Upstox Originals

India’s household debt is rising. What does it mean for its economy?

6 min read | Updated on July 31, 2025, 13:38 IST

SUMMARY

India’s household debt has been on a continuous rise in recent years. This triggers some key questions: Is the country heading towards a riskier debt landscape? What does it mean for India’s financial future? How does India’s household debt scenario compare to other countries? Let’s dig deep and find all the answers.

The per capita debt of individual borrowers has grown from ₹3.9 lakh in March 2023 to ₹4.8 lakh in March 2025.

The Reserve Bank of India (RBI) recently released its Financial Stability Report for June 2025. A little digging into the data will help answer our question for today: Are Indian households heading toward a debt trap?

As per the report, India’s household debt is rising like never before.

The per capita debt of individual borrowers has grown from ₹3.9 lakh in March 2023 to ₹4.8 lakh in March 2025. That’s a sharp 23% rise in two years. In fact, in the last 10 years, India’s household debt as a percentage of GDP has almost doubled to reach ~41%.

What does this indicate?

On one hand, it shows that an average Indian is getting better access to loans.

But it also means that every Indian carries an average debt of ₹4.8 lakh, and this burden has increased by ₹90,000 in two years. Now that’s a real problem!

The question here is:

What are Indians borrowing for?

To buy their dream house? Well, yes—but that's not the main reason people are borrowing.

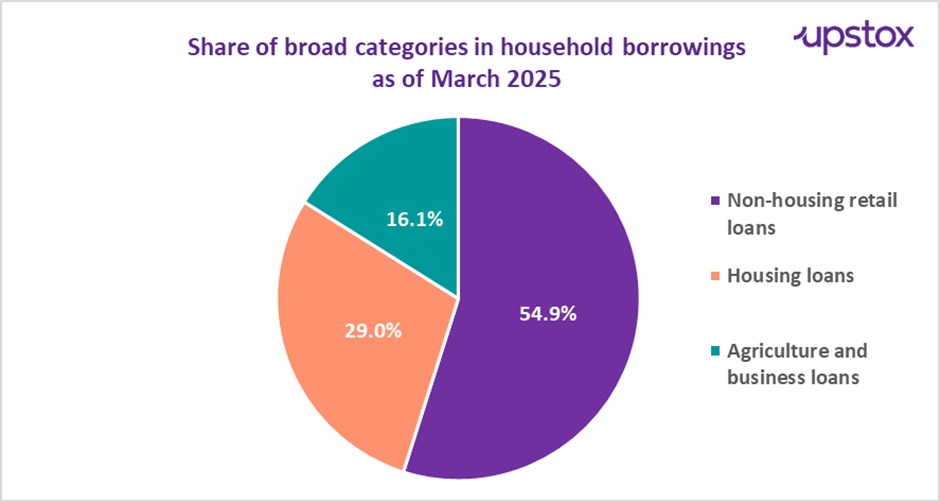

Surprisingly, an increasing number of Indians are taking loans for consumption purposes, i.e., to fund their everyday expenses like shopping, bill payments, holidays and experiences. These expenses fall under the non-housing retail loans category. Importantly, loans under this category do not lead to asset creation.

Non-housing retail loans account for a lion's share of 54.9% of total household debt as of March 2025. It is interesting to note that a common man spent 25.7% of their disposable income on paying off these loans in March 2024.

On the other hand, housing loans (used for home building, renovation, etc.) account for 29% of total household debt as of March 2025. And, agriculture and business loans account for the remaining 16.1%.

Source: RBI

Should this worry you?

See, borrowing in itself is not a bad thing. But the fact that a significant amount of borrowing is being done for consumption and not for investment is a cause of concern. Why so? Simply because Indian households are loading up on what is called as—destructive debt (such as personal, credit card and gold loans that do not help in asset creation) rather than constructive credit (such as housing loans that help in asset creation).

And the problem is not just the rising household debt burden. Even the overall household savings have slipped. The gross savings rate in India fell to 30% of GDP from 34% in 2012.

This clearly shows one big problem—we as Indians are spending more and relying on borrowings to fund the spends.

How did India reach a tipping point with debt?

To understand this, let us look at India’s debt position.

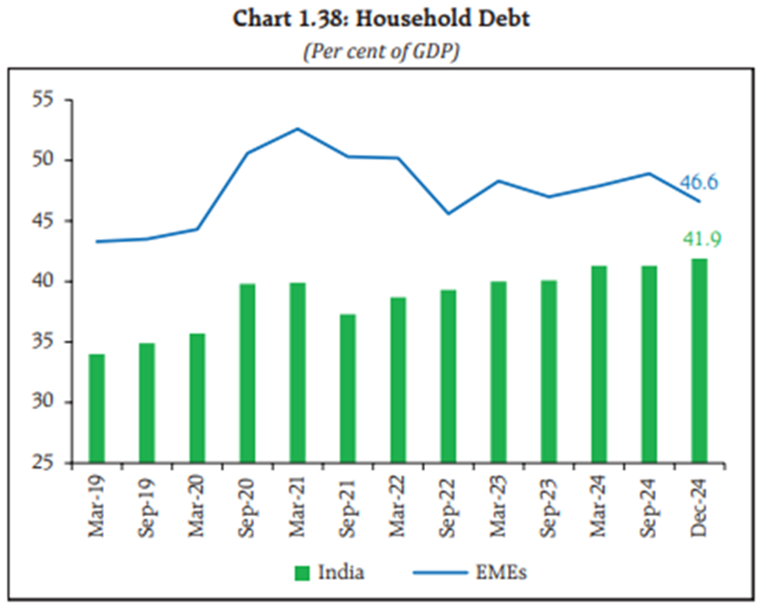

As of June 2021, India’s household debt was 36.6% of GDP. By June 2024, it rose to 42.9% and by December 2024, this number saw a minor dip and stood at 41.9%.

Source: RBI

Let’s put this in perspective: Not only are more households taking on debt, but they are also taking on more debt than before.

The biggest reason for rising household debt is inadequate income growth. Between March 2021 and March 2024, household disposable income grew by only 43%, whereas consumption grew by almost 50%. Households therefore resorted to credit to fill this gap. Over the same time period, personal loans by the banking sector and retail credit extended by NBFCs grew by a staggering 70-75%.

How does India’s household debt scenario compare to other countries?

If we zoom out and compare India versus its global peers, one thing is clear—India’s household debt-to-GDP ratio is comparatively lower than most large countries.

| Country | Percentage* |

|---|---|

| Switzerland | 125 |

| Australia | 112 |

| Canada | 100 |

| South Korea | 90 |

| United Kingdom | 76 |

| United States | 69 |

| Japan | 65 |

| China | 60 |

| India | 42 |

| South Africa | 34 |

Source: Trading Economics; *Data as of December 2024

While this is definitely encouraging, the fact that household debt is rapidly increasing and to fund daily consumption, should give us a pause.

What does rising household debt indicate?

Credit growth is generally a positive indicator for banks and the overall economy, as it reflects increased economic activity and brings liquidity to the system.

Access to credit brings more purchasing power in the hands of consumers, which in turn stimulates demand. Increased demand helps businesses scale up production and operations, which leads to business growth.

So, it is fair to say that an increase in household debt can boost economic growth, as households borrow more to spend on consumption and investment.

Good for economic growth, right? Well, not exactly.

The problem is—rising household debt is good for the economy only in the short run. In the long run, it can have negative effects on the economy.

As per the BIS study, a one percentage point increase in the household debt-to-GDP ratio tends to lower GDP growth by 0.1% in the long run.

You see, higher credit means a larger portion of your disposable income will go toward loan repayment. And unless your income grows rapidly, the burden of repayment will eat into your disposable income. This will effectively reduce your ability to spend, which will in turn reduce your future consumption and savings.

The result? Increased financial stress and default risk in the long term.

What are banks and policymakers doing to tackle rising household debt?

Well, the credit binge didn’t go unnoticed. To address the risks, the RBI introduced various measures in 2024. They increased the risk weights on unsecured personal loans to slow down credit growth.

But this strategy backfired.

While the credit growth did slow down sharply from 15.4% YoY in March 2024 to 9.5% in March 2025, it also slowed down consumption.

The hit on GDP growth forced the RBI to reverse its stance. And, now RBI is aiming to boost liquidity and credit growth in the economy.

What followed were eased regulations in the microfinance sector. RBI later reduced risk weights on bank loans to NBFCs and MFIs.

Not just this, the RBI also cut CRR (cash reserve ratio) by a steep 100 basis points to boost liquidity. How these policy changes will shape up in the future is something only time will tell.

The bottom line

From this entire story, one thing is clear — Indians are not conservative anymore. They are spending on what they love. But this comes at a cost of credit, which is adding to India’s household debt burden.

But as individuals, what we can do is follow responsible borrowing and debt management. On the other hand, the government could implement stronger regulations on lending and expand financial literacy programs to improve household debt management.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story