230 crore.

Growing divergence: FIIs vs DIIs

Here’s a surprising plot twist in India’s equity markets - for the first time in over 20 years, the domestic players have overtaken their foreign counterparts. Mutual funds, insurance firms, and pension funds now hold more of the market than foreign institutional investors. That’s a full structural shift in who's calling the shots - as we’ve highlighted here.

India’s equity story is increasingly powered by domestic confidence. This shift, as detailed in this article, marks a new era driven by growing domestic confidence.

What’s driving this shift?

It’s all about record-breaking inflows. In just one quarter - Q4 FY25, DIIs pumped in a whopping ₹1.8 lakh crore. Mutual fund SIPs led the charge with ₹1.1 lakh crore, followed by ₹47,500 crore from insurance companies, mainly LIC. And by July 2025, monthly SIP contributions hit an all-time high of ₹21,000 crore. Clearly, more and more Indians are betting on the country’s growth story.

On top of that, long-term investors like the Employees’ Provident Fund Organisation (EPFO) and the National Pension System (NPS) chipped in ₹55,000 crore between April and July 2025. These steady, policy-backed funds add stability and discipline, helping the market stay strong even when global uncertainties loom large.

Source: Moneycontrol

These inflows have changed the ownership landscape! By March 2025, Domestic Institutional Investors (DIIs) quietly took the lead, holding 17.6% of NSE stocks - just edging out FIIs at 17.2%. And if you zoom out to the Nifty 500, DIIs still have the upper hand with 19.2%, while FIIs trail at 18.8%.

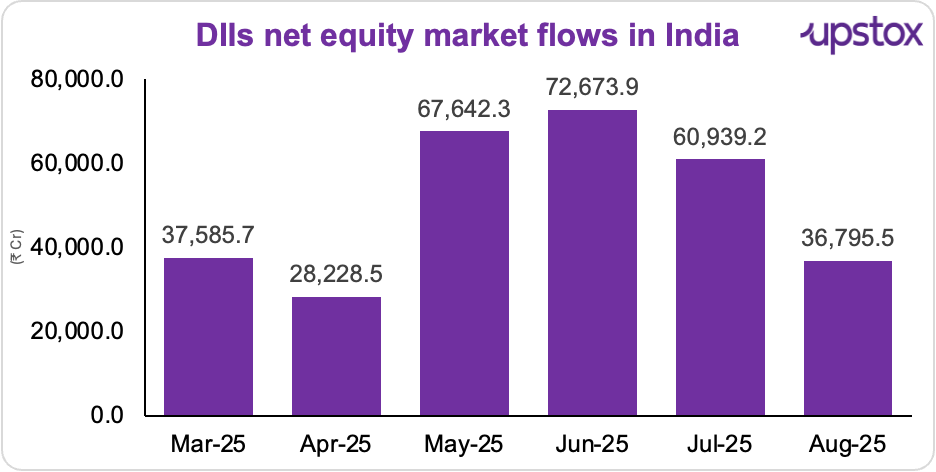

What’s even more interesting? Between July and August 2025, DIIs poured in over ₹1.54 lakh crore, focusing on sectors that really ride on India’s own demand - think banking, consumer goods, cement, infrastructure, and autos.

What lies ahead

Sensex and Nifty have had their ups and downs but no crashes - thanks to strong support from DIIs and steady retail buyers holding the line. FIIs? They’re not running away but shifting gears, moving into debt and emerging sectors. That’s boosting local ownership and softening global shocks.

What’s next?

Keep an eye on tariff drama and the US dollar’s moves. The Dollar Index dropped 2% in three months, sitting at 97–98, and could fall nearly 10% by year-end. How will this play out? That’s the million-dollar question for India’s markets and foreign investors.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story