Upstox Originals

Global yields on the rise: A threat to India's markets?

7 min read | Updated on September 03, 2025, 12:15 IST

SUMMARY

If “risk-free” bonds suddenly get risky, where does that leave investors? Japan’s exit from easy money, America’s swelling deficits, and stubborn inflation are driving yields higher - and the costs are piling up fast. Rising borrowing expenses and shifting capital flows are no longer local problems; they’re global tremors. For India, the question is whether its markets can withstand the pull of safer, higher-paying havens abroad.

Japenese bond yields reached 3.2%, highest in over a decade

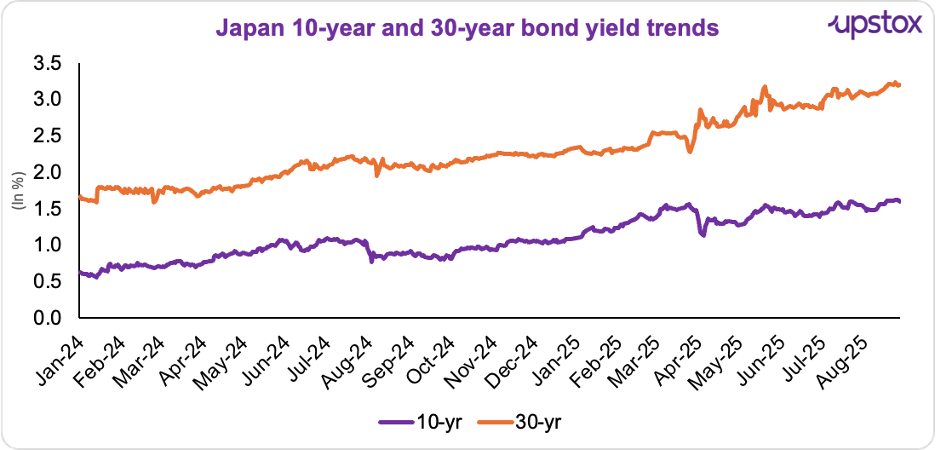

Bond yields are back in the spotlight, and this time, it’s not just noise. As of August 25, US 10-year Treasury yields stood at 4.276%, nearly 46 basis points higher than a year ago. Meanwhile, Japan’s 10-year and 30-year government bond yields reached 1.603% and 3.21%, respectively, their highest levels in over a decade, as of August 29, 2025. When the world’s biggest borrowers pay more to raise money, global capital shifts, investor appetite changes, and India could feel the heat too. So let’s break down what’s driving the surge in both nations, step by step.

Japan

Japan’s bond market is on the move, have we seen yields like this before? On August 22, the 30Y government bond yield hit an all-time high of 3.21%. Meanwhile, 20Y and 10Y JGBs climbed to levels not seen since November 1999 and October 2008, respectively. The 20Y yield ticked up 1.5 bps to 2.655%, matching the July 15 peak, while the 10Y rose 1 bp to 1.615%, its highest since 2008.

Source: Investing.com, data as of Aug 29, 2025

So, what’s causing this surge?

Policy normalisation

Japanese bond yields are on the rise, and one big reason is the Bank of Japan’s changing role. Since 2016, it ran Yield Curve Control (YCC), keeping 10-year JGB yields near 0% to fight Japan’s long-running deflation.

So, how was it done? By buying so many bonds that it now owns over half of Japan’s government debt, it has earned the nickname the “whale” of the JGB market.

And... Why was the BoJ buying so many bonds in the first place? The answer lies in history. After Japan’s asset bubble burst in the early 1990s, the economy slid into its “Lost Decade.” Growth stagnated, deflation set in, and the BoJ slashed interest rates to near zero. To cap borrowing costs and revive demand, it ramped up bond buying, a strategy that eventually evolved into YCC.

But with inflation finally returning and pressure on the yen building, keeping policy ultra-loose was no longer sustainable. That forced the shift from aggressive purchases to pulling back, letting yields rise.

So, in March 2024, the BoJ exited YCC and kicked off quantitative tightening (QT). It’s reducing JGB holdings by 21 trillion yen and cutting monthly purchases to just 3 trillion yen by March 2026. The result? The market is now in charge, and yields are climbing. Who’s steering the ship now… the market itself.

Life insurers pull back

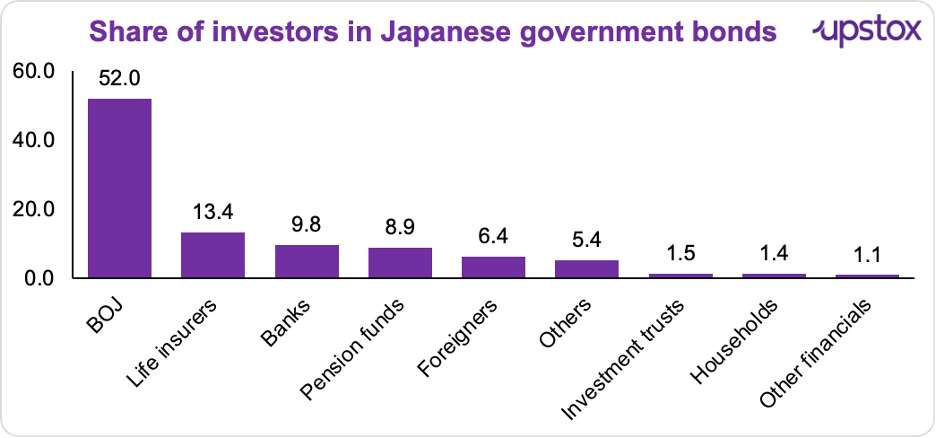

Japan’s life insurance sector holds around 13% of all Japanese Government Bonds (JGBs), making it the second-biggest investor after the Bank of Japan.

Source: Bloomberg; data as of May 2025

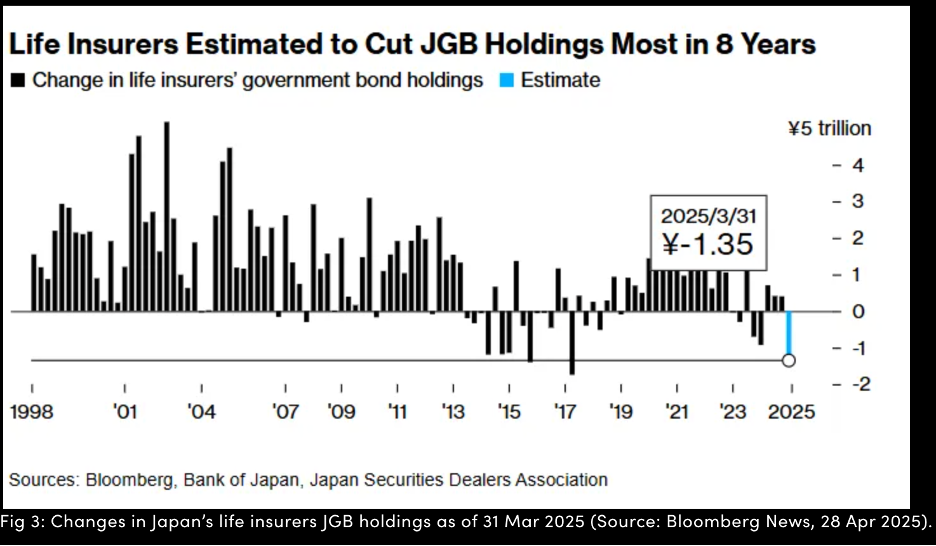

Big holders, right? But here’s the twist, being a heavyweight doesn’t mean they’re propping up the market right now. Instead, life insurers have been cutting back, and that’s one reason yields are climbing.

Why the caution? Volatility and thin liquidity have kept them on the sidelines. Add to that the fear of sudden market swings from the US administration’s unpredictable trade tariffs, and the path for BoJ rate hikes looks even messier.

And the scale of the pullback is hard to miss. In the three months through March 2025, Japanese life insurers slashed JGB holdings by 1.35 trillion yen (~$9.3 billion)—the third-largest cut ever and the biggest since 2017.

High debt

Japan has been carrying a massive debt load for years, and it’s not getting any lighter. Debt-to-GDP has hovered above 200% for over a decade and has now jumped to a staggering 250%. On top of that, the government’s fiscal giveaways during election season are adding fuel to the fire. The result? Rising bond yields that are making markets nervous.

Persistent inflation pressure

Core-core inflation has stayed above the BoJ’s 2% target for seven straight months. What does that mean for bond yields? Simply put, the economy is heating up. Should the BoJ keep easy money forever? With inflation staying stubborn, markets are stepping in, and yields are climbing.

In Japan, the biggest risk is obvious: can the world’s one of the most indebted nations really afford rising yields? Debt servicing is already eating up nearly a quarter of the national budget (a record ¥32.4 trillion in FY2025), and every tick higher makes it worse. Banks and insurers, who together hold over 40% of JGBs, face balance-sheet pain as bond prices fall. Add in the risk of investors pulling money back home, draining global liquidity and jolting the yen, and the BoJ suddenly finds itself in a credibility trap.

United States

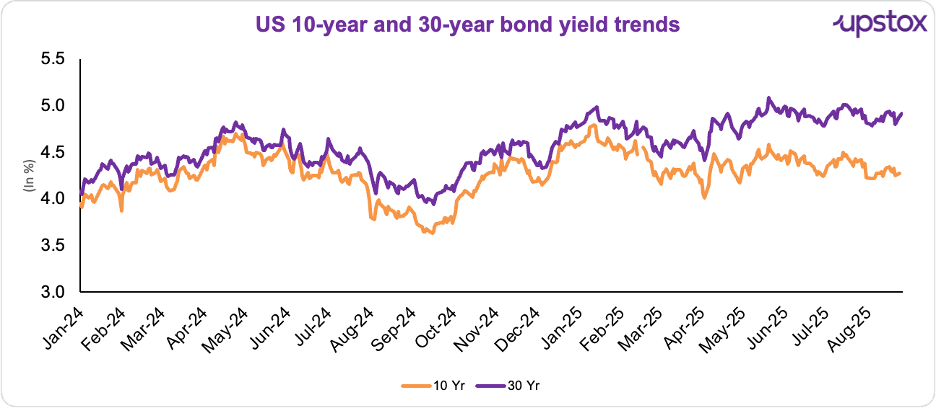

Now, let’s talk about the United States. On 25 Aug 2025, the 10-year Treasury yield stood at 4.276%, rising 2.7 basis points to 4.301%, while the 30-year yield climbed 4 basis points to 4.929%. For context, exactly a year earlier on 25 Aug 2024, the 10-year yield was much lower at 3.818%.

Source: Investing.com; Data as of 29 Aug, 2025

What are the key reasons behind the increase?

FED signals

US bond yields are climbing as investors react to Fed Chair Powell’s Jackson Hole speech on Aug 22. He warned, “Risks to inflation are tilted to the upside, and risks to employment are to the downside - a challenging situation,” and added the Fed will “proceed carefully” while the shifting risks “may warrant adjusting our policy stance.”

So, will the Fed cut rates in September? Maybe - but market bets on a quarter-point cut fell to 75% from 80%. With uncertainty high, investors are pricing in caution, and that’s pushing yields up.

Fiscal deficit pressure

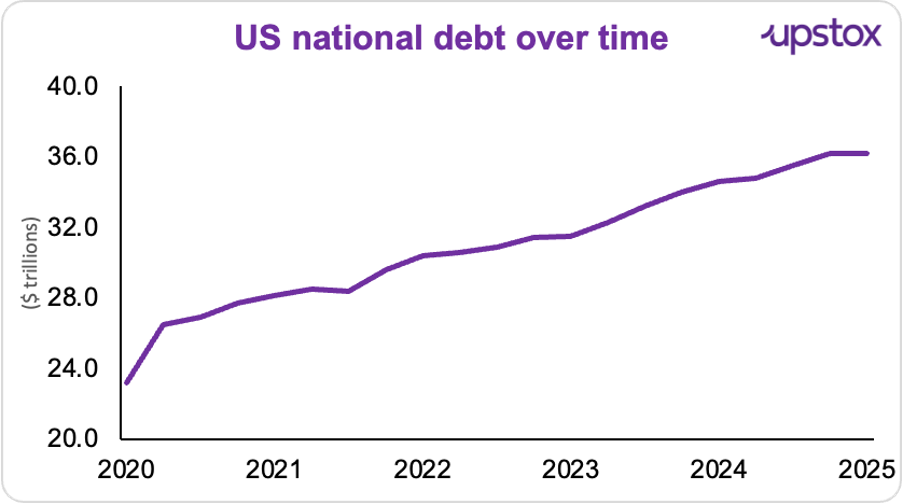

Rising debt… A reason parallel to rising Japanese bond yields? Yes. The US is projected to add $3.4 trillion in fiscal deficits, bringing total national debt to around $36.2 trillion. That sounds like a recipe for higher yields, but analysts say the market is cautious. Yields are range-bound, moving within a controlled range because investors aren’t yet confident enough to push them sharply higher. Still, the sheer size of the debt and deficits keeps upward pressure on US bonds.

Source: Statista

Now let’s talk risks. With debt projected to hit $36.2 trillion this year and net interest payments on the national debt expected to exceed $1.2 trillion in 2025, how long can Washington afford higher borrowing costs? Rising yields squeeze banks (remember the 2023 regional banking scare?), push up mortgage and corporate rates, and risk crowding out private investment.

What does it mean for the Indian market?

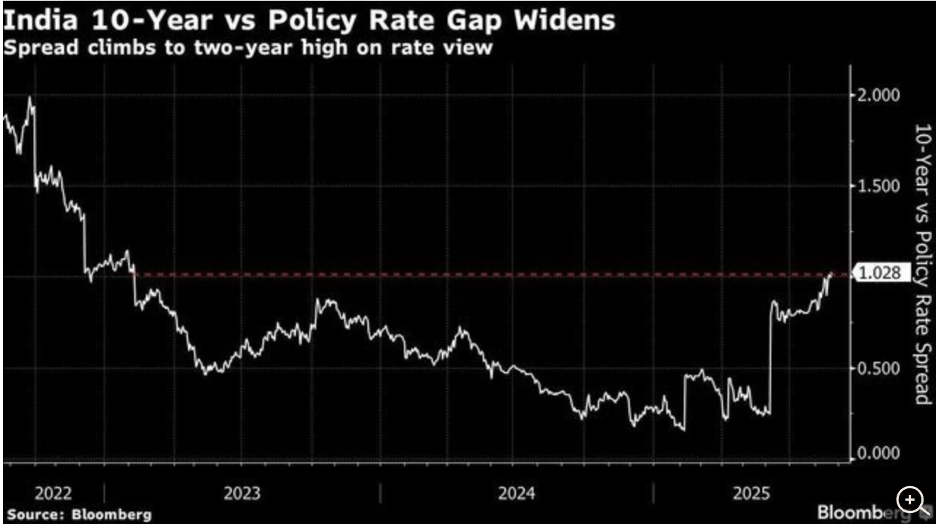

So, why should investors care? Rising yields in the US and Japan are not just distant numbers, they directly influence returns and risk at home. The spread between India’s 10-year bond yield and the RBI’s policy rate has surged to a two-year high of 1.028%.

What’s the takeaway? Investors are demanding more to hold Indian debt, a reflection of fiscal worries, supply concerns, and global rate volatility. Simply put, demand for bonds is cooling, and the lure of higher returns elsewhere is real.

Equities feel the impact too: If government bonds are paying more, why take the risk on equities?

- Rising yields push up borrowing costs for businesses, potentially undermining the RBI’s 100 bps rate cuts since February.

- History tells us that a widening bond–policy spread often precedes equity volatility. If this gap stays elevated, banks, NBFCs, and real estate could be hit first, and the broader market may follow.

In summary

Bond yields in the US and Japan are surging, sending shockwaves across global markets. Capital is on the move, chasing returns with little patience for uncertainty.But can India flip this volatility into an opportunity? If structural growth holds, the narrative shifts in its favor. In a world of restless money, credibility becomes India’s strongest currency.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story