Upstox Originals

How gold & silver funds raced to ₹1 lakh crore?

5 min read | Updated on January 08, 2026, 10:08 IST

SUMMARY

India’s gold and silver mutual funds have crossed the ₹1 lakh crore AUM mark. AUM has more than doubled, driven by record ETF inflows, a widening investor base and a strong macro case for precious metals as portfolio insurance. Is this just a fleeting craze or a structural shift in how Indian households and institutions are using these metals to hedge inflation, currency risk and equity volatility?

Gold ETF folios jumped from 7.8 lakh in October 2020 to over 97 lakh by November 2025

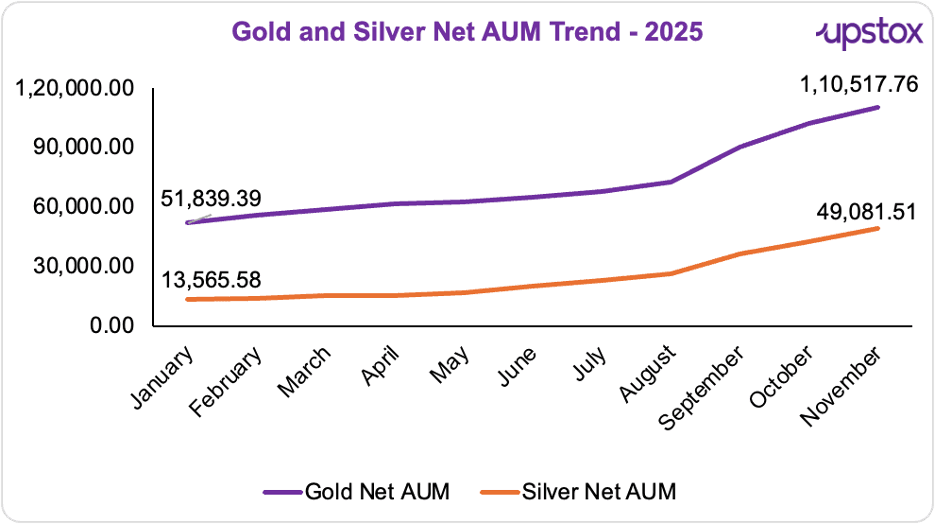

Would you believe it if someone told you that in just one year, the AUM of domestic mutual funds, manage gold and silver has almost doubled? Between January and September 2025, AUM rose from ~₹654 bn in January to nearly ~₹1,590 bn by November 2025.

Source: AMFI

Flows, folios and the new investor base

-

The story behind the ₹1 lakh crore milestone is less about one monster rally and more about persistent flows and democratisation of access.

-

Gold ETF folios jumped from 7.8 lakh in October 2020 to over 97 lakh by November 2025, pushing gold ETFs firmly into the retail mainstream. Indian gold ETFs now hold over 83 tonnes of physical gold, with nearly one-third of this added in 2025 alone.

-

Launched only in 2022, silver ETFs have already crossed ₹45,000 crore in AUM and 26 lakh folios, as investors warm up to silver’s dual role as an industrial bet and a hedge.

-

World Gold Council data shows investment demand (bars, coins and ETFs) has been the key incremental driver of gold demand in recent quarters, even as jewellery softened, with ETFs and central banks delivering some of the largest YoY gains in Q3 2025.

Where metals sit in the AUM pie

Stack gold and silver against the broader passive universe, equity index funds, target‑maturity debt, and vanilla ETFs, and they still look like a smaller slice, but one that is thickening every month. Together, they now form a visible “real‑asset” wedge in India’s ETF and index‑fund pie, signalling that diversification into hard assets is becoming a mainstream asset‑allocation choice rather than an afterthought.

| Category | Nov 2024 Avg AUM | Jan 2025 Avg AUM | Change |

|---|---|---|---|

| Equity-oriented Index Funds (Domestic) | 1,57,496 | 2,05,868 | +30.7% |

| Income/Debt-oriented Index Funds | 94,010 | 99,165 | +5.5% |

| Equity-oriented ETFs (Domestic) | 6,35,154 | 7,58,712 | +19.5% |

| Income/Debt-oriented ETFs | 96,034 | 97,792 | +1.8% |

| Gold ETFs | 47,940 | 1,06,021 | +121% |

| Silver ETFs | 13,035 | 45,421 | +249% |

Sources: AMFI

Why India is wired for gold (and now silver)

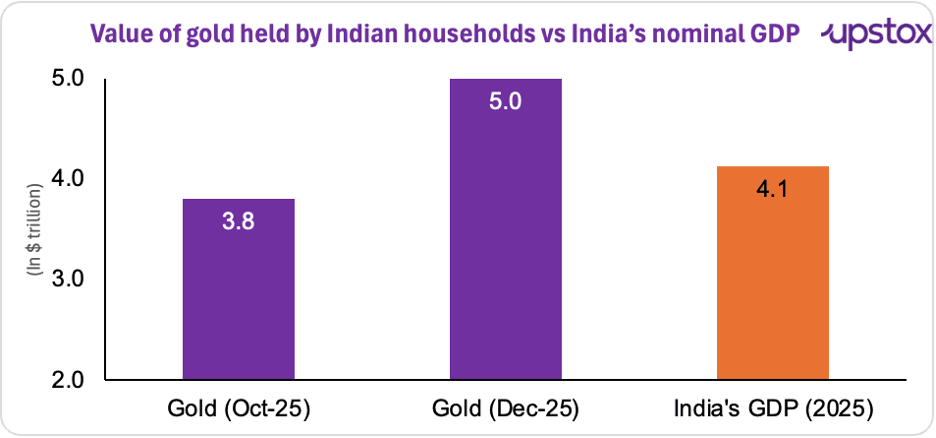

India’s long‑standing cultural affinity for gold is now being financialised rather than abandoned. According to Morgan Stanley estimates based on World Gold Council data, Indian households hold gold worth around $3.8 trillion (as of October 2025), equivalent to nearly 88.8% of GDP, making gold the single largest store of household wealth outside real estate.

As global gold prices climbed, the value of gold sitting in Indian homes quietly swelled. By December 2025, analysts estimate this stash may have crossed $5 trillion (₹450 lakh crore); largely due to higher prices rather than fresh buying.

Oh, and that’s more than India’s GDP! For context, India’s nominal GDP in 2025 is $4.13 trillion, according to the IMF.

Sources: Economic Times, NDTV Profit, Worldometer

Crucially, while physical consumption volumes have largely plateaued in the 750–840 tonne per‑year band since 2021, the value of gold consumption has exploded to an all‑time high of around $68 billion by June 2025, driven by price rather than tonnage growth.

Silver is riding a different, more industrial wave. Growing use in solar, electronics and EVs has pushed global silver into a structural deficit, and ETF holdings have responded with rapid accumulation since their 2022 launch in India, where silver ETF AUM has crossed roughly ₹40,000 crore with more than 25 lakh folios. What are the forces powering gold and silver’s rally?

In 2025, gold and silver broke record after record, moving from defensive hedges to market leaders.

Gold: Gold had a solid 2025 because the macro math worked. As markets priced in US rate cuts, real yields fell, bonds lost some shine, and gold started looking more attractive. Add steady geopolitical uncertainty and consistent flows into physical gold and ETFs, and gold quietly moved from a “safety trade” to a core portfolio holding.

Silver: Silver’s rally was about imbalance. Supply stayed tight, while demand from solar panels, electronics, and EVs kept rising. Since silver sits halfway between industry and investing, even small gaps between supply and demand led to outsized price moves. And with growing interest via ETFs and bullion, silver stopped being just gold’s volatile cousin.

If you’d like to read more on what’s driving silver prices:

Where do gold & silver funds go from here?

Gold and silver enter 2026 as core portfolio anchors, with demand holding firm despite bouts of volatility. As Ole Hansen, Head of Commodity Strategy at Saxo Bank, puts it, “the underlying drivers behind the rally remain intact rather than exhausted.” Gold is set to remain a monetary hedge in a fragmented global backdrop, while silver’s outlook is increasingly driven by industrial necessity, not just investor sentiment. Near-term moves may be choppy, but the bigger risk is flow-driven volatility, not fading fundamentals.

That said, metal prices are some of the most volatile ones and outlooks tend to be updated frequently. Given the price rise in the past year, investors should be careful with their metal exposure and ensure adequate diversifcation.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story