Upstox Originals

GCCs in India: Powering global tech, but at what cost?

7 min read | Updated on October 23, 2025, 18:42 IST

SUMMARY

Back office? That’s history. India’s GCCs now power AI, analytics, and global operations for the world’s biggest firms. With over 55% of them already based here, these hubs have become true mission control. But as MNCs scale up, is India’s $250-billion IT outsourcing industry staring at its toughest rival yet? The boom is real, but could it come at the cost of India’s own IT titans?

India accounts for almost 55% of all the global GCCs

Step inside Microsoft’s India Development Center in Hyderabad and you might just be looking at the brain behind its global AI strategy. Walk into Amazon’s facility in Bengaluru and you’ll find teams refining the backbone of its e-commerce empire. And if you drop by Goldman Sachs’ Global Capability Center in the same city, chances are you’ll bump into the folks building algorithms that move billions of dollars every day. These aren’t “support offices.” They’re mission control.

And India is full of them.

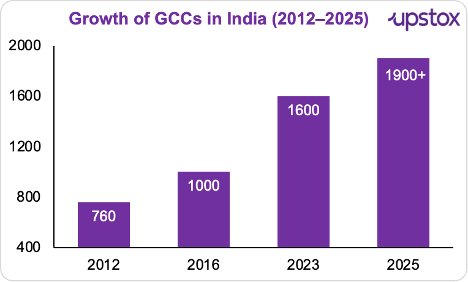

In fact, Bengaluru, Hyderabad, and Chennai alone accounted for 64% of office space leased by Global Capability Centres (GCCs) in just the first quarter of 2025. More than 65% of these belong to US-headquartered giants, but the work happening here is as global as it gets. From Texas Instruments’ first experiment in 1985 to a sprawling ecosystem of over 1,900 GCCs today, India has quietly become the world’s favorite backroom. Only, it isn’t the backroom anymore. These centres now lead everything from R&D and product design to analytics, AI, and global operations.

And the momentum is only building; by 2030, India is expected to house more than 2,400 GCCs, commanding 55% of the global market.

Source: ET

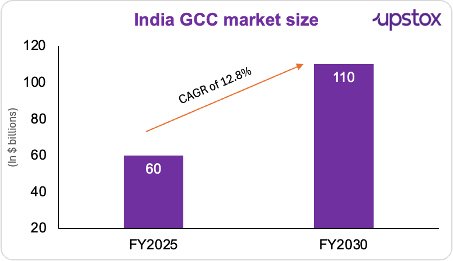

How big is this market anyway? Well, India’s GCC ecosystem isn’t just about shiny offices and brand names. Let us take a look:

Source: EY

What exactly are GCCs and how do they work?

Let’s say a Fortune 500 company wants to run a major AI project or launch a new product. Earlier, they’d call up an Indian IT vendor and outsource the work.

But now? They just set up a Global Capability Centre (GCC) in India.

Think of it as their own in-house hub. A GCC is a fully owned arm of the parent company that does everything, from R&D and product design to analytics and core operations. It’s not a vendor. It’s not a contractor. It’s simply the company itself, working out of India. And these aren’t token offices either. Walk into Microsoft’s India Development Center in Hyderabad or Amazon’s GCC in Bengaluru, and you’ll see teams building the very tools, products, and platforms that power the company’s global business.

What’s driving the surge in India?

-

The cost math works out. A GCC in India is 25–35% cheaper than setting one up in Eastern Europe or Asia-Pacific. And if you’re willing to look beyond Bengaluru and Hyderabad into Tier-2 cities, real estate and infra get 20–40% cheaper still.

-

Talent is the clincher. Median age? 28.7 years. Share of the world’s STEM workforce? 28%. Share of global software engineers? 23%. Oh, and 70% of college students here want to work in tech. Add to that a Gen Z workforce eager to learn AI skills, and you’ve got a talent engine unmatched worldwide.

-

Digital plumbing is world-class. Whether it’s 95% of banking transactions going digital, UPI powering half of the world’s real-time payments, or Aadhaar enabling the largest digital ID system, India’s digital rails are second to none. Perfect for GCCs experimenting with AI, cloud, and fintech.

-

Policy plays ball. 100% FDI allowed, exports exempt from local taxes, smooth online registrations, and modern data/IP protection laws. In short, global firms can set up shop without red tape nightmares.

-

And yes, it’s green. With 43% renewable energy capacity and one of the biggest green building footprints in the world, India also helps MNCs tick off their ESG goals while running GCCs. No wonder ESG reporting is itself turning into a booming service line here.

Decoding the economic power of GCCs

Real estate is the first big winner.

Over the past 9 years, GCCs have snapped up 180.9 million sq. ft. of office space, driving nearly 40% of India’s total office growth (JLL). In 2024 alone, they leased 29.4 million sq. ft., or 37% of all office deals across the top 9 cities, a staggering 29% jump YoY (CBRE).

Source: JLL

But it’s not just the metros anymore.

Bengaluru’s share of GCC units has actually dropped, from 34% in 2019 to 30% in 2024. Meanwhile, Tier-2 and 3 cities like Jaipur, Vadodara, Nashik, Coimbatore, Bhubaneswar, and Indore are stepping in. Their share has ticked up from 5% to 7% in the same period (NASSCOM & Zinnov).

Exports tell another story

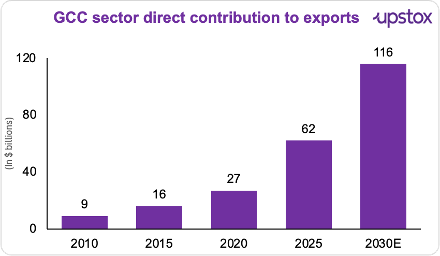

Most GCC revenues count as services exports, making them a forex booster. But here’s the catch, much of this is just a shift from IT vendors to captive centers. Even after adjusting for this shuffle, GCCs contributed $62 billion in net exports in FY25, up from just $9 billion in 2010. By 2030, it could touch $116 billion.

Source: ACCA

And then there’s the jobs angle

GCCs employed 1.6 million people in FY23, scaled up to 1.9 million in FY24, and could reach 2.8 million by 2030. But this isn’t simply about headcount growth. These jobs are moving up the value chain, from back-office support to careers in AI, data science, cybersecurity, product engineering, and R&D. For India’s STEM talent, a GCC role often beats an IT vendor gig: better pay, faster growth, and the cachet of a “Google” or “Microsoft” badge.

Life sciences is a case in point

Of the world’s top 50 pharma firms, 23 now run GCCs in India — and more than half entered just in the last 5 years, according to a latest report. They’ve gone from handling admin work to building digital therapeutics, AI-led drug discovery, and real-world analytics.

-

Novo Nordisk and Alcon have scaled into end-to-end global hubs.

-

Merck KGaA is using AI platforms and digital twins to slash R&D timelines.

-

EY says 70% of GCC leaders in this space are already investing in GenAI and agentic AI, while 76% are embedding Indian talent into global transformation projects.

How does India stack up globally?

-

Philippines: GCC market projected to hit $67.9 billion by 2032, up from $32.5 billion in 2023. Currently hosts ~150 GCCs, mainly customer support–focused.

-

Poland: Home to 400+ global centers employing 350,000 people. Cities like Kraków and Warsaw host Google, UBS, and Shell. Strong in analytics, cybersecurity, and finance ops. Boasts a 95% graduation rate in IT and engineering, with both cities in the top 10 global outsourcing destinations.

-

Mexico: Leveraging USMCA for cost and time-zone advantages. Guadalajara (“Mexico’s Silicon Valley”) already has 80+ global tech and finance captives driving IT and innovation labs.

-

Romania: Hosts 300+ GCCs/SSCs in cities like Bucharest and Cluj-Napoca, with HP, Accenture, and Deloitte among the big names. Focus areas: AI, cloud, compliance. Over 80% of IT employees are multilingual (English, German, French).

The squeeze

Sure, India’s GCC story looks shiny. But every boom has a shadow. And this one might just be cast on India’s $250-billion IT outsourcing industry.

Look at what’s happening. TCS says it could trim 12,000 jobs this year. Infosys hired just 210 people last quarter. And HCL gave junior employees a token 1–4% hike. Compare that with GCCs in India which grew by nearly 40% in FY24, while IT services could barely touch 5%.

Now, AI is the easy villain here. Yes, automation can write code, crunch workflows and slash timelines. But that’s only half the story. The real disruption? Multinationals are quietly pulling more work in-house through their GCCs.

And India isn’t the only game in town. The Philippines is targeting a $67.9-billion GCC market by 2032, Poland already employs 350,000+ people in 400 centres, and countries like Mexico and Romania are scaling up rapidly. If costs rise in India, MNCs won’t hesitate to shift more work abroad.

So for India as a whole, GCCs are a big win. For its IT giants, though? This might just be the toughest risk they’ve faced in decades.

In summary

GCCs have already flipped India’s role from back office to brain. But here’s the real question, can our IT giants reinvent themselves fast enough to matter? Or will MNCs quietly build the future while India’s outsourcing icons risk turning into relics of the past? The answer will decide whether India shapes the digital age or merely services it.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story