Upstox Originals

How is India's economy resilient amidst global uncertainties?

9 min read | Updated on September 16, 2025, 17:22 IST

SUMMARY

At a time when global uncertainties are mounting, India stands out. Real GDP growth at 7.8%, record GST collections, and stable inflation. All this resulted in India’s sovereign rating being upgraded by Fitch after 18 years. What differentiates India from rest of others is its strong domestic consumption (60% of GDP), strategic policy frameworks, a diversified economy, and an active approach to modernisation in critical sectors such as manufacturing and services.

India delivered a real GDP growth of 7.8% in Q1 FY26, comfortably ahead of expectations.

Tariffs shifting across borders, two wars dragging on, oil prices swinging, and highly volatile markets, global conditions have hardly been friendly. Yet, in the middle of all this, India delivered a real GDP growth of 7.8% in Q1 FY26, comfortably ahead of expectations. And it is not just a headline number.

GST revenues have been steadily rising, pointing to healthy formal consumption. Industrial production has not only held its ground but shown signs of improvement, with manufacturing and construction activity picking up pace. Put together, these trends send a reassuring signal: India’s growth story is not just intact, it is broad-based and resilient.

Unlike many economies struggling to balance inflation and growth, India’s fundamentals, domestic consumption, stable inflation, and rising capex are keeping it among the world’s fastest-growing major economies.

To understand why India stands out, let’s break down the major forces supporting this resilience:

GDP growth rate beating expectations

India’s economy continues to beat expectations. The NSO reported 7.8% real GDP growth in Q1 FY26 (Apr–Jun 2025), well ahead of the Reuters’ poll of 6.7% and even stronger than the 7.4% recorded in the previous quarter. That’s a striking outperformance at a time when most global peers are slowing.

Why it matters: Unlike earlier cycles where India’s growth leaned heavily on a single driver, this time it is more broad-based. Services contributed nearly 68% of overall growth, but manufacturing and construction also chipped in meaningfully, growing above 7%. That diversification provides resilience if one sector cools.

Investor implications:

- Near term: Favour beneficiaries of services demand and mass-market staples; GST prints above ₹1.8 lakh crore signal healthy formal consumption.

- Watch the mix: Urban-led services may outpace discretionary durables until rural terms of trade improve further with kharif outcomes.

GDP growth rate (YoY %) by components

| Sectors | Q1FY25 | Q2 FY25 | Q3 FY25 | Q4 FY25 | Q1 FY26 |

|---|---|---|---|---|---|

| Agriculture | 1.5 | 4.1 | 6.6 | 5.4 | 3.7 |

| Industry | 8.5 | 3.8 | 4.8 | 6.5 | 6.3 |

| Manufacturing | 7.6 | 2.2 | 3.6 | 4.8 | 7.7 |

| Services | 6.8 | 7.2 | 7.4 | 7.3 | 9.3 |

| GDP | 6.5 | 5.6 | 6.4 | 7.4 | 7.8 |

Source: MoSPI, PIB

In terms of broader segment, what remains the standout is that both consumption and capex are growing more than 5% YoY basis, this was supported by resilient exports sector growth despite uncertainty and overall trade slowdown due to tariffs.

GDP growth rate (YoY %) in terms of major components

| Q1FY25 | Q2 FY25 | Q3 FY25 | Q4 FY25 | Q1 FY26 | |

|---|---|---|---|---|---|

| Private final consumption expenditure | 8.3 | 6.4 | 8.1 | 6 | 7 |

| Government final consumption expenditure | -0.3 | 4.3 | 9.3 | -1.8 | 7.4 |

| Gross fixed capital formation | 6.7 | 6.7 | 5.2 | 9.4 | 7.8 |

| Exports | 8.3 | 3 | 10.8 | 3.9 | 6.3 |

| GDP | 6.5 | 5.6 | 6.4 | 7.4 | 7.8 |

Source: MoSPI, PIB

Inflation Control and macro-economic stability

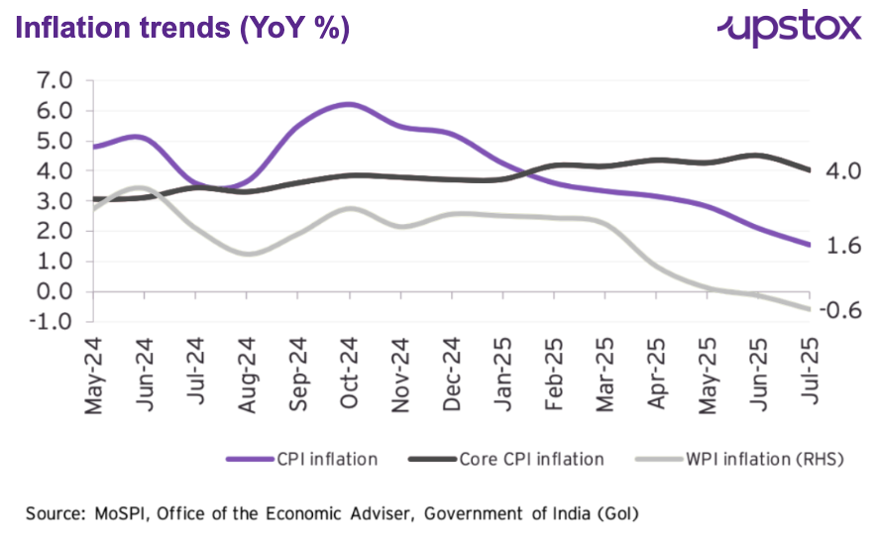

India has benefitted from relatively low inflation in recent times, which has provided the RBI with the flexibility to manage monetary policy. The CPI inflation dropped to 1.6% YoY in July 2025, the lowest level since 2017, with food inflation turning negative.

The persistence of core disinflation, particularly in housing, health, and transport sectors, has kept inflationary pressures under control.

With inflation cooling, households are feeling the benefit through stronger real incomes, while businesses are facing less pressure from input costs. For policymakers, this stability gives the Reserve Bank of India room to hold the repo rate steady at 5.50%, after earlier rate cuts. As a result, both consumption and capex are getting support at the same time. a rare sweet spot for the economy.

Investor Insights:

Recent measures like GST 2.0 will lead to CPI inflation easing by further 0.25-0.30% in FY26 and further 0.76-0.70% in FY27 as per SBI Research.

Lower interest rates to boost consumption and capex

After the 100 bps repo cuts (Feb–Jun 2025), banks swiftly lowered lending and deposit rates on both new and outstanding accounts. Pass-through was stronger at public sector banks than at private banks.

What lower rates mean for the economy

-

Households: Cheaper loans cut EMIs and lift disposable income, improving affordability for homes, autos, and education. Consumption tends to firm up first.

-

Businesses: Lower borrowing costs and easier refinancing reduce interest expense, raise project IRRs above hurdle rates, and pull forward capex and inventory building, especially for MSMEs with working-capital needs.

PMI and Industrial Performance

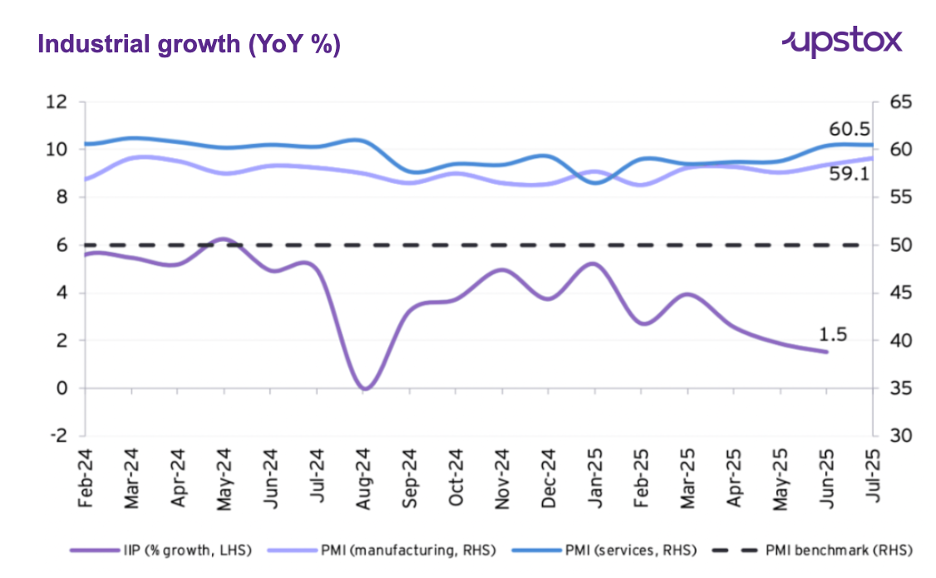

India’s industrial output has seen a strong resurgence, particularly in the manufacturing sector. The Purchasing Managers' Index (PMI) for manufacturing, which hit a 16-month high in July 2025, pointed to a robust increase in new orders and production, further bolstered by services expansion.

The overall industrial production (IIP) growth rate for July 2025 stood at 3.5% YoY, with manufacturing growing by 5.4%.

Industrial Production (IIP): The industrial sector has seen a notable revival, with an increase in output in key areas such as capital goods and infrastructure-linked categories. Manufacturing growth is further supported by a positive growth trend in GST collections (+7.5% YoY in July 2025), pointing to robust demand in the economy.

Investor insights

High-frequency indicators are sending a consistent signal of strength. From robust GST collections to rising PMI readings, both manufacturing and services are showing clear signs of expansion. Together, these data points suggest that momentum in the economy is not only holding up but gradually broadening across sectors.

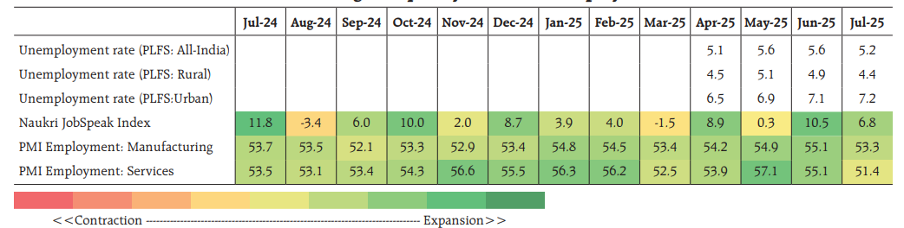

Labour market and employment

India’s labour market showed improvement with a CWS unemployment rate of 5.4% in Q1 FY26. In July 2025, the all-India unemployment rate declined to 5.2%, driven by a reduction in rural unemployment. The labour force participation rate and worker population ratio increased in both rural and urban areas.

Job creation in the organised sector remained strong, as reflected by record net payroll additions under the Employees’ Provident Fund Organization (EPFO) in June. The Naukri JobSpeak Index showed growth in white-collar job listings, particularly in travel/hospitality, insurance, and education sectors.

Additionally, the PMI employment indices for both manufacturing and services expanded in July, although at a slower pace than in June. These trends indicate a gradual recovery in India’s labour market.

Source: MoSPI, RBI Bulletin

FDI Inflow & Capital Expenditure

India recorded a provisional Foreign Direct Investment (FDI) inflow of $81.0 billion in the financial year 2024-25, marking a 14% increase from $71.3 billion in the previous fiscal year.

S&P Global Ratings upgraded India's sovereign credit rating to 'BBB' from 'BBB-’, 2025, marking the first upgrade in 18 years. The upgrade was driven by India's strong economic growth, effective inflation management, sound corporate and external balance sheets, and the government's commitment to fiscal consolidation and infrastructure investment.

This move is expected to improve India's access to foreign investment and lower borrowing costs, potentially boosting investor confidence.

Regarding capital expenditure (Capex), both the Centre and States have shown strong performance in Q1 FY26. The Centre’s Capex in Q1FY26 accounted for 24.5% of the budgeted amount, which is 8.2% higher than the 16.3% recorded in Q1FY25.

States also demonstrated a rise in Capex as a percentage of budget estimates, with the overall share for states in Q1 FY26 at 10.8%, compared to 9.8% in Q1FY25.

Among the 19 states, 11 states saw an increase in Capex as a percentage of budget estimates. Both the Centre and states have increasingly frontloaded their capital expenditure, demonstrating a stronger commitment to driving growth through improved implementation capacity and a focus on infrastructure-led recovery.

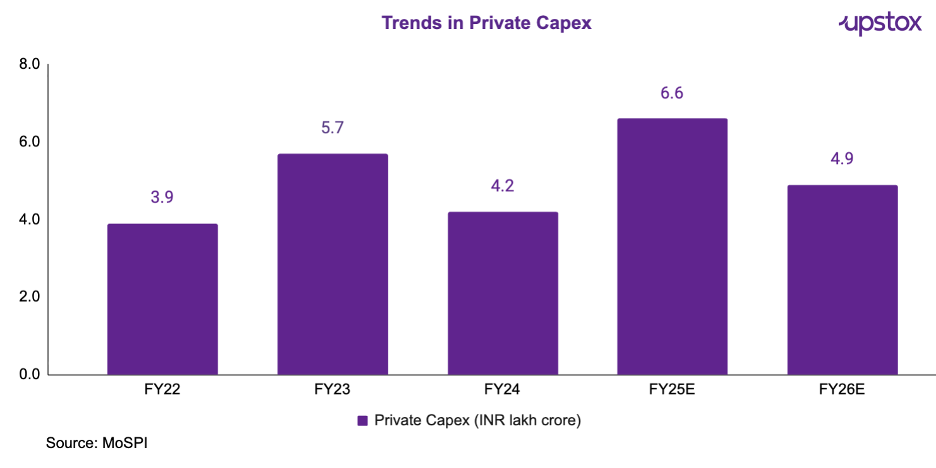

Slowdown in private capex and earnings is a major risk; revival needs to be tracked

Despite record corporate profits and a supportive policy environment, India’s private sector investment remains cautious. The intended capital expenditure for FY26 has dipped to ₹4.9 lakh crore from ₹6.6 lakh crore in FY25, indicating a slowdown in private capex momentum - something that needs to reverse for long-term growth to sustain.

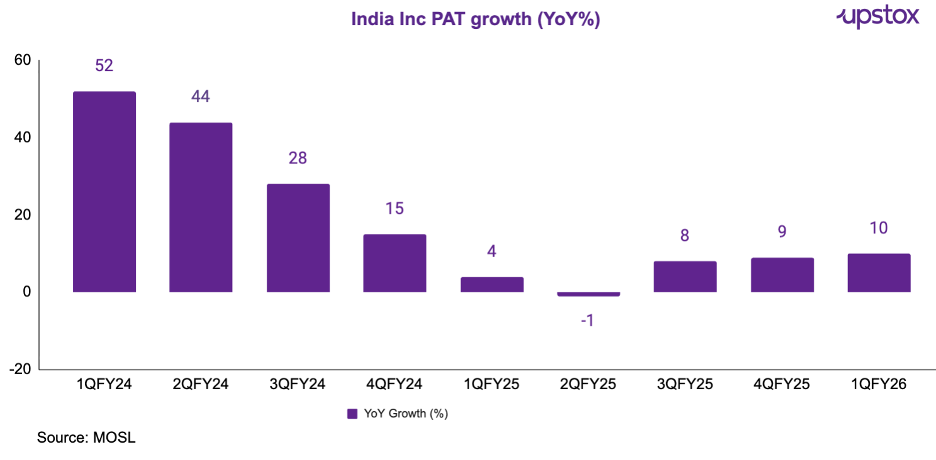

Slower corporate earnings

Despite subdued sales growth, the operating profits and margins remained stable for manufacturing and services companies during Q1:2025-26 on account of slower increase in expenses.

While the lag in private sector and earnings performance was a major concern, a recent report overall India Inc’s revenue growth will be boosted by 0.5% owing to GST 2.0 reforms.

While earnings growth is still low single digit, Nifty-500 companies posted a revival in earnings growth in Q1FY26 (as compared to Q4FY25), with aggregate sales, EBITDA, and adjusted PAT rising 5%, 11%, and 10% YoY respectively. The real standout was the midcap segment - earnings for the Nifty Midcap-150 surged 17% YoY, significantly outperforming both the Nifty-100 (8%) and the Nifty Smallcap-250 (6%).

Parting thought

India’s economy has proven itself to be resilient due to its diversified economic base, with services becoming the key driver of growth, offsetting slower performances in agriculture and industry. While there has been some depreciation of the Indian Rupee (INR), the country’s foreign exchange reserves provide ample cushioning against external shocks.

Moreover, controlled inflation, robust industrial growth, and low unemployment rates suggest that India is well-positioned to navigate future uncertainties. This economic resilience underscores the country’s strong fundamentals and strategic policies that continue to support growth in uncertain times

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story