Upstox Originals

How does UK-FTA put Indian textiles in a competitive position?

.png)

10 min read | Updated on May 21, 2025, 14:24 IST

SUMMARY

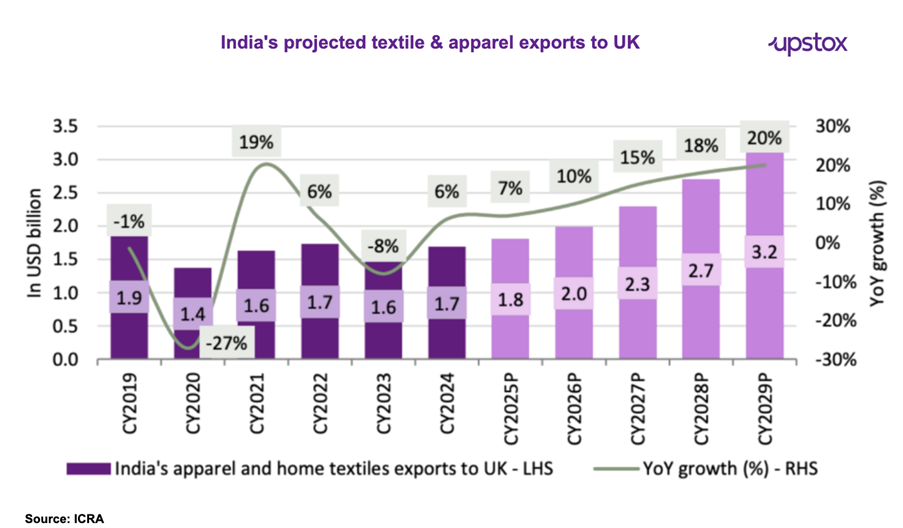

The UK-India FTA presents a significant growth opportunity for India’s textile sector. With Indian textile exports to the UK now enjoying zero-duty access, India’s textile exports, currently at $1.7 billion, are expected to double by 2029. The FTA not only strengthens India’s position against rivals like China, it also allows Indian companies to expand into new global markets.

The UK-India FTA can potentially help double India's textile exports to the UK

India’s textile sector, one of the most labour-intensive and export-driven industries in the country, is poised to unlock a significant opportunity following the Free Trade Agreement (FTA) between India and the UK.

Under the agreement, 99% of Indian exports, including textile products, will now have zero-duty access to the UK market, a substantial benefit from current duties ranging up to 12%. This includes end products such as apparel, home textiles, and technical textiles, which will see a considerable boost in demand.

The removal of duties positions Indian textile exporters to price their products more competitively while maintaining strong margins.

Let's break down the potential impact of UK-FTA on the textile sector

India’s textile exports to the UK - opportunity size

The market size of UK textile exports stands at $20.7 billion, which is just one-fourth of the textile export markets of both Europe and the United States. It, however, offers higher margins (considering it is a hub of luxury brands) and access to better technologies and trends as compared to other markets.

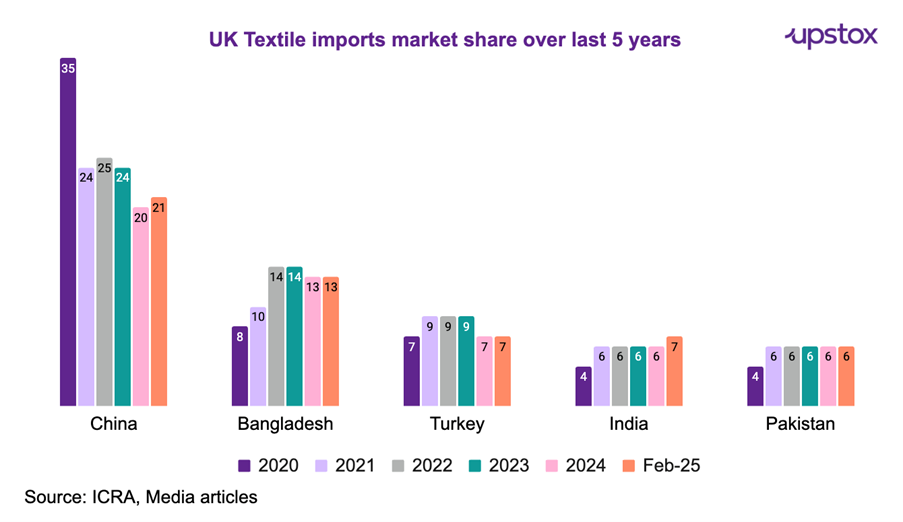

India's current share in the UK apparel import market stands at around 6-8%, valued at $1.7 bn, far behind China and Bangladesh. However, the newly signed FTA presents a unique opportunity for India to close this gap, especially with key competitors like Bangladesh, Pakistan, and Vietnam, who already benefit from zero-duty access.

The FTA allows India to become a stronger player in that market, potentially shifting buyer sourcing strategies. Retailers looking to diversify suppliers away from China may now turn to India, significantly boosting the country's apparel exports.

| Country | Apparel ($ mn) | Bedsheets ($ mn) | Towels ($ mn) | Market share: Apparel (%) | Market share: Bedsheets (%) | Market share: Towels (%) |

|---|---|---|---|---|---|---|

| Bangladesh | 3,924 | 20 | 16 | 19.9 | 2.9 | 6.3 |

| China | 5,003 | 247 | 20 | 25.4 | 35.4 | 7.9 |

| India | 1,198 | 75 | 70 | 6.1 | 10.7 | 26.9 |

| Pakistan | 947 | 249 | 103 | 4.8 | 35.7 | 39.6 |

| Türkiye | 1,556 | 13 | 32 | 7.9 | 1.9 | 12.4 |

| Vietnam | 1,067 | 1 | 0 | 5.4 | 0.2 | 0 |

| World | 19,670 | 697 | 261 |

Source: Elara Securities Research. *The above numbers are for key categories only.

The impact of the FTA

The FTA could double India’s overall textile exports (12% of total merchandise exports to the UK) from $1.7bn to $3.2bn by 2029, as per ICRA. The UK FTA promises to elevate India’s position in the global textile market, especially UK, by narrowing the landing cost from 10-12%

What does it mean for textile players?

For the Indian textile industry, which has been grappling with rising input costs, global competition, and disruption in logistics, the FTA offers a timely boost. By enabling duty-free access in a mature market, the agreement can lead to an increase in export volume, better capacity utilisation, and improved economies of scale.

Companies that have existing relationships with UK customers and available capacity are particularly well-positioned to capitalise in the near term. Furthermore, the FTA is anticipated to yield operating leverage benefits, especially for vertically integrated players like KPR Mill, Arvind, S.P. Apparels, Welspun Living, and Indo Count, who have end-to-end control over their supply chains.

Several leading Indian textile players are expected to benefit: S.P. Apparels: With a significant portion (~50%) of its revenue already coming from the UK, it stands out as a direct beneficiary.

-

KPR Mill: KPR Mill benefits from strong backwards integration and existing UK market exposure, positioning it well in the near-to-medium term.

-

Welspun Living & Indo Count: These players, with exposure to the UK at approximately 10% and 7-8% respectively (particularly strong in the bedsheet segment), are well-equipped to leverage existing relationships and available capacity to drive volume growth.

-

Arvind Limited: Positioned well in apparel, Arvind can immediately offer ~15% of its available capacity to UK brands and retailers, with more capacity expansions planned for FY26.

-

Pearl Global: With ~10-15% revenue from the UK, it can utilise its Indian capacities and customer relationships effectively.

-

Trident & Himatsingka Seide: Also mentioned as companies that are well-set with the capacity to capitalise on this opportunity.

| Company | The UK’s share in the overall revenue | Segments | Overall export contribution to revenue | Idle capacity available currently |

|---|---|---|---|---|

| Welspun Living | ~10% | Home textiles | 82.7% | 10-20% |

| Indo Count | ~7–8% | Home textiles | 95.9% | 30% |

| KPR Mills | ~5–6% | Garmenting, yarn, fabric | 36.3% | 11% |

| SP Apparels | ~50% | Garmenting | 75.3% | 20% |

| Pearl Global | ~10–15% | Garmenting | 99.3% | 30% |

| Gokaldas Exports | 5% | Garmenting | 89.2% | ~10% |

| Arvind | Negligible | Garmenting | 41.1% | ~15% |

Source: Elara Securities Research

In an interview with CNBC-TV18, S Ganapathi, Vice Chairman and Managing Director of Gokaldas Exports, highlighted how the UK-India trade deal will bolster India’s competitive edge, particularly against countries like Bangladesh. He anticipates that the full benefits of the UK FTA will materialise by FY27, with the UK's contribution to Gokaldas' revenue, currently at 5%, potentially doubling in the coming years.

Gokaldas Exports sees a $1 billion incremental export opportunity for Indian apparel in the UK market. With the FTA, India is now on par with leading textile-exporting nations. RSWM Limited further explained that the UK FTA will not only enhance their competitiveness in the UK but also enable them to offer higher-quality products with the latest trends to other export markets, leveraging the UK’s technical expertise.

Sutlej Textile emphasised that while Indian textile players are well-positioned to meet the initial surge in demand, scaling production to meet long-term, large-scale demand will require additional capacity building in the industry, but require further clarity on finer details of tariff structure and overall demand sentiments.

How does FTA position India in the competitive export market?

The FTA significantly improves India’s position in the global textile export market. With reduced duties, India’s landed cost has decreased by nearly 12%, closing the price gap with China. This puts India and China on an equal footing in terms of pricing.

Over the past five years, China’s share in the UK’s textile imports has steadily decreased—from 35% in 2020 to just 21% by early 2025—highlighting a clear shift in sourcing preferences. Meanwhile, India has maintained a stable share of 6-7%, showcasing its reliability as a key supply partner.

How India vs China stacked up in global textile export market

| Particular | India | China |

|---|---|---|

| Overall Price Competitiveness | Increasingly competitive, especially with rising Chinese costs and tariffs. Lower labour costs. | Historically more competitive due to scale; now faces higher costs and tariffs. |

| Tariffs to UK market | 0% post UK-India FTA | 12% |

| Raw material focus | Strong in cotton (yarn, fabric), natural fibers (jute, silk), and sustainable options. | Dominant in man-made fibers (MMF) like polyester, nylon, and synthetic fabrics. |

| Production scale | Growing, but generally smaller units | Automated and geared for high-volume production. |

| Technology & automation | Improving, but largely labour intensive. | Extensive use of automation and sophisticated machinery |

| Supply chain efficiency | Improving, but can face logistical challenges; less integrated than China. | Highly efficient, well-developed, and integrated supply chain. |

| Product specialisation | High-quality cotton garments, handcrafted items, sustainable fashion, intricate designs, home furnishings. | Mass-produced casual wear, basic garments, functional textiles, synthetics, and performance wear. |

| Quality perception | Often perceived as offering good quality, especially in natural fibers and value-added products. | Quality can vary; excels in consistent quality for mass-produced items. |

Source: Industry reports on Textile from India and China, Media Articles of India, China on textile.

Just as India capitalised on its superior quality and ESG standards to tap into the US textile export market, the UK FTA now opens up a $5.2 billion market in Chinese textile exports to the UK, which is almost three times the size of India’s current textile exports to the UK.

This opportunity was reiterated by KPR Mills in their latest earnings presentation, reinforcing the potential for India to capture a larger share of the UK textile market.

UK textile also paves way for European textile market, while UK’s textile market offers undisputed advantage of latest fashion trends considering London is fashion capital of the world, access of technical know how of biggest brands along with better spending capability of UK customers as compared to others and access to other global markets since UK brands have wider access.

With the UK-India FTA eliminating cost disadvantages, India is now well-positioned to capture a larger portion of the market. This is especially crucial as buyers look to diversify their supply chains and reduce reliance on any single region, further boosting India's competitive edge.

Comparison of import duty rates of India vs. other key exporting nations to the UK

Key Textile Products Imported by the UK

| China | Bangladesh | India before UK FTA | India after UK FTA | Pakistan | Vietnam | |

|---|---|---|---|---|---|---|

| Carpets and other textile floor coverings | 0% | 0% | 0% | 0% | 0% | 0% |

| Articles of apparel and clothing accessories, knitted or crocheted | 12% | 0% | 9.6% | 0% | 0% | 0% |

| Articles of apparel and clothing accessories, not knitted or crocheted | 12% | 0% | 9.6% | 0% | 0% | 3%-4.8% |

| Made-up bedding, curtains, table linen, etc. | 12% | 0% | 12% | 0% | 0% | 0% |

| Other furnishing articles, excluding those of heading 9404 | 12% | 0% | 12% | 0% | 0% | 0% |

Source: Trading Economics, Media Articles, ICRA

A few more green shoots for textile

Socio-political uncertainties in Bangladesh are prompting many apparel brands and retailers with significant operations there to diversify their sourcing, creating new opportunities for India and other countries. As a result, India is poised to double its market share in the UK’s ready-made garment (RMG) imports from 6-8% in CY24 to 12%, unlocking an incremental annual export potential of approximately US$1–1.2 billion in the near to medium term.

India has barred ready-made garments from Bangladesh at land checkpoints in a bid to redirect orders to domestic mills and stitching units. The Indian Chamber of Commerce says the move could unlock more than ₹1,000 crore in fresh business for home-grown manufacturers, replacing a slice of the roughly ₹6,000 crore worth of apparel India had been sourcing from its neighbour each year.

The recovery in overall UK RMG demand, supported by easing inflation and interest rates, coupled with India’s enhanced competitiveness following duty removals and supportive policies—such as the PM Mega Integrated Textile Region and Apparel (PM MITRA) parks and the Production Linked Incentive (PLI) scheme—will empower the sector to capitalize on these growing export opportunities.

The road ahead

The India-UK FTA undoubtedly presents a significant opportunity for the Indian textile sector to increase its market share, boost exports, and enhance competitiveness. Tariff removal is a key catalyst, enabling firms to secure larger UK orders without sacrificing margins. However, success depends on the implementation of FTA, global demand, supply-chain efficiency, and meeting UK market requirements.

Textile players are expected to ramp up their capacities to capture opportunities being created with a favourable tariff environment in the US and UK.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story